We need to talk… about compounding

Longer-term followers of our insights might remember our warning late last year, when we wrote: “…Superannuation will be no good for you if you are under 50 today, so invest the absolute minimum amount. That means no salary sacrificing, no co-contributions, and no non-concessional contributions. Ignore the calls to save tax and boost your super.”This, of course, was not advice; but an opinion based on some simple observations that those in charge are unable to resist ‘tinkering’. Also, that by the time someone who is today in their 20s, 30s and 40s would get around to actually using their super, the tax rates will likely be higher, the withdrawal amount will likely be lower and the qualifying age to access one’s super may likely be older than it is now.

Naturally, we hope to be wrong, but with the present government confirming that no group will be safe from cuts in the May budget, it’s not looking good. Considering a potential further rise in the pension age to 70, and we continue to believe that the risks of legislative changes to the current superannuation system are a real possibly – in not only this, but also successive governments.

In an attempt to force you to remain in the workforce longer to fund the profligacy of the generation before, building a nest-egg outside of the superannuation system is vitally important. That’s if you wish to be able to choose when you can retire, rather than told.

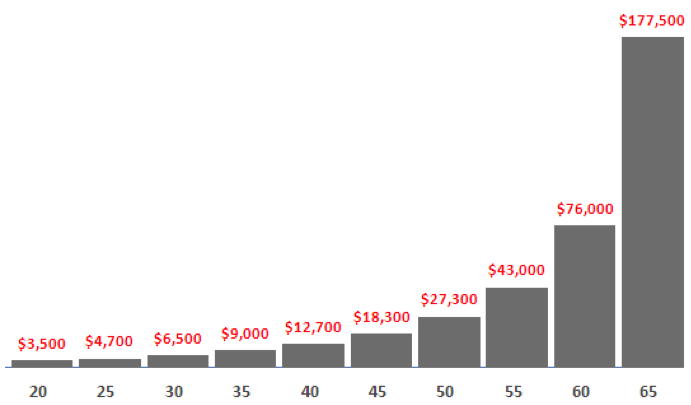

To illustrate the cost of self-funding your retirement, and choosing when you can leave the workforce on your own terms, we prepared the following chart to show how much you have to save each year to hit that magic $1 million mark – from now until you hit 70.

Defining a level of comfort in retirement differs depending on the quality of life to which you have become accustomed. But to generalise, if $1 million is considered the benchmark for being comfortable, what we don’t often get are specific guidelines on how much we should be saving to get there. The answer? More than you think. And sooner.

Assuming you can generate an after-tax return of 6 per cent per annum, if you start saving $3,500 per year at age 20, you will hit the $1 million dollar mark by the time you blow out 70 candles. If you wait til 30 to begin saving, that number almost doubles to $6,500 per year, and if you start at 40, it jumps to $12,700. And when you pass 50, well; let’s just say you want to make sure you give yourself a good head start.

Sure, if you’re currently in your 30s, stashing away $6,500 each year will be a big burden for most, and particularly young families with kids and a mortgage. But no matter how much you earn, to accumulate wealth and give you the flexibility in later life we all desire, we need to live within our means and start saving as early as possible.

Benjamin Franklin once said: “Remember that money is of a prolific generating nature. Money can beget money and its offspring can beget more.”

Every $3,500 lump sum you save at age 30 will be worth $63,073 in 40 years time, compounded at 6 per cent per annum. And it’s this compounding that gives you the flexibility to determine when you kick up your feet – not someone else. Let the miracle that is compounding work for you, but for it to do that – you need to give yourself plenty of time.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

There is more fear and guilt in the money industry than in some religions, and as with some religions it seems to be rather self serving. A couple of observations:

1. Why assume 6% after tax? Most of my eggs are in TMF and I believe (hope) this is a considerable underestimate. These “average” percentages are grossly misleading in that they include all funds, most of which are pretty “average”.

2. Although 1m might be realistic figure in a generation or so, I believe people can have a very comfortable retirement on considerably less. I have recently retired, I have a nice and new German car, I will travel overseas about once every 2-3 years (Rugby World Cup next year – see you there), I enjoy eating out and having a glass of red, and I certainly have less than 1m. I am not worried. A friend of mine describes these calculations about super and when to retire as the Golden Handcuff.

3. Remind me to give you an update in 10 years.

While I agree totally with the opinion in Russell’s post which is about getting an accumulated return of a nominal $1 million outside super to fund at least a modest lifestyle, it misses another very important issue–risk. As Roger has co-incidentally posted on the same day elsewhere (http://cuffelinks.com.au/think-risks-well-returns/), risk is something any investor should think about at the same time as returns. However, here I am talking about life’s risks. These make it not only important but I believe imperative for Gen Y (who are possibly of an age where they think ‘this won’t happen to me’, or ‘it’s not on my radar’), and any other generation before and after them, to treat the ‘opinion’ in the blog as a ‘must do’.

Governments and economists when thinking about populations tend to deal with averages and bell curve distributions, and to make too much of increased life expectancy which affects their costs, at the expense of thinking about the quality of life and the ranges of outcomes that can happen to actual people, and in quite large numbers. They want to balance their budget, not balance you!

However, speaking from experience, as someone who once fell into the top quintile of the population in income and lifestyle well before the age of 40, but is now in a different position due first to unexpected disability, and then on top of that age, life’s risks can happen to anyone, and they can be multiple and cumulative, and most cannot be insured for.

I want to make it clear I am not speaking through embitterment, as I have never been on welfare and have learned to cope positively, but my change in circumstances has made me observe and follow the trends in Australia with great interest.

The fact is, in deciding your investment vehicle, our current super system needs to be looked at in combination with our current job-support and welfare system, and the trends in that. The simple fact, as hundreds of thousands of older or disabled Australians have already unexpectedly found out, is that the current system can and does financially and emotionally destroy lots of good people who find themselves retrenched at an older age, or stuck with an unexpected disability that limits work or employability.

In our culture more and more people are making the assumption that those who are less well off have somehow have brought it on themselves. Probably some might have. But if you find that employers won’t touch you at say age 50+ despite excellent experience and qualifications, because of age, disability or because they’ll only give short term or casual work, then the welfare system which is set up for the supposedly job-shy will drive you into the ground jumping through useless hoops, which take time and emotional energy away from real efforts to maintain your sanity and be innovative and upbeat.

I have seen it happen with others. You won’t have access to your super until extreme hardship hits, there is no way it will last you from age say 50-85, and by then you’ll probably find that unless you are a Hollywood super hero, you will have sunk so low you are beyond the ability to recover.

Just like it is better not to be pulled down by negative people, it is far better to avoid the whole negative Government system and be entrepreneurial in your old age and disability, which is only possible with a capital base to sustain you financially while you get things together, as well as allow you to take risks and invest in yourself by transitioning to the newer economy opportunities, and to remain positive and upbeat.

Basically the current system does not help with that transition for educated, experienced people as it will waste your time making you do for example ‘how to do a resume’ course (even though you know this and the resume is not the problem), while you struggle on New Start, so in reality it will be entirely up to you, with the energy you have after dealing with’ the sytem’.

Unless you have built personally controlled capital, the task will require superhuman efforts. So, start now, and build your own, self-controlled emergency welfare system. If you don’t need it, then enjoy retirement with extra money anyway.

If you can snowball at better than 6% you can either start later, retire earlier or be richer!!!

Very good post Russell, i think this is the type of thing that people should be learnign more about in high school. I wonder if more people would be interested in maths if the questions they had to answer were along the lines of “How much do you need to save per year in order to be a millionaire by age 40,50,60 etc?”.

One way i guess you could say it is that for each year you put off saving for retirement the chance of you actually doing it gets exponentially harder.

I completley agree with the arguements made and as someone in the Gen Y mould, i have to say i pay little attention to my super for precisley these reasons. My ability to retire will be more highly correlated with my personal investment decisions rather than those of my super fund manager i believe.

Are these savings rate for inflation-adjusted $1m, or nominal $1m?

25 years ago, being a millionaire meant you were rich. Now $1m in liquid assets means you’re merely middle class (due to inflation and lower interest rates/div yields). I’ve got a feeling that by the time someone who is 20 in 2014 retires at 70, thanks to inflation $1m will barely allow a minimal standard of living!

Hi Joe,

All very reasonable thoughts/arguments.

To keep it simple, these are nominal amounts.

– Russell.

“Now $1m in liquid assets means you’re merely middle class”

No, it really doesn’t.

Given this estimate from last year that Australia had about 1.1m millionaires (bit.ly/1gsFxd8) – and that includes property wealth, not just liquid assets – it puts such a person well inside the top 5% of the country. Congratulations if that’s you, and I hope to eventually join you, but it is not “middle class” by any reasonable definition, and on current inflation rates it won’t be “middle class” for another 20+ years.

Good point Colin!