Will Baby Bunting be able to withstand Amazon?

At the current $2.06, Baby Bunting Group Limited (ASX:BBN) has a market capitalization of $260 million, and with net debt of $4 million it is selling on an enterprise value of 10.2X Fiscal 2019 forecast earnings before interest, tax, depreciation and amortization (EBITDA) of $26 million.

The Company is well run and here are some of its appealing dynamics:

- It has an advantage of economies of scale with an Every-day Low Pricing (EDLP) and emphasis is placed on high quality service from knowledgeable staff.

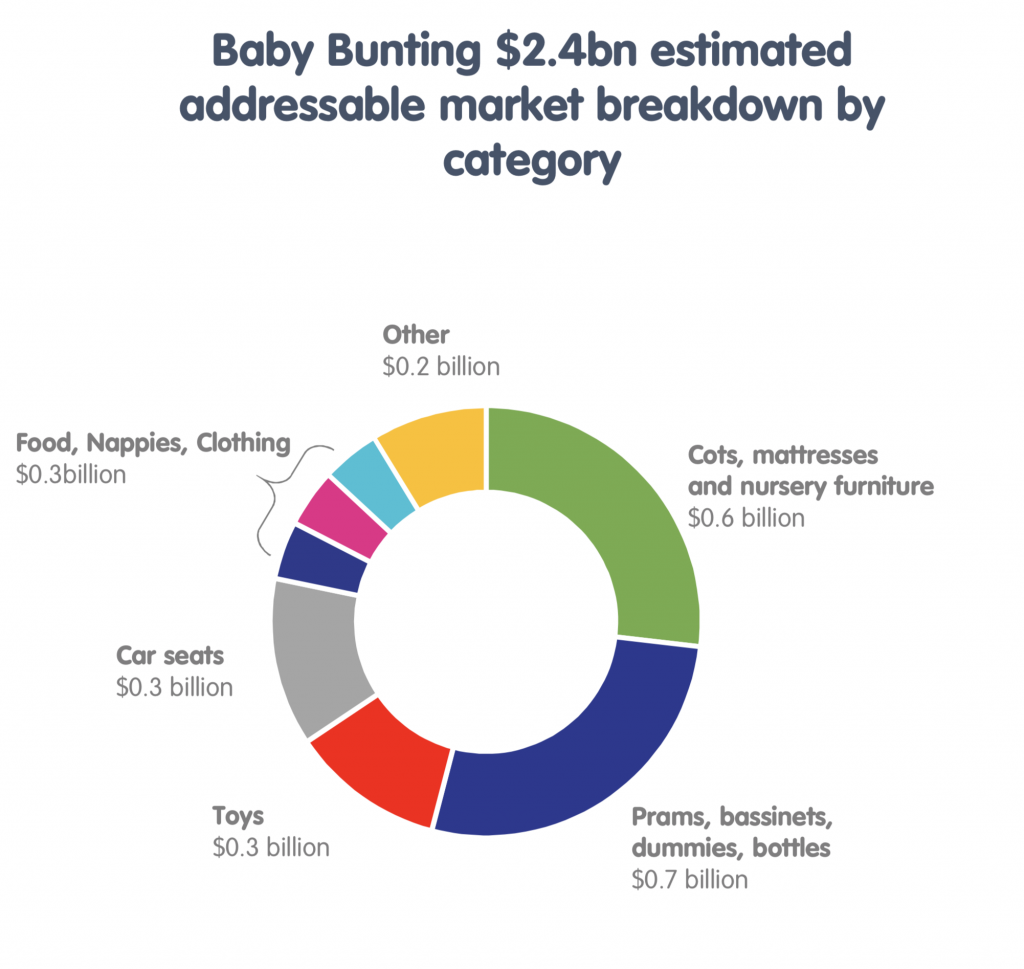

- It has a long runway, with over $300 million of revenue in a $2.4 billion addressable market, market share approximating 13 per cent.

- It has the largest focused “brick and mortar presence” in Australia with 50 stores, while most of its competitors including TRU/BRU, Baby Bounce, Bubs and Baby Savings have exited the Industry closing a combined 45 stores between them (and a combined $138 million of annual revenue). This leaves a large number of very small players as well as the major department stores (being Target, Kmart, Big W, Myer and David Jones, which number a combined 800 stores).

- Online sales account for over 10 per cent of revenue (+63 per cent in Fiscal 2018). Management is aiming for same day fulfilment for 90 per cent of online customer base, complemented via its “Click and Collect” strategy, which accounts for 50 per cent of online sales, as well as its pronto delivery service, which usually takes under three hours from the time of order.

- In an attempt to resist the added competition from Amazon, management have pursued State based fulfilment hubs, opening in Hobart, Tasmania, Cannington, Western Australia and Melbourne, Victoria this financial year.

- Private label has grown from 11 per cent of revenue in Fiscal 2017 to 21 per cent of revenue in Fiscal 2018 and management expects this to exceed 25 per cent of revenue in Fiscal 2019 and is targeting private label and exclusive products to account for 50 per cent of revenue over the longer-term.

- The company plans to have 54 stores by June 2019, and its long-term plan is to target 80 stores, with the new stores supporting the higher margin “Click and Collect” sales growth.

- Management believes new stores can generate $7.5 million of revenue and $1 milion of EBITDA by the end of their third year of opening. With 4-8 stores being rolled out annually, this indicates both Revenue and EBITDA could potentially double by the mid-2020s to around $600 million and $51 million, respectively, implying an EBITDA margin of 8.5 per cent.

While the competitive factors can change over time, management claims Baby Bunting is (currently) well positioned in terms of its range and prices given:

- 80 per cent of Baby Bunting’s top 250 selling SKUs are not available outside Australia.

- 56 per cent of Baby Bunting’s top 250 selling SKUs are subject to Australian safety mandatory standards.

- Only 20 per cent of Baby Bunting’s top 250 SKUs are sold on Amazon, and there is not a significant difference in pricing.

Source: Baby Bunting

While Baby Bunting seems to have a long runway, particularly with many of its competitors having recently exited the industry, a lot will depend on Amazon’s competitive response and investors in Baby Bunting will need to ascertain how severe this becomes over time.

John Penn

:

Good summary of BBN David – you obviously know them well, do you think they’ll be able to withstand Amazon?

David Buckland

:

Hi John, I think a lot of “higher end baby purchases” are emotional and this, together with BBN’s store growth, will make them more resilient than many other “bricks and mortar” retailers I can think of.