Why the banks are cutting mortgage rates

After raising standard variable rates on interest only and investment property mortgages in 2016 and 2017, the big banks have recently unwound some of these increases. This has surprised some observers. So, what’s going on?

The move can be explained by the banks’ response in meeting APRA’s macro prudential regulatory caps and the outcome of those actions.

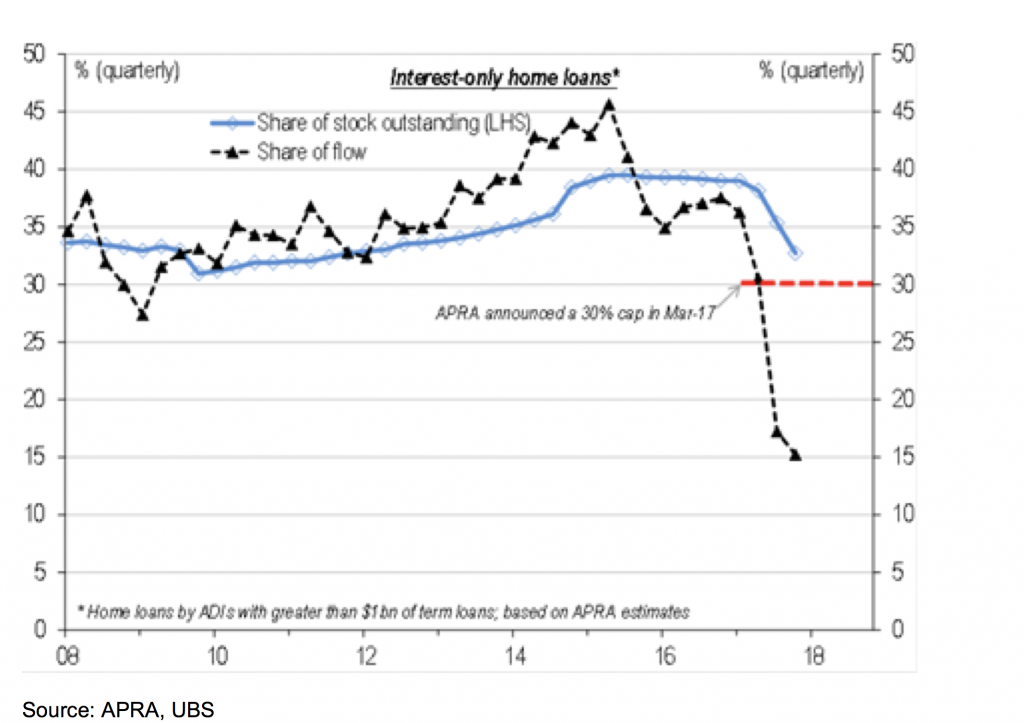

In March 2017, APRA announced a 30 per cent cap on the proportion of new mortgages that could be interest only. This cap came into effect in the September quarter of 2017. While APRA would have preferred to see the banks meet this requirement by restricting the volume of new interest only loans through the approval process, the banks took the right approach in a capitalist economy by rationing newly constrained supply by using the price mechanism. In other words, the banks increased variable mortgage rates on interest only loans to reduce demand for the product. This is basic microeconomics supply and demand theory.

The problem was that the banks did not know how much interest rates needed to increase on interest only (IO) mortgages relative to principal and interest (P&I) loans to reduce demand for IO loans sufficiently to come in under APRA’s cap. The banks also faced one other complication in meeting the cap on a short term basis. Any application that was already approved as at 30 June but was settled in the September quarter was included in the cap. The banks decided to honour any loan applications that were approved prior to the announcement of the cap, leaving them even less room to write new IO loans in the September quarter and still come in under the 30 per cent cap.

Given the implications of not meeting the new APRA requirements, the banks decided that if they were going to miss, they would miss to the low side of the cap. Therefore, they aggressively lifted IO mortgage rates, to ensure they reduced demand for IO mortgages by more than was necessary. In the end, the rate increases were far more successful in cutting demand for IO loans than expected, with new IO loans falling to around 15 per cent of new mortgages in the December quarter.

The banks are now unwinding some of the increase in the price differential between IO and P&I variable mortgage rates given that they now have so much headroom under the cap.

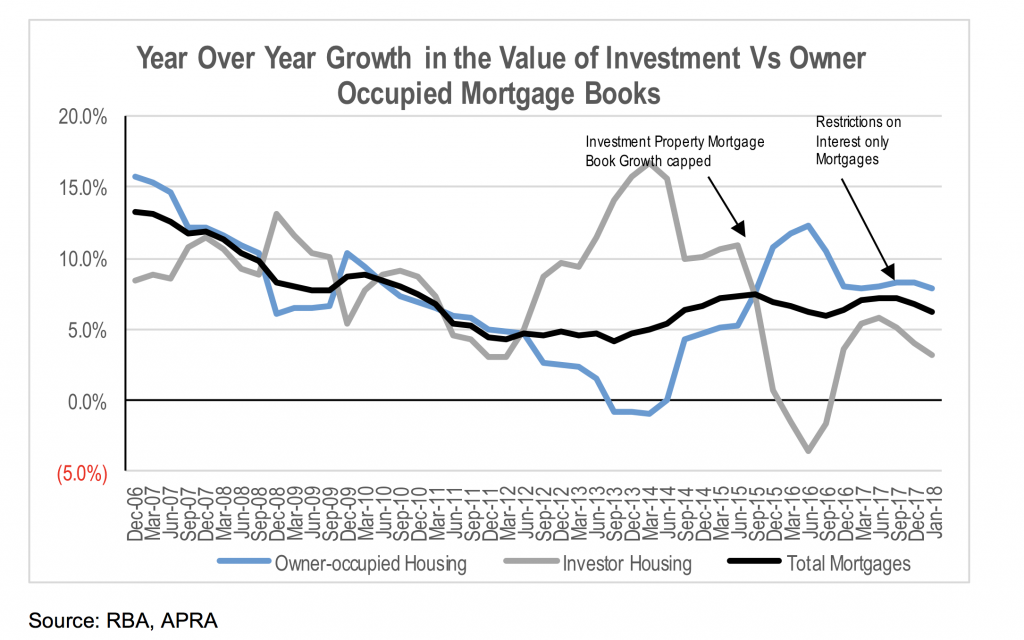

A similar thing is occurring in investment property loans. APRA imposed a 10% cap on growth in investment property loan books for the banks. The rate of growth in investment property loans has fallen significantly in recent months such that it is now in the low single digits. This allows the banks to get more aggressive in accelerating the growth rate of their investment property loan books while remaining under the cap.

In terms of the implications for the banks, more aggressive pricing in IO and investment property loans could result in an acceleration in mortgage loan book growth. However, the offset is likely to be downward pressure on spreads due to the combination of the shift in mix to lower rate P&I loans, and a reduction in back book IO and investment property mortgages.

After raising standard variable rates on interest only and investment property mortgages in 2016 and 2017, the big banks have recently unwound some of these increases. This has surprised some observers. So, what’s going on? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thanks that helped. The 3m BBSW has been rising recently. If it rises further, do you see the RBA hiking to keep up as they have generally followed the BBSW in the past?

The rise in the 3 month bank bill swap rate (BBSW) in March is interesting. It implies an increase in credit spreads relative to the overnight cash rate, and appears to be following an increase in the repo market. This suggests liquidity has been withdrawn for some reason and could also reflect the increase in spreads in the US implied rising LIBOR rates. Liquidity is periodically withdrawn for short periods of time and BBSW reverts back to previous levels relative to the overnight cash rate, but this move appears to be larger than recent instances. The banks will be keeping a close eye on the 3 month BBSW rate given that it is a key reference rate in their wholesale funding costs. If sustained, it could force them to reprice some loans. I doubt the RBA is looking to raise rates given the current state of the economy, but it certainly an indicator that should be monitored.

Does this mean we should start to see house prices rise again?

It’s possible that the added fuel provided to property investors could see a near term improvement in property prices, it’s more likely to reduce the risk of short to medium term mortgage stress that would increase the risk of forced selling.