What a weaker Aussie dollar means for your investments

Back in January, we saw a steep increase in the value of the Australian dollar vs. the US dollar. However, since then, the Australian dollar has declined against the major currencies. If this trend continues, it could pay to be overweight businesses that benefit from a weaker Australian dollar.

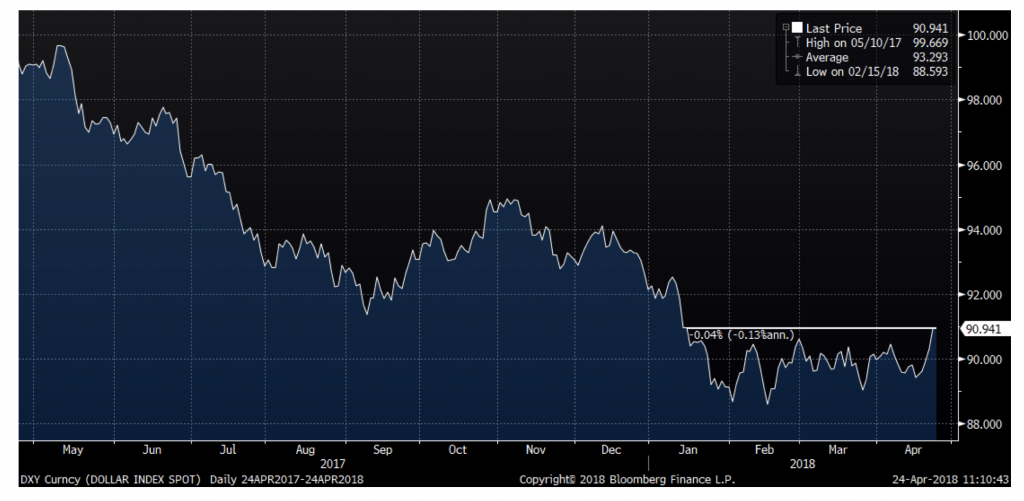

If we start with the US dollar compared to a basket of other currencies (the DXY index), we can see that it is basically unchanged since my last blog post. Any movement in the Australian dollar is therefore likely to be more general than when we last looked at it.

If we now look at what has happened to the Australian dollar during the last 4 months, we can see that it has declined by just over 4 per cent vs. the US dollar:

And by a very similar percentage vs. the Euro:

So, what does this mean for stocks?

To repeat from my January blog post:

- For companies that have a mismatch between their currency base of revenues and costs, changes in the value of currencies can have quite significant negative or positive impacts on margins. If you are an export-oriented company with manufacturing in Australia (not so many of those left unfortunately) and the value of the AUD goes up vs. the currencies you sell your goods in, you will most likely see a squeeze on margins; conversely, if the AUD goes down, your margins will benefit. If you are a company that is focused on imports, you will experience the reverse effect. This can of course be impacted by any hedging you undertake but the fundamental direction should still be the same. Since most companies are valued with some reference to their earnings power, changes in currencies will impact the share price. Long term changes in currencies will also have a long term impact on the relative competitiveness of different companies and industries.

- For companies with borrowings in different currencies, changes in the value of those currencies will impact the value of the debt that will eventually have to be repaid and hence have an impact on the share price as the value split between equity and debt will change.

- There are some companies that are dual listed and where the primary listing is not in Australia. The share price for these companies is generally set in the foreign currency and any changes in currencies should translate directly to the value of the Australian listed shares.

- Commodity prices are generally set in USD and companies that are either producers of commodities or heavy users of commodities are hence directly impacted by changes in currencies.

Basically, a weaker Australian dollar is good for exporting companies and bad for importing companies. At Montgomery, we are – as you probably know – defensively positioned and (although we do not proclaim to be currency forecasting experts) our view of currency is part of this and we are generally overweight companies that benefit from a weaker Australian dollar. Examples of such companies are BT Investment Management, Navitas, Resmed and Ramsay Healthcare.

The Montgomery Funds own shares in BT Investment Management, Navitas, Resmed and Ramsay Healthcare. This article was prepared 26 April 2018 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade BT Investment Management, Navitas, Resmed or Ramsay Healthcare you should seek financial advice.

The Australian dollar has declined against the major currencies. If this trend continues, what does this mean for stocks? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY