Watch out for rising bond yields

In the Video Insight on January 12 2015 I mentioned poor consumer confidence and low wages growth domestically, in addition to very low growth in China and deflation in Europe that would see monetary policy “stay easier for longer”. I forecast the Reserve Bank of Australia would cut the cash rate “two more times in the first six months of 2015 and this would likely put a floor under the Aussie market.”

So it was no great surprise when the Reserve Bank of Australia (RBA) cut the cash rate to a new record low of 2.0 per cent yesterday from 2.25 per cent in February. In the media release, RBA Governor Glenn Stevens said “The Federal Reserve is expected to start increasing its policy rate later this year, but some other major central banks are stepping up the pace of unconventional policy measures. Hence, financial conditions remain very accommodative globally, with long-term borrowing rates for sovereigns and creditworthy private borrowers remarkably low.”

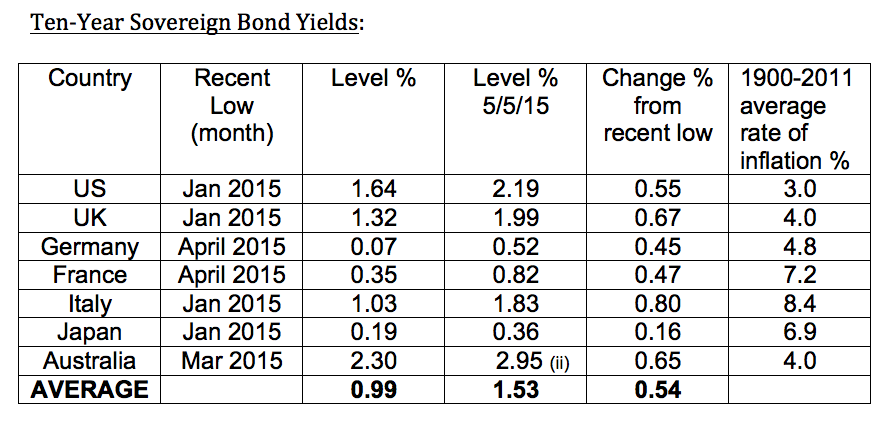

One sign investors should be wary of is the recent increase in ten-year sovereign bond yields. The table below includes seven Western World countries and concludes that in recent months bond yields have, on average, risen 0.54 per cent from 0.99 per cent to 1.53 per cent.

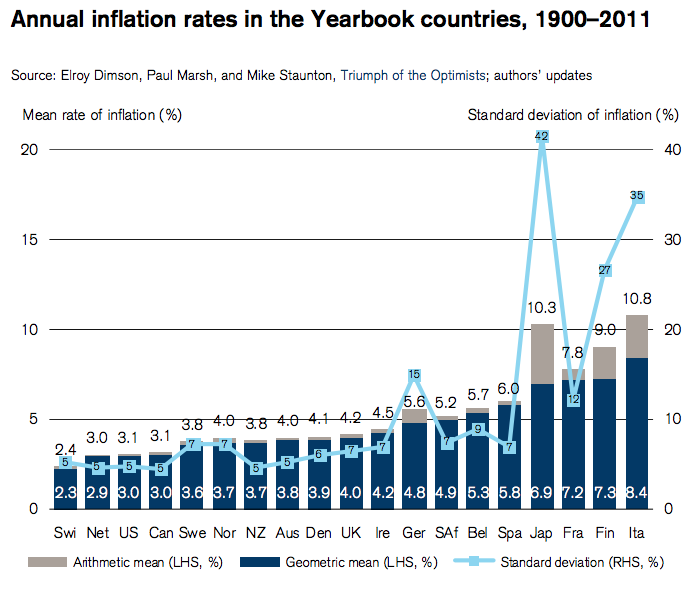

For context, I have also detailed each country’s geometric average annual inflation rate over the 1900-2011 period, based on analysis by academics Elroy Dimson, Paul Marsh and Mike Staunton from the London Business School.

It is certainly worth asking the question, what will happen to bond yields and equity markets if inflationary expectations ever return to “more normal levels”?

It is certainly worth asking the question, what will happen to bond yields and equity markets if inflationary expectations ever return to “more normal levels”?

If ten-year bond rates continue to rise, the argument for seeking higher yields in stocks weakens.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

What effect will this have on their respective currencies ? Surely, rising bond yields also means rising interest rates / stronger currencies in those markets ?

if they’re all going up at the same time? It could be a flight to safety first that sees the US stronger regardless of their lower relative rate…