Value Creation – Part 1

When it comes to investing, choosing the right businesses to back may seem like a daunting task. With literally thousands of opportunities presented to you daily and loads of exciting ‘stories’ that management teams are more than happy to tell you about in order to attract your capital, there’s a way you can further break down the opportunity set into more bite sized chunks.

One of the tenets that we practice here at Montgomery Investment Management, and what will push you towards those businesses more likely to create value for shareholders and see a rising share price over longer-periods of time, can be presented in the following example.

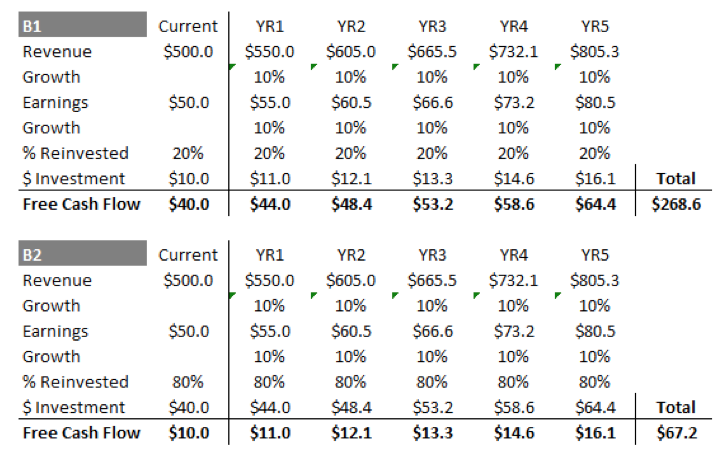

Today you are presented with two businesses from your friendly investment adviser which we shall call B1 and B2. For arguments sake, both businesses have the same level of revenue and earnings as each other, and further, both have the same level of forecasts for revenue and earnings growth – 10 per cent per annum for the next 5 years. In all respects so far, they are identical to each other.

Whilst the decision might be an easy one, I’ll hedge my bets and take both! Despite the businesses appearing to be identical both in terms of revenue, profits and their prospects, they are very, very different and will ultimately lead to very different investment return outcomes.

Whilst it’s easy to conclude prima facie that both are deserving of the same P/E ratio (or valuation), that’s not actually right. One business will go on to create excellent value for shareholders, while the other, even though it’s growing at the same pace, will actually end up being a bit disappointing in comparison.

In basic terms, all value is not created equally. That’s true of businesses listed on the stock market or run privately, and to separate your decision making into more bite sized chunks, it is important to understand that although they look the same, the estimated growth for B1 or B2 does not come without cost and the paths to achieve growth will be very different.

What we are attempting to convey here is that most businesses need to reinvest back into the business to achieve future growth of any magnitude. There are a few businesses we have seen in our time that require little on no capital to grow, they are indeed unicorns and very rare. Therefore, you must dig deeper into management’s presentation and ‘growth’ in revenue and earnings story and try and work out this – what level of capital will be required to generate that growth?

In terms of our example, B1 will need to reinvest just 20 per cent of its earnings in order to generate and maintain the businesses 10 per cent per annum growth, whilst B2, will be required to reinvest 80 per cent.

In tabular form, how the next 5 years for B1 and B2 shapes up can be seen below. Despite having the same level of revenue and earnings throughout, B1 and B2 are very different businesses from a shareholder perspective. What now becomes evident is that B1 after subtracting the need to reinvest creates materially higher free cash flows than B2. Whilst this alone means that B1 is the obvious choice from an investment perspective, there is more to this story as we dig deeper.

What now becomes evident is that B1 after subtracting the need to reinvest creates materially higher free cash flows than B2. Whilst this alone means that B1 is the obvious choice from an investment perspective, there is more to this story as we dig deeper.

Keep an eye out for Value Creation Part 2.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Great article