Will small caps outperform again?

The following chart pack reveals the material underperformance of U.S. and global small companies against their larger-capitalisation peers. The relative performances are displayed over the last twelve months and the 2023 calendar year to date (YTD).

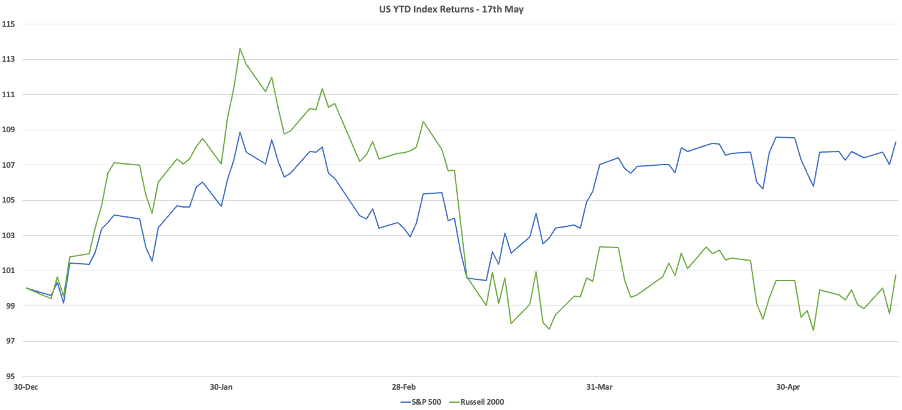

Figure 1. U.S. YTD S&P500 versus Russell 2000 – 17 May 2023

Source: Montgomery Investment Management, Polen Capital

The U.S. S&P 500 index is comprised of 500 large-capitalisation companies. The Russell 2000 index comprises 2,000 small-capitalisation companies. Both indices are market cap- weighted.

By way of background, much of the recent outperformance of large caps has to do with the larger weighting to technology stocks and the spectacular recovery from last year’s sell-off of a handful of the very largest tech firms. The Russell 2000 has a lower weighting to technology stocks than does the S&P 500. And keep in mind small caps suffered materially during and following the COVID-19 pandemic, displaying stronger reactions to lockdown and reopening news.

Figure 1, reveals the S&P500 is up almost nine per cent for the year to date, while the small cap index is up less than one per cent. Much of the outperformance, however, has occurred only since mid-March when fears of recession began to gain traction.

Recession fears have disproportionately hit the valuation of small companies and this is arguably to be expected. Small caps are perceived as being more economically sensitive and they are less liquid than large caps. Moreover, investors understandably seek the security of large companies, whose stocks are more liquid, and whose business tend to enjoy greater diversification of revenue and stronger positions in the supply chain and in their markets.

While it seems logical for a flight to more liquid large caps to occur when recession indicators are flashing red, or when fears of a recession dominate the investment narrative, history does suggest a different posture.

According to a 40-year study conducted by broker Schroders and published in February this year, investing in small caps during recessions has generated superior investment returns.

The near-40-year period Schroders examined encompassed numerous recessions, across the U.S., Europe and Asia, which followed a variety of regional crises, and included the rare synchronised global downturn of 2007/08, following the Global Financial Crisis.

According to Schroders, “the market tends to sell small companies heading into a recession in favour of more liquid large cap stocks. The selling, however, gets overdone… Once we’re in recession, however, and as the market begins to discount recovery, there is an equally forceful rush of capital back into small caps. Investors are now anticipating benefiting from the sensitivity of small cap earnings to the recovery.

“At the same time, valuation re-ratings can be very powerful as the spiral of liquidity concern during the dash for safety impairs the valuations of small caps to well below what is fair from a purely fundamental perspective.

“The data tells us this combination of recovering earnings expectations given a more supporting economic backdrop and valuation re-rating from renewed confidence continues well into the recovery phase of the economic cycle.”

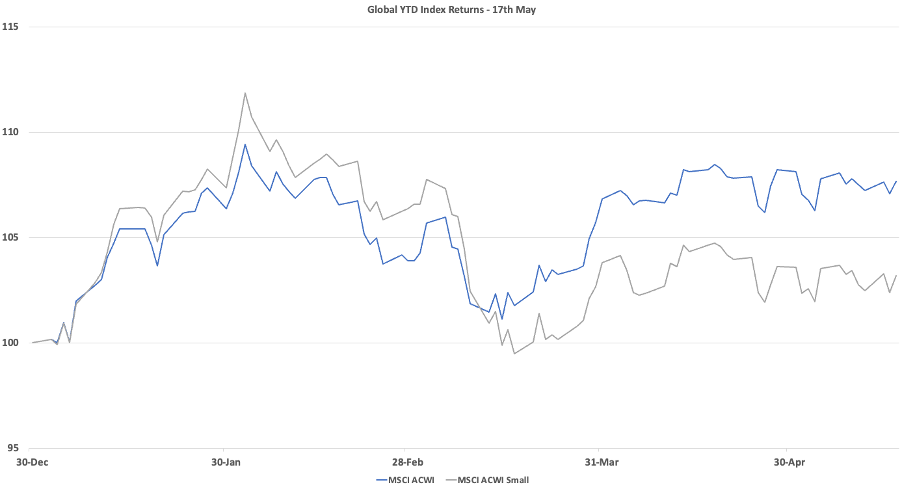

Figure 2. Global YTD MSCI versus MSCI Small – 17 May 2023

The year-to-date relative underperformance of U.S. small companies is mirrored globally. Global small and mid-cap companies have also underperformed their large-cap brethren, rising 2.5 per cent YTD versus about seven per cent for global large caps.

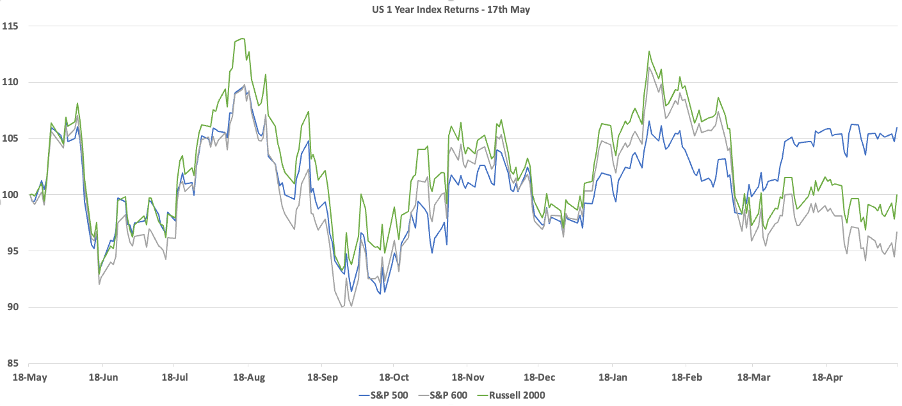

Figure 3., a chart of the Russell 2000 and S&P600 representing small caps and the S&P500 representing big caps, confirms – by looking at performance over the course of the last twelve months – much of the underperformance of small caps has been recent, coinciding with heightened fears of recession.

Figure 3. U.S. 1-year S&P500 versus Russell 2000 & S&P600 – 17 May 2023

Source: Montgomery Investment Management, Polen Capital

Over the last 40 years, the world’s economy has spent about half its time in a recovery phase and that’s when small caps tend to outperform. If a recession occurs, small caps may have already priced in the worst outcome. This tendency for small cap investors to fear and ‘price in’ a much worse outcome, going into a recession, might also present a tactical investment opportunity right now. The combination of expected recession and over reaction potentially sets small caps up for outperformance. And if a recession doesn’t transpire, even more so.

*Link to the full Schroders research conclusions here.