Who made the Value.able grade?

The Value.able class of 2010 is indeed all class.

The Value.able class of 2010 is indeed all class.

Your nominations for the A1 stocks to watch in 2011 are fine examples of the sorts of companies that I eagerly seek for my own portfolio (with the exception of the odd recalcitrant student who diverged from the lessons learned).

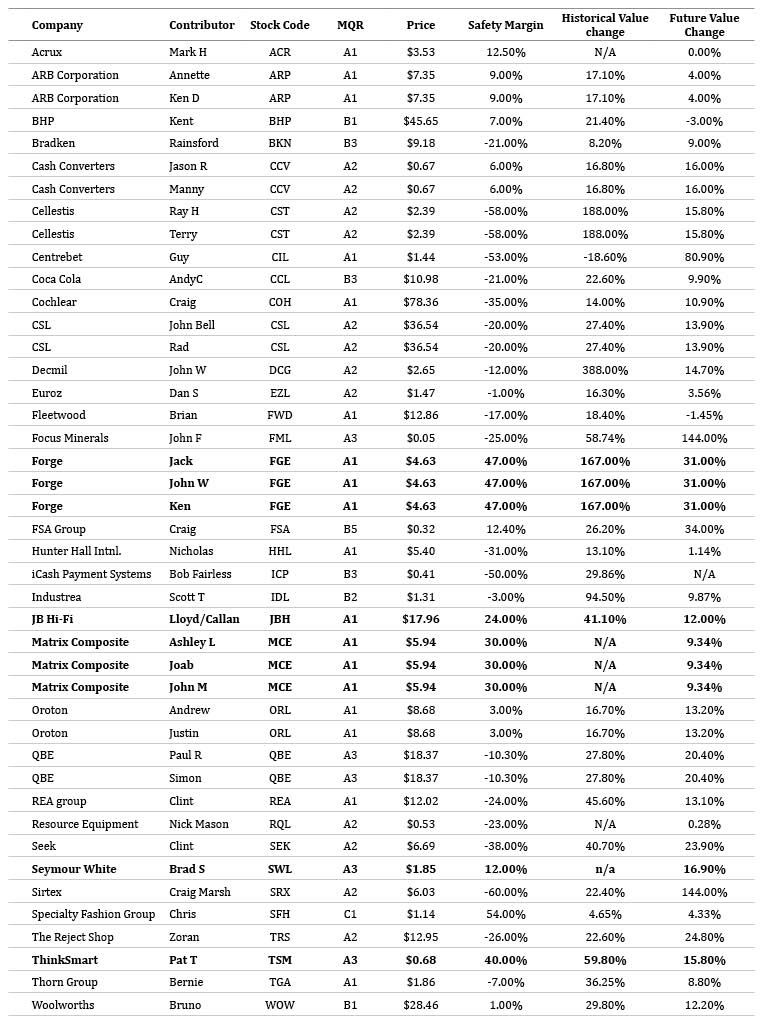

I haven’t yet decided which will be revealed on Sky’s Twelve Shares of Christmas special tonight at 7pm, although the shortlist may be obvious from the numbers presented in the table below.

If we presume that all A1s have equally bright prospects – they don’t – then the job of picking the top stock comes down to the one that offers the highest return when combining the discount to intrinsic value and the prospective change to intrinsic value over the next two or three years.

One difficulty with such a simplistic approach is that firstly, varying degrees of certainty about the future cloud the picture. I have also used consensus numbers to produce the valuation changes and these are notorious for being optimistic at precisely the wrong points in the business cycle.

To avoid this dilemma for the purposes of the exercise (but perhaps not for the purposes of investing), I could elect to go with the choice that received the most recommendations. The winner of that contest would be a tie between Matrix Composite & Engineering (MCE) and Forge Group (FGE) and the equal runners up would be Oroton (ORL), ARB Corp (ARP), Cash Convertors (CCV), Cellestis (CST) and CSL (CSL). The remaining contributions include Acrux (ACR), BHP (BHP), Bradken (BKN), Centrebet (CIL), Coca Cola (CCL), Decmil (DCG), Euroz (EZL), Fleetwood (FWD), Focus Minerals (FML), FSA Group (FSA), Hunter Hall (HHL), iCash Payment Systems (ICP), Industrea (IDL), JB Hi-Fi (JBH), QBE (QBE), REA Group (REA), Resource Equipment (RQL), Seek (SEK), Seymour White (SWL), Sirtex (SRX), Speciality Fashion Group (SFH), The Reject Shop (TRS), ThinkSmart (TSM), Thorn Group (TGA) and Woolworths (WOW).

Whilst I have identified a universe of A1 companies trading at discounts to intrinsic value that have slipped under your radar, the objective of the exercise was to ask for your picks and now that I have the list, choose a winner I must.

On tonight’s Summer Money program on Sky Business at 7pm I will reveal the ONE stock that you have selected as the relatively best prospect for 2011. It won’t be Roger Montgomery’s pick. It will be the top pick by the Insights Blog Community – the Value.able Graduate Class of 2010!

Posted by Roger Montgomery, 16 December 2010.

Hi everyone

I was wondering if someone could help me with my calculations for MCE. I am not sure what I am doing wrong as I am getting an IV of $19.57.

Step A: 2010 ending equity of $59,907.54 / 2010 ending shares of 69,964.10 on issue = 0.86 equity per share

Step B: 2010 dividends paid of $2,258.56 / 18,159.91 2010 NPAT = payout ratio of 12.4%. I have rounded this off to 12%

Step C: 2010 NPAT of $18,159.91 / 20,590.76 2009 ending equity = ROE of 88.19%. The tables don’t go that far so I’ve been using 60%.

Is there another table that I should be using or have I used the wrong figures? Thank you.

Guys,

Be VERY VERY careful going above 60% and read pages 193 and 194 of my book. There are reasons I have presented everything the way I have.

Hi MLK,

I have an equity of 59.9 million which gives me a ROE of 30%. Equity per share looks right and payout around the same mark as mine. I think it is just the equity is wrong.

Hi Roger,

I understand you are managing a fund again. Just wondering if this means there will be a reduction in your company and investing insights shared via this blog and via appearances on Sky? Of course you’d have every right to do that. And I also understand you may not want to reveal your plans but thought it can’t hurt to ask.

Thanks

I will do my best to manage the balance Steve. See you in the new year. Happy Christmas.

Hi Roger

was going to post “good luck with the new venture” but that would be silly, luck wont play a part. Maybe “many happy returns to your fortunate investors” is more appropriate. We all know it will be another success and look forward to watching from the sidelines.

By the way I have had a great year in my investing and visiting your blog, thanks for providing this forum for like minded value investors.

Have a great break and bring on 2011

Thanks Craig.

Hi folks, Im in my 20’s and started investing early this year. Its been fantastic reading all your insights and getting to know a few of the regular characters through silent reading!

January through to april was lots of speculation, transaction fees and charts with very little gain but since learning about value investing and enjoying uncovering and researching great business’s not only is it fun but rewarding. What I appreciate most is the principles behind it and Rodgers teaching. You have helped “give a leg up, not a hand out” (to quote Rodger). There is such a wealth of knowledge on this blog but I dont come here to take but rather to learn, think and make my own decisions and for that I am greatful! All the best to evrybody on the blog, next year I hope to share in the discussion.

Thanks again

Christopher

Hi there,

A quick thanks to Ken for taking the time to share his thoughts on AIR. Yes I did go back to that post titled ‘Where should you focus your digging?’ and noted the reply to Peter’s question. I had mentioned in my post that I hadn’t yet looked at cash flow, and from Roger’s reply to Peter’s quesion it appears as though cash flow (at least for last year) was negative.

The biggest concern I have about AIR is that there doesn’t seem to be a competitive advantage – if there is one I don’t know what it is – and this means that any other company can easily encroach on AIR’s market share.

I also read that AIR will be paying 60% of their profits as divs and with that information my IV dropped to around $2.19. So although AIR is still trading at a significant discount to my IV I have decided (as you did Ken) to forego investing in AIR, even though the numbers for this business look very appealling.

Again, a Merry XMAS to all,

Chris

Hi Chris,

Dont want to give you advice but A1 businesses trading at half price are rare.

Hi Roger

Haven’t seen Summer Money and look forward to this week’s masterclass on Thursday night.

Am re-reading your book (On Hamilton Island), and have come to Pt 2 and issues of acquisitions & capital raisings. NVT,a company with an MQR of A1 has been involved with an acquisition and capital raising to help fund this. Even though it is an A1 it’s price has been way above it’s intrinsic value.

I’d be grateful for yours and the community’s thoughts on this and whether like MMS it affects it’s MQR and intrinsic value. By the way, the book is even better the second time around.

Best wishes for Christmas and again, many,many thanks

Cheers

Jim

Hi Jim,

Its unlikely I will be able to address that question before taking leave. But lets return to it in the new year.

Hi Roger

I wasn’t expecting such a quick response. I look forward to reading your response in the New Year. Compliments of the season to you and your family

Cheers

Jim

And to yours Jim.

Hi Roger,

could you post a copy of the video from Summer Money where you selected MCE as your one stock. I missed it and have been trying to find a copy of the show but as yet haven’t been able to.

Also, many thanks for opening my eyes to value investing. I have had great success so far and look forward to more in 2011.

Cheers

David

Coming Soon David.. And thank you.

hi roger,

I’m curious to know how you arived at ACR @12.5% discount

with the current price at 3.53, 12.5% discount gives us a value of $4.03

my valuation with a 14% RROR is significantly higher as follows:

Earnings Per Share 28.7

Dividend Per Share 0

Shares 161

NetProfit AfterTax 47

Start Equity 31

End Equity 80

Required Return % 14

Return On Equity ROE 84.685

VALUE $10.72

?

Thanks Will. I will have to have a look back at the numbers and come back to you after Christmas.

I would also be interested to see how this was calculated – like howe my IV comes out a lot higher.

A little scuttlebut for those following JBH and HVN

I paid a visit to my local (Brissy) Harvey Norman electrical and JB Hi-FI stores today shopping for a tele. Found a park fairly easily at both stores although JBH was easier and much smaller car park (we’re drowning here at the moment so rain may have been a big influence today – carparks aren’t undercover and certainly not one of those hot sticky December days when everyone flocks for the aircon). However good line up at the checkouts, particularly at Harvey’s.

Salesman at Harvey’s had only been there 4 weeks so I concentrated on the purchase and not the scuttlebut. However I managed a good chat with the salesman at JB. His numbers indicated that sales at his end of the store (tvs etc) were really poor – down about 15% on last Christmas & competition fierce. He mentioned that honouring the pricebeat guarantee against online stores was leading to below-cost sales in some cases but they were obligated.

One chap (shopper I didn’t know) actually butted in while I was talking price on one unit at JB and said he’d been quoted $200 less – I felt sorry for the salesman. I think the chap was likely wrong as it is hard to tell models of one brand apart these days – from the front they are exactly the same but electronics differ with a big range in price between models.

I wonder if people are actually importing many teles from the US online? I can go online and purchase one tele I’m interested in at 2/3 price quoted (shipping costs aside). However with shipping the discount is less. I wouldn’t do so for a tele but have for smaller items – even when the dollar was weaker.

So where am I going to make my purchase HVN, JBH or online? JBH will likely win – a good enough deal to not bother with OS option and headaches involved (never really an option I would have pursued in any case as I mentioned). The JB offer really was competitive with a 5-year guarantee thrown in – not to mention a bonus Chrissy give-away from the supplier. However hearing back from Harvey this week when stock arrives on a model which JBH doesn’t hold (two units only in their Australian stores). May as well take advantage of the fierce competition while it lasts. I actually thought for a fleeting moment to suggest to my wife that we ought to stick with our tiny tele and buy JBH shares instead – survival instincts kicked in though.

The local news this evening made the point that, in lead-up to Christmas, Qld was fairing worst of all states in terms of retail spend so this should be kept in mind. Keep in mind also this is a subsample of one.

cheers

Ken D.

Further to above, the salesman at Harvey’s, although new to the store, really knew his stuff. We got talking tele technologies. He said that falling prices had really squeezed out all other technologies apart from plasma and LCD (or newer LED LCD format which will be the standard from here on for LCD – slimmer, lighter and more energy efficient). Two or three years ago, when purchasing new kitchen appliances, I had a ‘flat screen’ discussion with the salesman (I really have been holding out for a long time – when my big CRT blew up I just used the small spare – it takes a fair bit to get me to the shops and I’m not into keeping up with technology!). The salesman at that time said wait for laser technology to come out for a while before you buy – ‘this technology is much more energy efficient and, once released, will come down in price after a year or so’. So when I brought the subject up today, my Harvey Norman salesman informed me that, in the end, laser technology just couldn’t compete on price. Although LCD was never meant to stay, it is now entrenched due to cost advantages. Checking out Arasor (ASX: ARR) out of curiosity, it seems they were delisted earlier this year and had burnt a lot of dollars whilst listed.

The other thing my Harvey’s salesman confirmed was that the bigger brands had really converged in terms of their offerings, both in terms of quality and technology – this was quite evident when I was comparing online beforehand. I guess, for me, this all helped to reinforce the importance of competition and having a competitive advantage. I will end this post by saying, in all honesty, there have been at least half a dozen Harvey Norman adds on my (tiny) tele whilst writing these two posts – a reminder of JBH’s ‘low cost’ competitive advantage (I didn’t realise one could learn so much from a rainy day’s shopping).

cheers again

Ken D

Hi Ken,

nice analysis on jbhifi. I would like to point out that Harvey Norman will always lose in price because of the shop space they waste, when presenting their goods. In the old days TVs were well presented and floor space was cheap. These days TV nominal prices have remained stagnant but floor space gets dearer and dearer. When I did my Business info systems 101 subject, one of the KPIs you learnt was “revenue per sq metre”. My opinion is that the “compactness” of jbhifi stores is their competitive advantage. The lower prices come naturally. even their cd section is so compact that I believe they can store more discs than Sanity.

Hi Roger,

Thanks a lot for all your efforts through out last twelve months on the publication of this A1 blog where by we all have learned so much in the investing world.

You have no doubt left a amazing charismatic effect on all value.able readers and of course on share price of the stock MCE, up 7% next day after you appear on sky business channel!!!. Of course as a value able graduates we all know that in the long run price will follow the value

You have made the complexity of share investment into a simple and easy to understand live examples of companies in your book Value.able. Your book Value.able and A1 blog are indeed great value for which I do not have words to express. Great work Roger thanks once again to you and your team and of course all the active participants of the blog. I am one of the silent reader of the blog it is indeed greatly appreciated by all silent readers like me.

I wish you and all value.able graduates Merry Christmas and safe happy new year.

Daksha

Thank you Daksha,

You are very kind to take the time to write such encouraging words. Please have a wonderful Christmas and thank you again. And don’t forget, I cannot predict shares prices.

hi roger,

Interesting that TSM made it on the list :) . I bought Thinksmart (TSM) at well under 60 cents a few months back. I think the UK expansion will be an interesting prospect and I like how they leach onto the big electronic stores in Australia and the UK.

I have the 12/09 value at 70 cents and the 12/10 value at $1.03. I have forecast the net profit at around $6 million (up from $5 million). I’m guessing that your 40% margin at a price of $0.68 means that your IV is around $1.13?

Thomas

Will have a look and put it on the list Thomas.

Hi Thomas,

Have you been hacking into my computer Mate…Just Kidding,

These are my thoughts and actions as well

My calculations for TSM were based on company data for 2009 and an analyst’s forecasts for the year to December in 2010, 2011, and 2012. The data were:

Equity ($m): 2009=18.2, 2010=38.5, 2011=42.9, 2012=48.2

No. shares (m): 2009=100.2, 2010=108.7, 2011=132.2, 2012=132.2

NPAT ($m): 2009=5.2, 2010=7.0, 2011=10.3, 2012=11.8

POR (%): 2009=49.7, 2010=26.0, 2011=51.8, 2012=50

Using an RR of 12%, I calculated TSM’s IV as $0.99, which provided a 31% margin of safety given their current price, $0.68. With an RR of 11% TSM’s IV would be $1.14 and the margin of safety 40%. With an RR of 10% the IV would be $1.34 and the margin of safety 49%.

It would have been better to have a consensus of analyst’s forecasts, but that’s not always possible. It was one factor that led me to use a more conservative 12% RR. We’ll soon learn how accurate the 2010 forecasts were.

Happy Christmas to all.

Thanks Pat. Happy Christmas to you.

A 40% safety margin on a price of $0.68 would make Rogers IV $0.95

Roger and all

Can someone explain what IVs they are getting for REA please? Roger you have it as A1 with a margin of safety of 24% which puts its IV around $15-$16. (at current price of around just $12)

I am getting heaps lower numbers and I have used both conservative and agrressive estimates. If I use average of 2009 and 2010 equities to calculate ROE I get

ROE = NPAT/Av Equity = 45%, RR 10 and I get IV= 11.19 . If I change RR to 12 , IV obviously even get lowers. Also if I dont avareage the equities the IV obviously becomes even smaller.

I would be really interested to find out what others are getting or what I am doing wrong?

Thanks

Manny

Hi Manny,

I think that is negative 24% so it is trading at a premium to IV.

I have IV under $10

I am pretty sure in Rogers chart it is saying that it is trading at a 24% premium to IV. The positive numbers are ones trading at below.

For what its worth my IV for REA is around $8.85 based on the 2010 annual report.

Hi Manny,

I get an IV of $9.07

ROE of 37.5, RR of 10% (low risk at the moment), payout of approx 32%

I do get a very good increase of IV over the next 2 years, but unfortunately not trading at a discount to IV at the moment let alone a large discount.

Hope that helps.

Thanks Nic, Andrew and Ashley – My IV’s are in line with yours. My mistake, I did not read the table above correctly. I did not see it as -24% margin of safety. I read it as 24%.

Cheers

Manny

Great performance on the show the other night Roger. You talk up MCE and the price goes up 7%! The power you have Roger. Awesome. But seriously…….

Just a short message to wish you and yours the best for the festive season. And also to the class of 2010. Your comments and insightful thoughts have revolutionised my investing life. Thanks to you, your book, and all the guys and gals here I have received the best Chrissie present ever – I have finally had the guts to dump the last of my TLS shares. What a weight that has been off my shoulders. For years I have desperately hoped that things would get better. And maybe they will, but armed with the tools that I know have I can now clearly see that TLS is a woofer of the highest order. I wish all the TLS holders all the best for the future, but for me, I’m out.

And it feels great.

And I feel I am part of the (mostly) silent majority on here. I vow in 2011 to lift my game and start contributing more to the blog!

On behalf of everyone here, We look forward to hearing from you Sav.

Roger, just a quick comment before Christmas to thank you for the book- amazingly good value at $49.95, and more particularly for this site where we continue to be exposed to thoughtful comments. I’m concious of not having contributed much myself- thus being a bit of a ‘free rider’.

One small thought then, which may or may not be of use to someone. The obvious thing to do after reading your book, is to knock up a spreadsheet. Spreadsheets are a bit dangerous, since it is so easy to copy paste and add yet another column and extrapolate forecasts out 2, 3 or 4 or 100 years. I’ve noticed a little bit of this in some comments. It seems to me that a valuation is always subject to the company’s next announcement.

I’ve also been thinking about something that you mention in the book, but don’t go into great detail about quantifying, which is how to try to determine how much of the retained earnings of a company is required simply to maintain the existing business, and how much is truly available for expanding it. I’d be interested to hear anybody’s thoughts on this. Merry Christmas all.

Hi Geoff,

There are a bunch of techniques for estimating (and separating) the maintenance capex. More on that subject next year perhaps!

Hi fellow graduates,

Seems like a number of us are reflecting upon our investment journey over the past year. It has been an exciting year for most of us.

Looking back, I started off being very excited about the valuation method when I finished reading Value.able. Like most of us, I have build a spreadsheet model and improved it further by adding stuff like sensitivity analysis etc.

However, I soon realised that ‘the story’ is equally important as ‘the numbers’. In fact, both need to stack up together.

Accordingly, I began to make a conscious effort to spend equal portion of time understanding the business and its competitive advantage vs determining its intrinsic value. In fact, I probably spend more time understanding the business. As a trained accountant, being able to move away from the numbers is a breakthrough for me.

To all my fellow graduates, thank you for all the comprehensive and well analysed comments.

To Roger and his team, thank you for all your contribution and support to help us understand and apply Value investing in such a simple yet effective way.

Merry Christmas, and I look forward to another interesting year ahead with everyone.

ps: the price of WOW in the list above seems abit too high.

Great observation Joab,

I too noticed alot of the posts have focused on the calculations of company numbers.Don’t get me wrong I pay great attention to those but one of the most valuable things I have learnt from Roger this year is to actually sit down and read the Annual reports and other gems like results presentations to investors to really understand the business. Much more indepth than just visiting the website.Hopefully this is allowing me to become an ‘expert’ not only in the company but also the sector they inhabit.

If I can give an analogy :in my occupation which is health its not just looking at the vital signs (or numbers) of the patients but everything else in their history (annual reports etc)applying the most up to date evidence based medicine (Val U Able) then putting it altogether and hopefully coming up with the right result. Lots of hard work.

WOW should be $26.46…… not $28.46

Things I have learnt over the past 9 months.

1/Ignore charts, they mean nothing and buying a company at the highest historical price is not necessarily a bad thing as long as you still have an adequate margin of safety.

2/Debt is bad, high ROE is great and positive cash flow necessary.

3/ Technical analysis is pure speculation. The more technical analyst out there the better for value investors.

4/Traditional diversification while not to be totally overlooked can be neutralized with the “if your on a good thing stick to it” theory.

Roger and all other bloggers, I thank you for sharing your thoughts and views throughout the year. I have visited this blog daily learning a whole heap on the way.

For what it is worth my favorite stocks for the upcoming year are

MCE, FGE, JBH and SWL.

Wishing everyone a Merry Christmas.

And a Happy Christmas to you too Paul.

Hi Roger,

Just want to say that Seymour White (SWL) is a company for 2011. Big contracts, high ROE and plenty of growth. Thanks for Brad for contributing his piece on the company. Just wish I knew about it at when it floated!

Also CAP has provided me a with a nice christmas present. Great management team does alot for a company, and their results will come in the coming years.

Merry Christmas and Happy New Year to all!

And a Happy Christmas to you too Lachlan.

Hi Roger,

I missed the show last night, any chance you leave a youtube link so I can watch it.

Merry Xmas

It will be posted soon John…stay tuned.

Hi Roger,

Thanks for this table, and well done on your appearances last night.

I must say I am slightly confused, looking that numbers above on your table it appears to me that Forge (an A1), has a bigger margin of safety and better future value growth than Matrix.

As they are both A1’s but Forge seems to have better metrics on this table, I was wondering why you chose Matrix over Forge.

Merry Christmas to you and all the winners on this blog

Scott T

Hi Scott,

I picked something that I thought also had an identifiable and a more sustainable competitive advantage.

In the nomination’s table above do the stocks in bold have any special signifigance

Thanks

I don’t think so, I will have to have a look at why some are in bold.

Hi Roger,

Sadly I was one of the ‘odd recalcitrant students’ who diverged from the lessons learned.

I selected SFH as my pick, even though it certainly isn’t my favourite stock pick for 2011.

Thanks for including SFH on your list even though I broke one of your two (very simple) rules.

I saw you on channel 602 last night and was not at all surprised to see you select MCE as your pick for 2011. Interestingly the share price hit $6.65 today :)

I’m starting to think you might have the power to influence the markets Roger. Maybe a new trading strategy for you could be to buy a thinly traded stock, make up some bogus but exciting stats on it and why it is the pick of the century and then sell into the buyers. The biggest problem with this strategy is that you will only get away with this once. Ah, maybe twice!?!?

Anyway, I haven’t got that much experience in value investing and I therefore feel that I shouldn’t bother contributing to this blog, however after my dismal efforts in selecting SFH I thought I’d share with everyone another (better) business I have been looking into lately.

The business is Astivista (AIR)

AIR seems to be a very strong business which is involved in the importation, warehouse and distribution of bathroom, kitchen and solar products. It also sells renewable credits.

It’s a fairly simple business, and fairly easy to understand (tick from Warren Buffett).

Here is the website (http://www.astivita.com/corporate/index.htm)

AIR was recently de-merged from Tamawood (TWD; often referred to as DIXON Homes).

TWD has been mentioned by Roger and has received his A1 rating. This is not a big surprise when you look at the performance of TWD…For more than 10 years TWD has generated ROE over 25% and has a zero debt position.

Anyway, AIR is (at least partly) operated by the same people who operate TWD.

So if TWD is anything to go by AIR could be another fantastic business to hold for the long term (tick from Warren Buffett).

The ROE for AIR last year = 43.8% (tick from Warren Buffett).

AIR has only a 9% debt to equity ratio which is great (tick from Warren Buffett).

There are 3 main risks/threats to the business (as indicated by the annual report)

1. There are a few LARGER businesses that are entering the market place that could steal some of AIR’s market share, although AIR claims to have a superior (more efficient) product.

2. Because AIR is an importer it obviously has currency risks.

3. Governments can change regulations as to what you can get out of renewable permits and this makes the profitability of AIR quite difficult to forecast.

Last year AIR paid ZERO dividends to shareholders.

My value of AIR is considerably higher than the current share price.

Current share price is around $1.25, my value is in excess of $4.00 (Perhaps I am not calculating this correctly, so if others would like to check it out and let me know their valuations that would be great).

In my calculation I used the following.

ROE = 35% (even though 2010 ROE was higher.

Shareholders Equity = 10.8 mil

Shares on issue = 23.17 mil

Payout ratio = 0%

RR = I just used the standard 10%

I don’t know if the company is going to pay dividends in the future – obviously if they do the IV drops.

Finally, AIR is an extremely thinly traded stock (only 23,170,000 shares on issue) and has only been listed on the market since Dec 2009. Price has therefore not been influenced by fund managers (etc).

One thing (a very important thing) I have not put much consideration into yet is Cash Flow, but I will work a little more on this when I have some time.

Anyway, sorry for being one of those ‘odd recalcitrant students’,

Chris

Thanks Chris. I really appreciate the time you are taking to contribute.

Thanks Chris,

That’s great,

About your earlier comment about Roger effecting the market.

In the short term that may be the case but remember Ben Graham…….Over time price follows value.

So MCE is up 40c today. Probably on the back of Rogers TV appearance. But over time price follows value…..So MCE is just doing what good quality undervalued companies do…..Roger may have spead up the process but it is inevitable that price will follow value.

If Roger has any influence on the Market,,,,It will only be a short term thing…..Eventually Price will follow value.

Merry Xmas too BTW Chris

Hi Chris,

Thanks for this post as I have also taken a look at AIR – a ‘by-product’ of looking at TWD (following it being listed here). The following is from memory. I recall one commentator referring to the listing as ‘brave’ given the size of the business. Very successful since listing and some nice figures in terms of current ROE, zero dividend payout ratio etc (they intend paying a dividend this year and it will be a high dividend – I recall they are aiming for a 60% payout ratio). If memory serves me correctly, one of the reasons for spinning off the company was to allow AIR to gain better access to TWDs competitors. Although I could come to grips with TWDs competitive advantages and was impressed by management, in particular emphasis on organic growth, I came to the conclusion that AIR has to be assessed on its own merits. I must confess that I was a bit concerned when I learned that 65% of the company’s revenue comes from the solar panel market. What worried me was the influence of government incentives for the uptake of solar panel technology. I was concerned that AIR’s current high ROE may simply be reflecting a ride on this likely (am I being too cynical?) wave of incentives (on listing they were more a bathroom fitting wholesaler but now it’s more solar – very opportunisitic). How many rainwater tank suppliers emerged during the drought in SEQ when there were all sorts of incentives? – I put in a tank at next to no cost. How many rainwater tank suppliers went bust when the incentives were withdrawn?! There has been a lot of government incentives for solar installation in recent times here in Qld – will this remain if there is a change in government? As governments commit to renewable energy targets one has to consider where solar (and govt incentives for solar) sit in that mix. Also, if incentives continue, will margins be sustainable? Being uncertain about all of this, I failed to be convinced that AIR’s high ROE was sustainable. Although current figures looked great, and price looked very attractive (if ROE could be sustained) I could not clearly identify a sustainable competitive advantage and decided to put the company aside at that point. Had I had more conviction I may have paid them a visit (just to cut my teeth) as the office is not far from where I work. Perhaps someone can convince me here? Part of me still says I might be missing/dismissing a bargain but I think, in this case, this is the ‘speculative’ part of my make up (which has lead to both grief and reward in the past). Value.able has helped to confirm my own thinking that a strong conviction based on sound analysis is all important. As Buffet puts it – what is needed is a ‘sound intellectual framework and the ability to keep emotions from corroding that framework’.

A quick google before posting lead back to this very site! Part IV: Where should you focus your digging? (see Peter’s question and Roger’s reply). Roger poses some good questions to follow up on. I’m also feeling a bit more reassured about my own thinking and comments having read this particular post but over to others here now.

Thanks again – Ken D

Hi Guys

AIR looks very interesting indeed. I have a value of $2.60.

The company is very well managed. The Magor concern is barriers to entry. However the supply agreements that AIR have signed alieviates this to a certain degree……..I have I as an A1.

Initially I was very concerned about profits falling away due to the expiration of the Kevie cash splash in 2009 which would have helped the 2010 figures…. That said the first quarter profit figures were very encouraging given a few headwinds that they encountered. I have estimated flat profits for my valuation but they could be up a fair bit

Solar would appear to be a good space in the next 10 years given easy to get at oil running out and some form of carbon trading becoming enevitable……..

I actually dont mind this little business

Just my view…….No advice

Sorry Roger, just realised that the price section is actually market price. Which makes a lot more sense to me looking at some of the MOS figures against my valuations. Happy Friday everyone!

Congratulations to all Value.able graduates for a great year with the Roger Montgomery investment college. It appears that everyone has paid attention and done their homework. Hope Santa brings you lots of pressies (maybe a copy of Value.able? And if you have put your money where your company selections are, I am sure Santa will bring you lots of capital gains.)

Looks like people are taking notice of the Matrix, peak oil story. MCE is very quickly catching up to its Intrinsic value. A very worthy winner of the Christmas homework competition.

I really enjoyed my Roger Montgomery BBQ night last night at my best mates place, although it was touch and go for a little while, as we had a severe thunderstorm which would of prevented me going. In the end all was well and I enjoyed a wonderful BBQ and two great Roger Xmas segments on the Sky Business channel.

All the best of Christmas wishes to all my fellow Roger/Value.able afficionado’s as well as Roger and your team. Hope to see you all here in the new year.

A special thanks to Roger and all your hardworking staff for changing my life for the better and turbo charging my investment future. Using your Value.able framework has been an extraordinary catalyst to my investments.

One last request for the year, if I may. Roger, what is your current IV for MIN. I am getting an IV of $10.67 using RR12 (I have dropped the ROE selected to 27.5 for a larger margin of safety).

Thanks John for those very kind wishes. Have a very Happy Christmas and thank you for your support.

Hi John

I picked up some MIN last week. I got an IV much higher than yours initially since the data on “previous yr equity (2009)” on comsec was much lower than 2010 equity so ROE was coming very very high. When I averaged the two numbers I got an ROE of 30 and using RR of 10 got an IV of 16. I still thought it was not correct so I increased the margin of safety, reduced ROE to 27.5 and RR 12 and got pretty much what you got. Future IVs are increasing though.

I am new to this and still trying to figure out the correct way of calculating “previos yr equity” to divide NPAT by to get ROE. For large mature companies like WOW, banks etc it works well with what Roger says in the book but for small/medium and companies growing very fast it is not accurate as the equity changes substantially within a year. I have started averaging but even that is not perfect (as you saw I still got an IV of 16+ for MIN).

Any inputs welcome

Roger, great work and thanks again for this book and blog.

MC and a HNY

Manny

Hi Manny,

Thanks for your reply. Previous year equity was announced by MIN in the 2010 Annual Report on page 29 Statement of financial position – Total equity for 2009 was $ 144.77 million. Using Roger’s technique:

ROE = NPAT/((CURRENT EQUITY+PREVIOUS EQUITY)/2)

ROE = 97/((486+145)/2)) = 30.7%

I don’t have any hard and fast rules here, but because there was such a large spread between current and previous years equity, I have intuitively dropped the ROE selected down a notch to the 27.5% level. Always remember, all valuations are only approximate and subject to change, so the most important purchasing decision is to wait until you have a significant discount to your Intrinsic value. What is everyone’s views on ROE selected vs Calculated with this large spread in Current and previous Equity, and what Intrinsic value does everyone calculate for MIN?

Hi Roger

Thanks for all the great insights over the last year. I really had no idea how blindly I had been investing prior to reading your book and this blog. I’m still learning but at least i know what i should be looking at now.

Also do you think its a coincidence that you publish a table showing Forge and Matrix undervalued by 30 & 47% and the next day they are up 2-4% by mid-morning when the rest of the market is slightly down. Not complaining though i bought mine last week.

Thanks again

Andy

As I have always said seek and take personal professional advice and do your own research. The shares for these companies could halve tomorrow and I have no ability to predict it.

i wake up every morning and cross my fingers and every night i pray that matrix drops to below $3…. :-)

Hi Ron,

LOL so do I Mate.

Then Mae West really would have her day

I think in that case Ron you are going to be doing lots of praying and not much buying of MCE in the future.

Whilst Roger advocates buying shares at a significant discount to their intrinsic value, and I agree, sometimes you have to pay up for these rare companies displaying such excellent qualitative and quantitative properties.

Best Wishes,

Nick.

i own a lot of matrix…..but still praying.

Hi Ron,

You have no doubt heard me say here, seek personal professional advice. One of the things an adviser can discuss with you is appropriate diversification. Owning “a lot” of something sounds scary to me. The price could drop 50% tomorrow for no apparent reason, what would you be thinking then?

Yes Ron,

As Roger says seek professional advive,

But if it falls to $3 remember Mae West

No advice BTW

hi roger,

when i recognize a great business at a discount to its value i buy it and then hope that in the short term the price will halve!! this will enable me to buy more of a good thing for cheap.

i am a fan of your blog and your book, and it has definitely help me refine my valuation techniques.

the way i invest is if i like something i go big!

i have done this for many years and have done really well. i don’t believe in taking professional advice and i don’t believe in diworsefication.

But i understand where u r coming from, so thanks again.

merry xmas to you and everyone.

cheers.

Hi

I would like to thank Roger and everyone else for their contributions on the blog throughout the year, it has been very interesting and I wish you all the best for next year.

Looking at some of the valuations you have put up along with your commetns about “If we presume that all A1s have equally bright prospects- they don’t” would i be right in saying that as a general guide to things, the above are worked out on a 10% RR basis or are is the RR’s for the valuations mixed depending on the company as you and i would do in the real world and not blog world?

I know they are meant as a guide only and that we should seek and take further advice and analysis but just wanted to check. Also, for everyone out there please remember that line about not all businesses have great future prospects and that Roger said he also used consensus figues etc which can sometimes be overly optimistic so make sure you do your due diligence before using any of the above information for investment decisions.

I have to say that it appears a good list and all credit to you Roger, you apepar to have taught us well. Most companies i have either on my watch list or on my “getting to know you” list for companies that i may be interested in but need to educate myself more on the company and industry before i even consider it.

Obviously there are some companies i would not be interested in (some are good and some not so which don’t fit into my overall criteria).

Unfortunatley i missed the show last night so will wait till you let us know on here or through youtube.

Thanks for all your help during the year and for all the effort put into this blog by yourself and any of the supporting players helping you behind the scenes. Your effort has been appreciated by a great number of people and could potentially have a huge impact on some peoples future lives as their investments lead them to a more positive future.

Merry Christmas to you Roger, the Value.able and rogermontgomery.com crew as well to all my fellow bloggers. Hope you all have a great new year and some great discounts to intrinsic value.

Thank you Andrew,

Yes, do remember they are based on possibly optimistic forecasts.

When evaluating how safe the investment is through the balance sheet, for banks and companies such as mortage choice (MOC) how do you go about evaluating the risk. How did we know lehmans & others were going bankrupt as they are complex institutions.

Hi Tyler,

Great question. Go and look up KPI’s used by banking regulators. Its all there.

Oops, glad I was wrong. MCE is definetly to the best choice.

Congrats to Ashley and all for a fantastic pick.

I’ll be holding onto mine for the longterm, they have a very bright future.

Roger, that was a very informative piece tonight, enjoyed it immensely you really out did yourself.

Thank you Craig for the supportive and encouraging words.

Hi All

MCE up 40c today

I wonder what inspired that

just it’s discount to intrinsict value ant the fact it’s one of the best little businesses on the exchange at the moment. Can’t identify any other catalyst.

Jokes aside, it is fast approaching the current IV but the future potential IV is much higher. What are people thoughts re. mounting risks as IV is breached, will you continue to hold with the future in mind or cut an run?

I believe they have a lot of promise in the future as most here do. My thoughts are to hold on past this years IV and look to take profits at 2012 IV and exit all together at the 2013 IV, if it’s breached. The results in Feb will shed light on what those valuations look like.

I am interested in other MCE holders strategies, Roger eluded to his thoughts when quizzed on Thurs night.

Hi Craig,

It comes down to how far above your current IV the price is, coupled with how quickly the IV is rising in future years (and therefore whether that IV will catch up to the current price in a reasonable time frame).

The important thing to think about is the risk of capital loss. If there an investment opportunity with a lower risk of capital loss then that should be the winner.

It could be easily summarised by saying that if the features of the investment opportunity that got you in cease to exist then you might consider getting out. The only caveat being that while you hold on to the investment you are enjoying an interest free loan from the government on your capital gain! I think they were Munger’s words.

an interesting side thought about MCE, FGE and other companies heavily mentioned on this blog is that there is probably a higher proportion of value investors on their share registries

I wonder then how far above their IV these companies are likely to progress?

Of course there are still plenty of irrational share market participants, and not all value investors subscribe a stock the same value nor react at the same speed to changes in value, but it is a thought that intrigues me.

However, something tells me nothing will change :)

It hasn’t in the last fifty years even with Buffett promoting it.

G’day Matthew R,

MCE now has a market cap of almost half a billion dollars – I suspect that there will be plenty of irrational, non-value investors in there, including about 500 that jumped in on Friday (inexplicably!).

Hi Craig,

I will worry about that if and when it happens…..Remember it is still at a good discount to 2011 IV.

Hi Ashley

absolutely and while the discount exists I am a very happy holder. I am interested in others exit strategy.

I would like to see how the story unfolds after the completion of Henderson. The 2012 and 2013 IVs are going to look very different from all our current calculations once(IF) the orders start rolling in.

As an excercise for 2013 I’ve extrapolated a equity figure of $107m, ROE of 45%, POR of 50% and issued shares of 71m. Using my pre-value.able formula I get an IV of $16.50 but using 10% value.able tables I get $14.63. Just looking at what might be possilble.

Stay dry

Hi Craig,

Yes High and dry unlike other people here…I will be going to the coast in a few days and returning in the new year. Hope I still have a home to come back to.

Just wanted to thank you for your kind words thoughtout 2010 and wish you and your family a great xmas.

I always value your views.

tc Mate

Hi Craig,

Sorry re read the post….I will explain a bit more of my strategy. If and when MCE gets to its value. Then a sell decision will depend on what other ideas I have and opportunities are being put up by the Market….

Have some cash for opportunities first……Have had WOW since the float and this would be tough to sell but it would be next…… Orl is close to my IV so it would be next. The rest are still at discounts….so if a great opportunity arose I may actually sell MCE (But it would have to be good)

I like my Buffet quotes and this one below is my fav

You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing

2010 Has been a period where loads of ideas and opportunities have come along. Just guessing but 2011 may not bring the same thing.

MCE is a seriously good business….If you owned the whole business what price would you sell it for……My answer for me is much high than the current price….and probably much higher than forecast iv’s

So my strategy is dependent on what is happening at the time…….If nothing is happening then do nothing.

Hope I have explained this well

tc

Thanks great response and yes very well explained. One other thing wow about WOW, nearly 18 years of many happy returns. Think of that interest free gov loan your sitting on. I bet the weekly shop is a pleasant experience.

Hi Roger,

Thanks for your video…..Great Stuff.

I can’t actually remember when you started this blog but it would be getting close to a year now if not longer… I have been trying to remember but can’t quite do it…. I do remember you posting about QBE and I think you had the blog for awhile before that.

I do know that I was one of the first reading the Blog. It took me awhile to actually post (being a shy Qld country boy)

When I first started reading the Blog I thought I knew all there was to investing…….. How wrong can a bloke be.

The amount I have learned from you and our fellow bloggers over the last 12 months has really changed my life.

All the Buffet and Munger stuff I have read over the last 6 years just fell into place with the help of you, your book Value.able, and the community here.

You (and we can’t forget your support) have a rare gift of making complex things easy to understand for us less informed and less knowledgeable Investors.

Personally I have gain so much from this site it is hard to put in words. BTW I am not talking monetary gain here although that has been nice.

I don’t think we can lay claim to MCE but the Blog has unearthed some really good stock …..ITX comes to mind which was discussed here in great detail …..Thanks Lloyd for convincing me of the competitive advantage.

Want I really want to say is two things

1) Thank you Roger and all the bloggers. Words can’t express how I feel about this web site

2) To the silent readers…………….We really would appreciate your input…..Don’t feel Intimidated ..We all will appreciate your thoughts…. Not be shy…I was at first but what you think is very very important to the rest of us.

Take care guys and have a good holiday

If I keeps raining here, which it is atm, then we need to find a business that make tinny’s…….They will be in big demand in Qld

Ashley, Thanks for your help as well and making this blog so informative. Merry xmas, Matt

Thanks Matt

Merry Xmas,

Your comments mean alot to me

thanks again

Roger, if I may be permitted a little ‘social networking’ and to advertise here a free service which may be of interest particularly to country folk

Hi Ashley,

I am Brissy boy and it is wet here too. We have a saying here at work (I work in a climate group) that average rainfall in Qld equals drought plus flood divided by two! We also have an interest in providing information to help primary producers better manage climate risk. Our (free) information is available on our website. If anyone here is interested enough to obtain a password and dig hard enough, you will find that, as at Nov 1 this year, we calculated that the odds of summer (Nov-Mar) rainfall being well above average (decile 7) for much of Qld was above 80%. This particular service is not well advertised and currently password protected. However the password will be provided to those who indicate their interest here. I do not wish to take up any more space on Roger’s site discussing this or to receive feedback here but if any are interested:

I must admit I am finding this blog rather addictive! I’m not sure which I am more passionate about – climate or investing – but managing climate risk and investment risk has much in common!

cheers

Ken D

Hi Ken D,

if anyone works the land and is interested in Ken D’s service let me (and Ken) know by posting a comment.

Hi Ken/Roger,

Love your Joke about drought and flood in Qld

We have loads of Farmers as clients they would all be Interested in this I think. We have a fair few Mining Services clients as well and this may even interest them.

Roger, has in him system somewhere both my home and work emails and If he passes them on to you it would be great to get a password to have a look at this.

We also run a monthly breakfast and get speakers in. The topics have been very diverse from Market forecasts and the new carbon credit system, just to name a few. This may be a good breakfast topic for next year is we could get someone out.

That’s if we are not flooded in. I am In Dalby and we have 3 Bridges. 2 are currently underwater…..Some very nervous locals ATM.

I live near the airport which is the highest part of the town so I will be the last to go under…..Lucky I am like Dale Kerrigan and like living near airports.

Flood update

all three bridges went under and many houses got flooded but clearing now and water going in a direction that the shorters like……It could have much worse……That said the forecasts are not looking good…….More rain coming on wednesday through Monday

Ken if you have any contacts from above at your climate centre can you put in a word for us

Will hook you guys up.

Hi Ashley and thanks Roger,

I would be more than happy to come out to Dalby for breakfast. I will email you once I have your details.

cheers Ken D.

Hi Roger,

I am perhaps a little late but anyway. My suggestion is Credit Corp. I have read that you regard this as an A2.

Its ROE is not what it used to be when it was pumped up with debt and chasing fast returns on its ledger purchases. They have changed their approach it seems with more revenue coming from payment plans and collecting more debt from older ledgers. They hit some bumps in the road when they ramped up staffing and their average collections fell – as you would expect if you hired a heap of new people in any business, they take some time to become effective. This aspect seems to have improved over the past year and I think the ROE is stable and will climb slightly in the medium term. Cashflow seems to have improved with debt declining.

By my (crude) numbers CCP are priced at a discount to its current valuation. Unfortunately I think the company is intent on paying dividends (perhaps at a higher payout ratio), but the value will rise in the future in my view.

I am interested in your view

Regards,

Michael

Hi Michael,

Very interesting indeed. Its been mentioned here previously. Look at the comments on past posts. I will try to put one last list up before Christmas for homework.

Hi Michael,

I’ve been interested in Credit Corp recently as well, there are a few comments about them on here.

They certainly hit some speed humps a few years ago but it appears they have navigated their way through that and come out the other side. For what it is worth, I believe they were highly regarded in their field before the GFC. If they learnt from their mistakes (which I believe they might have) then it only bodes well for their future.

Time well tell, but it appears they are doing a good job at collecting the debts. This success is then being passed back to the sellers of the debt ledgers through higher prices. I view this as a competitive advantage for CCP.

High quality balance sheet and very strong free cashflows. A competitive advantage. Attractive Valuation. Good future prospects. Certainly worth a look.

Thanks for bringing it up Michael. Does anyone have an insight in to the industry they would be happy to share?

Or maybe someone has had a call from CCP about their plasma TV lease? :)

Cheers,

Matt

Hi Matt,

I have held them for some time (through the rollercoaster ride)! Every time I think of selling them to buy something else I can’t justify selling at the discount to the IV. I think the ROE will increase marginally, but it won’t get to the levels they were – but that was boosted by too much debt.

A massive difference between CCP in 2008 and now in my opinion is the certainty of collections – in under three years they have got 70% of their collections coming from people on payment plans, up from 45% (and they are collecting more $$ as well). This reduces risk in my opinion.

Regards,

Michael

And a discount to Intrinsic value…

For CCP I get a 2011 value of $4.59 assuming $0.39 per share NPAT (Lower end of given forecast), 12%RR and assuming the dividends will double to give a payout ratio of 25%. Am I in somebody else’s ballpark?

Personally I think it will come down between two, MCE and FGE…

And I think FGE will pip MCE at the post.

Hi Roger,

What a great post, thank you! You always manage to add so much information and detail to your posts. Very impressed that you put so much time and commitment into it.

Was disappointed to hear you will no longer be on YMYC tonight. Here’s hoping they can re-schedule. Hope everything is okay.

In regards to the ‘universe of A1 companies trading at discounts to intrinsic value that have slipped under our radar’ – are you planning to share some of these soon? Any in particular we should really look into?

Steve

Thanks Steve,

WIll be back on YMYC next year.

I have been away and missed the task and the results. Makes for some excellent reading and a plethora of information to absorb over the Christmas period.

Seymour Whyte is of particluar interest. I know a little of the company and look forward to digging into the financials myself but on face value it is in an attractive industry and has strong prospects. Whether it has a competitive advantage, that will require even more research.

Now I have to add DWS Advanced Solutions to the list. It has been hammered on what appears to the back of a $1.0M downgrade in EBITDA (terrible financial metric) due to a telecommunications customer not requiring any servicing work from late Dec-late Jan.

It is in a competitive industry but the company has an outstanding market reputation (client centric and quality focused) in the provision of high-end technical solutions. Its client base is characterised by many long-term relationships with over 35% of current revenue coming from clients who have been with DWS for over 5 years. The majority of customers are also ASX 50 entities.

At $1.70 I had a it trading a small discount to IV but I believe now at $1.32 it is compelling value.

Maybe I am missing something and would appreciate Roger’s or any other graduates’ comments.

Also, FGE, MCE, ORL and ARP get the Christmas chocolates for mine. Oroton is an outstanding company with a great competitive advantage. My fiance was in David Jones the other day and noticed that the ORL display was clearly superior to its competitors. It is a great entry point for the aspirational who can’t or don’t want to purchase the Prada’s, Chanel’s, Versace’s, etc of this world. And unlike direct competitors i.e. Mimco that target the young, you will find 20yo and 60yo with ORL products in tow. That’s an advantage!

Cheers

Al

I get a current valuation of $2.20.

2011-$2.66

2012-$3.15

2013-$3.77

Hi Roger,

I’m just curious as to what you now think of LYL. I bought some awhile ago and they seem to only be going up. Do you think they are going to continue to do well and do you still consider this an A1 company?

Hi Roger,

Thanks for the list. Just one thing, I think AndyC may have been referring to KO rather than CCL.

Regards,

Craig.

Ahhh Different result then Craig. Thank you.

Absolutely Craig.

Considering how proud I am to have my name up in lights on Roger’s site, I want it to be the right pick :)

CCL is interesting, but it’s no KO!

Hi Roger

a great exercise, a real bit of fun. Looking at your list I’m guessing your choice will be FGE it’s got both the voting and weighing machines on it’s side.

Thanks for the oppurtunity to contribute and thanks to the all the contributors, what an incredibly value.able amount of research.

Good luck tonight I’ll be watching.