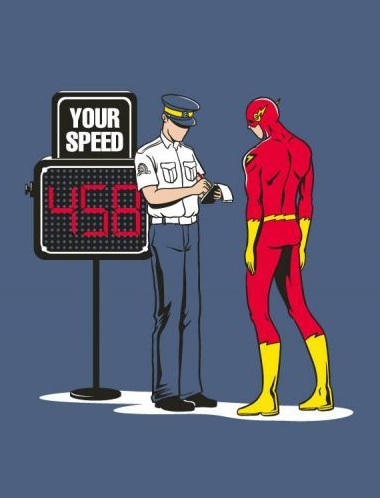

What if the sell-off is just a Flash?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

Hi Rodger,

Not sure if you are still seeking contributions to the future investment forum.

I have tried to think outside those companies that repeatedly appear, therefore my suggestions are:-

LWD

NFK

PAN

BSA

If contributions are still being sought I am happy to attempt the IV for these companies and set out why they appear on my watch list.

Cheers

Phil

That would be great Phil. I look forward to seeing the results, as I am sure everyone else is.

Hi again Rodger,

You requested I set out why LDW, NFK, BSA & Pan are on my watch list, so here goes. They are in no particular order.

I welcome any comment/suggestions from either yourself or the forum participants.

NFK – Norfolk Group Limited.

Market Cap. $ 200 mil, positive cash flow past 4 yrs (2011 up 19%), revenue increasing past 4 yrs, no long term debt, ROE 29 (Av. past 4 yrs), 2011 profit increase of 15%, order book $820 mil.

NFK operates within 3 divisions 1) electrical engineering 2) Air Cond., mechanical engineering 3) management services. They have operations in India and SE Asia.

IV at $1.97 rising to $ 2.27.

BSA – BSA Limited

Market cap $50 mil, positive cash flow, revenue increasing past 6 yrs (up 39% 2011), book value greater than share price, growing order book, NPAT up 71%, div yield 9%, ROE 17% (av. past 4 yrs).

BSA operates within two divisions 1) involved in design, drafting & manufacture of heating, ventilation & air cond. – clients include Westfield, Watpac, Lend Lease & Leighton. 2) Installation, maintenance services for Foxtel, Optus, Silcar & NBN trial. Expert in digital hardware, fiber splicing & satellite infrastructure. They have a small national network. I thought they might be a takeover target, especially as the NBN starts the roll out.

IV $ 0.52 – I have no future IV at this stage.

LDW – Ludowici Limited

Market cap. $ 120 mil, revenue increasing over past 5 yrs, positive cash flow past 5 yrs. has debt of $ 45 mil, ROE 13, div. yield 5.5%.

LDW has exposure to to a global coal & copper processing market by providing services to that market. LDW has a factory in China which is about to be expanded.

IV $ 5.49 for 2012 rising to $ 6.00.

PAN – Panasonic Resources

PAN is a mid-size operational miner of base metals. They have released details of a potential large gold find at their Gidgee Gold project (approx 3 year lead time)

Market cap $ 400 mil, div. yield 5.4%, no debt, interest cover of 96.5, ROE 17.3 (av over past 3 yrs), cash of approx $100 mil.

IV of $2.97 rising to 2.97 in 2013 fin. yr.

I have to declare that I have shares in a couple of those listed above – not large parcels.

They are on my watch list in addition to some that have already been mentioned by the forum members.

Thanks for inviting my participation on your blog.

Cheers

Phil

Amazing work Phil. Thank you again on behalf of everyone who reads and benefits from the blog.

Thanks Phil,

I like your first two very much.

Hi Rodger,

I am really chuffed at present, especially after reading your latest blog “Are there really five bargains out there”.

Although you don’t use your Value.able methodology I’m pleased to see PAN makes the grade – I will now upgrade it on my watch list and look for any future price opportunities with this stock.

Cheers

Phil

Great Phil, just remember everyone, seek and take personal professional advice at all times.

Hello Roger and bloggers,

I too have been stunned by the work awaiting me after a weekend away for a wedding.

Roger, I am puzzled by your response to comment by Andrew S re COH. Your post infers that the selloff of COH because of Aust $ fluctuations is irrational, but you have taught us that eventually price follows IV. As you have valued COH at considerably less than its price, could it be simply that price is following value, despite the fact it is still a quality business?

Also, could you make a comment sometime about reconciling the value investing method with the need for income (I am retired), as waiting for price to catch up to IV can sometimes be a long wait. Does one simply choose quality businesses that also pay good dividend?

Regards,

Glenice

Hi Glenice,

Its important to understand that movement in price – even towards intrinsic value – in the short run can still be irrational. This is particularly true when the movement is a reaction to something that over the very long term does not itself impact intrinsic value. Regarding income, I would be delighted for you to buy high income producing companies. Just stick to the highest quality and continue to only buy below intrinsic value…and you can have both! As I mention in my book, the pursuit of quality and value does not preclude income.

Re light speed:

Jack Gibson once said about ET:

“that boys so fast, he turns out the lights and is in bed before it’s dark”

Therefore there is something or someone that can, obviously, travel faster than light….

here’s my list:

AIR

CCP

CIX

DCG

DWS

FGE

MCE

SWL

VOC

ZGL

criteria is industrials trading <60% of my val using 10%RR (except CIX which is trading below NTA)

Good to hear from you Brad.

For MCE I have taken into account the capital raising and worked out that IV RR10% is $7.97 ending June/2011 and $11.77 June/2012.

Thanks Thomickers

In the theme of out of favour businesses or perhaps, in the “market backwash” for a reason businesses with questionable value.able bright prospects/potential I would add the following to the many good suggestions already:

Computershare (ASX:CPU, MQR ?) Mature dominant global registry player with a potential value-adding acquisition in the pipeline. Will be interesting to see if they end up overpaying for the “synergies”.

DWS Advanced business solutions (ASX:DWS, MQR ?)

I downgraded the IV on the back of the latest market update in May to $1.27, so trading around IV. Just noticed they announced an acquisition a couple of days to go. You’re never bored in this game.

Infomedia (ASX:IFM, MQR ?) Seems to be trading on undemanding value.able metrics, however the dividend payout ratio over the years seems that there has been pressure to extract money from a business that is struggling to grow. Will be interesting to see if they can attract more subscriptions to their online service. Recently left the All Ordinaries.

ISS Group (ASX:ISS, MQR ?) Recently traded at around 80% of net current assets. Very small fry this one and perhaps out of consideration based on the short business history, lumpy, inconsistent earnings and unclear market penetration or depth for their products. Still interesting to see if they can increase licences and actually make a profit this year.

Sorry, that should be 120% of net current assets.

I have started on my Analysis of annual reports.

In Campbell Bros (CPB) report I discovered had some ‘quirks’.

Using the total equity and profit does give an ROE close to their ‘average’ figure (near 16%). using the only number of shares figure I could find also gives close to the eps, and dividends per share. However they quote a nta per share of 4.77. They have lots of ‘intangilbles’ on the books.

Dividing the equity by the number of shares produces a much larger figure. This larger figure is, I think, the appropriate one for the ‘value’.

Cash flow in the last few years is not good.

Colorpak (CKL) is in my view worth considering. They have just bought extra capacity so the next Report and calculations will be interesting. On the old figures they are trading at less than my calculated IV.

Also Cti Logistics CLX

Neither have been ‘hit’ by recent declines.

Thanks Robert.

Here’s my watch list.

I have several already mentioned here such as MCE, FGE, BKL, REH, JBH, WOW, CSL, ZGL & ARP.

I am also looking at

LYL – Lycopodium – ROE averages > 30% since listing, no debt, 21m in cash, profit margins have increased, cash flows are very good.

ORL – Oroton – An excellent business, mentioned here many times.

CAB – Cabcharge – almost a monopoly business, fantastic margins, ROE > 20%.

GUD – GUD Holdings – very consistent returns, ROE over 20% since 2004, profit margins have been increasing, GUD has reduced debt/equity from 70% in 2009 to 7% in 2010. Cash flows are very good.

MLD – MACA, although it has a good chunk of debt, it has good future prospects, ROE is huge at > 50%, and I have it >60% in 2011.

Cheers

Mike

Good list Mike. Thanks for that. I am impressed with everyone’s selections.

Hi Roger,

my picks have been listed by numerous other graduates but something else has struck me: because of the high quality of your A1 A2 B1’s isn’t it true that they also have a higher than average chance of being desirable takeover targets? ACR CST STU BGL RHD KRS CIL CCV sprang to mind.

Yet another way shareholders in these fine companies often benefit.

Re the list the only one I came to independently of MQR is Medusa MML, the gold and soon copper producer in the Philippines. I have noticed quite a few of your contributors also like it – as well as being debt-free with fast growing profits, I believe it is the (world’s?) lowest cost (US $200 per ounce) gold

miner, which I figured was a good thing in a commodity-dependent business.

Roger,

re COH “Rational, anyone?” Quite apart from any currency considerations, isn’t it to be expected that sooner or later Cochlear’s share price will align with its Intrinsic value ie might ‘out of the blue’ head south towards $47?

Thanks Andrew,

WIll add it to the list. Just remember that no debt can sometimes (perhaps not in this case) mean that no self-respecting bank would lend an ounce.

A quick reply regarding GUD Holdings. I recently finished an accounting subject in which I analysed financial position and performance, as well as historical cash flow. What stood out to me was the companies ability to continually improve over the last four years what they call their CVA strategy. This is worth looking into for prospective share holders, as it adheres to the fundamental views that Roger explains in his book. However, Shareholder wealth has been destroyed through capital raisings which essentially just raised money to pay dividends (company has a history of high POR – one year it raised capital and then paid out more than capital contributed in dividends) Since 2007, ROE has been declining and there are inconsistencies in reporting that have inflated certain key ratios. Trends indicate that GUD is becoming more efficient at turning revenue into cash, and improving ROA suggest that management are performing well (no asset stripping identified). Historical disregard for share holder wealth undermines these positive trends for me, and I for one will be watching FY2011 results for evidence of positive trends continuing, and company cash profit increasing without the dilutionary effect of capital raisings.

Excellent suggestions Leigh. Thanks for contributing to the discussion.

Hi Roger,

What about FGE group? It appears to be trading at a fair discount. I know you have covered it many times in the past. My valuation is $7 +?

Any thoughts?

regards

Prasad

Stay tuned Prasad.

The companies I own shares in and looking into investing.

DLX – I visited Ikea and they advertise in their showroom that they use Dulux paint. Not sure if it’s free marketing but it sure helps. My IV for 2011, if they make an estimated 70M profit after tax, is $3.92. DLX have paid off quite a bit of their debt and I have their cashflow at a positive of 58M for FY2011.

RMS produces high grade gold with low cost production. They also reported a profit last year with no debt and very strong cash flow. I don’t believe many gold mining company can boast those records. Have their HY2011 valuation at $1.33 I’m going to be quite optimistic and say their full year is going to be close to double the value.

CLV

Pros:

-Divest their investment in FFI, therefore focusing on their core business of omega 3 oils and patented encapsulation technology

-Slightly under-valued currently at $0.29 and IV is approximately $0.32

-Supplies omega 3 to foods, supplements, pharmaceuticas and children fomula

-Microencapsulation process is suitable for other product and applications

Cons:

-Waiting to sell their investment in FFI

-May require an ongoing and increasing R&D program to stay ahead of market competition

Notes:

Waiting on the latest of their divestment of FFI and latest annual report

As you probably noticed I did a bit more research on this company :)

CIX

Insurance company that does small business and personal insurance. Reduced debt from 25 to 5M and bought back shares.ROE is on a low side but has strong cashflow, might be one to consider after their 2011 annual report.

AMA

Good little company that deals in automotive after-care and accessories. Went through a turbulent time when the previous CEO was at the helm but the current CEO has put things back in order. Nice ROE last year and they have been aggressively paying off debt. IV for 2010 at $0.47 and a slight increased IV of $0.52 for 2011.

Due to currently market conditions, I’ve used a RR of 12% and a MOS of ard 40% to justify me putting money in the market.

Looking forward to comments and Roger’s A1 service!

Interesting look at some companies that haven’t been mentioned by others on this blog. I have previously looked at AMA and your IV looked grossly different to mine, and have a feeling that some of your inputs might not be right.

Shares outstanding: 269 mill

Equity: 6 mill

Price:0.11

Market cap: 31 mill

Net cash position: -16mill

EV: 47 mill

WACC/RR: 0.1

NPAT: 4 mill

Growth rate: assume 0.03

ROIC: 0.67 (but a lot of this is due to accounting handling of equity- and expect to normalise in next 2-3 years)

Value (buy): 0.09

Value (sell): 0.14

MOS (buy): -0.22

MOS (sell): 0.25

My inputs give a price closer to the actual market price.

Thanks Mal, Do you mean a ‘price’ or a ‘value’?

Of course I meant value!

*The two valuations above are based on no growth and growth ~ 3%pa (general GDP growth rate).*

Here are my fomulas for AMA and it’s the same spreadsheet I’ve used for all my other cals so if there is a mistake please point it out :)

Equity per share for AMA is $0.02

FY2010

1st multiplier x Equity Value

5.139 0.13 0

2nd Multiplier

19.035 0.47 0.47

HY2011

1st multiplier x Equity Value

3.626 0.09 0

2nd Multiplier

10.161 0.25 0.25

Even when using their half year profits for 2011, their value is $0.25

Entity cashflow of 5M in 2010 and HY2011 is 2.6M(Base on Valueable calculations chapter 9)

I did make a mistake by not putting in the updated equity numbers for HY2011.

Equity per share for HY2011 is 0.05

HY2011

1st multiplier x Equity Value

2.524 0.11 0

2nd Multiplier

5.293 0.24 0.24

Nevertheless the value is still pretty close.

I own some AMA shares, I got them based on P/E before buying Value.able and started valuing shares properly. I’ve valued them at $0.27 – as they are completely focussed on paying off debt, I’m using the multiplier based on a 100% payout ratio even though they are not paying dividends. I agree, the current CEO is doing an excellent job of putting the company back on track, and has a fair bit of skin in the game.

Hi Everyone,

With regards to Diploma Group

– Long Term Debt $9 mil

– Short Term Debt $21 mil

– Equity 30 mil

– Accounts Receivable 85 mil

– Account Payable 50 mil

Most of the debt is project finance to the property development side of the business.

– Funding Facilities $150mil

– Drawn from Funding Facilities $90 mil

How risky to you think this business is? what are the chances of default. I strongly believe in the earnings side of the business with management 20 years old, 1.1bn order book, high presales.

On another note FGE is looking interesting at current levels. Can someone care to explain their competitive advantage & the ability to raise prices if they are the price takers (contracts)

Thanks, Tyler

I looked at this one beore tyler butit is not foe me

Be careful with this one Tyler. Have a look at the cashflow statement from the half-yearly- operations were losing money and they borrowed money. Interestingly even though the cashflow demonstrated some 7million in borrowings, the long-term debt increased by more than that!

I am not sure how Diploma group handles its apartment sales and how the cashflow varies with time, from past reports it seems that it is cyclical, and if anything you will be the beneficiary of a cyclically good profit result, but I wouldn’t count on it. Of course although the risk might be higher, the return may also be!

Hi Roger,

I’ve been working on behavioural economics over the past year (for my legal work), and I am starting to understand the benefits of investing when the market takes an irrational turn. With this in mind, my ten picks take advantage of the sell off.

They are:

BHP – on my watch list, and ready to buy some shares in August/September at its previous support of $36. Seriously undervalues at these levels, $42.

Atlas Iron (AGO) – this is my “star stock”. Yes the market will be flooded with Iron ore in the next few years. But with rising demand from China and India, this company has a very bright future indeed. Port access and 66% high grade ore, combined with a projected spike in production soon. Supply may rise in the market, but so will demand.

Matrix C&E (MCE) – down 4.5% today, but fundamental remain strong.

Forge Group (FGE) – down 4.1% today, but a “no brainer” being in the right sector.

Monadelphous Group (MND) – a 3% tumble today but attracting a 5% yield at these levels, combined with excellent growth, I am keen to pick some MND shares up at the $17 mark.

Boart Longyear (BLY) – one of the largest drilling services providers in the world. Down 4.39% today.

Origin Energy (ORG) – great growth story with focus on LNG, and we all need to keep warm, light our homes/offices and cook food!

Incitec Pivot (IPL) – has taken a hammering in the last few weeks, but teh fertiliser and explosives trade will be sure to grow with more demand for food and Australian resources.

Myer (MYR) – I know what you’re thinking! Please, let me explain. Myer has been treated harshly in 2011. It will respond to internet shopping though myfind.com, and it offers a very attractive yield. You will need to get 13% from the bank to match it. As I said at the start – taking advantage of irrational selling, which has been over done with Myer in my view. It may have BEEN rational at some point. Myer, Qantas, Billabong, etc have been treated harshly. I’ve also started looking at Fairfax Media and Seeven West Media.

ANZ (ANZ) – expanding into Asia is a great strategy! I think right now the banks look great.

I am 27 so lots of time to build my portfolio – obviously starting with BHP, the banks (ANZ), Myer, and Atlas Iron (when they reach a good price). I hope to start dipping into other stocks once I have a nice diversified portfolio in the big players.

Cheers

Great contribution Angelo. Thank you for taking the time to share and join in.

For what it’s worth, my 10 in no particular order are:

BHP

Whilst not a fan of the resource sector I do own this one simply to have some exposure. Well managed, diverse and starting to look cheap against consensus forecasts.

FGE

I’m keeping an eye on the Clough influence which I consider to be both a positive and negative and the pending appointment of a new MD

.

MCE

Cash flow when they report and potential commissioning risks/delays associated with the new Henderson facility are front and centre for me.

TSM

Is about as close as I’ll get to investing in retail. $24 per week sounds a whole better than $2,500 up front. Energetic and enterprising leadership with skin in the game. Increasing footprint, valuable and improving IP/technology, substantial funding arrangements in place, enduring contractual relationships with key customers, annuity income streams etc.

FRI

Unloved and in a sector with some quite severe headwinds at present but, nevertheless, a well established business with a good track record and proven business model. Recent decision to extend footprint to Karratha could prove to be a visionary and financially astute move. Director’s committment to their shareholdings in recent times is, to some extent, a vote of their confidence in the company’s future.

TGA

Have only recently started to research this business. Although the vital signs look encouraging, I’m maintaining an open mind pending the outcome of their current capital raising and some further research into the regulatory impact that recent changes to the national consumer credit act may have on the business.

CCV

I’ve always liked the investment qualities and performance of this business and have in fact invested in it in the past. However, judging by it’s recent share price performance, Ezcorp’s proposed increased shareholding does not appear to have been well received by the market. As a general rule, a cornerstone shareholder with circa 55% of the issued share capjtal doesn’t appeal to me so I’ll just maintain a watching brief for the time being.

WBC

My preferred bank in the sector. If anyone can optimise cross sell opportumities and extract greater synergies out of the business, I believe Gail Kelly can. Currently paying a respectable fully franked dividend and trading below my current IV with upside potential in the medium to longer term.

CCP

Nothing much to add to what has already been posted about this stock. Am looking forward to their fy11 results with interest.

HSN

Am encouraged by the resuts of my initial research and their specialised offering to the utilities sector. Am still trying to fully understand their business and competitive advantages but otherwise like the fundamentals.

So there you have my five bob’s worth for what it’s worth. Apologies in advance for any spelling or grammatical errors but my Ipad doesn’t afford me the luxury of a spell check or preview mode.

Peter

Thanks again for sharing Peter. Your work is appreciated.

Thank Peter,

When we look at the cashflow for MCE we will have to take into consideration that businesses that grow very quickly often have alot of their cashflow tied up in increased debtors and inventory. I believe that MCE cashflow from operations will be negative for this current financial year but I am not concerned

That will depend on how many new contracts they get and therefore how many deposits they receive…

Hi Peter,

Lots of great companies in your list. Only one I disagree on is FRI – Finbar. If you have a look at the company’s cash flow, you’ll see that its declared profits bear no resemblence to the actual operating cash flows. In fact, if you add up the cash flow over the last 10 years its negative $40m!! So much for a company that’s reported net profits of over $80m over the same period of time.

cheers

Mike

Hi Mike,

Thanks for the feedback. Although i haven’t analysed their cashflow over the last 10 years, I did take a look at their balance sheet and free cash flow position for the fye 2010 and H1 2011 which produced the following results:

Balance Sheet FYE 2010 = +$74.8m

Free cash flow FYE = 2010 = +$54.8m (2009 = (-$54.9m)

Balance Sheet H12011 = +$1m

Free cash flow H12011 = (-$12.6m)

Lumpy to say the least but not inconsistent with the nature of their business/sector (construction) which, as I’ve said before in another post, is not condusive to everyone’s risk tolerance/appetite.

Peter

Mike

For what it’s worth, I don’t know how FRI curently rates on Roger’s MQR list (was an A1 at some point If I recall correctly), but it’s curently a B according to my quality assessment. Perhaps Roger would be kind enough to provide us with his current MQR on the company.

Peter

Stay tuned, thats what this post is all about – collecting everyone’s suggestions for the next post.

Hi Peter,

2010 cash flows are ok, but if you check the previous years, you’ll see that they aren’t great and many of them are negative. Lumpy I can live with, its just that there’s been a big difference between what the company’s reported profits and the actual cash flows its received over the past 10 years. Based on that, any calculation of intrinsic value that uses net profit, you need to be careful with.

I rank companies out of 10 based on financial data, including historical and its latest financial year results. Finbar gets a 5.8 / 10, compared to Matrix which gets 8.3 /10.

Cheers

Mike

Hi Mike,

Thanks again for taking the time write. Your ranking doesn’t appear to be too inconsistent with my own whilst your point regarding the need to take care when using NPAT to calculate IV in these circumstances is well made.

For this reason, my optimum entry point (<=$0.76c) which includes a high RR and and healthy MOS.

Whilst I think it's important to keep an eye on the rear view mirror, I'm equally inclined to look through the windscreen at things such as the recent expansion of their footprint into Karratha. Will be interesting to see how this pans out in the fullness of time.

Whilst there are undoubtedly better stocks out there to invest in at the moment, this is the one in the construction sector that has my interest at the moment.

Cheers

Peter

Looking forward to a triumphant release of the A1 service Roger!

Most extraordinary companies have been well covered in this post, including who I can consider to be the best managed of them all over recent years – ARP.

An A1 not often referred to in the posts is LYL, who continue to impress. The trait that appeals most to me about companies like ARP, FWD and LYL is that they perennially underpromise and overdeliver. They are pleasantly deficient in the areas of self-promotion and self-interest, but conspicuous in acting for the benefit of shareholders. This sets these types of companies apart from the remaining listed companies who I like to refer to as ‘proletarian companies’. It is companies like LYL that I feel entitled to have special confidence in.

It is indeed a great trait and something to look for.

Hey Roger,

excellent post.

The standout junior company listed on the ASX at the moment is Resource Equipment Ltd (RQL) which I’ve mentioned on this blog many times and which I’m sure long time readers of your blog are a little tired of hearing about.

I recommend to all readers to read the latest activity update from the company and do a little research into the people involved with this excellent business

This has been my top prospect for just over a year now and is currently trading at a 15% discount to my valuation. The end of year report is going to be very interesting.

Thanks for the compliment Nick. really appreciate you taking the time to throw your suggestion into the hat.

keep an eye on their ROE for signs of deterioration.

Hi Nick,

I had a not so quite chuckle at your comments. ” I’ve mentioned on this blog many times and which I’m sure long time readers of your blog are a little tired of hearing about”

I do recall you mentioning this one once or twice but I will never tire of reading your blogs. Keep up the great work

You’re very welcome Roger, thanks for the ongoing work you put into the site.

Ash, thanks for the compliment.

Ron, at the moment RQL is not paying any tax due to carried forward tax losses (from the previous business which RQL backlisted through, nothing to do with the current company.) When they start to pay taxes next year it is almost inevitable that their ROE will drop so prospective investors should keep this in mind when evaluating the company.

Investors should also keep in mind that after the nuclear disaster in Japan RQL was selected from a worldwide field of candidates to design and supply a system to help mitigate the disaster. This they did literally from Friday night to Saturday night when their equipment and system was transported to Japan. This to me speaks volumes about the quality of the company, the service and equipment it provides and the people involved.

Investors should also keep in mind that RQL acts as a near monopoly in a very specialised niche industry and has a number of compelling competitive advantages.

Hi Nick,

In my honest opinion, one year of profits in a cyclical industry does not a company make. While its valuation may indicate its cheap, it also has no track record. Not one for me.

cheers

mike

Hey Mike, whilst its true that RQL as a publicly listed company has recorded 1 year of profits its main subsidiary ‘Resource Equipment Rentals’ has been operating since 2003. Since 2003 it has grown revenues every single year including during 2008-2009 when many miners reduced production and in some instances halted production.

Jamie Cullen makes the important point that water issues continue during good times and bad and that the company is focusing on mines already in production, not new mines.

So whilst the company may operate in a cyclical industry its services are definitely not cyclical (its profit growth and increased market share during the GFC is testament to that.)

That said, if mines were to shut down completely then its bottom line would be hurt.

Mark, thanks a lot for your feedback, it fits closely with mine. I have a good friend who once did some work with a few guys from RQL and he told me that they were all extremely professional and very good at their jobs.

Good stuff Nick.

I have been talking to a few people who work at RQL seeing as they are directly opposite me and they seem very positive about the outlook for the business and they have had some good things to say about management.

Purely anecdotal evidence I know but I thought i would add it anyway.

Having said that I still think it needs to be cheaper given that there are probably companies with better track records trading with better MOS out there at the moment.

I still think FGE looks good with a wide MOS and I am looking forward to their results.

Thanks Mark. Every little tidbit of info can help even if it only leads one to investigating a path they otherwise may have missed.

Still dont think the market is so cheap.

My Favs are :

CCV –> Underpriced, strong growth, no competitors. However FFF is a minor competitor but doesnt seem to be doing to well.

DGX –> construction & property development company. I like the quality of their buildings, they are small & in a niche market (no big competitors will bother) strong relations with government & other companies shown through the increasing order book (1.1bn). First half of this year was disappointing due to the ‘timing’ of completion of developments etc. Long term management for over 20 years.

Only worrying thing the is the amount of current liabilities

Thanks Tyler,

Well done. Good spotting. Try not to let yourself be distracted by the level of the Market. Agree it could fall further but be mindful that we are investing in businesses. You could be the next Buffett given how young you are. Stay humble and open minded.

Hi Tyler,

I am a 27 year old lawyer and behavioural economist working on reforms to financial regulation. I’d be wary of CCV (Cash Converters) because the Commonwealth is pushing to create national interest rate caps of 48% on payday loans. This is in line with the law in NSW. This directly impacts CCV, especially in Victoria. CCV charges up to 425% interest on payday loans in Victoria. Not long before Parliament addresses this predatory lending, so the future does not look great for CCV in my view given the extent of the reforms (National Credit Reforms phases 1 and 2, Future of Financial Advice Reforms etc) which borrow heavily from US reforms.

Cheers

Angelo

An interesting looking GOLD company I like, still in development phase, is Beadell Resources (BDR). They have a portfolio of gold exploration tenements throughout Australia and Brazil. Their Brazil operation is going ‘full steam ahead’ for first gold pour in first quarter 2012.

Two days ago they put out an Investor Presentation, so rather than trying to do it justice here, better to read it for yourself.

I currently have it trading above Intrinsic Value, but I also have IV going up in leaps and bounds over the next two years.

And a rising gold price will lift all boats, hopefully Jim Rogers and Paulson will be right…

The list, one’s own list, will vary from time to time, and do so according to Mr Market. Poor man, so despised here for his schizophrenic gyrations and freaks, and yet he is important. His importance of course is at the point of buying or selling, in other words, price is the last thing to consider, and only when everything else is in order. That does not make it unimportant.

My own watchlist just now (with a glance at the frenetic gyrations of Mr Market in my peripheral vision) includes MCE, CSL, FGE, TSM, CBA, FMG, and ACR. Another I watch is ABC – has it ever been discussed here? I have not tried to value it myself.

Hi Rod,

Nicely articulated. Give valuing ABC a go and let us all know what you come up with. helpful to show your workings so others can compare theirs with yours.

Ok, here goes for ABC at 10% RR. I got:

SOI 636.3m

ROE 17.3% (av.)

EqPS $1.47

x div multiplier =2.5725

x growth multiplier =4.02586

POR 90.1% – hence

0.3985

+ 2.3125

= IV $2.71

MOS -12%

Estimated ROE seems to be rising very modestly. I guess cement is a bit dull and boring, but it’s at least solid :-). Indebtedness about 16%, and falling as far as I can tell from their reports. Comments and corrections welcome.

Hi Rod,

Have a go at running the business cash flow calculation next. Also go back through the business cycle and have a look at the pattern of ROE…

Now, Roger, I’ve taken your instructions absolutely literally, so that, for example, I’ve ignored current assets that appear not to be cash in the bank. So:

ABC ‘000 2010 2009

Cash at bank (2.8) (25.5)

Current borrowings 1.0 0.4

Non-current borrowings 150.2 200.5

Contributed equity 692.7 690.4

Total 841.1 865.8

Operating cash profit 24.7

Dividends paid 114.2

Company cash profit 138.9

ROE 2009 2008 2007 2006?? Have not found this yet.

Is this the same as ‘return on funds employed’?

If so, it rose from 13% to 18% from 2009 to 2010. You see what an innocent I am!

Good work Ron,

ROE is not the same as return on funds employed which uses operating earnings rather than NPAT and includes debt rather than only equity. You may find you will have to calculate it yourself or you can find it in compendiums like Morningstar’s Shareholder reference.

Had a quick look at ABC, my valuation is approximately $3.

I think Zicom warrants further a further look in, i spent an hour on it, the business is a bit confusing.

Can anyone explain to me MCE’s competitive advantage or moat?

Tyler

a quick google search like :

matrix site:rogermontgomery.com

will give you plenty to read

hth, Matt

Hi Tyler,

Have a look on the companies website and read all you can especially the analyst reports by heath(can’t remember his last name) from Austock. He covers this company the best.

Plus their is a very good interview on Rogers youtube with Arron and Peter Switzer where Arron mentions IP which is very important in this field.

If you do some googling you may get some idea of the companies reputation in this field as well

Sorry to do this to you mate but we had to do our own digging so I am just giving you the mud map

Hi everyone,

Recently I met up with the CEO of BGL, Jason Ashton, and discussed his business and it’s bright future.

I will write about my insights from the meeting on the blog this weekend.

Until then, here are my top 5 companies that I believe are still very cheap and all have very bright prospects:

1. BigAir (BGL) – I wrote about BGL a few weeks ago when it was still under the radar. Since then it has gone up by 50%!

Luckily for all of us I believe it is still cheap. I reckon this company will earn $4mil profit next year and with no debt and a strong cash position I think it is perfectly poised to continue it’s consolidation of it’s regional competitors and organic growth. My IV for fy12 is 40cents.

2. M2 telecommunications (MTU) – an A1 business and another that I think is still cheap. Premium telecom reseller focusing on quality service to it’s business customers. High ROE and strong cashflows and With a CEO and founder who answers your emails on the weekend, you know he’s working for you. My fy12 IV is high $4 mark.

3. Credit Corp (CCP) – wrote about this business couple of weeks ago too. I think it is still cheap. My fy12 IV is around $7.

4. Matrix (MCE) – no need to expand. I believe it is still cheap.

5. Maquarie Telecom (MAQ) – Premium reseller of telecom services, largest hosting business in Australia, and soon major player in the data center industry. Loaded with cash. Good ROE. Founders are focused on their service to their business and government customers. In fact they are so much focused that their customers nominate on their website who gave them service and how happy they were. Competitive advantage is in their service and high switching costs. My fy12 IV about $14.

Obviously I own all these businesses so be mindful that jumping in pushes the price up and assist me. My largest holding is BGL. This is as diversified I will ever be. :-)

Cheers.

Thanks Yaron,

Be sure to only discuss publicly available information in your posts. If unsure leave it out. All good ideas and next week I will write about some of them again. Stay tuned.

By the way, Yaron is my full name, but since its hard to pronounce, i use Ron for business purposes. the reason i haven’t changed this on the blog, is because it will make it hard for others searching my past posts. cheers.

Hi Ron,

Any reason why Voc is not on the list?

plenty of short term risks for VOC. Large chunk of shares coming off escrow, potential large and dilutive capital raising for another company, etc. good business though.

my chartists investor friend tells me its heading under $2 in the short term. who knows. :-)

I would like to see lower prices. Might be a good time for them to issue shares for an acquisition…

I’m confused by this statement Roger. Wouldn’t a great business issue shares at a price well above IV and buy them back well below IV?

To me your comment implies the opposite.

I would say that Roger is hoping that they’ll issue shares to the institutions (of which Roger’s MontInvest is one) at a price down there (well below IV). I would be buying more if I saw vocus at $2, that is for sure

Hey Guy…..I know zero about charts but some of my cricle of friends have sugested VOC will go well below $2.

$1.30 has been mentioned

Fingers crossed that is does

Here are the ones I am watching, or already own:

ARB Corporation – Australia most consistent company in terms of ROE. Buy and put in the bottom draw for the next 10 years. Trading around its fair value.

Reckon – Consistent performer, and switching costs creates an economic moat. A bit expensive despite recent decline.

JB Hi Fi – Cost advantages and strong “share of mind” with its customers. Still plenty of life left in this company and recent weakness in retail is a reason to be buying now, and not waiting until everything is rosy again.

Woolworths – A boring stock at the moment, but after tracking sideways for a long time, better returns should be ahead.

Westpac – When you look back in 20 years time, won’t buying a bank just after a credit crisis seem like good timing?

Forge/Matrix/Monadelphous – Exposure to upside of resources boom, with less of the downside risk of commodity price movements.

I would happily buy these companies at good prices, and not be concerned if I didn’t see a stock quote for 5 years.

I am not yet sold on adding technology companies dependent on the internet to my portfolio despite their increased popularity. What will Vocus look like in 10 years – I have absolutely no idea, and no-one should be suprised if it doesn’t exist by then. These companies will generate good returns, and then quickly become obsolete. This could happen at any time. They will however, provide you with more excitement than most of the companies I mentioned, and make you make crazy statements like “the sky is the limit”.

Good luck!

Great thoughts Michael. Thank you for sharing your ideas. Not sure I agree with the obsolescence thought for VOC. I do agree its an issue for many players but perhaps VOC actually can take advantage of new technologies. What are you thoughts?

I think in the short term it may be able to benefit from other technologies, but inevitably, at some point in the future the internet will be delivered in a different way to how it is now. This may be by satellite, or some other method that hasn’t even been thought of yet. So ultimately, it will meet its end point. This may take some time, I can’t be sure.

It may well be that I am wrong, but at this point I am staying within my circle of competence and staying away.

I have commented on this before.

Einstein’s theory of relativity states that nothing can travel faster than the speed of light. There is the idea of quantum teleportation but that probably won’t be happening for Internet communication in any of our lifetimes. I believe it is currently just a thought experiment (any quantum physicists around to back me up?)

The point of all of that blabber is to say that light is fastest, nothing is faster than light.

The shortest path between Australia and the USA is a straight line going through the earth’s crust and mantle. That is not possible since we would have to dig a hole so big that not even Matrix’s drills could reach!

The next shortest path is under the sea – which is what Vocus has done.

My point here is that they are using the physically fastest possible method with the shortest possible distance. Therefore, the method of routing back bone traffic on the Internet will not change! However, new cables may be laid in the future.

P.S. Assuming Roger’s servers are somewhere in Australia, this message was probably sent through one of Vocus’ routers ;)

Cheers,

Luke

Hi Luke and Michael,

Great points made by both of you. I remember when doing Electronics we were told that modem speed would be limited to 1400 baud. They did hit the wall at 56k bps but not before they came up with all sorts of data and transmission and manipulation frequency shift and phase keying etc.

When I was employed in the computer industry, mid 80’s to 90’s, we used to marvel at the speed at which technology was changing. I was asked then “would it end?”. My colleague suggested we would soon reach a point where we had more speed and capacity than we would ever need. My answer then is the same as today. We would develop uses that continually become more sophisticated and require more of both. I do not ever see this changing.

The rise in our need for speed and capacity will continue to rise. If this requires ever increasing sized “pipes” and better algorithms or some other change in technology then, so be it.

The limit of the speed of light is just one part of the equation.

Hi Roger,

Just picked up a minor spelling mistake, ‘Of course tyring to fit all this into your daily life can be a challenge.’ I think you mean ‘trying’. Also, why did CSL get upgraded to an A1 from your last post on June 9 which shows that it was an A2. I can’t see any news that would change this.

Chris

Thanks for picking it up Chris! I will go back and have a look at CSL. Could be a “tyrpo”!

Only company I can add is CDA, I have a MOS of Approx 35%

Recently they upgraded forecast NPAT, however lately I have

ROE as Steady (not increasing at a good clip). Will wait for next

lot of reports to confirm 2012 and 2013 IV

Cheers

Rob Walker

Will keep a close eye on CDA Rob. Thanks for posting again!

Hi Rob,

Be careful with CDA. Company had $14.9m of abnormal income in 2010, so its ROE is exaggerated if you use profit before abnormals of $29.3m. Adjusted profit was only $14.4m.

Debt/Equity ratio is 47%, and if you have a look at their ROE historically, its all over the place. My valuation for 2012 is only 1 cent higher than its current price and as it pays out most of its profits as dividends, doesn’t increase much each year.

cheers

mike

Hi Mike,

Thanks for the heads up with CDA, I have researched metal detectors lately and all roads lead to minelab (cda). There communication division looks very professional and high end wil wait for 2012 results, thanks again for your feedback

Mce – My favourite. A real high barrier to entry industry. They have focused on cost efficency (hendersons) and quality – it’s quality assurance testing facilites and product are world class. Future prospects are good Oil and related product talks eg woodside.

Forge – In the right space. It’s next strategic move is important.

They are talking an acquisition play? – Appears they are seeking the right human resources to take them to the next level. Should be able to keep growing organically in this space.

Sandfire – a grade of copper 5 times the industry average. May have run it’s race, have to run the numbers.

Iluka – World leader in mineral sands and BHP Royalty. However its future intrinsic value would be rising very sharply.

Others – Lynas & Marengo.

Hi Dino,

Thanks for taking the time to throw some suggestions in. Really appreciate your contributions…

This is certainly an interesting time for new value investors. A few months ago people may have bought into top quality A1 companies such as MCE and FGE. They would have been taking a sensible approach by buying top quality stocks at discounts to intrinsic value. However those investors would now be sitting on some sizeable paper losses. So you could certainly look at this as a time where the faith is being tested. For myself as a relatively new value investor, I am looking forward (and hoping!) to seeing my faith being rewarded a few years down the track. I do enjoy investing but made some big losses, as many people did, during the GFC. I’m certainly hoping this new approach is one that proves itself and I can stick with for life!

A couple of the stocks I have had on my watch list are VOC and FLT. Knowing that the A1 Service is just around the corner (which I believe will supply updated intrinsic valuations), I have decided to sit tight and wait for this to be launched before making any more investments. Doing my best to be patient. I figure even if the market has risen a fair bit by then, there will always be other downturns!

PS Roger I have no doubt this will be an excellent service but am also hoping it will be somewhat affordable!

Hi Steve,

We are value investors too so don’t worry about that! It is important to think out many years rather than several months when buying businesses (as opposed to trading stocks). Think of all the noise surrounding Telstra and the NBN. One or two simple questions to ask; Do I think Telstra will double its profit in five years? They haven’t been able to for the last ten. What is going to change in their competitive environment that could shift their fortunes? If they can double their profit, that’s 15% compounded growth in earnings. Maintaining 100% payout ratio means a comensurate increase in ROE and therefore intrinsic value. But if not…

Hi Roger,

I will be interested to see what Thinksmart report. Especially to see how their move into the UK is going and what the prospects for future growth and profitablility look like.

Hi Iam,

Me too.

Hi all, Im a newbie here.

I think we should Navitas (NVT) to the A1- company list

Thanks William. I am interested to see if anyone else thinks the same thing?

First time heard about them, but seems to have excellent fundamentals. Good ROE, little debt, growing revenue + profit. Good business. I think it is a pretty good candidate for A1.

Way over my valuation though, since it pays 100% of earnings next year valuation is around $2.00 – don’t need the book for that one :)

Everyone needs the book Prasad!

Sorry Roger what I meant was did not have to refer to books multiplication tables since POR is 100%. Because Value = D * RR

Thanks Prasad, I was kidding around. No need to explain.

In most of the metrics i measure it would appear to be an A1. Very low debt to equity (some would say leverage in the minus). Lots of cash generated, actually above the reported NPAT, high ROE, double digit net profit margin etc. Very good operating cashflow and company cashflow.

One thing that did get my attention and was the only brown mark i could find in an admittedly quick analysis of the financial report for 2010 was that its current assets were below its current liabilities which means that they would potentially have needed to find some form of short term capital to deal with these liabilities. I have only just started looking at this company so i don’t know whether this ever really eventuated in anything,

There are some definite good symbols that would warrant further investigation, i would not be surprised if you did call it an A1. I am not sure whether the current liabilities/assets might mark it down or if there is somethign i missed. My main thing at the moment is to try and work out whether there is any identifiable competitive advantage.

Some interesting thoughts (but fairly conventional) about what to look for there Andrew. Regarding liquidity, important to break it down further.

Andrew, I’m hardly the most qualified to advise you but regarding the working capital: -ve isn’t always bad… You need to consider cash flow as well as working capital ratios together.

Consider WOW as an example – they have had negative working capital for years.

How do they do it?

By paying their suppliers on very favourable terms (for WOW shareholders)

How can they do it?

Lots of reasons, but the main one is that they are the biggest buyer and so if you are a seller and want to grow your sales you might be willing to accept poorer payments terms (obviously lots of WOW’s suppliers are eager to)

How does it work?

When WOW buys something there is an addition to both the inventory and the payables. WOW have high turnover of stock and sell everything for cash so the might sell that inventory within a month. However, and this is the key, THEY DON’T PAY FOR THAT INVENTORY FOR UP TO 3MONTHS. There is a current liability (the payable) still exists, but that inventory is now in cash. That cash is not due to be paid out for a few months and so WOW instead put that cash toward paying wages, buying plant etc.

Therefore, if you think about the current assets/liabilities there might be three months worth of purchases accumulating on the liability side but at any one time there is only one month of inventory on the asset side. If you wanted to think about a dollar coin that flows through WOW it might go in to the woollies checkout in March, but go to a farmer who sold their bananas in December.

Does that make sense?

Companies with negative working capital can be very attractive because they generate a return on the working capital (ie interest in the bank) and they can also expand without need for investing in additional working capital (their suppliers supply the working capital!).

It is a great process if you are a WOW shareholder

Thanks Matthew,

Not sure that suppliers are eager to…see The Walmart Effect.

…and Andrew, changes in the items that comprise working capital will provide insights into the primary source of liquidity generated from the operations of the business.

Hi Guys.

I have allways liked this company but I fear they paid way too much for their last acquisition.

Plus growth problems for companies in Australia are not just limited to retailers

Hi William,

I agree Navitas is an A1 Company, Pity it is trading at about 150% above my IV,

Great Return on Equity, But I have iV as Flat, actually I have the IV the same for

2011,2012 and 2013. For me I would not look to purchase unless it was around

$1.20 and only if the forecast IV started to rise and a good rate. I used 60 % ROE

and 12%RR

Just my own Ideas, as usual D.Y.O.R

Cheers

Rob Walker

SOunds like it is worth putting some numbers up for comparison? Anyone care to do that?

NVT

Growth Rates (exponential trend from the 6 financial reports as a listed company)

Revenue: 39.7%

EBIT: 18.1%

Total Assets : 13.6%

Funds Employed (Equity + Debt): Minus 6.2%

Shares outstanding have reduced from 346.5 Million to 342.4 Million.

ROE x Retained earnings has not correlated to Navitas’ growth rates in the past and is unlikely to be a good approximation of future growth. The SAE acquisition is also an extremely low capital intensity business. Concluding that NVT has zero growth prospects because it pays out all of its reported earnings is to neglect one of the most important ingredient in what makes a wonderful business.

Because the business model delivers growing returns on investor’s funds I value NVT a lot higher than the consensus here. I hold NVT shares.

The risk is that the Business Model is so lucrative that it will inevitably come under fire from competition and perhaps legislation regarding course prepayments. Major growth initiatives may not deliver the same self funding characteristics (reference SAE acquisition) as more moderate organic growth. Actually with this business as any business there is a million things that could turn out unexpectedly so best guesses are best served with lashings of MOS.

A low capital intensity business with a sustainable competitive advantage is the ultimate wealth creating business. Purchased at the right price and held long term it will be generate substantial investment returns. NVT’s low capital intensity is easy to see, the sustainability of its competitive advantage needs to be assessed and a valuation should be made accordingly.

Read widely and happy investing.

Well done. AGree with all you have said Gavin. ROE should be rising then…

I first bought NVT around 2008, when I spent some time teaching tutorials at Curtin University. I would have been better off if I was teaching in mandarin (although my pronunciation is rather mediocre). After speaking to these guys, I realised pretty quickly that someone somewhere was making a lot of money.

The NVT model is nothing short of amazing. Each foreign uni student they bring in the door (and they bring in 1/8 of all foreign students in Aus) pays them A$20k, some of which is upfront, hence their negative working capital as discussed above.

I think their main competition is in fact, the Universities themselves. This is why they make a big effort to appease the Unis, who are effectively their JV partners.

The relationships and their track record with Universities is their big competitive advantage. The durability of this seems robust – I’m not sure how many university partners have taken the materials and terminated / not renewed the contract, but I don’t think it is a significant proportion. Their business model is another.

Like most family-run businesses, the management team emits passion and core businesses competency. The main reason I sold was because the risk (as I saw it) that they would make a silly acquisition made me slightly uncomfortable. Remember, they also looked at some of ABC learning centres. SAE doesn’t look like a bad business per se, but it does dilute shareholder exposure to their core business.

I just think they should spend all their time growing their University business in the US, UK and Canada, where there is huge growth potential, albeit attached to A$ headwinds.

Nice review Dan. Thank you.

Thank you very much all for the inputs.

I bought this one when it was still under the IBT code. It was my very early days in the stock market in 2006.

In summary, I knew about this one because I went to Sydney Institute of Business and Technology – SIBT , part of the IBT (which was a pathway program to get into Macquarie Uni for overseas student like me).

For the period from 2003 (the year I arrived in Sydney) to 2006, I noticed a significant growth in overseas student numbers and Macquarie uni had been gaining popularity amongst overseas students who wants to do business degrees (UNSW, USyd and UTS used to be much more popular).

Furthermore, government regulation was still very supportive for overseas students in terms of getting a student visa, then a permanent residency after finishing my study . In addition, other external factors were also favourable : exchange rate was still reasonable, middle class income countries such as India, China and a range of south east Asian countries was booming. Therefore, Australia was seen as a popular destination.

Long story short, I did some research on the company, read some announcements, company strategy, basic financial reporting analysis , then I thought this company was worth it.

I have to be honest, It was a bit speculative buy from my point of view because I could not determine the intrinsic value of the business back then because I did not have the ability to do so. But, being the customer of the company itself gave me confidence to step in to buy.

Any suggestions is welcome!

Hi fellow Value.able graduates,

There are definitely a few companies I’m kepping an eye on at the moment, with the intention of picking up a few shares. On top of the list are CSL, Woolies & one of the banks (either WBC or CBA).

Cochlear is also interesting, but it’s a shame that it’s still quite some way above IV. If it keeps heading south I might not be able to help myself… It’s such a great Aussie company.

Thanks for the post Roger. Great stuff.

Hi Shaun,

Thanks for those thoughts and delighted you are finding the blog useful.

Hi Roger,

I’ve done some valuations of this list. Appreciate feedback. hope comment appears properly formatted.

Company ROE M1 M2 POR EPS Value

JBH 35% $ 3.50 $ 9.50 60% $ 2.71 $ 16.01

COH 35% $ 3.50 $ 9.50 73% $ 7.82 $ 40.05

CSL 22% $ 2.20 $ 4.30 49% $ 7.68 $ 25.11

WOW 26% $ 2.60 $ 6.00 70% $ 6.15 $ 22.26

REH 20% $ 2.00 $ 3.48 50% $ 6.00 $ 16.44

PTM 60% $ 6.00 $ 25.00 94% $ 0.40 $ 2.86

MCE 30% $ 3.00 $ 7.20 14% $ 0.84 $ 5.57

ANZ 15% $ 1.50 $ 2.00 65% $ 12.98 $ 21.74

VOC 38% $ 3.80 $ 10.80 0% $ 0.18 $ 1.91

ZGL 15% $ 1.50 $ 2.00 18% $ 0.26 $ 0.50

Thanks

Prasad

Excellent work Prasad and great formatting! What does everyone else think of Prasad’s valuations?

I think you have you numbers around the wrong way for MCE. i assume you are using a required rate of 10% and on this basis your numbers would look like:

MCE 30% ROE,

M1 $3.00

M2 $7.20,

Div payount 14%

and value around $7.00.

I think i had a ROE of around 35% for memeory the last time i looked and came up with a vlaue of closer to $9.

I hope this hjelps or someone can correct me!

Prasad,

Here are my 2011 valuations on the stocks in your list that I monitor.

JBH – $16.30

COH – $48.16

CSL – $28.51

WOW – 25.39

REH – $13.81

PTM- $2.74

MCE – $7.25

VOC – $1.72

ZGL – $0.52

Hope this helps

Prasad,

What RR are you using?

Steve

Steve,

I was using 10% RR and last years financial data in CommSec (‘financials’ tab). Now I started looking in to some of these companies in details, realised next years valuations are higher for JBH, VOC and MCE due to share buy backs and capital raising.

My new valuations are approximately:

JBH: $17.64

VOC: $2.28 and

MCE: $8.97

This assumes current ROE is maintained, which may not be the case for all as new capital may not return as much.

David,

I don’t think M1 and M2 mixed up but EPS did not include new capital, hence low valuation.

Thanks everyone again.

Prasad

I work in the financial services industry and have a keen interest in funds management stocks such as Platinum, Hunter Hall, Magellan and Treasury Group. The ROE that can be generated in this industry is very exicitng and on face value an ageing population and mandatory super contributions are positive influences but there are headwinds.

Growth seems to be a real issue. A great number of investors are scarred after the GFC and you can hardly blame them. Many people saw their superannuation and investment account balances get smashed. And now they see term deposit rates at 6% and justifiably think “if I can get 6% in a risk free investment (our banks are safe as house aren’t they?) then why should I stick my neck out and invest in shares?”

Its for this reason that I think that many of the afore-mentioned stocks are suffering from a lack of growth. The income yield is often good, but without new fund inflows growth just isn’t materialising.

I think Andrew made a very good point about the competitive advantage of these firms resting in the star fund managers that head them up. If I had the money why would I invest in Montogmery Investment Management? Roger Montgomery of course. No disrespect to Roger’s team whom I’m sure are highly capable people, but its Roger who is the face of the business and that I have faith in. The goes for for Platinum (Kerr Nielson) and Hunter Hall (Peter Hall). If these individuals leave then my faith might quickly evarporate. Thus the competitive advantage is in the faith investors have in those individuals.

In summary, I think financial stocks such as PTM and HHL are extremely attractive when the tide is running their way but unfortunately I don’t think it is at the moment. In the absence of such growth their stock prices need to be lower to tempt me to invest.

Perhaps Berkshire is suffering from the same concerns Nicholas. Thank you for the post and for taking the time to contribute to the discussion. Please keep it up and if you have any other insights or mail, go ahead and share it here.

In relation to the “Flash in a Pan” list and a list of companies that are well worth a long term investment (5 years in my case) I propose the following: (Those with an asterisk I currently hold)

As well as a currently good ROE, and management =>

*JBH – still opening new stores

*WOW – Lots of cash to spend wisely

*MCE – during the very early Aussie gold rush, the seller of shovels and the like made the most money and profit!

*MND – same reason as above

*ANZ – interesting advances into Asia

*VOC – see Roger’s comments

RKN – possible ‘Cloud’ venture with Melbourne IT

*DTL – excellent annual report indicating a clear path forward

The reason I have chosen only a five year period is because companies like JBH, RKN etc. will have completed a roll out venture and possibly reached maturity; also will do not know what the effect of possible high oil prices will be after five years of growth in India, Asia and china.

PeterB

Love it peter, thanks for sharing those ideas. Not everyone will agree but that is what makes a market.

Some great companies. With DTL, its cashflow has been poor of late. Can anyone shed some light on this? It would appear that it previously collected cash in advance of providing the products/services, but is no longer doing so. For these types of companies, the revenue in advance can be a good indicator of future profitability – and it has declined quite a bit.

Hi MIcheal,

Cashflow is always better in the seconf half as governments prepay for things so they don’t get their budgets cut

Hi Roger,

My list is quite similar but also slightly different as my circle of competence (and understanding) is different to yours. My list is as follows –

Matrix – Fantastic moat and a fantastic business. Looking forward to their results and I do expect them to meet market expectations. Looking for slightly cheaper prices before I buy more around $6.47.

ARB Corp – Fantastic business with very consistent EPS over the last ten years with intrinsic value increasing at a good clip. Too expensive at the moment but would like to buy at around $6, probably wishful thinking.

Reject Shop – I really don’t think the internet will affect this business and in-fact a slow-down in the economy would probably help their profitability. WB looks for companies that have a one off profit down grade with a pull back in the market creating the perfect storm and to me this looks like the Reject Shop. Happy to buy around $9.37 but a bit expensive at the moment.

Woolworths – Great business which will grow with an increasing population over time, it is guaranteed. Too expensive for me and I would be happy to buy around $22.43.

Credit Corp – Great business showing consistent growth other than a recent speed hump. Would buy around $4.17.

Anz – Starting to look interesting but would like to buy at around $19.19. Looking for the next financial scare to pick some of these up.

BHP – Prepared to trade this one and would be happy to buy around $40 and sell around $58. Not a long term hold due to the risk in commodity prices.

Vocus – All I can say is that I can’t wait to get the next two financial reports.

Looking for substantial discounts to IV on all so please do your own research. At the moment I hold MCE, VOC, BHP, CAB, CIL, BGL, NAB and ZGL. Biggest weighting in MCE and VOC.

Thanks for sharing Brad. Delighted to see no graduate mentioning Telstra today! A broker told me “time will tell”. Yes time always does that, running around saying ‘I’m telling’.

haha…I know you only want quality posts, but that comment of yourse was too funny Roger…’running around saying ‘I’m telling’.

To increase the quality of the post and keep with the theme, a business I really like and own, and think is now cheap – but not rising as quickly as it was – is TSM.

Cheers,

Chris B

We all thought it was pretty funny too. The broker was in stitches…

For what it’s worth my 10 in no particular order are

DTL

Not particularly cheap but a well run company that I think can be much bigger in the future. IV rising at a nice clip

JBH

I think the buyback will put a 3 as the first number for the IV in a few years and if they keep allocating surplus capital this way the owners will do very well.

MCE

My favourite, and in such a good space

BGL

Cheap Microcap in a niche market. Despite the blond spikey hair I think the CEO has talent

VOC

Not particularly cheap but the guys running this are first class

TSM

I think this is a little hidden gem with very good prospects

MTU

Aside from MCE i think this is possibly the cheapest stock on the market with the brightest prospects.

FGE

Cheap but they will have to go up another level so value can still rise in the future

NST

Not really a value.able stock (my little specy) so don’t look too hard at this one

CCP

A bargain a few weeks ago and still not expensive. There will always be a demand for collecting debts.

Just my current thoughts and I would be very happy for people to disagree. Particularly the VOC MTU and BGL shareholders as these are the three I want more of.

Great stuff Ash. Good to challenge and shake things up. ANy opposing views, go right ahead and put them up. I know that lots of you are concerned about Matrix. Watch their cash flows…

G’day Ash,

Re JBH and similar companies, I think that for maturing high ROE companies, share buybacks can be an excellent way of increasing shareholder value. Certainly, for low tax paying shareholders the buyback itself can be very good relative to the current share price. I suspect that there will be extended periods of time though when these companies may be able to execute these buybacks at a significant discount to IV due to being perceived as ‘ex growth’. This, as you note, can give the IV a big fillup, and is quite regularly repeatable as the cash pile mounts and the company can take advantage of periods of malaise in the market. We just hope that the company doesn’t do something stupid in between.

You are right Greg, just have to wait for all those bright analysts and investors (the efficient market!) to catch on. And of course for the company to avoid disappointing. Other trends/influences at work of course at the moment…

Thanks Greg Mc,

Fortunately the have a good track record in the not doing something stupid department.

This of course does not exclude a future brain explosion

Hi Ash,

Please can you tell me your views on MTU and what you think their moat is?

Hi Brad.

Have a read of John M ‘s post here http://rogermontgomery.com/is-it-time-to-clean-up-your-portfolio/

I would add that sometimes a competitive advantage cdan be the management skills in the business and in this case MTU really shines

Hi Roger,

Think I may deleted by accident what I had written.

My portfolio is just the big guns, as an inexperienced investor I wanted companies that will still be around when I wake up in the morning and hopefully in 10 years will have done well. Not sure if I am right or not. :-(

Westpac

BHP

Woodside

Woolworths

Worleyparsons

QBE

Newcrest Mining

National Australia Bank

Incitec Pivot

Commonwealth Bank

ANZ

Wesfarmers

Coca-Cola Amatil

Telstra

Origin Energy

Westfield

Rio Tinto

Westfield Retail Trust

Regards,

Peter.

There are some good names and some not so good names. I am sure some of the Value.able Graduates can share their ideas with you. You could have bought Qantas ten years ago on the basis that “it will be around”. It is indeed still around but the share price today is lower than ten years ago. The opportunity cost has been enormous.

Unfortunately for many people, TLS are still around but not doing enough for anyone but traders.

I think we need to be clear that even though we are after A1’s & A2’s to have and to hold for 10 years, that doesn’t mean there won’t be a reason to sell from time to time, as well as top up when price is significantly less than IV.

WHich brings me to QANTAS (I know we aren’t supposed to say that word here). Near 25% discount to NTA – what are those hunks of metal flying around freeloaders really worth?

Jim,

I like that “to have and to hold”… Have you heard of investors falling in love with ‘their’ companies? I think it’s quite hard not to – maybe something to be aware and wary of.

Indeed Andrew,