Why Westpac is the biggest holding in The Montgomery Fund

In a recent webinar to discuss the August reporting season, I was asked to provide thoughts on questions about the bank stocks. In my third post, I am covering: Why is Westpac the biggest holding in the Montgomery Fund. Why do you like it, more than anything else?

All of the major bank stocks trade with a high degree of correlation. However, there tends to be some stock specific differentiation between the Commonwealth Bank of Australia (ASX:CBA) as the highest quality bank. Historically, while CBA was seen as the highest quality bank, Westpac (ASX:WBC) wasn’t far behind, with both Australia and New Zealand Bank (ASX:ANZ) and National Australia Bank (ASX:NAB) viewed as lower quality. The main point of differentiation was return on equity (ROE), with both CBA and WBC tending to generate higher returns than ANZ and NAB.

The reason for the ROE differentials was primarily the result of differing portfolio mix. CBA and Westpac had, and continue to have, a larger percentage of their loan books in residential mortgages, while ANZ and NAB are relatively more exposed to Institutional and business lending respectively.

The return on equity generated by mortgages tends to be higher than business lending and institutional lending due to the amount of gearing that can be applied to the loan. This is a function of the risk weighting applied to each type of loan. The risk weighting on mortgages has decreased materially over the last 10 years as the major banks began utilising internal risk based (IRB) models rather than the standardised risk weights used by smaller banks. This cut the risk weighting from over 35 per cent to as little as 15 per cent a few years ago. More recently, APRA has introduced risk weight floors that have increased IRB to at least 25 per cent and further changes expected to be released later this year will see further differentiation in the risk treatment of certain types of mortgages.

If a bank is required to hold a minimum CET1 ratio of 10.5 per cent, and has a mortgage risk weight of 25 per cent, then the amount of common tier 1 equity capital the bank will need to hold against the mortgage will be 25 per cent of 10.5 per cent (i.e. 2.625 per cent) meaning that amount of debt funding that can be utilised is 97.375 per cent of the value of the loan. If the risk weight was 35 per cent, the bank would need to hold 3.675 per cent of the loan’s value as common tier 1 equity, 40 per cent more equity for a given loan size. Given the interest rate generated on the loan is a function of market competition, it is extremely unlikely that the bank would be able to increase the rate sufficiently to compensate for the 40 per cent higher equity requirement without a competitive impact.

So as mortgage risk weights fell for the major banks, the ROE generated on these products increased relative to smaller banks. With a higher percentage of their overall loan books exposed to residential mortgages, CBA and WBC benefitted more than ANZ and NAB.

While APRA’s soon to be released changes to risk weights and the impact of near zero official interest rates will negatively impact the margins and funding advantages enjoyed by the major banks, particularly on mortgages, the ROE generated on these products is expected to remain higher than returns generated on business lending.

Therefore, banks that are more focused on mortgages should continue to generate superior ROEs than those with relatively more exposure to business lending. This differentiation should be reflected in the market’s valuation of the banks relative to the amount of capital invested (e.g. the net tangible assets (NTA) of the bank).

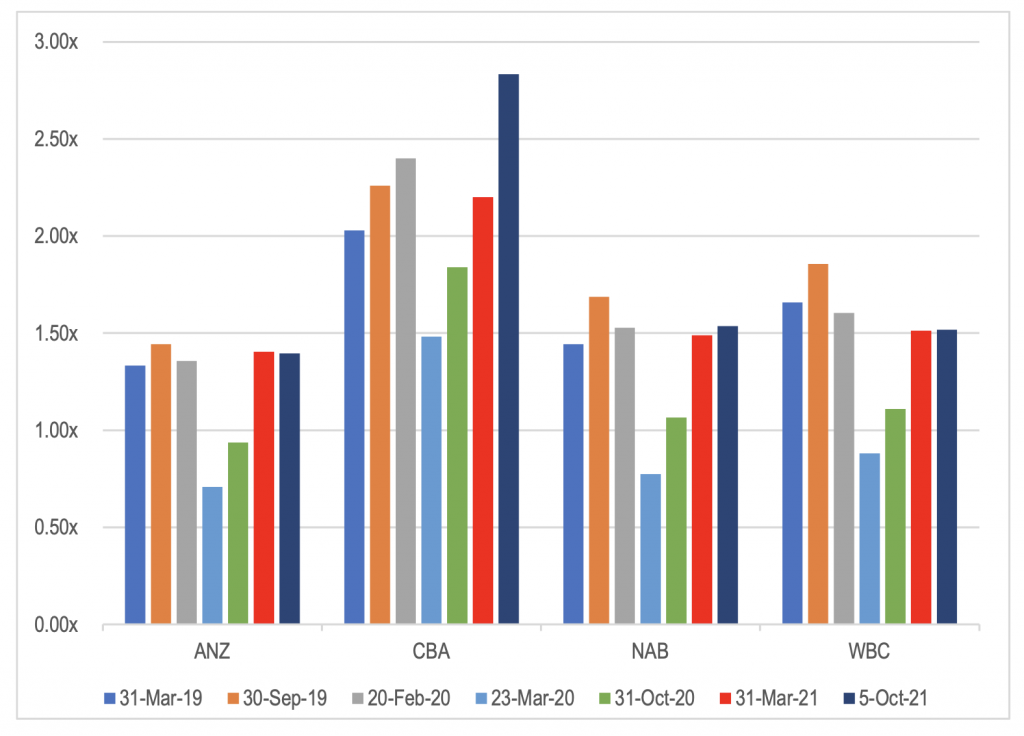

Figure 5: Major bank price to NTA ratios over time

Source: Companies, MIM estimates

Note: The NTA used for CBA as at 5 October 2021 adjusts the 30 June 2021 NTA for the recent A$6 billion off market buy back

This is certainly the case for CBA, which trades at a material period price to NTA multiple premium relative to the other major banks. Historically, WBC traded at a premium multiple relative to ANZ and NAB (albeit not as high as CBA). More recently, this premium has disappeared for three reasons.

First, the bank has had a number of very public governance failures, including the recent AUSTRAC claims that resulted in a A$1.5 billion fine.

Overpaying for acquisitions and other investments historically and failing to integrate them properly. This has resulted in added complexity from a technology perspective and has likely been part of the cause of the governance failures noted above.

While these issues are disappointing, we don’t believe that they have done enduring damage to Westpac’s core brands, at least not relative to the core franchises of the other major banks.

Last, WBC has been seen to be in a weaker capital position than the other major banks, reducing the potential for capital management. However, this is largely due to the other major banks moving to sell non-core wealth management and insurance assets earlier than WBC. While WBC still has its Panorama platform to sell, its CET1 ratio is well above the levels required to meet APRA’s ‘unquestionably strong’ standard. It also has a far larger balance of unutilised franking credits than the other banks, meaning that it will be able to undertake an off market buy back to return the capital to shareholders in a very tax efficient manner.

As such, we view WBC as offering a better risk return trade off with the potential for a re-rating of its core franchise as capital is returned to shareholders and returns improve after some difficult years.

You can read my first and second question here:

Why near-term bank dividends should remain strong

The difference between funding for small and big banks

You can watch the full webinar here: Montgomery’s reporting season review

The Montgomery Funds owns shares in Westpac and Commonwealth Bank. This article was prepared 25 October 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY