Why a U.S. recession is no sure thing

Fears of a U.S. recession and its impact on small companies may be one reason the share prices of many small caps have been subdued over the past year. But is a recession inevitable? Possibly not, if you look at recent data. For investors, this means many quality businesses are likely trading at very attractive prices.

In November last year, we suggested conditions were ripe for a good year for the stock market in 2023. We pointed out the historical pattern of good years following terrible years, the track record of poor years occurring in isolation over the last 100 years rather than clustering, the fact that price-earnings (P/E) ratios were then attractive and that central banks globally had recommenced quantitative easing (QE).

The view was somewhat contrarian because fears of a recession in 2023 were acute late last year (see the references to an October 2022 Bloomberg article below).

Today, fears of a recession are abating, and two charts may help explain why.

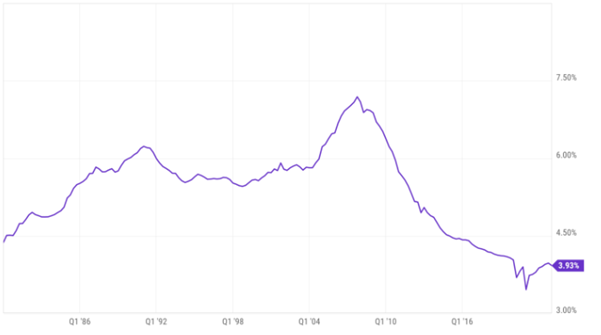

Figure 1. U.S. Household mortgage debt service as percentage of disposable income

Before the U.S. Federal Reserve commenced its series of interest rate increases, U.S. homeownership stood at just under 67 per cent. Of that percentage of the population who own a home, 38 per cent have no mortgage at all. The remaining 62 per cent do.

As a percentage of all U.S. households, 42 per cent have a mortgage, 25 per cent of all U.S. households own their own outright and the remaining 33 per cent do not own a home.

Presumably, during the period of ultra-low rates, many of those homeowners (remember U.S. banks offer 30-year fixed rate mortgages) borrowed or refinanced, securing very attractive rates for the next three decades.

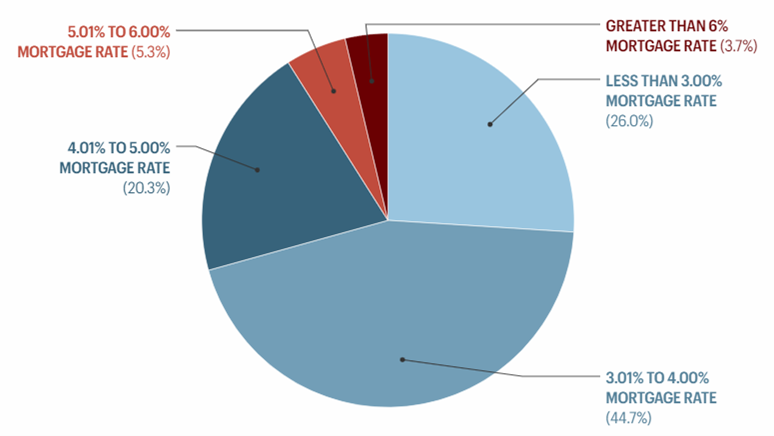

According to Fortune magazine, who sourced their data from Morningstar and the Federal Housing Finance Agency, 91 per cent of borrowers now enjoy mortgage rates under five per cent. And 70 per cent of borrowers are enjoying rates of four per cent or less. Only 3.7 per cent of mortgagees are paying rates of greater than six per cent.

Figure 2. Percentage share of outstanding mortgages by interest rate

Breaking down the numbers another way, we can see that 33 per cent of U.S. households who don’t own a home and are therefore not experiencing any impact from rising rates (they are of course experiencing the impacts of inflation and higher rates on car loans if they’ve borrowed to purchase a car).

Another 25 per cent of U.S. households have paid off their mortgage entirely. This group have also avoided the impact of rising mortgage rates as the Fed raised its cash target from zero to five per cent.

Combining the two, we can see that 58 per cent of American households are unimpacted by the rise in mortgage rates thus far. They will also not suffer any direct consequences even if the Fed raises rates further.

Meanwhile, 90 per cent of the remaining 42 per cent of U.S. households have locked in rates of less than six per cent and 70 per cent (equivalent to just under 30 per cent of all U.S. households) have locked in rates of four per cent or less.

Back in October last year – October 17 to be precise – Bloomberg ran a story entitled, “Forecast for US Recession Within Year Hits 100 per cent in Blow to Biden”. The story went on to say, “A U.S. recession is effectively certain in the next 12 months in new Bloomberg Economics model projections”, adding, “The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100 per cent.”

Figure 1. reveals that the aggregate percentage of disposable income required to service mortgages is less than four per cent at the end of March 2023. That leaves a very large portion of disposable income available to prop up other areas of the economy.

There are still three months to go for Bloomberg’s prediction to be correct but employment data, mortgage data, excess savings, and a recovery in the stock market (the wealth effect) suggest the certainty of a recession must now be far less than Bloomberg’s 100 per cent.

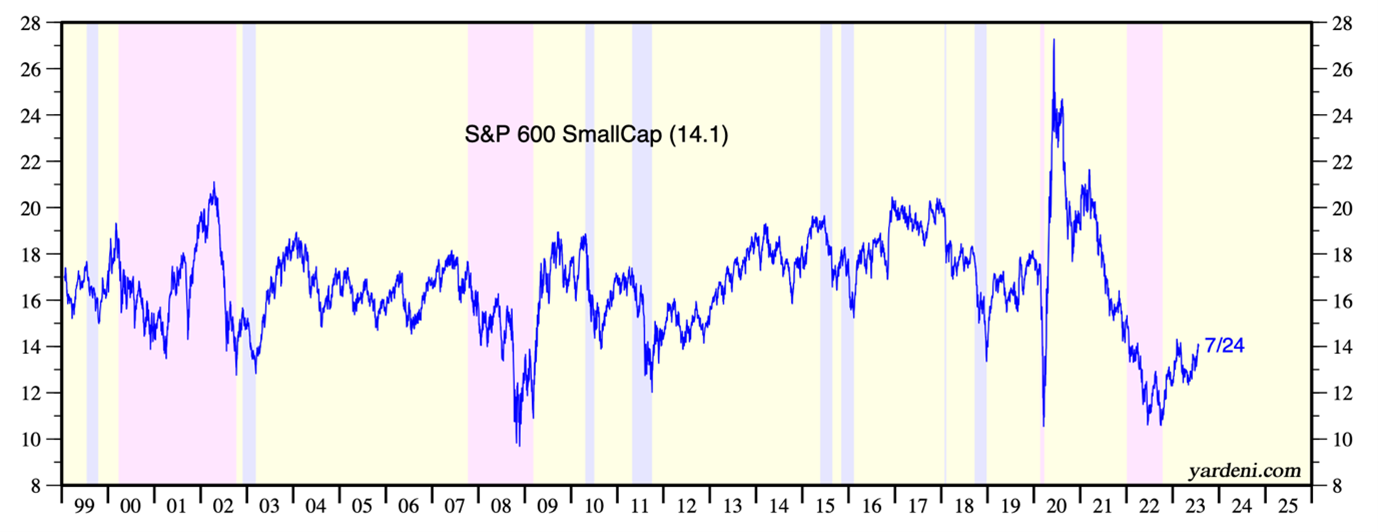

Figure 3. S&P600 Small Cap P/E Ratio, as at 24/7/2023

A quick look at a U.S. aggregate small-cap index’s performance suggests the risk appetite is low relative to history. In fact, there are many quality investment opportunities that are currently either being priced for recession or unpopular because of fears of recession.

Fears of recession and its impact on the earnings of small companies may be one reason investors aren’t willing to pay higher multiples for a company’s earnings. If those fears prove to be misplaced, however, quality small caps, for example, could do very well again. And don’t forget the well-worn investing aphorism: “Things can take longer to occur than you thought they would, but when they do, they happen faster than you thought they could.” If you wait for the swallow to sing, spring may already be over.

Roger, this may be true for the US, but I wonder whether the same picture applies to Australia, as our fixed rate mortgage rate durations are far less than the USA, and this apparent “mortgage cliff” for us…

Hi Chris, you might like to read these blogs about the so-called mortgage cliff: Here and Here.