U.S. Consumer insight from a tiny Denver bike manufacturer

Australian equity investors enamoured with the study of consumer behaviour might take an interest in the cycling industry, especially as it impacts the ASX-listed Flight Centre (ASX: FLT).

To many, including those in the cycling industry itself, the surge in demand during the pandemic was a complete surprise. What happens next might offer important insights into many retail sectors beyond cycling.

The cycling industry in the U.S. and worldwide was once a hubbub of frenzied activity and an intense boom between 2020 and 2022. Today, however, the industry seems to be taking a “big exhale,” as some industry insiders have remarked. Experts had anticipated a decline after the pandemic-inspired boom, but its duration and magnitude remain uncertain.

The global pandemic sent shockwaves across various sectors, with bicycle retailers experiencing unprecedented turbulence. Once familiar with the annual rhythms of a seasonal business, bicycle stores suddenly faced an overwhelming surge in demand, dwindling product availability thanks to fractured supply chains, and a daily grind (pun intended) defined by unpredictability (Figure 1.).

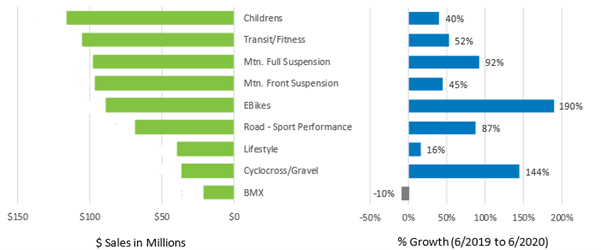

Figure 1. June 2020 year-on-year sales performance of key bike categories

Source: The NPD Group

And Figure 1., reflects the surge in sales in the first few months of the pandemic, which continued for nearly two more years.

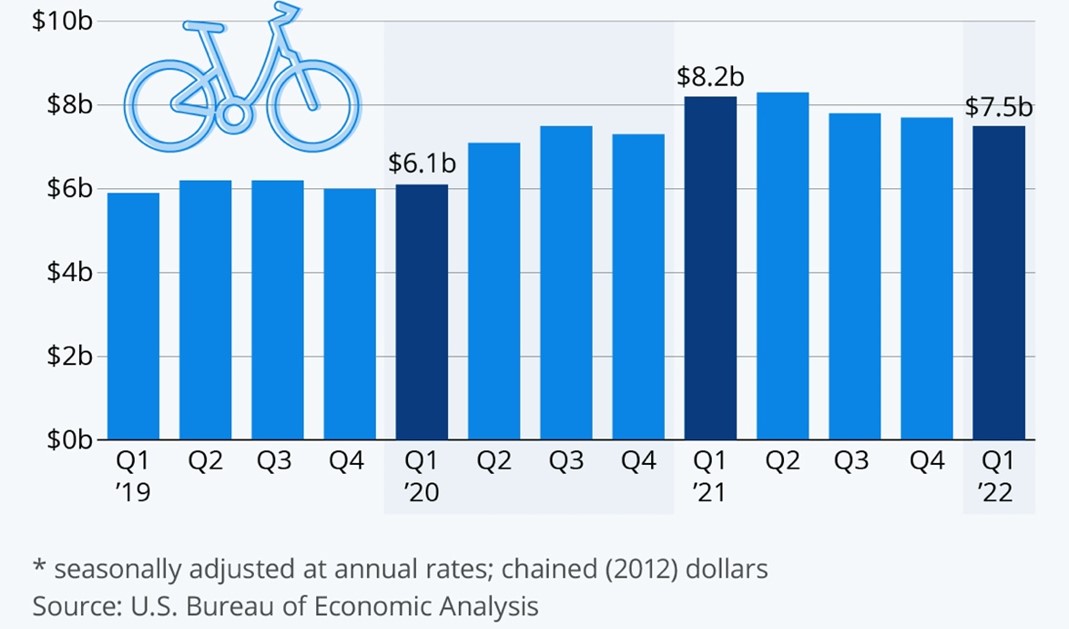

Three years after this unpredictable surge, its aftermath, as revealed by Figure 2., is still evident. As the industry gradually transitions back to what feels like “business as usual”, the landscape of the industry has evolved significantly.

Figure 2. Real U.S. personal consumption expenditure on bicycles and accessories ($U.S.)

Fresh faces entered the market, while established giants took audacious steps that garnered varied responses. Retailers who ventured into stockpiling and digital commerce at the pandemic’s onset reaped exponential revenue growth. In contrast, those who couldn’t adapt swiftly often struggled with the sudden and overwhelming demand.

In an email to customers and investors, niche Denver-based brand, Rodeo Labs, offered insight into the most recent reverberations in industry dynamics, noting, “we’re operating in one of the least settled periods in the bike industry”.

The most recent tumult became evident in late 2022, a time which typically sees a seasonal slowdown due to the onset of colder, darker winter months in the northern hemisphere. For Rodeo Labs, the question as to whether they would face the same challenges as larger companies in the industry was answered by early summer, when “there was a palpable decrease in energy in the global bike party.”

The shift wasn’t limited to bike sales. Major cycling events, once selling out almost instantly, are witnessing slower registrations. The once-popular trend of large group rides seems to be making way for smaller, more intimate rides, with many participants even opting for other activities entirely.

Reflecting on this change, Rodeo Labs observed, “I think there just isn’t as much interest in ‘events’ as there was in previous years. People seem less inclined to spend money to go on a ride with a bunch of other people than they were 12-24 months ago.” Sponsored athletes also seem to be moving away from events, with many focusing more on other careers.

With the cycling community seeing significant shifts, bike companies are grappling with the change. “In the next six months, you’re going to see a number of bike companies fail,” an industry representative reportedly shared with Rodeo Labs earlier this year. Denver recently bid farewell to Guerilla Gravity brand, a promising brand that showcased the feasibility of scaling bike production in the U.S. While the exact reasons remain undisclosed, many brands have faced challenges with inventory and financial constraints, a fact that has become a subject of industry talk.

And that talk is not restricted to the U.S.. Here, in Australia, booming COVID sales were also met with a shortage of stock and furloughed manufacturing in Taiwan. Massive orders were submitted to meet the demand, but those orders are only being delivered now, when demand has slumped.

The Australian Financial Review (AFR) recently reported the value of Brisbane-based 99 Bikes-owner Pedal Group, which is unlisted and 47 per cent owned by Flight Centre, 22 per cent owned by Flight Centre CEO Graham Turner and 15 per cent owned by his son Matt, has “almost halved since the peak of cycling mania during the coronavirus pandemic, as an oversupply of bicycles bites.”

After generating earnings before interest and tax (EBIT) of $51.6 million in 2021 and $18.7 million in 2022, as pandemic lockdown orders triggered massive demand for bikes, Pedal Group posted EBIT of $5.5 million in the 2023 financial year and an overall loss of $12.4 million.

According to documents seen by the AFR, Pedal Group is now valued at about $127 million, following a planned issue of equity to staff at $5.18 a share, which is down materially from $10.73 a share in November 2021.

Consumer bicycle buying behaviour through the pandemic and following its conclusion, is reflected across a range of leisure equipment industries. The extent to which operators can cancel orders made during the height of the buying boom will determine, in many instances, who survives. Those that do will reap the rewards not only of a return to stable conditions but also a larger share of the market.