Why valuation still matters

There has been a lot written about the death of value investing, and how growth investing has outperformed significantly over recent years. However, it is important to distinguish the difference between the traditional concepts of “value” investing – i.e. capital intensive industries trading at low price-earnings or other similar ratios (including price / book), with the concept of “valuation” – determining the present value of an asset.

The concept of valuation is subjective to the valuer, but it transcends all form of investing. In its purest sense, value is reflected in the last transacted price, as it reflects the middle ground between a willing buyer and a willing seller at that point in time. As an individual, you may not agree with the price, but there may be someone out there who is willing to take a different view – this is what makes the market.

However, there are times when the last transacted price may not be a meaningful reference point to determine a future value outcome despite the human tendency to do so – a potential form of anchoring bias. The example of Pro Medicus (PME:ASX) is a useful case study to illustrate when the concept of valuation – rather than price – becomes important.

PME’s share price performance

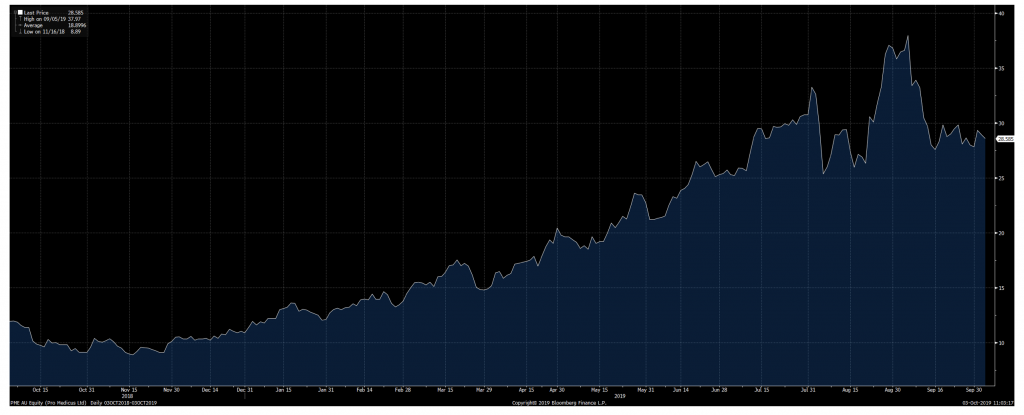

PME has been one of the top performers on the ASX300 this year, with the share price peaking at $38/share, good for a 218 per cent increase over the past 12 months. However, the stock was one of the worst performers in September, with the current share price of around $29/share equating to a 24 per cent fall from its recent highs. The fall was for the most part triggered by a small sell-down of shares by the founders (around 2 per cent of shares on issue).

Pro Medicus share price performance

Source: Bloomberg

Given the share price fall, does this suggest PME is now good “value”? Using the recent highs as a guide – the shares are 24 per cent “cheaper”– and the fact there’s been no major change to underlying business fundamentals, would suggest a closer look is warranted.

However, instead of looking at where it has come from, it is important to ask was that the “right” share price in the first place. A share price fall may trigger initial interest, but having a valuation overlay helps put price moves in context.

When valuation matters

Valuation overlays help to provide an anchor for when a share price may suggest good “value” to the incremental investor, given a certain set of projections. i.e. would the buyer expect to reliably make a profit from acquiring shares at the prevailing price regardless of investing strategy – whether it be earnings growth, company re-rate, price momentum, greater fool theory, or any other method. Note how this is completely independent to the concept of being a growth or value investor.

This anchor applies for any sort of valuation methodology – whether it be revenue or earnings multiples, balance sheet ratios (price / book) or discounted cash-flow analysis. While subjective, it is these valuation metrics that help determine your view of a “floor” price on a given set of assumptions.

Despite having a superior product to competitors, the concept of valuation is separate to the perceived quality of a business. At a forecast PE of 119x for 2020, and given the size and nature of PME’s contracts, it would have likely taken a number of years before the projected growth of PME’s earnings could justify the prevailing valuation metrics for the majority of investors.

Potential to forgo gains, but process is important

The potential downside to this argument is that strict adherence to these philosophies may result in taking profits early – in this case, one could make a reasonable argument about PME’s stretched valuation metrics at $25/share based on the projected level of earnings growth.

However, these same stretched metrics would have only gotten more stretched at $30/share, $35/share, and eventually $38/share, so selling at $25/share would have resulted in forgoing 50 per cent of the upside.

One exercise that may help mitigate sellers’ remorse is to back-solve the revenue and earnings growth projections that are implied in the share price – compared to your projections – through a relative value lens, to determine whether the assumptions may appear reasonable to the incremental investor.

While this process may inevitably lead to taking profits earlier than what hindsight will determine, this discipline should help limit the downside as a result of an unexpected change in market sentiment to the shares.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Wesley Horn

:

Joseph

The aim of value investing is to find shares that are perceived to be undervalued. Looking at charts showing price v intrinsic value, you often notice a share has historically been overvalued for much of the time, and yet it still could have been a good long term investment.

It seems to me that as long as a company shows good growth in profitability (that is smooth year to year), and reporting to the market is timely with no shocks, a share can continue to rise even if it consolidates for a period and perceived to be overvalued. It seems to me a company that promises the world and shocks the market with bad news are the ones to be careful of.

My point is can we afford to wait and only focus on buying a share when it appears to be undervalued?

Wes.

Joseph Kim

:

Hi Wes

You raise a good point which in my view highlights an important distinction between “value” and “investing”.

The concept of value is usually thought of in static terms – a point in time reference check compared to the price.

Investing however, is more fluid in nature. Over time, the value of the asset acquired will change as the business and its operating environment evolves. If the business continues to grow its earnings, the value of the business will in general continue to appreciate (usually along with the share price), which is what you alluded to.

As an example, consider the following – the share price of a company you have invested in exceeds estimates of intrinsic value by 10%. While the shares may now appear expensive and may tempt you to sell, it’s entirely possible the share price may never drift down to your own estimate of intrinsic value. Rather, the company may continue to grow profitability in its core and adjacent markets, which will result in the business becoming more and more valuable. If you had sold these shares when they were 10% expensive, you will likely end up paying a higher price a few years later.

Of course when you take this to the extreme – i.e. the price is over 100% expensive compared to value estimates, the shares are more exposed to a fall as a result of any disappointing developments (however mild) relative to the projections that are underpinning the share price. This is the concept I was referring to in this post.

So to answer the question about “waiting” for undervalued opportunities – sometimes it is better to buy a good business at what appears to be a fair price, and let the earnings growth of the business take care of the rest.

Hope that helps.

Pelham

:

Joseph – I like your article on SYD very much. What is the best order for me to read your SYD articles, please?

Joseph Kim

:

Thanks for the positive feedback Pelham.

Chronological order would be best – starting with the brief video blog introduction from the 6th February and running over 4 weeks.

I also wrote an update on the battle over airport pricing on the 25th September re: the Productivity Commission report – note this was released to the public this afternoon.