What is your best performing stock pick for the next 9 months?

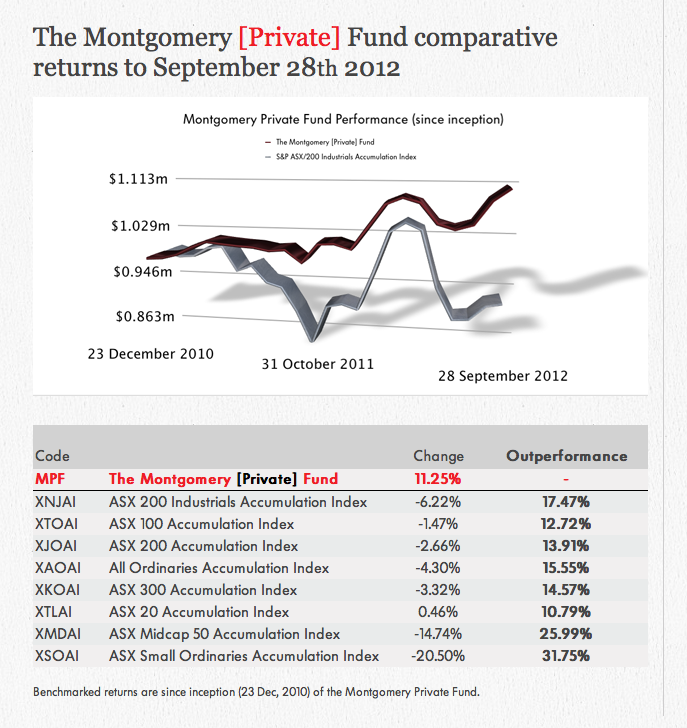

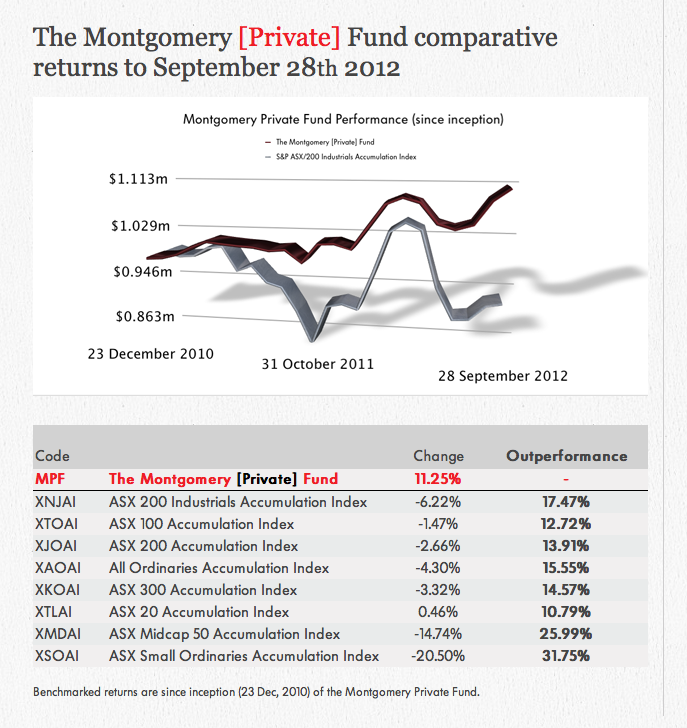

September was a challenging month for investors but Montgomery chalked up another outperformance in both The Montgomery [Private] Fund and The Montgomery Fund (see figure 1).

Of course in the short term the performance of share prices can be attributed to noise and randomness and so the bigger question is always; which businesses will be worth substantially more in the future?

What is your suggestion for the best performing stock for the next nine months to June 30, 2012?

Pick the best performing stock in the next nine months and gain fame and notoriety, kudos and credit.

Each month we’ll track the list and present the table until June 30, 2012.

All the best and stay tuned.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Tiger Resources Limited (TGS) is forecast to grow earnings by 300% over next two years. TGR is an Australian-based company focused on the discovery and development of copper/cobalt deposits in the Africa Copper Belt in the Democratic Republic of Congo (DRC). The Company’s two main projects are the Kipoi and Lupoto Projects.

Hang on, you mention outperformance to the benchmark etc, so I have assumed that by ‘best performing’ you mean, “return”, right?

RIS doesn’t do any liquidity at all…so I will go with PPP.

Lock in PPP.

Hi,

I will suggest Westfield (WDC). Maybe I am way wrong but they have had a great year and assuming the US property market goes up and the US dollar goes down, then that is a good sign (I hope!)

Hello Roger,

I am interested on your thoughts on a company called Ceramic Fuel Cells Ltd. CFU. Their product sounds amazing, power generator for the home, low emission conversion of gas to electricity. Produces double the needs of the average home. Sell the surplus back to the grid.

If only they can stay afloat until they start to generate income.They need to scale up production enough to make the product affordable, currently $40K a unit. It does not score at all on Skaffold’s rating system.

Would appreciate hearing any views you have on their prospects Roger.

Alan

This is an example of a company where knowledge of customer acceptance is essential. Notwithstanding conventional balance sheet and cash flow assessment, that is the primary driver and which needs to be researched.

My pick is SXE, Southern Cross Electrical

SM of 11%, forecast change in value 43%, current ROE 17% forecast to increase to mid 20’s, and no debt

Thanks Nigel.

My pick is Medusa Minining (MML). Currently at $6.00. It’s a cheap producer based in The Philippines and is increasing production substantially in 2013. Has zero debt.

I will leave the micros to others. I haven’t had a chance lately to really follow any companies and think what their prospects are etc but i like playing these games.

I am going to say JBH, the launch of the iPhone 5 and new Galaxy should send some action its way, continued drop in interest rates should get people more willing to spend and christmas is coming up so it is all coinciding rather nicely i think. All they need to add to the macro picture is for the aussie to drop further against the american.

On the micro level, it still is a good company that has great scale and a pretty good bricks and mortar and improving online footprint.

I have them earning only about $97.3 million but i think their is potential for a surprise with them. I know this is all rather specualtive.

I have them at a decent discount anyway at the moment as i think the IV is worth $10.94 a share this year and rising slightly to $11.02 next year. Which being a mature retailer in the current climate makes sense to me.

As it is a large very liquid company it probably doesn’t have a chance in this little game as it takes a lot more for very good price movements compare to smaller and more illiquid companies but i will stick with them.

Energy Action (EAX), good value, strong recurring revenue & will benefit from increased focus on power efficiency with Carbon Tax.

I submit HiTech Group Australia Ltd (HIT), probably the most speculative A2 company on the Australian market in my opinion, and in which I have a very small holding.

HIT supplies recruitment services mainly in the ICT sector and in terms of business performance has had a patchy history.

However for 2011 and 2012 HIT earned a NPAT of 648K and 570K respectively which understates the performance of the business itself as those numbers include losses on financial assets that HIT has invested their spare cash in.

The balance sheet is very strong, the ROE has been good over the last 2 years, the market capitalisation of HIT is less than the cash balance and the shares are trading on a P/E of under 3.

There are a number of things that make an investment in HIT speculative in my opinion.

The ownership of the company is highly concentrated and the market in the shares is extremely illiquid.

As almost all of the financial assets had been sold by the end of 2012, it is unknown at this point what the company intends to do with the cash.

I am attempting to contact HIT management about what the cash might be used for.

It would be great if you had a page on your website were we could view the daily pricing, would this be possible?

Hi Roger,

Great topic, my pick for the next 9 months is Hawkley Oil and Gas (HOG)

They continue to improve their balance sheet structure and Skaffold now has them as an A2.

Whilst they are a microcap and a bit news driven, the good news continues to flow and from this low base I can see out-performance for the rest of this FY.

All the best

Scott T

Hey Scott,

I continue to hold and accumulate HOG at current prices. With their current producing assets the share price should be at least twice current levels. Cash flow and profitability are now strong so we’re just waiting for a couple of catalysts to get some positive momentum happening. On top of this, if Chernetska is viable, we’ll really see some blue-sky potential.

Dave

I’m assuming that each person is only allowed one suggestion.

If only one then RFL. Please let us know if we are allowed more than one suggestion.

Hi Roger,

I will select Objective Corporation OCL.

It is only a small company and over the last few years has had flat revenue due to increasing revenue locally offset by declining revenue in Europe and the effects of a stronger Aussie dollar.

OCL has lots of cash, and expenses a high amount of R&D for such a small company, but still has great cashflow and return on equity. Last year on $40M of revenue they expensed $9M on R&D, bought back $4M of shares, paid $1.8M in Dividends, and increased cash by $3M. The only thing missing was earnings growth.

The share price has run up a bit lately, which perhaps makes it a little more difficult to be the best performer over the next 9 months, but It won a good contract with Australian customs in April and if it can grow revenue and profits this year it might still perform well.

I look forward to seeing the list and how all the companies perform.