Why I don’t think this is a dead cat bounce

With equity markets steaming ahead, there’s no shortage of people calling this a ‘dead cat bounce’ and, by implication, predicting another market correction. History, however, suggests that 2022 was simply an isolated poor year for markets, and that we have now returned to ‘normal programming’. If I’m right, then 2023 could be a good year for investors.

Here’s a thought: irrespective of whether the market goes back down or goes up, it will go back to normal.

By that I mean to suggest there will be nothing extraordinary that will happen to markets in the short term, or maybe even in the next year or two. And when I say a ‘normal’ market, I mean one that will simply be driven by all the usual factors such as earnings growth, the ability to meet or exceed guidance and expectations, capital raisings and restructurings and so forth.

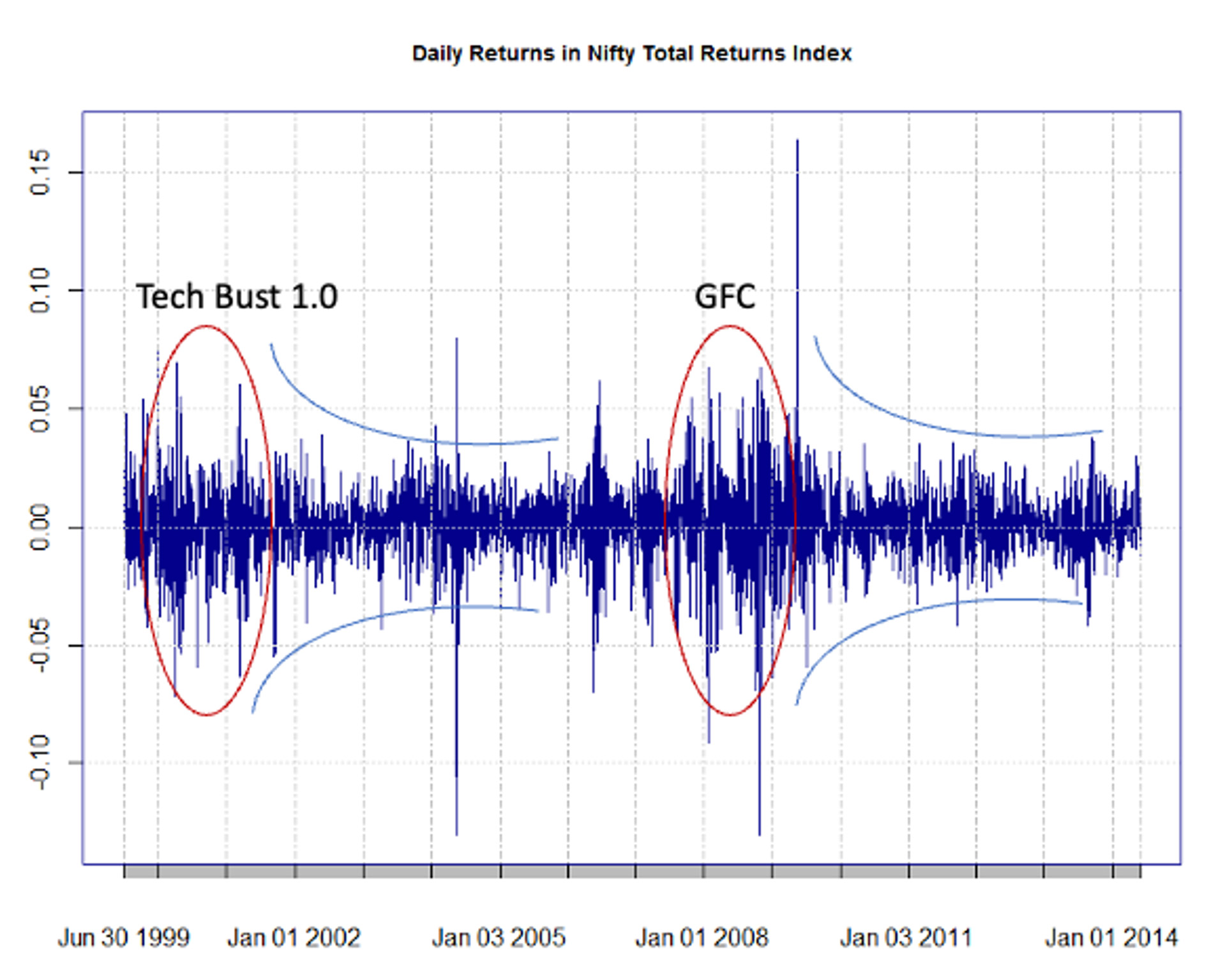

In his eye-opening book, The (Mis)behaviour of Markets, Benoit Mandelbrot observed a pattern in markets where long periods of low volatility are occasionally interrupted by short bursts of extraordinary volatility. The goal of the book is much more ambitious, of course; to ask readers to consider the merit of looking at market behaviour through a fractal lens rather than through fundamental, technical or even random walk lenses.

In one of the early chapters, the author suggests two types of randomness: “mild” and “wild”. Where “mild” randomness is analogous to tossing a coin, “wild” randomness is analogous to a drunk sniper hitting their target.

Periods of mild randomness tend to dominate, and these are periods where everything is ‘normal’ and significant deviations from the mean have a low probability of occurring. When deviations do occur during mild periods in the real world, you find analysts and commentators describing deviations as 6-Sigma events and so forth. The references to 6-Sigma events are usually a function of the market’s emergence from a long period of mild randomness.

The market, however, may in fact be entering a period of wild randomness, where averages, or means, don’t converge. During this period the aberrations are so extreme they make the averages look irrelevant. During these periods analysts and commentators redraw their averages. You might, for example, see charts with a long-term average plotted, as well as a second, more recent average plotted a long way from the former.

Figure 1. Mild versus wild

The periods of wild randomness are brief relative to the periods of mild randomness but rarely are analysts or commentators even aware they have exited one phase and entered the next.

The periods of mild randomness go for long enough for entire industries, theories and fads to be built upon them. Think ‘house of cards’. The tech bubble of the late 1990s, the two-for-one property boom prior to the GFC and the Zero Interest Rate bubble punctured by rising rates in 2022, all spring to mind as long periods of low volatility followed by brief periods of massive volatility.

I believe we have just exited a period of wild volatility and are now entering a period of mild volatility. Most commentators aren’t aware of the migration from one to the other and so are still forecasting ‘big’ things, wild swings, asset market crashes and the like.

More likely, however we are now returning to an extended period of lower volatility with the market driven by the usual drivers mentioned earlier.

Forecasting the switch from ‘wild’ back to ‘mild’ is as prone to error as any forecast, but acknowledging the possibility prepares the investor to invest perhaps with a little less trepidation.

As I write this note, company’s are reporting and JB Hi-Fi was down three per cent after disclosing sales growth slowed precipitously in January. Nick Scali reported the same conditions in January and its share price was down just four per cent, eight days later. These are simply anecdotes and I don’t have the time to conduct a complete statistical analysis of every company’s share price reaction to a miss or beat, compared to the same time last year and the years before.

I don’t need to.

Mapping volatility will show we have just emerged from a period of heightened volatility. And that volatility was wilder than the long period that preceded it, a period defined by interest rates being cut to, and held at, zero.

Investors can now start to think not about whether the recent rally is a dead cat bounce, or a bear market rally destined to collapse and test the recent lows. I am of the view investors can return to thinking about the longer-term fundamental drivers of share price performance.

Remember the immutable arithmetic of investing in equities; your return will equal the earnings per share growth rate a company generates if you buy and sell the shares on the same P/E ratio. If a company grows its earnings per share at 15 per cent per annum, and you buy the shares on a P/E Ratio of 10 times earnings, and year hence, sell them on a P/E ratio of 10, your return will be 15 per cent per annum.

Remembering that obligates you to think about which companies can grow earnings in the current environment and beyond, and which company’s shares are trading at reasonable P/E multiples.

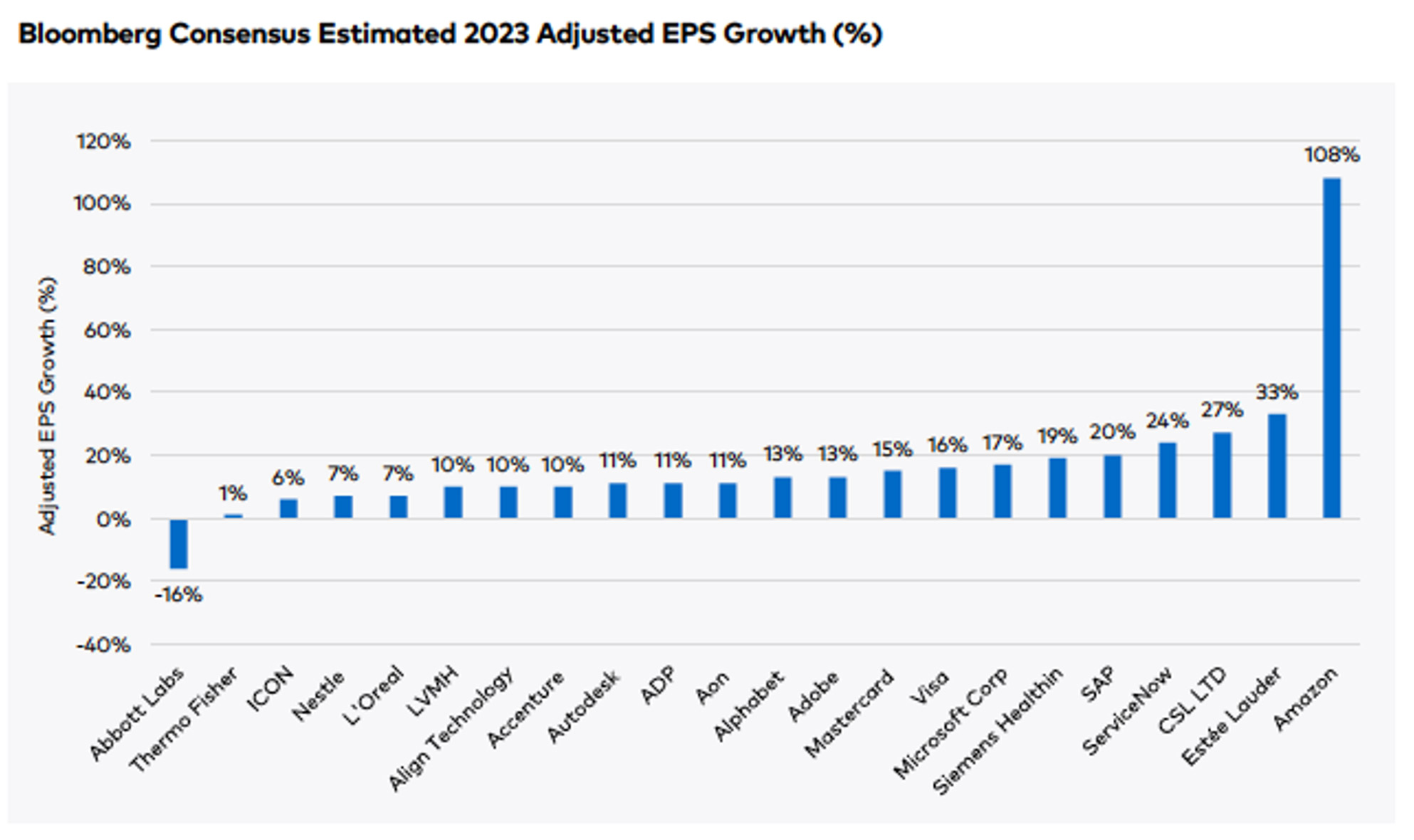

Figure 2., is a chart from Polen Capital revealing the earnings growth rates of Polen Global Growth Fund portfolio holdings

Earnings growth rate of Polen Capital holdings

It shows that despite all the talk of recession, there is a multitude of companies expected to grow earnings at double-digit rates.

I realise there are plenty of learned experts willing to predict another market crash and warning investors to wait for more pain. History however suggests good years tend to follow poor ones. History also suggests poor years are more commonly isolated years. They rarely cluster. If history rhymes then 2022 will be an isolated poor year. Meanwhile, Benoit Mandelbrot’s fractal framework for thinking about markets, suggests a long period of mild volatility follows the interspersing short periods of wild volatility, which we can say anecdotally, we have just experienced.

To my mind, the case continues to build for a good year for investors in 2023. Late last year I said it was time to sharpen the pencil. Continuing with the metaphor, 2023 might be the year to start writing.

Thank you for an insightful position on the market.