Understanding the Value of Growth

In theoretical terms, company valuation is a simple enough concept. The value of any company should equate to the present value of all the dividends that the company will pay over its lifetime.

That dividend stream can be divided into two components: the dividend the company currently pays, and the future growth that can be expected. The first of these is usually easy to estimate, which means that much of the challenge in valuing a company lies in estimating future growth.

To make the challenge a little more tractable, it can help to think of future growth as having two dimensions: the rate of growth, and the time horizon over which that growth rate can be sustained. This latter point is important – no company can grow rapidly forever, and thinking about how long rapid growth can be maintained is important to estimating value. It’s also something that tends to be overlooked. Analysts often make reference to the growth rate a company is expected to achieve in the next few years, but say little about how long that growth can be maintained.

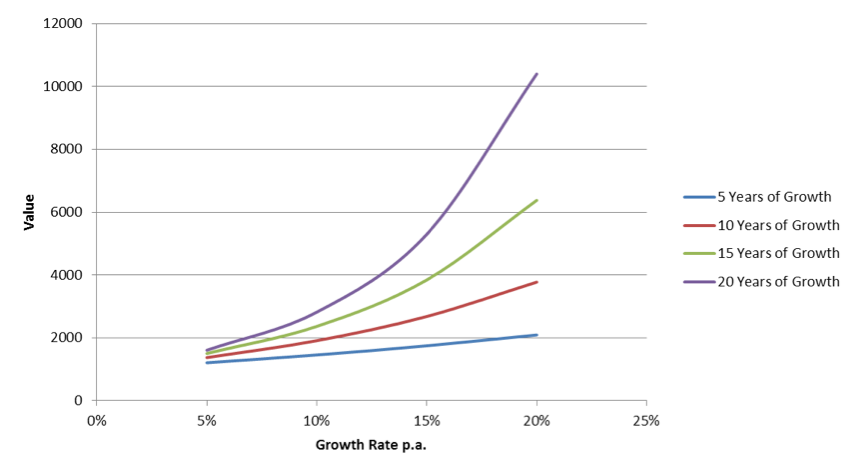

The following chart helps show why the growth horizon is important. What we have done is calculate the value of dividend stream using different assumptions about the growth rate and the time frame over which that growth is maintained. We have used growth rates ranging between 5 per cent per annum and 20 per cent per annum, and time frames ranging between 5 years and 20 years.

Value of a Growing Dividend Stream

What the analysis shows is that the growth time horizon is more important than you might think. Growth at a relatively modest 8 per cent per annum that can be sustained for 20 years is more valuable than growth of 20 per cent per annum that lasts for only 5 years.

What the analysis shows is that the growth time horizon is more important than you might think. Growth at a relatively modest 8 per cent per annum that can be sustained for 20 years is more valuable than growth of 20 per cent per annum that lasts for only 5 years.

While it is not easy to look 20 years into the future, it is worth thinking about whether a company has the legs to go long-term. For example, a business that is already approaching the limits of its addressable market probably can’t grow quickly for much longer, and a business that is susceptible to technological, regulatory or industry changes might also run out of growth sooner rather than later. On the other hand, powerful brands and natural monopolies can have a good chance of sustaining growth many years into the future.

As well as the present value effect, companies with a long growth horizon can make your life easier by reducing the number of good investment decisions you need to make. Long holding periods equals less portfolio turnover, lower transaction costs and avoided CGT.

These are benefits that Warren Buffet has harvested successfully over many decades.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To learn more about our funds please click here.

Hi Tim,

Very interesting thoughts. In particular, this one always gets me thinking:

“The value of any company should equate to the present value of all the dividends that the company will pay over its lifetime.”

While this is true, how many companies EVER have or will pay dividends matching or exceeding the NPV of the current share price? I doubt there would be very few.

For instance, take Amazon. A great company that makes little in profits. Can a shareholder buying today expect over $440 in dividends over the course of the next few decades and still have a viable business? And this is the discounted value!!

Sometimes this feels like a pyramid scheme to me where you hope to find a greater fool to take your position. It all comes down to a sustainable business model which can grow for decades as you allude to.

Growth companies generally reinvest most of their cashflows back into the business which is what we want if providing high ROEs. But eventually shareholders need to be compensated and these cash flows directed to shareholders when ROE start degrading and drops to low levels.

And “lifetime” is an equally important point. Technology disruption is only going to increase with seemingly resilient companies, struggling into the future. For some businesses, high growth can quickly evaporate and business models made obsolete in a very short short time.