Yes, its over! Property prices to fall…

If you still aren’t heeding our warnings about property prices the data we are about to share should strike fear into the heart of anyone who has just purchased a property or is geared to the limit in property having suffered a misplaced bout of FOMO (fear of missing out).

For better or for worse, we have been discussing here at Montgomery HQ, and I have been sharing privately with friends, the suggestion that apartment oversupply will exacerbate a decline in property prices already cooling. If you prefer not to be hanging around, skip to the worrying trends from CoreLogic below.

History shows that asset prices move around much more than their underlying intrinsic value and there is no reason to think the dynamic is any different in property. In the short term there is no doubt that prices are driven by “news” – a euphemism for surprises and predicting surprises cannot be done successfully by the mass market because, by definition, it wouldn’t be news at all.

History however also shows that markets do eventually reflect demand and supply dynamics and demand and supply can be easily observed my following comments from a month ago paint the picture:

“Employment, inflation expectations, interest rates, debt-to-income ratios, house-prices-to-income, financial stress measures and the like all influence short-term property prices, but basic demand and supply seem to be the most important influences over the medium term. And given very few people buy property to ‘flip’ over the short term, it is the medium term we should focus on.

There is merit in looking at household formation as a proxy for demand and construction as our indicator of supply. With the exception of the circa 80 per cent falls in property prices in mining towns in Australia, the most notable real estate price collapse that occurred recently was in the US.

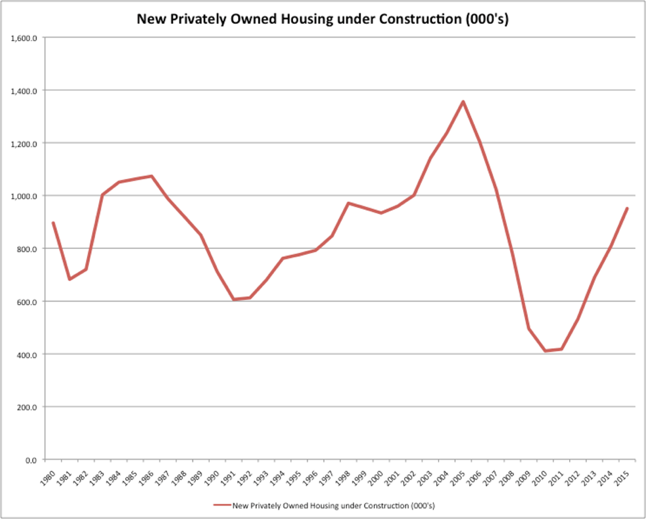

Figure 1 illustrates one of the conditions that preceded the collapse: a sharp jump in the level of construction. According to the US Census Bureau, in the years prior to the GFC, the number of dwellings under construction had risen from 993,000 annually in 2000 to 1.1 million in 2003, 1.2 million in 2004, 1.4 million in 2005 and 1.2 million in 2006.

Figure 1. US private housing construction, 1980-2015

Meanwhile, according to the US Census Bureau’s Current Population Report entitled Projections of the Number of Households and Families in the United States: 1995 to 2010, household formation was increasing at about a million per year. In other words, the US was oversupplying dwellings for seven years, and by 2007, possibly a million excess dwellings needed to be soaked up.

Houses were simply being built faster than they could be occupied. In 2012, Warren Buffett observed as much when he said, “In normal times, we need about one million or more homes to keep up with household formation.”

And we know what happened next in the US.

How many residential dwellings are needed in Australia?

In Australia today, dwellings are being constructed at a rate faster than they can be occupied by newly-formed households.

According to the Australian Bureau of Statistics (ABS) March 2015 report Household and Family Projections, Australia, 2011 to 2036, “The number of households in Australia is projected to increase from 8.4 million in 2011 to between 12.6 and 12.7 million in 2036.”

In other words, household formation is increasing at about 1.6 per cent annually and in 2017 that equates to about 150,000 new dwellings required.

The ABS also reports dwelling units commenced and the construction industry is currently building about 56,000 dwellings per quarter. That’s 228,000 per year, a lot more than seem to be needed. More importantly, this has been growing since 2011 when 35,000 dwellings were being constructed per quarter, which was about the same number as the number of new households being formed. It roughly balanced.

So if we assume an average of 47,000 dwellings were constructed per quarter in the years 2012 to the first quarter of 2016, and we add the 18,000 or 19,000 monthly approvals occurring now and project this number for eight months until the end of 2016, we arrive at a supply of 923,000 dwellings. During this period, the number of dwellings required, as estimated by household formation, is 716,249. That suggests an oversupply of about 200,000 dwellings.

At the current rate of household formation, that oversupply could be soaked up in about 18 months, provided construction of new dwellings ceased completely. But of course construction will continue and the oversupply will take longer to be absorbed.

It looks like Australia has a greater oversupply problem than the US did in 2007. The estimated 18 months is more than the 12 months oversupply the US had and after their property market collapse, it took five years before property prices began recovering.

Granted we didn’t have the subprime lending standards and borrowers they did.

The Latest Worrying Statistics

It appears CoreLogic is catching up with the analysis of the data we published last month and republished above.

According to an examination of data published by CoreLogic and published in the Australian Financial Review, “The number of new apartments due to settle over the next two years has hit record highs in Australia’s capitals…The volume of new apartments is now approaching, and even exceeding, the average number of apartment sales overall in the past five years…”

“The historic sales figures, compiled by CoreLogic, include sales of both existing and new units. New stock usually accounts for a smaller proportion of total sales than resales of existing stock.”

In other words, the historic unit sales numbers include new AND existing units. The number of new units due for settlement is so high that even if sales of established apartments ceased completely and every future buyer only purchased new dwellings at the same rate they purchase total units in previous years, supply of those new dwellings would still represent more than a year of demand.

And keep in mind that the numbers are skewed by a boom in apartment sales in recent years due to low interest rates. In a declining market it will take even longer to sell the excess stock!

You can read our previous articles through using these links:

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Hey Roger,

Do you think property prices will bust in 2017? or will it happen gradually over time. I tend to agree that prices will decline, with potential increases in supply and so many investors being blocked out of the market, I can’t imagine demand staying as high as it is.

Thanks for the article, was amazing to read!!

Roger

It’s early 2017, what do you think about the property market now? Still think we are headed for a decline in prices?

yep. But be sure to seek and take personal profesional advice before doing anything at all.

Just in case you haven’t seen it, Roger.

http://www.news.com.au/finance/economy/australian-economy/australia-six-weeks-from-a-housing-collapse-us-report-warns/news-story/866d2fdee41b1227ce654f66ed8d9837

I wish you were right, Roger. But, prices keep going up and going up. Since the time of this article in mAY, until today….04. of September, 2016.

I am confident we will be right. I see you are an architect. be sure to make hay while the sun shines.

Hi Roger,

Does this ‘household formation’ which you use as an indicator for demand, account for the large influx of foreign investors Australia’s seen of late?

Carol

Yes it does. It counts migration.

Hi Roger,

As always you’re on the money predicting the disconnect last year.

Old faithful in our democracy, the supply and demand relationship increasingly out of whack. A return to balance will be painful. A big whack!

The great seduction of low interest rates but higher and higher property prices catches them all the time unfortunately.All residential property 1,2,3, etc beds units and houses will be impacted I have no doubt.

Why is money- economy,demographics,supply demand etc not a compulsory subject in school from yr 1 to yr 12.

One hour a week for 12 years not a big call!!

If you looked at interest rates 2 years ago relative to house prices then compared interest rates and house prices now. Guess what you are more likely, above 75% chance, that net debt will be bigger than 2 yrs earlier when interest rates were higher.

Leverage with assets to expand wealth is less supported by the financial system. Serviceability and cash together is king in property market.

Cash is where it is at for the next while, I believe. How long is a while? Roger has better guess. My guess 18 months but could be much longer.

The smart ‘bargain hunters’ of 2017-2019 will be very wealthy using their cash but need to be ‘disciplined’ and those that believe the bottom will be bigger the next year could be right or could be missing opportunity. Predicting the bottom has nearly always been inaccurate.

I know WB does not worry about bottom as he looks for increasing value in the company or its undervalue status and opportunity to grow the company but his critical aspect for consideration is to buy at a good price.

But perhaps and I subscribe to this view the new bottom could be ‘flat’ for a long time.Why because the uncharted territory we are now in and ahead of us for some time,the weight of debt above us, demographic mix and disposable income are ‘reality’ checkers big time and should be considered before we spend.

Roger says ‘diversification’ is critical not only in asset classes but in scale of

exposure in each asset class.

I read the next demographic demand wave is some time off, years perhaps right out to 2021-2026 but the cruncher is the next wave already has debt and most under 30’s are not high savers.

A problem for demand, poor thing, to try and soak up over supply and when supply falls demand still not rising to soak up is an interesting dillema.

Having sold properties over the last 18 months and one to go I am close to resting and thinking and trying to imagine the Montgomery team and Warren Buffett people ‘their graphs and curves’ and predicting where the relavant graphs are going and how fast.

Beginning to sit pretty is a relaxing experience and I will enjoy reading comments for the next 3 months or so as I plan my next move.

There will be twists and turns no doubt, but on thing is sure downside not demand is the increasingly dominant ‘force’ in town.

BLACK SWAN or Cassandra. Buying the town in QLD for $725k ( 40 acres, 18 houses, pub, silos, petrol staion etc) last week may be a missed opportunity. I have no time to analyse but unusual opportunities may pass by all of us over the next 3 years and how we respond is what is exciting.

A nice little article summing up settlement risk for developers.. http://www.afr.com/real-estate/property-developers-risk-100000-loss-per-apartment-as-default-risk-builds-20160520-gozpaw

The Bronte property market that I am more familiar with ‘walks to the beat of a different drum’. I would be speculating to say that so many of these properties are tightly held and when sold often go to people in banking, finance or high end professionals; and that therefore the last year’s banking bonuses have a bigger impact on prices paid. I find it hard to correlate over supply of unit development with the real estate prices of free-standing homes in Clovelly/Bronte. The very large sums involved mean that this market segment is highly interest-rate sensitive. With many commentators predicting further falls in rates, I therefore struggle to see any major price falls coming in the next two years. I am happy for you to clobber my logic. Regards.

Roger, I’ve been around long enough in the Finance industry to have seen similar occurrences over 50 decades. Sure, you have “bubbles & bursts”, that’s the normal cycle. Whilst your analyses are all fine, you give no suggestion as to what to do. My view would be, remember why you invested in property in first place, if for short term gain, then maybe it’s time to “leave the building. Even then, need to think, where do I invest now & there are no stand out options. Previously, when one market fell, one or other markets increased, today, property has been on rise, whilst cash & shares on decline. Can’t see shares & cash rising in near term, so where do you go?.

If, as I’m sure, most people invest in property for long term whether investment or home is objective, then sit tight & do the best you can to survive.

What’s your suggestion?

Great article, Roger.It’s been a long time coming.

Do you think that will mean it will be harder and longer to recover?

I guess that could mean the time to buy that beach house is approaching

Timing of these things is always the most challenging part. Simply don’t know when or by how much. Beach houses tend to lag both up and down

I have been reading articles about the coming property crash every couple of months from various commentators for the last 20 years and I’m still waiting.

You must have missed the 40% falls in Mosman during the GFC then.

A new head of steam?

http://www.afr.com/real-estate/house-price-growth-accelerates-again-corelogic-20160531-gp8k6u

No doubt the apartment market in major capitals appears to be heading for oversupply, with overseas buyers drying up and lending restrictions being put in place. Developers late in the cycle, recent buyers will be underwater and their financiers will be heading for trouble. However it remains to be seen if prices will drop outside this segment in the more traditional and higher quality housing markets in the inner to middle ring of our capitals (where most of us live and are invested). Demand is still far outstripping supply in these areas because of restrictions to supply due to limited land availibility, NIMBYism and tighter local planning controls. The ‘property market’ is also made of up of many thousands of micro markets, with their own supply & demand characteristics and dynamics. For quality markets, two thirds of which are supported by mortgage holders and NOT investors. Sure mortgage holders are borrowing more, but the debt tends to be in the hands of those who can afford it, with non-performing household loans extremely low in the current environment, at ~0.6 per cent. Many Australians are saving more, taking on less credit card debt and paying off their mortgages faster than they need to which improves the state of their personal finances (the average is two and half years ahead). ~70 per cent of us own or are paying off our own homes.This in turn reduces the risk of house prices collapsing if interest rates rise or the economy hits a speed bump. In contrast to some overseas markets Australians have amassed a huge amount of equity in their properties (in the past two years alone), and thus have a conservative debt position. In fact half of all homes have no debt against them (also if you look at the delinquency stats – home owners would rather sell their own mother’s before they sell their house or IP).

House prices “collapse” (not cyclically correct, but collapse) when people are forced to sell their homes and there’s no one willing to buy them. Apartments, mining towns and peripheral housing estates aside, were prices to collapse in the blue chip inner ring areas of Brisbane, Melbourne and Sydney by 30-50%, I would expect there to be an almighty rush for the quality stock at once in a lifetime bargain prices, well below ‘intrinsic’ value (intrinsic value for a home I might add includes the intangible emotional value).

There is a large unit development on the Parramatta River, near Parramatta. The first stage of 200 units (total of 800 in the whole project) settled almost two months ago and at least 40 units remain unlet. Whilst the location on the river may sound ideal, it is well away from public transport links and this may be a factor in the project not attracting tenants.

Stage two construction has commenced, but I wouldn’t be surprised if the final stages are “canned”.

This could be a symptom of over supply, as prospective tenants are obviously becoming choosy about where they live.

Hi Roger. I love your analysis on RE. I am in my early 30’s and buying a house has never interested me. I am interested to hear your rationale as to why you have been recently investing in Australian Banks. Banks are paying out record dividends as a percentage of earnings (for Westpac it is over 80%)

Given your previous statements which I 100% agree with around the false economics of dividend stocks and given Australian banks are exposed to Aussie mortgages to a far greater state than US banks were exposed to US mortgages I struggle to see how Australian banks represent value.

Also there are more headwinds for RE that will eventually be priced in. Already negative gearing is being discussed though the next will be the $800 bill in real estate pensioners are not means tested on.

Roger, I agree house priced are far too high for those want to buy and those who want to flip .I sold a house in the Harvey Bay area three years ago just above cost , now houses there are selling below cost and hard to sell. A house will become a debt ,not an investment or asset if over supply continue.

Hi Rodger,

Love your analysis and insights on all things investing.

What is your medium term view on property prices that are not units (i.e. free standing Torrance Title residential houses). Do you think there is an oversupply like units and prices will also decline at some point in the future?

Further, if Labour are elected what is your view scrapping negative gearing (with the exception of new houses) will have on house prices?

Thanks,

Simon

Torrents title property cannot avoid being impacted simply because buyers see apartments and houses as alternatives. One cannot decline, for example, by 30% and remain lower, while the other remains buoyant. And if neg gearing were abolished it would have a devastating impact on prices for owners but it would be a huge bonus for buyers

Hmmm. I’ve been following the Adelaide property market for 17 years on a daily basis. In the past 5 weeks there has basically been an under supply of torrens title houses (not flats or apartments). Whether the looming election is scaring people I’m not sure. But as far as I’m concerned the mentality of owning your own Aussie home is entrenched deep in our culture. Housing affordability for the wealthy is not a problem. I believe you need to look at other factors such as poor performing superannuation accounts and low term deposit interest rates and you’ll see why people are chosing property as a huge chunk of their portfolio.

You have explained the reason for currently high property prices; “poor performing super and low term deposit rates are today driving people into property” but you’ve not explained why those influences won’t change, nor what happens if they do. And those questions presume deposit rates and porr performing super are the only reasons for the currently high prices, which they aren’t Andy.

i once read that if you are buying an asset with a hope that someone else is willing to pay higher price then you are probably speculating. In my humble opinion, most buyers of real estate are buying or “investing” with a hope of capital gain.

Good point Clement.

G’day Rog,

What’s the best way to benefit from this forecasted slump in housing prices? Is the purest way to buy puts on the big banks? Is there anyway to short RMBS in Australia?

Regards,

Johnny

Hang on, what if sellers simply decide not to list because prices are too low? What forces most property owners to sell inventory at poor prices? Significantly higher debt service costs. How does that happen? Higher interest rates and withdrawal of financing for committed projects. How likely is this to occur in the near term and to what extent?

Developers are the sellers. They owe banks money. They’ll be forced.

There is a fundamental flaw in your analysis.

Your numbers are correct…

HOWEVER….between 2005 and 2012 there was an UNDERSUPPLY of 30,000 dwellings per year….which means we are about in balance now and possibly at the beginning of the oversupply phase. This means price growth will be flat to down slightly for the next couple of years. Prices will not crash.

it’s NOT the same as the US and it is completely wrong to make that comparison.

Thanks for pointing out the “fundamental flaw”. Sadly, developers who will soon be stuck with unsold stock, which they will have to discount, might be forced to disagree with your conclusion. Many off-the-plan-purchasers are increasingly likely to be unable to complete due to limited financing sources. CBA, Westpac and others have announced changes to lending policies on off-the-plan-purchases, including changing the LVR’s and revaluing properties lower just prior to settlement. This will force buyers to have to find a greater equity contribution that many won’t have. Further, the banks have ceased lending to purchasers using foreign income as a source of security. It will be interesting to see whether developers even know the location of the purchaser, where they live, their capacity to settle, whether they are a cash buyer or requiring finance and who the financier is?

Is it possible that Supply will withdraw (the curve would move left) to meet demand at a higher price point than would be expected as a result of a crash type scenario with sticky supply? In other words, we need to understand how the market behaves when past oversupply begins to dominate demand. Does price respond precipitously, or does equilibrium form at a relatively rather than dramatically lower level as a result of flexibility in supply?

Because the of the lead times involved, when developers secure sites, lodge development plans, make adjustments in order to obtain approvals and perhaps even argue points in court (Land and Environment Court in NSW for example), the market cannot respond quickly to a withdraw of demand. Those developments that were approved continue to flow into the market even if demand evaporates and the supply continues for some time. Even now, banks have pull back their lending to apartment developers but developers are still securing financing through high new worth syndications and so supply will continue for some time yet.

Roger, have you validated your model by reviewing the historical trends of those two key statistics – rate of household growth versus new dwelling approvals? Cheers, Pete

Only recently. Haven’t found enough continuous data to say with statistical certainty that the correlation is valid in all circumstances. if it were a certainty there’d be no risk and the prices would have already factored it in.

My approach to property is the same with shares: be a net buyer over the long term, and buy quality property for less than its worth. The bonus with property that doesn’t really apply to shares is the ability to add value to the property through improvement and construction/subdivision.

A correction wouldn’t be bad, for people who don’t plan on selling.

Good point Luke,

While declining prices might not be great for sellers, its great for the other half of the market.

Hi Rodger, it seems to me that construction is the only gig in town at the moment in Australia since the mining boom evaporated ,do you think that as this property boom unwindes unemployment will therefore rise and feed further into a property market decline ?and if prices start falling the investors and speculators local or international will back out of the demand side looking for a bottom leaving only sellers in the market for some time.Is a Perfect storm brewing? Love reading your very informative articles.

Andrew ronan

Hi ANdrew, that is precisely our concern for the Australian economy – that a slow down in the construction sector will lead to broader employment issues than the end of the resources boom did. Having said that, the banks are pulling back from financing developers right now, but developers are still finding financing from high net worth individuals, so construction will continue for a little longer yet. We would guess that within the next 24 months – 36 months we will see the issues emerge. Be sure to seek and take personal professional advice.

Hi Roger,

Can you please elaborate on the funding through the high net worth individual? How does it work in practice?

Syndicated mezzanine finance. I have been invited to participate in a few shopping centre developments myself but so far I have not participated due to concerns about future interest and discount rates.

Roger, can you value a property using a DCF formula just like you would do for a business?

Of cours you can. You will however be frightened by the result!

Thanks for posting roger

As negative gearing is essentially a capital gain play so with higher supply and lower demand investors will tip these properties back in the absence of capital gain further exacerbating supply. If unemployment rises could get further negative multiplier effects. With gross rental yields of around 2% a better investment would be Montgomery funds I would suggest

Very good point John.

I always find it funny (?) that your posts about property always garner much, much more comments than any other topic.

I’m not sure of the demographics of the readers here but I’m part of the 20/30 somethings and I know many, many friends, acquaintances and complete strangers I’ve met for the first time who have effectively stopped considering home ownership as something they’ll achieve in the short, medium or even long term.

As Dan Baillie mentioned below, go to a BBQ with anyone in their 40’s-80’s and you’ll be hounded all night with the idea that investing in houses is the only way to invest and their way is the best way. Whether they are right or wrong is irrelevant. There is an entire generation coming up behind them who is completely apathetic with the idea of home ownership. Mention home ownership with the generation following and there’s a defeated “it’d be nice, but it’ll never be” and that’s the end of the topic. Who knows what the effect of this will be.

Hi Asher, Yes there is definitely an national infatuation with property. Importantly however most, if not all, of our investors have exposure to property and so its important we share our views with you all.

Hi Roger.

As I hope for a correction these are very interesting numbers. After hoping for quite some time I grow pessimistic. As property is just about the only global game at present I can’t help feel that overseas buyers will snap most of these up with no intent to occupy. London is scattered with mostly vacant high end new build apartments. Although this does seem to be cooling off there I feel that unless mass developers go under and trigger a banking crisis then governments will do everything (i.e. do nothing) to keep the bubble going. Australia just seems to be a few years behind what is happening in the UK so for me there is a long way to go before this whole mess unwinds barring a major catastrophic event.

All of which might just happen to coincide with the first attempt in decades by a major political party to reform housing tax policy.

Of course it won’t be seen as a coincidental. Commentators, politicians and lobbyists from far and wide will blame any price correction on said govt policies, resulting in a 110% policy reversal and wiping out any chance of future reform for decades to come….

All of which might just happen to coincide with the first attempt in decades by a major political party to reform housing tax policy.

Of course it won’t be seen as a coincidental, commentators, politicians and lobbyists from far and wide will blame any price correction on said govt policies, resulting in a 110% policy reversal and wiping out any chance of future reform for decades to come….

Interesting article Roger. Your use of comparisons USA to Aus is interesting.

In 2010 I recall flying from LA to Houston and from 30,000 feet was amased by the expanse of the sprawling housing developments which had taken place withing the 1st 45 minutes of this flight. When speaking to colleagues in Houston about what I had seen during the flight I was informed that “what you have seen was some 20,000+ empty houses built during the USA’s housing boom”. The majority of these houses financed by sub-prime junk loans to those who had no capability to repay. It seems that following the GFC house building just continued unabated until the money ran out. That is, once the loans were approved, apparently they could not be withdrawn and the houses just had to be be built! Nice if you were a builder, to bad if you were the financier!!

For me the similarity here in Australia, is the ability Australia has to mirror, but not learn from, what happens in the USA (and elsewhere in the world), as here in Australia, we keep on happily building houses and unwanted apartments due to an apparent housing shortage and rising demand due to an influx of ready cash from outside. If there is such a rising demand then why are there over 80,000 dwellings unused in Melbourne?? Surely this is a sign something in the ‘supply/demand’ logic is chronically out of sync? Or more importantly something is going to badly ‘pear’ shaped in the not to distant future.

http://www.heraldsun.com.au/news/victoria/massive-number-of-melbourne-homes-are-lying-vacant-angering-homeless-agencies/news-story/86c1de02ada02dce7c9b1bca9f6b147d?nk=667e1ace04fdbda319905ecd95d14924-1463389510

Thanks Roger! Great article as always!

Try putting across those views at a bbq/dinner party and see the reaction. Property ownership and being a landlord (getting ahead) is so deeply seated in the Australian culture that when the time comes for a correction it could be far more consequential than other countries experiences in the last decade.

Yes. The apartment market oversupply is very evident

Yes. The lending practice can be strengthened.

But I’m still hesitant to call a broad based property market decline. Because a) unlike stock market, the property market is very fragmented. The apartment market may suffer a significant decline price, which was evident in the some instances already.

b) residential property market (except for holiday homes, mining town) is fairly resilient. So long as there is no nation wide surge in unemployment, I struggle to see there is going to be massive dumping of properties for sale due to foreclosures.

c) The surge in apartment building approval is another testament to holding land, which is becoming more and more scarce in the long run.

d) all these interim noise about property market/lending practice will serve to create opportunities for patient investors to set up for a long term gains

Whilst I broadly agree with household formation as a component of owner-occupied demand, what about the investment component? For example, a household may currently own their residence but may decide to (for whatever reason) invest into property. Furthermore, I do not think household formation factors in overseas investors, which admittedly has been shut out of the borrowing market in recent times but would presumably still have an impact between 2012 and today

William, even if one “household” which already owns and occupies a property buys a second property for investment purposes, that first “household” still has to lease it out to another “household”.

But if the supply of properties is outstripping the demand of households, which it appears to be doing by some margin, then, as sure as eggs, you are going to see property prices come down.

Whether that entails a crash may be just a question of semantics, although I personally think that all the elements for a GFC-style crash in the Australian property market are lacking.

Roger, I agree with all you say about our property markets.

Should we be selling off our Bank stocks in our portfolios?

Australian Banks have been dependent on housing loans for years (most if not all of their growth in the last 10 years) with the inevitable reduction in homes loans will our Banks struggle to find the growth in profits year on year that have driven up their prices & earnings

Hi Dale, We are underweight banks. This means we still hold the banks having bought them at what we believed to be recently attractive prices, but we have also weights nothing like their weights in the market.

I’d love to know your thoughts on the Perth property market?

I tend to agree with what you’re saying but not sure if it fits as well with Perth as it does Sydney and Melbourne?

Thanks guys

Perth is arguably the first city to be hit by the wave that is now spreading across the country.

Thanks for the thought-provoking article Roger.

Scott, if you take a look at apartment construction in South Perth, the CBD and surrounding suburbs and you’ll notice hundreds new apartments are due to be completed in the next year or two (and many yet to start construction). Most of these dwellings were planned and approved near the height of the mining boom or soon thereafter, apartment buildings that are 30-60+ stories high, with supermarkets, restaurants etc within the complex. Where the demand will now come from is anyone’s guess (you know it will be bad when property developers start saying China will supply that demand). Agree with Roger’s assessment that Perth may be hit first.

Maybe I spoke too soon….http://www.news.com.au/finance/business/banking/mortgage-fraud-is-the-dirty-secret-that-could-spark-a-financial-meltdown-economist-warns/news-story/53bf8bf125b31e39e0d05c61b3f34d06

This is a useful discussion, thank you for presenting this information. The conclusion seems self evident.

Is there any data on how supply and pricing have behaved in Australia in previous cycles? Or do we on the current period?

One point: when interest rates a low, and inflation is low, its a very attractive time to build homes (units and houses) from a commercial development point of view, regardless of sales pricing. From experience, I know that small and large operators, including Merriton, deliberately build out at maximum capacity and then bank units (control supply) through either leasing, short term stay or even unfinishishing the final product (warehousing). This is particularly effective if financing is relatively secured, or in the case of Merriton – not required to a large extent, due to either high internal cash/equity availability, or other sources of cash flow generation. To be sure, returns on capital may suffer (to an extent), but not if the cost of development (particularly at scale) is sufficiently favourable compared to the ultimate sale price. Warehousing stock in a partly completed state is an art the most successful private developers employ in city and “country”. Staying power is the fiend of a smart developer (big or small) in building when its cheap and only selling when its expensive. Just like value investing. I doubt all, if the majority or developers have the capacity to operate this way though, but the BRW rich list for the last 30 plus years is full of them.

Sorry, forgot to add the data for (Price x rate)/AWE Dec 81 to Dec 15

71.93%

66.35%

57.36%

53.88%

60.17%

70.29%

74.26%

86.29%

110.07%

103.32%

76.53%

65.48%

59.05%

66.64%

64.86%

56.08%

52.14%

52.45%

57.43%

64.33%

57.15%

78.80%

91.71%

87.44%

82.78%

83.76%

89.78%

81.09%

69.05%

84.99%

67.09%

70.78%

73.68%

81.27%

94.99%

The price of housing isn’t the factor influencing what people pay, it is the cost to them. A buyer has the expectation that whatever they pay is the fair value market value. It is their capacity to meet repayments that determines how much they spend.

If you take the ABS AWE figure as indicative of income levels, the RBA’s indicative mortgage rate (FILRHLBVS) and median Sydney house prices and do the calculation (Price x rate)/AWE you find that over the last 35 years the result has been between ,52 and 1.1 and between .57 and .87 for 80% of the time. Throw in the unemployment rate (as a measure of buyer uncertainty) and the and the range narrows further.

So, the potential for future growth in property prices is linked to a further drop in interest rates (probably not significant), wages growth (currently flat) or a drop in unemployment. All of which makes perfect sense.

Hi Roger,

Your argument about oversupply is compelling & I agree, it as a reason to expect property prices to come off and not come back until the underlying oversupply issue is addressed.

But is there an element missing from the Australian situation that was present in the US that caused their major collapse?

What I refer to are the triple evils of:

-“Sub-prime” lending (or lending money to people who couldn’t hope to service the debt),

-No recourse lending (the ability, if you couldn’t pay, to just hand back the keys & walk away)

-The toxic asset class of “Collateralised debt obligations (CDOs) whereby these worthless loans were bundled up & traded as if they were actually worth something.

The escalating speculation, (“flipping” as it was called) drove prices to the point where the music eventually stopped and there were not enough chairs.

My thoughts are, that for there to be a spectacular nation-wide collapse, there needs to be this toxic debt element. Would you agree? Or is there something I am missing?

Do you see the looming crisis in inner-city apartments and the potential for settlements to fall over on projects currently underway (which I also see) as the trigger for the collapse?

Love your work & appreciate your insights.

Andrew

Yes, if you read our previous posts we do note that unlike the US we haven’t been lending US$700,000 to mexican strawberry pickers earning US$14,000 per year. The level of debt determines how toxic the period after the crash is. Debt itself is a required catalyst.

Thanks Roger,

Just after posting this, I read a story in news.com.au (posted by me at 10:22am – see above). I said “maybe I spoke too soon”. It seems that there are commentators alarmed at the quality of loans bankrolling the current property boom. Maybe we have the seeds of the catalyst there?

Andrew

Hi Roger,

If property prices are to fall and human sentiment panics could we see a sell off and buying opportunity in REA shares who as you have previously mentioned are positioned to benefit from both falling and rising property prices?

With cash in hand, knowing patience is a virtue i wait in anticipation.

Hi Garry, that’s probably asking us to be more precise than we can be. One would expect sentiment to always impact short term stock prices.

Thanks for the post RM.

I agree that there is definitely an oversupply forming in Australia, in particular the unit market. In saying that, you need to take into consideration that households are decreasing in size and many of these units are 1 and 2 bedroom, therefore the supply will be absorbed at a faster rate than in previous cycles.

Cheers

That sounds like wishful thinking…