What does the future hold for the Big 4 Banks?

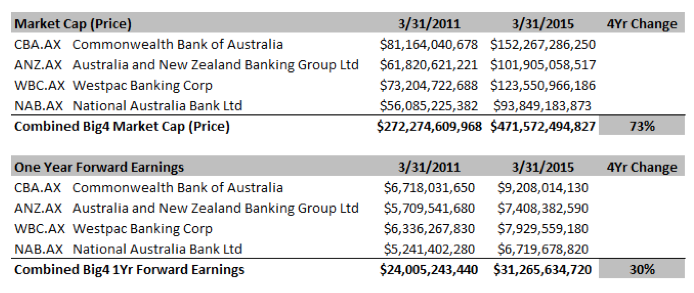

Let’s say four years ago you were offered the opportunity to buy a portfolio of well-known businesses for $272.3 billion, which are expected to generate $24 billion in after-tax earnings. While this implies an earnings yield of 8.8 per cent, you decide to forgo the investment.

Fast-forward to today, and you’re offered the same portfolio. The earnings have grown from $24 billion to $31 billion but for this 30 per cent increase, you are now asked to pay $471.6 billion, a whopping 73 per cent more than the previous asking price.

If it weren’t a real example of the share market in action you would probably shake your head in disbelief and no doubt be frustrated by the opportunity forgone. Don’t worry, you are not alone. This is exactly the situation that confronts would-be investors in our ‘Big 4’ Aussie banks right now.

Source: MIM analysis; company filings

Source: MIM analysis; company filings

While the current earnings yield of 6.6 per cent is far higher than what can be achieved by making a deposit with these companies, investors should take heed. Share prices follow the earnings power of a business, and even the best businesses cannot sustain market valuation increases at more than twice the rate of earnings growth forever (73 vs. 30 per cent).

And herein lays the rub. What can’t continue forever will eventually stop and by that we mean at some point the share price will need to stagnate until earnings catch-up. This also reveals a rather simple rule of investing: the higher price you pay for a given quantum of earnings, the lower your future return.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

According to the InvestSmart website as of end of Apr, Montgomery Investment Fund held WBC and ANZ in it’s top 10 holdings. Are you stil holding on to banks now despite these concerns about valuations? Or have you trimmed previously overweight positions?

Trimmed Gaveen