What does SMSF asset allocation look like?

If you have a self-managed super fund (SMSF), you know you’re in charge. Trustees are accountable for developing and implementing the fund’s investment strategy, and making all investment decisions. When preparing and reviewing your investment strategy, in addition to considering the personal circumstances of the fund members, you do need to consider diversification – how will the fund invest in a range of assets and asset classes.

We have all heard the old adage – “don’t put all your eggs in one basket”. Well, investing with your superannuation money is no different whether it is in an SMSF or a retail fund.

By spreading investments across a number of different assets you can reduce the overall risk for your portfolio, as you’re not relying on only one or two assets as your investment. It’s called ‘diversification,’ and while it doesn’t guarantee that you won’t make a loss when markets are down, it can reduce the risks associated with investing.

The aim is to hold assets that do not always move up and down together at the same time. This is called low correlation – as one investment doesn’t perform, hopefully another investment in your portfolio goes up and therefore creates a balanced result for the portfolio overall. On any day, some of your assets may win, some may lose, but overall the result should be that the portfolio rises in value in the long term.

Do all investors take the time to ensure that their super and investment portfolios are properly diversified?

In the last published ATO SMSF report on asset allocation reveals that an average SMSF has approximately:

- 35% of its assets invested in Australian direct listed securities

- 25% in cash, and

- only 9% in overseas assets.

Anecdotal evidence also suggests that many super funds are also heavily exposed to the traditional ‘blue chips’ that are familiar to most, and have historically given a solid, fully franked yield. Common examples include the big four banks, as well as companies like Telstra (TLS), CSL Limited (CSL), Woolworths (WOW), Westpac (WES) and BHP Billiton (BHP).

Although this strategy has worked well in the recent past, it is never possible to guarantee that it will work in the future – especially in the face of falling bank profit margins, events like BHP’s recent woes, and the extremely competitive landscape in the supermarket space. Regular readers on the blog will know our views on these businesses.

For most Australian investors, the path towards successful diversification lies in looking outside of the traditionally popular blue chip stocks. There are many companies who have bright prospects, and are not even in the top 50 ASX listed companies (but may be one day). However, it can be daunting to make a decision on any new investment. And considering that there are over 2,210 shares on the ASX, and 13,000 on the other major western stock markets… Where do you start?

One solution may be to outsource some of your portfolio management to a professional active fund manager. By outsourcing some of your investment management, you are effectively buying a small piece of a larger portfolio of individual stocks – thereby diversifying your wider holdings.

Investing with a fund manager effectively allows you to harness their knowledge and analytical resources, to improve the total performance of your whole super or investment portfolio. Ideally you will invest into a fund that covers an area of the market you don’t already have exposure to.

If chosen carefully to match your situation, the correlation between the fund manager and your other holdings will be low, reducing volatility and hopefully increasing long term performance. For example, there would be little benefit to invest in an ASX large-capitalisation focused fund if you already had a high exposure to these individual stocks. The correlation would be high and overall diversification benefits low.

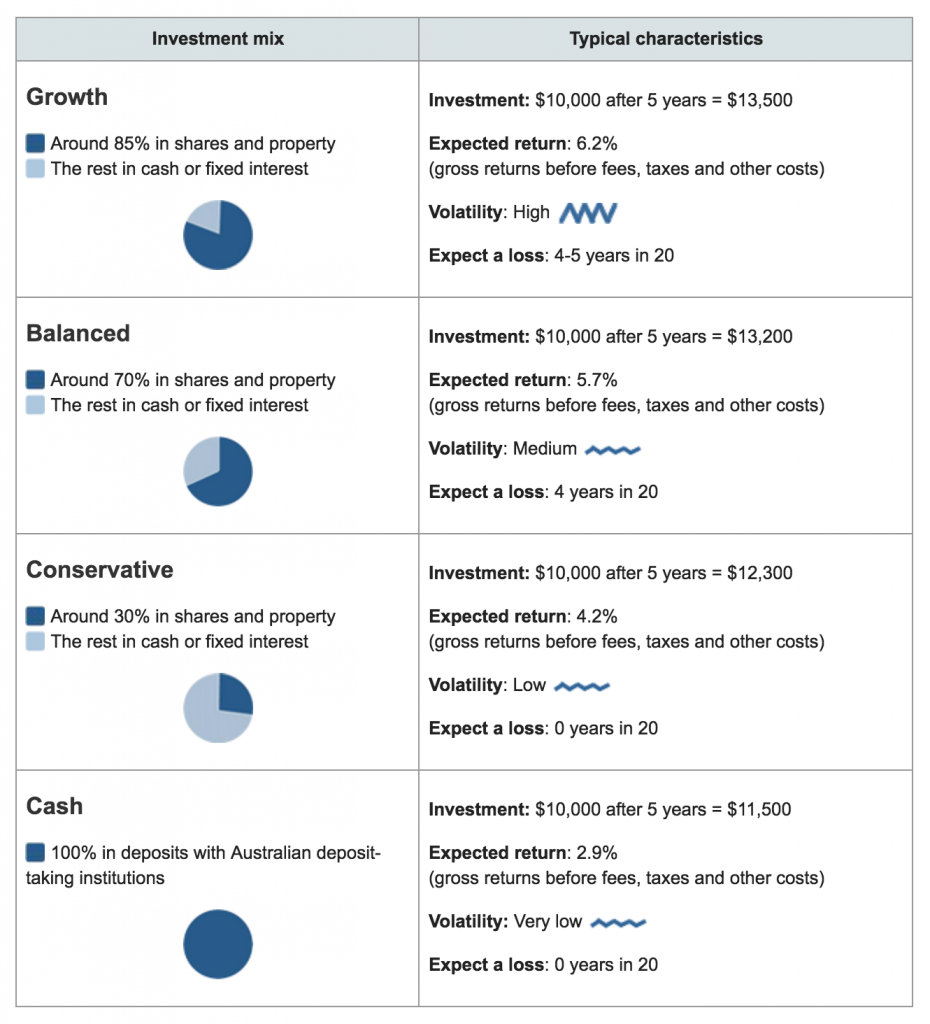

Here are the typical investment characteristics of different investment options. Source: ASIC Smart Money Even investors who manage their super in a retail or industry super fund, and have a “balanced” investment option may find that their diversification is lacking. Although the fund may be spread across different markets, the underlying stock portfolio usually closely resembles the broader index for that market – which leads to a pre-disposition to larger stocks and a non-targeted approach to investing. It’s similar to buying an index fund, the pitfalls of which have been mentioned previously on this blog.

Even investors who manage their super in a retail or industry super fund, and have a “balanced” investment option may find that their diversification is lacking. Although the fund may be spread across different markets, the underlying stock portfolio usually closely resembles the broader index for that market – which leads to a pre-disposition to larger stocks and a non-targeted approach to investing. It’s similar to buying an index fund, the pitfalls of which have been mentioned previously on this blog.

Allocating a portion of your super account balance to an active fund manager is a simple way diversify.

However, before choosing a fund manager you should carefully consider their investment philosophy and their investment universe (i.e. the sectors/markets they will focus on) to make sure you are comfortable with the way they will manage your money, and whether it is a good fit for your overall super strategy.

We offer multiple funds here at Montgomery that may help you diversify your super investments.

You can invest your super into Montgomery Funds with, or without an SMSF. No matter what your current superannuation structure is, we can help you to find a suitable option to diversify your super.