Three positives from the Commonwealth Bank result

The Commonwealth Bank (ASX:CBA) released its results for the six months to December 2020. The numbers were generally better than expected across most lines resulting in a better earnings result than consensus sell side forecasts.

The three main positives from the result were the:

- Sequential improvement in revenue growth

- Lack of any material step up in loan impairments

- Growing surplus equity capital balance

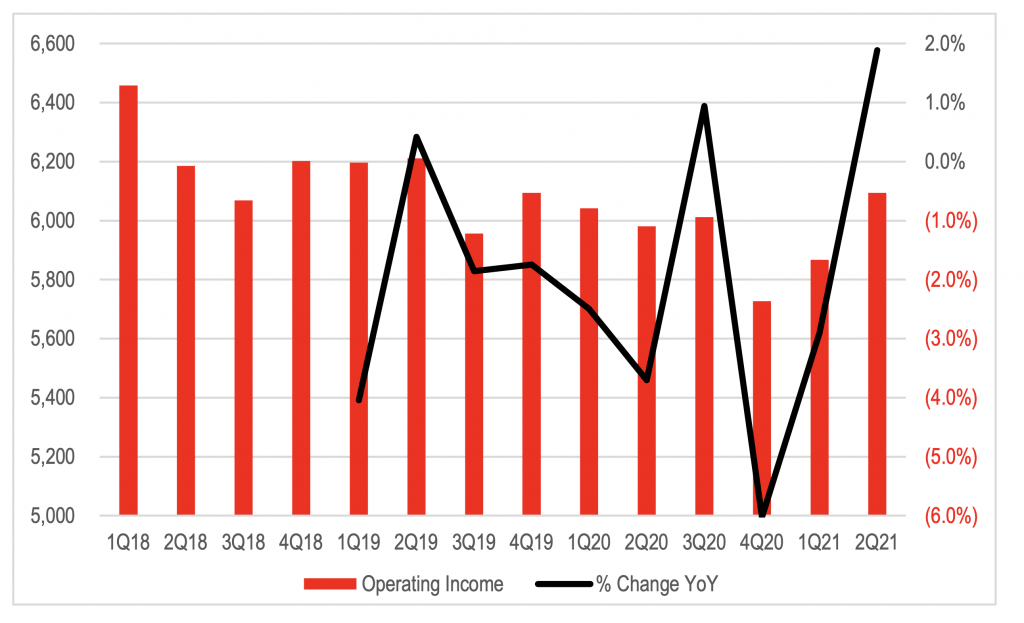

Revenue growth in the second quarter of FY21 accelerated to around 1.9 per cent. This is an improvement on the declines recorded in the previous two quarters and fairly anaemic year on year growth over the last two years.

Figure 1: CBA Quarter Operating Income and Year-on-Year Growth

Source: Company, MIM estimates

While the acceleration in non-interest income growth was partly due to increased trading volumes, which is unlikely to be sustainable, fee growth also improved, as did loan book growth and the demand for credit, which is encouraging. This is consistent with the recent data that has indicated a material increase in demand for credit. This step up in demand was initially focused on mortgage credit, but is becoming more broad based across the economy. CBA’s market leading share has seen it benefit directly from the increase in activity and demand.

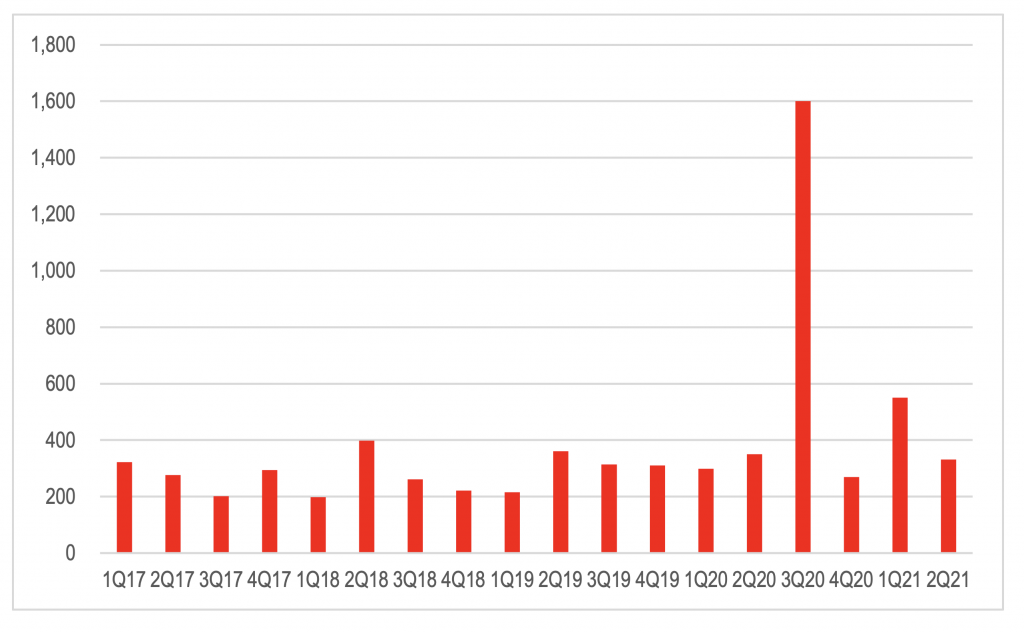

The reduction in the number of loans on repayment deferrals has reduced significantly over the last six months. However, this has not resulted in a meaningful increase in the rate of loan impairments to date. While loan book quality has been bolstered by the enormous fiscal and monetary stimulus from the Federal Government and RBA, this has been a better than expected outcome.

This saw bad and doubtful debt charges remain low and the collective provision coverage increase from 1.41 per cent of credit risk weighted assets at the end of June 2020, to 1.54 per cent at the end of December 2020. This places the balance sheet in an even stronger position to cover any potential COVID driven spike in loan impairments in future periods.

Figure 2: CBA Quarterly Bad & Doubtful Debt Charge

Source: CBA

If there is no material increase in impairments, then the collective provision overlay raised in 2020 could be written back with the capital available to be released to shareholders.

This would add to the CBA’s existing excess common tier 1 equity on its balance sheet, with its CET1 ratio increasing to 12.59 per cent at the end of CY20. Additionally, CBA expects this to increase by another 32-42 basis points to as much as 13.0 per cent once the proceeds of announced divestments of CommInsure Life and Colonial First State are received.

This highlights the driver of the improved performance of the banks over the last few months as the market has shifted from expecting the banks to continue increasing their level of provisioning on the back of growing bad debts resulting from the recession. This initially changed to incorporate the view that the collective provision overlays raised in mid CY20 would be enough to cover bad debts resulting from the recession. This resulted in increased confidence that the banks would be able to resume or increase dividend payments in the near term.

With credit and economic performance in Australia and New Zealand continuing to surprise to upside, the market is now starting to believe that the banks could write back the collective provision overlays and return excess equity capital to shareholders.

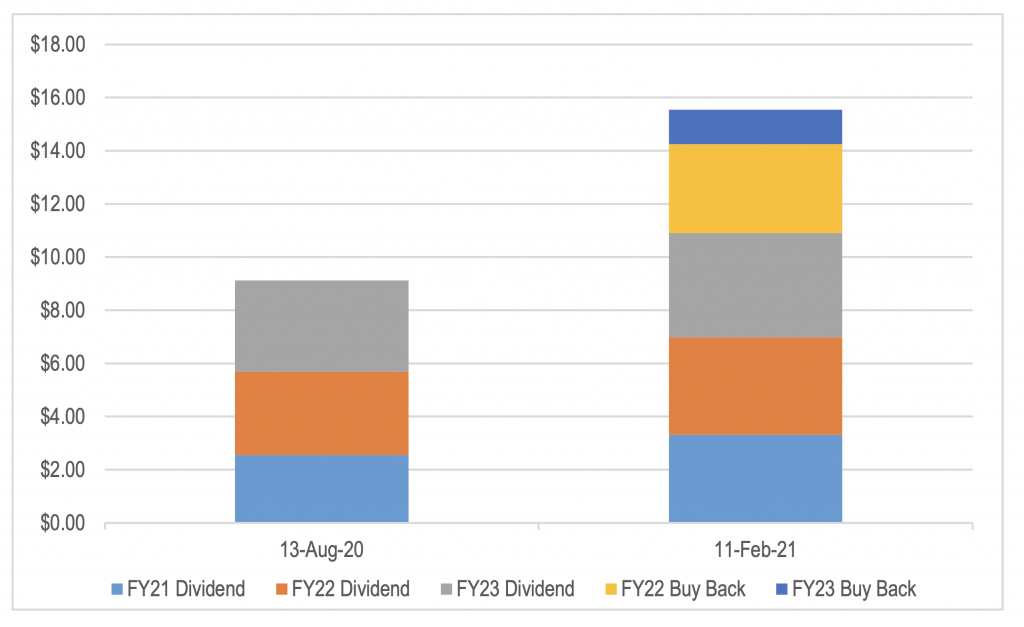

If we look at consensus sell side expectations for the amount of equity CBA will return to shareholders between FY21 and FY23, we can see that there has been a material increase between the release of the FY20 result on 12 August 2020 and the release of the 1H21 result on 10 February 2021 as shown in the chart below.

Figure 3: CBA Forecast Capital Per Share to Returned to Shareholders – FY21 to FY23

Source: Bloomberg, MIM Estimates

The chart shows that not only have sell side analyst forecasts for dividends increased from A$9.12 to A$10.91 on average, forecasts now incorporate around A$4.63 per share of capital returned through buy backs. This implies a 70 per cent increase in the amount of capital expected to be returned to shareholders over the next 3 years.

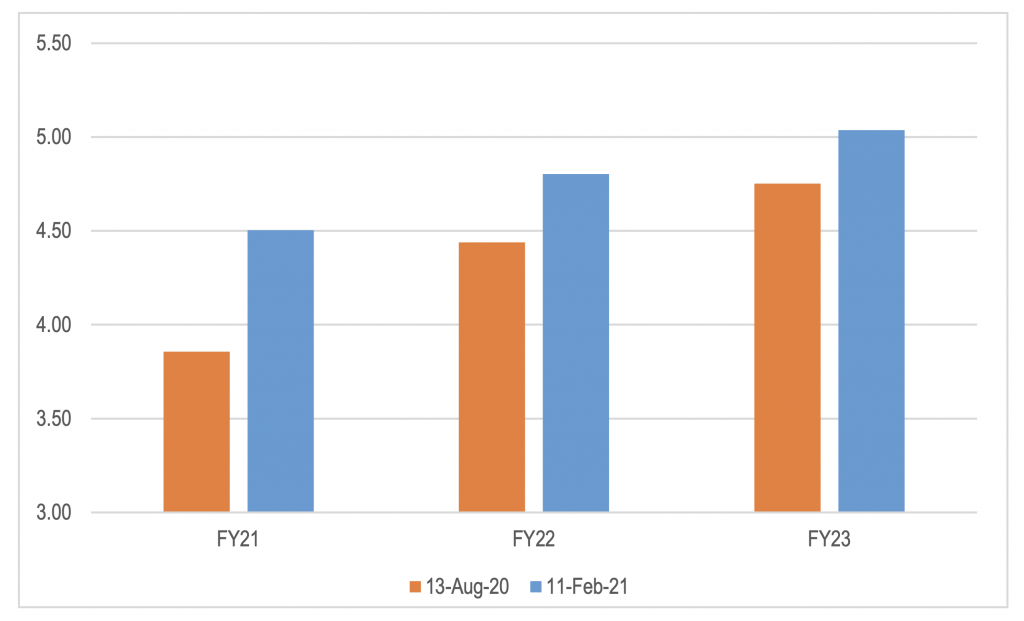

This comes on the back of a step up in earnings per share forecasts.

Figure 4: CBA – Average Sell Side EPS forecasts – 13 August 2020 Vs 11 Feb 2021

Source: Bloomberg, MIM Estimates

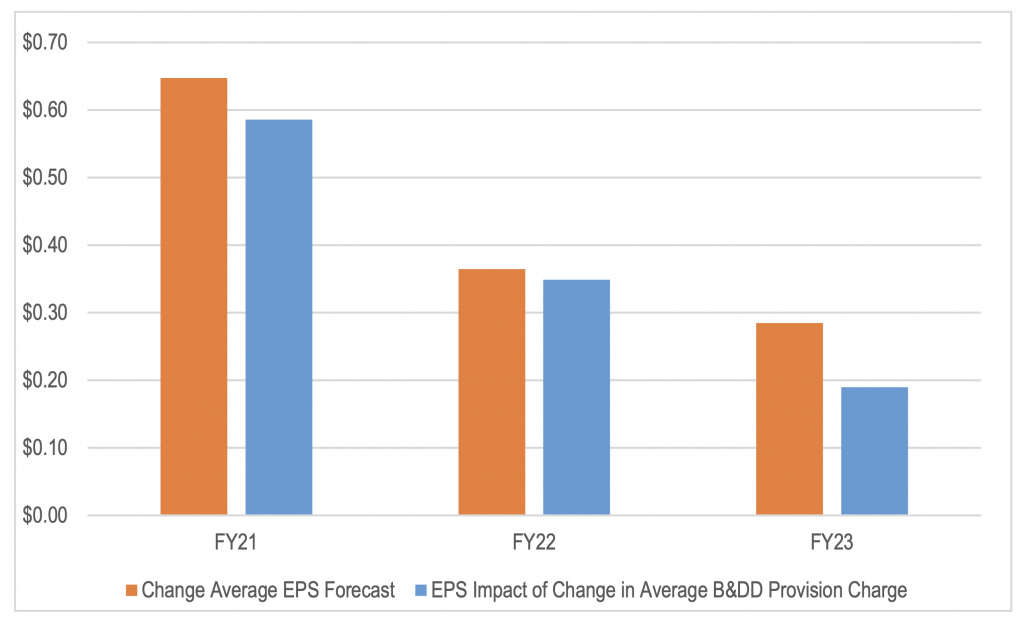

The increase in EPS forecasts is largely due to a reduction in bad and doubtful debt charge assumptions.

Figure 5: CBA – Change in Average EPS forecasts Vs EPS Impact from Revised Bad & Doubtful Debt Charges – 13 August 2020 Vs 11 Feb 2021

Source: Bloomberg, MIM Estimates

This implies that sell side analysts are generally sceptical that the positive surprise from the result on the revenue line can be sustained as stronger revenue growth in future periods and that the stronger performance of the bank stocks is more a function of the increased probability of greater capital flows to shareholders.

As noted, an important component of the step in the amount of capital expected to be returned to shareholders is the potential release of excess equity capital through buy backs. In regard to the potential for CBA to release its excess equity capital, the company stated that in order for this to occur it needs to see:

(1) Greater domestic economic certainty;

(2) Ongoing improvement in credit quality and risk factors;

(3) Prudential regulatory guidance.

The Montgomery Funds own shares in the Commonwealth Bank of Australia. This article was prepared 16 February with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade the Commonwealth Bank of Australia you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

marly

:

Hi Roger,

Can you please advise me what the real value of Bitcoin is. And what is is based on.

Is my opinion about it, not correct?

Bitcoin, in my opinion, is just another instrument created by human to fool another into believing that there is value in this product. It could just as well be an interesting rock with a catchy name that is passed on from person to person. For example, it cost the creator or discoverer of this rock USD$5 to make it or mine it. The creator or discoverer then wants to exchange or sell this rock for something, usually money or something else valuable. So they point out the distinct features, the limited edition and quality of this rock to a customer. They need to sell the story of this rock to make it sound precious, hard to get as it is limited, valuable and worth something. The creator / discoverer manage to sell or exchange the rock for USD$5 from their first customer (now, real value has been added onto the rock).

The first customer who is holding this rock wants to increase the price of this rock to make a profit because they need money to pay for their living expenses or goods. So the first customer then tells the story of the rock- about its quality, features and limited number to another potential customer, and this time the price of the rock is now selling/exchanging for USD $20.

This second customer, buys into the story of the rock and is willing to pay for it at this higher price….more value is added onto the rock. Now the second customer does the same, and so on. Those who have made a profit from this kind of exchange chant about their fortune and the rock story. Later more and more people are enchanted by their story and want to get involved….a hype has been formed.

When someone has invested US$30,000, they must quickly sell it to another person for the same price or higher to recoup their money back. So they hope that more people gets sucked into the rock story and willing to exchange their real wealth for this rock. The wealth of one customer is passed on to the seller in exchange for this rock, and now the last customer has paid US$50,000 for it. (Initially it has no value until people pay for it with their hard earn money…thinking that they are investing into something)…

The creator/ early buyers of this rock may still have some of these rocks in their storage. They start selling all their rocks at the higher price before the hype is over, and move onto another novelty rock. Some may still believe in the story and continue to keep some of this rock, and chant about it every day to excite new people into purchasing it and continue to support the rock story.

The value of this rock is not based on any underlying commodity or a profitable business…

<<<>>>>

It needs to be exposed for what it is, the transfer of wealth from one person to another via the purchase of this rock. It is as simple as that.

Don’t get sucked into this kind of activity.

The story continues…. Later an Exchange is created to facilitate the buying and selling of this rock. The Exchange may or may not own any of this rock as investment. Most likely the latter as they are smarter than most ordinary people. They are purely there to charge commissions off the buyers and sellers of this novelty rock, and charging a cost for storing or looking after their rocks.

Meanwhile, ordinary people believing that it is now legitimate because there is an Exchange for it. Therefore, they are motivated to get involved, take risk and pile into it once again, and so the rock story may live on forever.

Roger Montgomery

:

Yes Marly, pet rocks and other fads do indeed come to mind. Do remember the point I made in the post about the original purpose of digital currencies. There was a legitimate reason for their creation. That of course has been forgotten as speculation commenced in earnest.