Can you trust a progressive dividend policy?

With the release of their interim results for the half year to 31 December 2015, the Board of Directors at BHP Billiton Limited suddenly realised they weren’t overseeing a toll road business, which typically raises its prices by a few per cent per annum, and finally disbanded their “progressive dividend policy”. After paying out US$0.62 per half-year in each of September 2014, March 2015 and September 2015, BHP’s upcoming interim dividend has been cut 74 per cent to US$0.16 per share.

Those BHP shareholders who believed in the “progressive dividend policy” and concluded the US$0.62 (A$0.8778) dividend paid out in September 2015 was sustainable must now be ropeable. Over the past six months, the “x per cent fully franked dividend yield chestnut” has seen a $10 per share or 40 per cent capital loss and BHP’s “blue chip” status has been kicked into touch.

“The (new) dividend policy provides a minimum 50% payout of Underlying attributable profit every reporting period”. I just hope the creatives updating the BHP Billiton website are quicker than their superiors in understanding they are working in a commodity business – which goes up and down with supply and demand and the economic cycle.

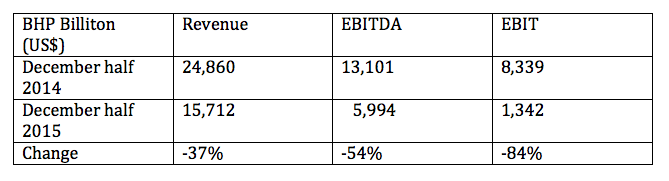

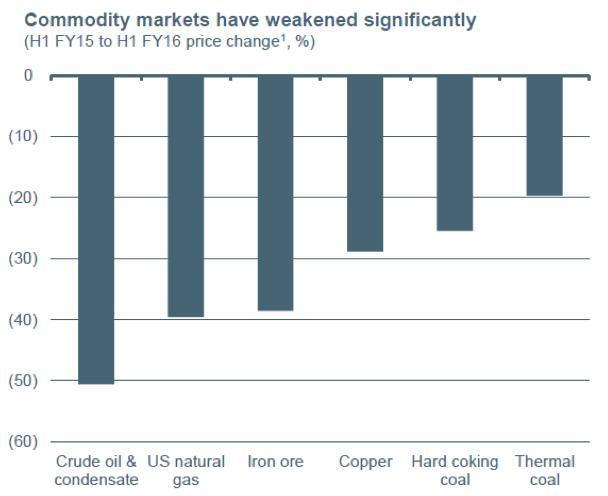

When the average realised sales prices for the December 2015 half-year declined by between 20 per cent (thermal coal) and 50 per cent (oil) year on year (see table below), this results in pressure on revenue and earnings, as follows:

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Hi David

Great article.

However I am a big fan of progressive div policy for BHP and resource company’s as their history of successfully allocating capital is so woeful it is hardly believable. If BHP followed RM’s lessons in capital allocation many dud acquisitions would have been avoided and cash used to pay a reasonable div.

Circle of life- repeated every investment/commodity cycle so it seems!

TC

Yes Tim, the ability to burn capital at the top of the cycle remains intact.

You know that you are in dangerous territory when analysts say that BHP (or any mining stock for that matter) is “an income stock”.

Hi David

Thanks for the article. If there is one thing this reporting season has spelt out to me is that progressive dividends only make sense in the presence of earnings growth. BHP,RIO,WPL etc on the negative side, SEK, CGF,CCP etc on the positive side.

Cheers Jim

Thanks Jim.

I don’t think any company, and particularly commodities businesses, should have a progressive dividend policy.

Over the very long-term, in all countries, industries and companies, there are good times and bad; booms and busts.

There are changes to the competitive landscape from technological, wealth, regulatory and demographic shifts.

And instead of dividends, better quality businesses may well choose to reinvest in opportunities internally or via acquisition, broadening their economic moat, and generating a high return on incremental capital.

So when BHP Billiton Chairman, Jac Nasser says “Our purpose is to deliver consistent and sustainable shareholder value” I just don’t believe the word “consistent” is appropriate.

Nice article David

I decided when I first started investing to avoid resource stocks as they’re far too reliant on the supply and demand for its revenue.

Have the Montgomery funds ever invested in resource-related companies? Would they be open to it in the future? What about companies like APA?

Hi Tristan,

The Montgomery funds do not own any shares in resource companies and are unlikely to in the foreseeable future.

That said, Montaka has a few “short positions” and these have contributed wonderfully to the investment return over the recent several months.

APA’s main business is high pressure gas transmission pipelines, and accordingly is far less dependent on the underlying commodity price.