What to do when a takeover offer is made for a stock you own

Lately, we’ve seen numerous takeover offers for ASX-listed companies like Smartgroup, Hansen Technologies, and Iress. These offers inevitably leave investors wondering whether to buy more shares, sell their holding or sit tight. The answer is always the same: it depends on the context. In this blog, I set out a few tips to help you assess the best way to respond to a takeover offer.

Smartgroup became the latest casualty in a growing list of “failed” takeovers, as would-be acquirers either reduce their bid price or step away from indicative, non-binding bids following a period of exclusive due diligence. The decision of the TPG-led consortium to revise down its bid price by approximately 10 per cent (from $10.35 per share to $9.25 per share) – comes soon after similar situations with BGH Capital’s withdrawal of its offer for Hansen Technologies, and EQT of its offer for Iress.

Assessing takeover offers

When a company receives a non-binding, indicative offer that is deemed to be sufficiently attractive (and legitimate), it is the Board’s responsibility to act in the best interests of shareholders and look to engage with the would-be acquirers. In many situations, they may also be bound to disclose the approach under continuous disclosure obligations.

Once a potential bid / approach has been disclosed, a company’s share price usually rises to a level close to the indicative bid – generally at a more than 20 per cent premium to recent trading levels. In the case of Smartgroup, Hansen Technologies and Iress (below), we can see the bump in each company’s share price following the disclosure of the bid interest.

Smartgroup share price

Source: Bloomberg

Hansen Technologies share price

Source: Bloomberg

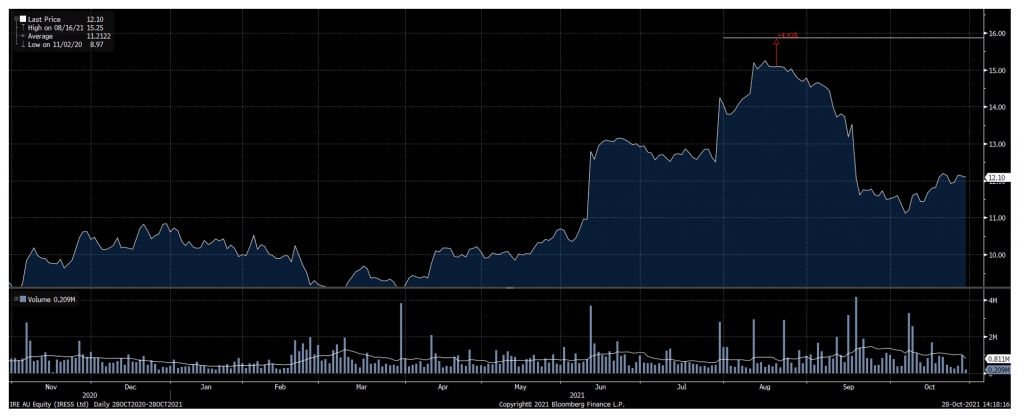

Iress share price

Source: Bloomberg

Unsurprisingly, the share price falls after a bid is withdrawn in most instances as the takeover premium disappears. This is largely attributable to the change in shareholder register that generally accompanies takeover situations – as specialty funds (funds specializing in special situations such as merger-arbitrage opportunities) acquire shares in the target, looking to profit from the spread between the informal bid price and the prevailing market price. The sellers in these situations are existing holders, who may look to allocate the capital elsewhere in positions where they see greater upside.

In each of the Smartgroup, Hansen Technologies and Iress situations, there is a notable gap between the horizontal flat white line (the indicative offer price) and the market price (blue shade).

How should existing shareholders respond?

In takeover situations, the Board will provide a recommendation as to whether shareholder’s either accept, reject or take no action in relation to the bid. In fact, many takeover bids require a favourable board recommendation as a condition of any formal, binding bid being lodged.

However, this does not mean existing shareholders don’t have an alternative course of action. As per my above comment, existing holders in many examples look to sell down a portion or their entire holdings. There are two primary reasons for this:

- They see better risk-reward opportunities in other parts of the market

- They have limits on their position size in any one holding

If you own shares in a business under a potential takeover offer, it is worthwhile assessing the opportunity on its own risk-reward basis.

In situations where the offer is at an indicative stage (and still subject to due diligence and other conditions customary to deals), the spread between the indicative bid price and the market price reflects the equilibrium view between the marginal buyer and seller of whether a deal would proceed.

That is, if a share price is trading at a deeper discount to an indicative offer, it reflects the marginal buyer / seller’s view on any transaction being unlikely to proceed at the price – higher risk, higher reward. The spread on the share price of Smartgroup vs the bid price of approximately 10 per cent is high in the context of takeover situations, reflecting a degree of market concern over completion of any deal.

Similarly, a share price trading at a much smaller discount to an indicative offer price reflects the view of a transaction being more likely to proceed – lower risk, lower reward.

Finally, a share price trading ABOVE the offer price reflects the market’s view that the bid is insufficient, and a high likelihood that the offer will either be revised upwards, or a competing bid will appear.

The situations where the tightest spread will occur are when a formal binding bid has been lodged, and conditions are assessed to be readily met – e.g., financing, regulatory approvals etc. As an offer approaches completion, the “spread” will tighten to reflect the time value of money (i.e., cash-rate) plus a small premium.

Deciding to sell on market versus a potential bid price

As a shareholder, it’s worthwhile assessing the upside (very defined in takeover situations) versus the potential downside if a transaction fell over.

This is because merger-arbitrage situations usually have a very different (and defined) risk profile versus when an investment is first made. That is, it’s likely that if an investment is under takeover, the premium will provide an up-front “reward” for a longer-term thesis that has yet to fully play out.

If the market price reflects what you believe is a fair return for your shares, it may be worthwhile taking advantage of any share price strength if there is some concern around the due-diligence and takeover process – at the expense of potential upside on deal completion or a bump in the offer price.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Do you have an opinion on the CashRewards takeover offer? CRW which will be delisted if it goes ahead.

Hi Sue,

No opinion aside from the fact it appears the takeover offer will go through at the $1.135/sh offer price.

Thanks

Joseph

Thanks Joseph. Would be interested in your team’s views on the merger between Praemium and Netwealth.

Hi David,

Thanks for your comment – very quick I might add given the merger just got announced 30 minutes ago!

Unfortunately I’m not in a position to comment on the NWL-PPS merger, but our small cap team has written a blog specifically on PPS here: https://rogermontgomery.com/have-the-praemium-board-hung-up-the-for-sale-sign/

In a scrip-based deal, it’s also worthwhile trying to understand the “value” of the acquiring business shares and the potential impact of any merger. The share price is a logical place to start – however, if you are not a longer-term holder of the combined entities (or tax roll-over relief is not a consideration) it doesn’t materially change the equation in terms of a screen-traded share price vs your assessment of the target’s value.

For example, if the merger is a logical fit and expected to generate real synergies, one may reasonably expect to see both shares rise – the acquirer (ie combined value business is higher) and the target (mostly because the offer is based on the price of the scrip of the acquirer).

In other cases, the share price of the acquirer falls as the expected benefits of a combination is more than outweighed by the takeover premium being paid.

Hope that helps.