Why the east coast gas crisis is such a big deal

My recent blog post on the national energy debate created some heated (sorry!) responses from a few of our readers. Now I’d like to discuss another hot energy topic, the east coast gas crisis, which has seen a constrained domestic supply send gas prices soaring by a whopping 300 per cent since 2015.

East Coast gas prices are important for a numbers of reasons:

- As mentioned in the blog post linked above, gas fired electricity generation is what most of the time sets the wholesale electricity price on the east coast of Australia. Now, wholesale prices are only part of the total electricity price that customers pay (network transmission costs and retail margins are the other parts with network transmission costs being the biggest part of the total electricity cost), but given the recent volatility in wholesale costs, it is the biggest contributor to the recent increases in electricity costs. We consider the electricity price important for three reasons:

- Electricity is (in the short term) a non-avoidable cost for consumers and increases in electricity costs for households have to be compensated by decreases in other spending, which has an impact on the rest of the retail sector and parts of the service sector.

- Electricity is a significant input cost for a number of industries ranging from the obvious ones as manufacturers of building supplies (like Boral, CSR and Brickworks), mining companies (like BHP and RIO) and steel companies (like Bluescope Steel). It also impacts a range of other more non-obvious industries like aged care providers such as Estia Health. High electricity prices can have a very negative impact on the margin of such companies and it is something we keep a close eye on when making investment decisions.

- There are some companies like AGL and Origin that benefit from the high electricity price as they have other sources of low cost generation (renewables and coal).

- Natural gas in itself is a significant input feedstock to a number of companies in Australia like Orica, Dulux and Incitec Pivot.

- And finally, although resource companies do not really fit with our definition of quality companies, we do keep an eye on them to see if there are opportunities presented by significant mispricing.

We are indeed glad to see that the political debate has shifted slightly in the last couple of weeks from the focus on keeping old coal fired power stations open past their design life to instead addressing the real problem with the energy market which is the price of gas.

Prime minister Turnbull last week made a deal with the LNG exporters to divert more gas to the domestic market rather than selling it on the Asian spot market. The deal was agreed under the threat of triggering gas export control regulation.

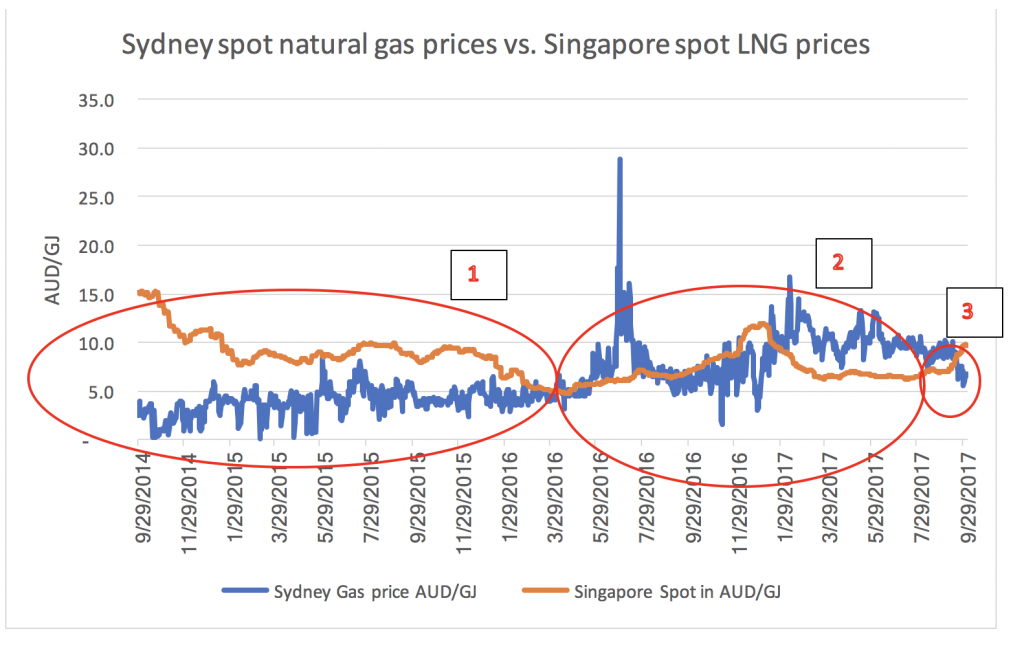

So, let’s take a look at what has happened to the price of gas. The chart below shows the comparison between the Sydney spot prices for natural gas (source: AEMO) and the Singapore spot liquefied natural gas (LNG) prices (source: Bloomberg) in AUD/GJ.

We will divide the chart into 3 parts and discuss each separately.

Part 1

This is the situation before about mid-2016 which is before the LNG projects in Queensland really started to ramp up production and consume a lot of gas. The domestic market was very well supplied as the gas producers were developing gas production to make sure that they had available gas to feed the LNG trains when they came on-line and they marketed this excess gas domestically.

During this time we also saw a significant decline in the Singapore spot price from about $15/GJ to ~$5/GJ. The reason for this is both the growth of LNG production in the world and the fall in the oil price from above US$100/bl to about $55/bl (the price of LNG is closely linked to the oil price and most contracts are written with reference to the oil price).

Part 2

We then entered a period, starting around mid-2016, when the LNG projects in Queensland fully ramped up and started consuming a lot of gas. As a consequence, the domestic market experienced a supply shortfall and we saw gas prices rise significantly above the long term average and even the bizarre situation with domestic prices exceeding the price in the spot market in Singapore.

Now, normally, in such a situation with prices in export markets being significantly lower than the domestic prices and there being additional costs involved in the export of the gas (liquefaction and shipping), we would expect the gas producers to divert gas from export to the domestic market as the returns should be higher but this has not happened until very recently. There are a couple of reasons for this:

- The producers are still in the verification phase of the LNG plants and they want to fully establish the capabilities of the plants by running them as hard as possible.

- The domestic gas market is relatively shallow with only a few producers with spare capacity and it is very possible that the gas producers make more money by restricting the supply to the domestic market than they would by increasing supply and realising a lower price (please note that we are not suggesting that there is open collusion amongst the producers, but the number of producers is small enough that you can get such rational outcomes without any illegal collusion).

Part 3

In the last 2 weeks, we have seen a sharp reversal of this trend with Singapore prices rising sharply and domestic prices coming down significantly so that normality has returned – with lower domestic prices than export prices. This raises a number of interesting questions:

- What is the cause of the increase in Singapore spot prices? Is it the risk of Australian export restrictions that is forcing up prices or is it a normal increase in buying as Asia is approaching winter when demand for gas is higher (we saw the same increase in Singapore spot prices last year)? The answer to this question will determine what volatility we see going forward.

- How sustainable is the fall in domestic spot prices? Is it driven by real fundamentals (i.e. real supply/demand) or it is a speculative move driven by political noise? Distinguishing between these two factors is very hard in the short term and it is way too early to say which is the real driver.

- Will the lower Australian spot prices translate into longer term gas contract prices falling as well? Normally there is quite a bit of lag between movements in the spot and contract market and companies are generally much more dependent on long term contracts than on the spot market so we will want to see evidence of the lower spot prices translating into lower long-term contract prices before we start factoring in lower electricity prices and lower input prices for domestic companies, which could have some clear positive implications for quite a few companies.

- Will the domestic gas suppliers fulfil their promises of diverting gas to the domestic market if we were to see continued strength in the Asian spot market even when the ramp-up period of their plants is over?

We are, as mentioned, following the development in the gas market closely both for the impact it will have on the overall economy but also for the specific impact it will have on specific companies. We currently do not have any positions in any of the companies mentioned above.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY