Why I am personally adding to my equity investments

In this week’s video insight Roger discusses how the higher interest rates expected from the U.S. Federal Reserve are almost entirely responsible for the sell-off in the stock market, causing the Price Earnings (P/E) compression we have seen to date. Unless the Fed surprises with even more aggressive rate hikes, the future direction of the market should now be determined by earnings growth.

Transcript

Roger Montgomery:

Several friends have asked me to let them know when I decide to make additional investments in equities. Of course I can’t predict what will happen in markets in the short term, I guess there is security in numbers. And over the longer term, I am acutely aware of the old investing aphorism; the lower the price you pay, the higher your return.

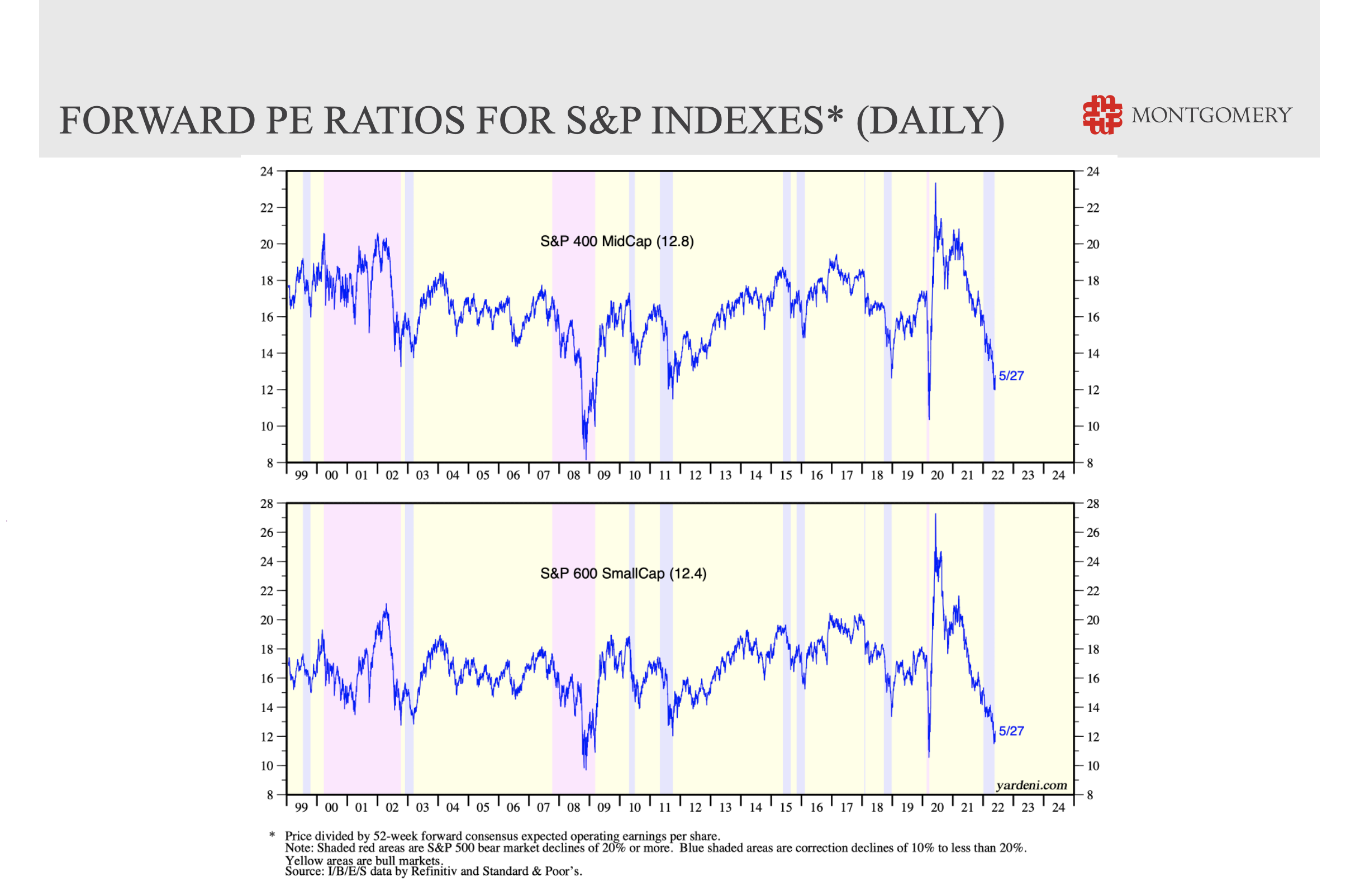

This chart from Ed Yardeni Research reveals Price Earnings (P/E) ratios for small and mid-cap companies are now approaching the lows of the COVID 2020 correction.

As you look at this chart, remember one thing; the circumstances surrounding each previous P/E low was different. For example, when the stock market sold off aggressively in 2018, the U.S. Federal Reserve quickly changed tack and ceased raising interest rates before cutting them again. And of course in 2020 the COVID lockdowns prompted unprecedented fiscal and monetary stimulus. If you believe what the Fed is saying today, that is unlikely to be the case. They really want inflation to get back down to two per cent.

But there might be some good news. The latest U.S. inflation data is starting to show the benefits of a higher month-to-month base effect. You might recall inflation recently peaked at 8.5 per cent in March before falling to 8.3 per cent in April. Of course whether the market likes this or not will depend entirely on sentiment. Investors in the U.S. may dislike the falling inflation rates today by pointing out that it was around this time last year inflation started taking off, so today’s numbers are benefitting from the base effect of last year’s higher numbers and are therefore still too high today.

Importantly however the higher interest rates expected from the Fed are almost entirely responsible for the sell-off in the stock market so far, causing the P/E compression we have seen to date. Unless the Fed surprises with even more aggressive rate hikes, the future direction of the market should now be determined by earnings growth.

Many investors of course are worried about a recession and the impact that it will have on earnings. A recession may indeed be on its way, although current economic forecasts for the rest of 2022 and 2023 aren’t suggesting any negative rates of growth. So, with P/Es now at recent historical lows, I’d prefer to look at the earnings growth of the companies we own.

When I first invested in the Polen Capital Global Small and Mid Cap Fund I didn’t expect the unit price to decline by nearly 40 per cent. But it has. The aggregate forward P/E ratio of the stocks in the Fund at inception was 44 times. That has now fallen to 25 times. If I break up the P/E multiple compression of the portfolio into its components, we find about 70 per cent is due to lower prices but 30 per cent is due to higher earnings the companies have generated.

And that’s the point. Polen calculates the companies in the portfolio have grown earnings by nearly 25 per cent per annum over the last five years on revenue growth of 18.5 per cent per annum over the last five years. Annual earnings growth for the next five years is estimated to average between 20 and 25 per cent.

Every company in the portfolio is generating profits and has a very strong balance and no companies in the portfolio are cyclical.

With all that in mind, have a look at this chart again. It might explain why Berkshire Hathaway has spent more than US$51 billion on stocks in the three months ending March 31. And I trust you can see why I have instructed my banker to transfer additional funds into the Polen Capital Global Small and Mid Cap Fund. And if the market continues to fall, I will be calling my banker again to continue the process of dollar cost averaging.

Roger Montgomery owns personal units in the Polen Capital Global Small and Mid Cap Fund. This video was prepared 31 May 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to invest in the Polen Capital Global Small and Mid Cap Fund you should seek financial advice.

Great post Roger. I’ve been active the last 2 weeks and it has been quite lucrative already. The view is always long term of course but the early signs are very positive.