What we can learn from the CPA Australia fiasco

The promo for Alex Malley’s book, The Naked CEO, says the author has ‘led a life rich in successes and mistakes’. Well, those successes and mistakes have been on show of late, thanks to the spectacular meltdown of the organisation he led, CPA Australia, where we’ve witnessed the very worst of corporate excess – but at a not-for-profit industry body.

The role of CPA (Certified Practising Accountant) Australia is to govern, promote and advocate the accounting profession. To this outside observer (I am an engineer by training, an analyst by trade and whatever accounting skills I have were developed though on-the-job training), it is quite astonishing how an organisation that has the power to issue a certification of competency in accounting (i.e. a critical skill to running and governing a commercial enterprise) has managed to mismanage its affairs to such an extent.

We will not go through all the things that have gone wrong here but my quick overview of the situations is:

- CPA Australia is a member organisation set up to promote and further the interest of its members. It gets its revenues from application and annual fees from its members and hence its revenues are very annuity-like. There is no direct monetary return path to the members if the organisation produces a surplus and hence it makes sense that the organisation should be run on a not-for-profit basis maximising the utility that its members get from the fees they are paying.

- It seems like the organisation has completely lost track of this “raison d’etre”. This has manifested itself in a number of ways:

- The remuneration of the leadership and the board seems to have grown exponentially in the last few years probably best exemplified in the $1.9m annual salary for the CEO Alex Malley as well as the $4.9m termination payment (3.5x base salary which is significantly above the Corporation Act which limits CEO payouts to one times base salary for public companies).

- CPA Australia has set up CPA Australia Advice. This is an advisory business that is in effect competing directly with some of its members existing practices and cannot hence be said to be in the best interest of its members. It has, to date, accumulated losses of $12.4m which has been spent on salaries to its employees and (quite significant) board fees of $291k per year to the members of its board (it should be noticed that the board members of CPA Australia Advice have also been members of CPA Australia’s board and the CPA Australia Advice board fees have been in addition to their fees received from CPA Australia).

- As CPA Australia issues and monitors a Code of Conduct that all CPAs must adhere to, setting up CPA Australia Advice means that they are in effect monitoring their own compliance which is a clear conflict of interest and also not allowed under the law that created the Financial Adviser Standard & Ethics Authority. As a result, the NSW Government (who approves on a national basis) has said that they cannot sign a renewal of the professional indemnity scheme that protects CPAs from malpractice lawsuits. The Victorian scheme expires on the 7th of October 2017 and hence CPAs in Victoria will potentially be open to multi-million lawsuits post this date until CPA can get a new Scheme approved.

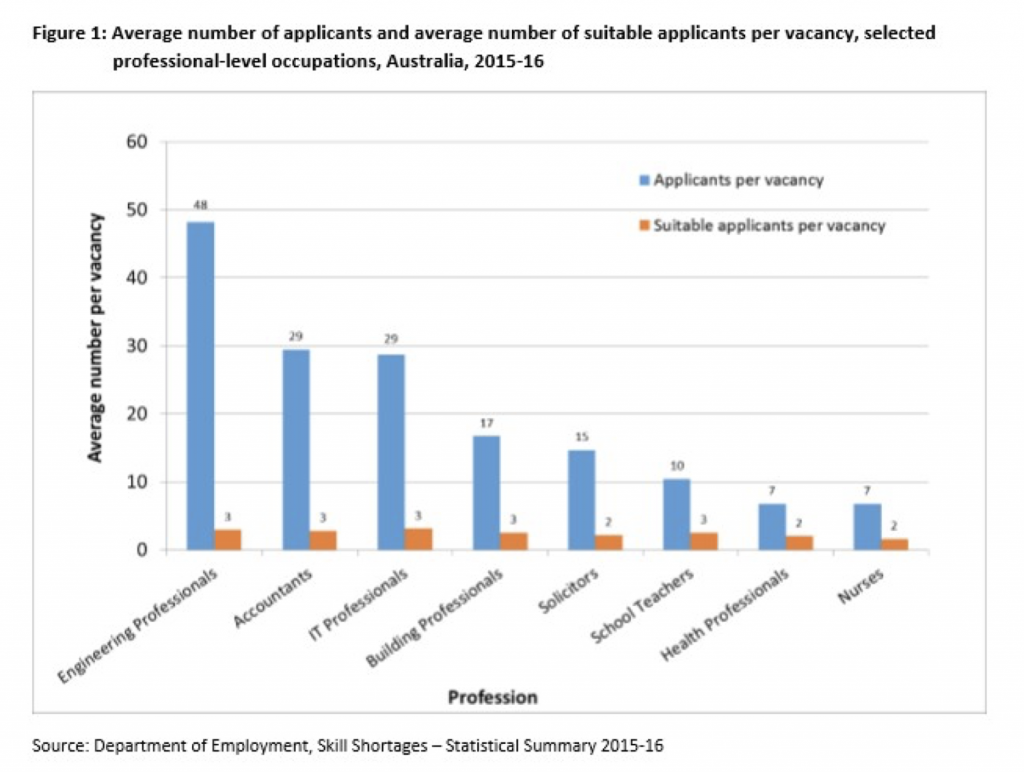

- CPA Australia has been successfully lobbying (together with universities) to keep accounting as one of the professions on the in-demand occupations, against the advice of Department of Employment and the Australian Workforce and Productivity Agency’s (AWPA) advice, for skilled migrants for 457 visas. At the same time, they have been conducting recruitment drives in low cost overseas locations. Remember that CPA Australia certifies the qualifications and work history of accountants including the ones from overseas who want to practice in Australia and hence acts as one of the gatekeepers for foreign accountants that want to move to Australia.

- At the same time, accountancy seems to be one of the most over-supplied occupations (after engineering) with on average 29 applicants per vacancy according to the Department of Employment.

- Salaries for accountants follow the same demand/supply laws as any other product and CPA Australia’s lobbying to keep accountants on the in-demand list and boosting its membership and revenues has the effect of lowering the salaries and employment prospects of its existing members. Not exactly in line with the charter of the organisation…

- A lot of CPA Australia’s marketing budget seems to have been spent on promotion of the CEO Alex Malley personally with the creation of his own TV show and Times Square billboard promoting his book, The Naked CEO. To what extent this publicity directly benefits the practising members of CPA Australia is very unclear to this author.

- 7 out of the 12 directors of CPA Australia have resigned and the remaining board had to exercise emergency powers to appoint an additional director to be able to form a quorum and continue to function.

Lessons to be learnt

SO, what can we as stock market investors learn from the implosion of CPA Australia? It is after all not a public company that we can invest in.

It is also true that CPA Australia has a spectacularly complicated governance structure compared to a public company where shareholders have a much more direct say (even though still quite indirect) into the governance of the organisation so the creep in priorities has been able to occur more easily than what would probably have happened in a public company with the direct feedback mechanism of a share-price.

I do though believe we can learn certain things from this situation and that we can divide the lessons into a couple of categories:

- Lessons for investors:

- When you see a company that loses track of what it was originally set up to do and changes strategy significantly, be careful and have a very good think about whether it makes sense or not. Skills and strategies that have been successful in the past in a specific setting are not necessarily transferable to a new setting.

- Where a disproportionate amount of the value a company creates accumulates to stakeholders other than shareholders (employees, customers, suppliers, governments etc.), be very careful as it 1. leaves a much lower margin of error for when things go wrong and 2. Shows that there is potentially little alignment between the incentives of the other stakeholders and the shareholders. Some argue that Macquarie Bank is a good example of this. It is a very good company that is very good at creating value but a solid portion of the value created tends to accumulate to the employees rather than shareholders.

- When a substantial and well renown news organisation like The AFR gets hold of a story and really starts to run with it, get out if you are invested! Specialist journalists in specialised press are generally good at digging and when there is existing discontent within an organisation, you can be certain that they will have a steady supply of information to write about so the negative stories will not stop for a long time.

- Lessons for companies:

- Keep true to your purpose and if you are going to significantly change strategy, communicate very clearly and timely on what you are doing and why. Your investors/members invested in/joined you for certain reasons and if you are to significantly change, you have to explain yourself to them.

- Be very careful with strategic creep. The changes in CPA Australia that led to the current crisis did not happen overnight and each individual change did most likely make sense at the time. It is important to step back now and then and try to fully answer the questions “Have the changes we have cumulatively done during the last 1/3/5 years made us a better or a worse organisation?” and “Are we still serving the stakeholders that we were set up to serve?”. In CPA Australia’s case, it is clear that the board did not ask itself the last question for a long time…

- See c. in the list above! Be extra careful when you get indications that there is a growing discontent inside your organisation as you will not be able to contain the leaks of information (thinking about it, the Trump administration is another good example of this).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Engineering is being removed from the MODL list of in-demand occupations and the body who represents them has been actively campaigning FOR this, because there is not enough work for the existing ones here in Australia. So that is an example where the industry group is actually aligned with their member interests.

They know that importing more will not help their members, when there is a finite pool of work, and lobbied Parliament…it took a long time for them to listen.