Three factors that drive private hospital profits

As an investor, there’s a lot to love about private hospital businesses, like Ramsay Healthcare (ASX:RHC) and Healthscope (ASX:HSO). For a start, they’re hard to disrupt. They also benefit from Australia’s ageing population, with its rising demand for health services. But the factors that influence profitability are a bit more complex.

Here, I’d like to focus on three of these factors – occupancy, scale and case mix.

1. Hospital occupancy

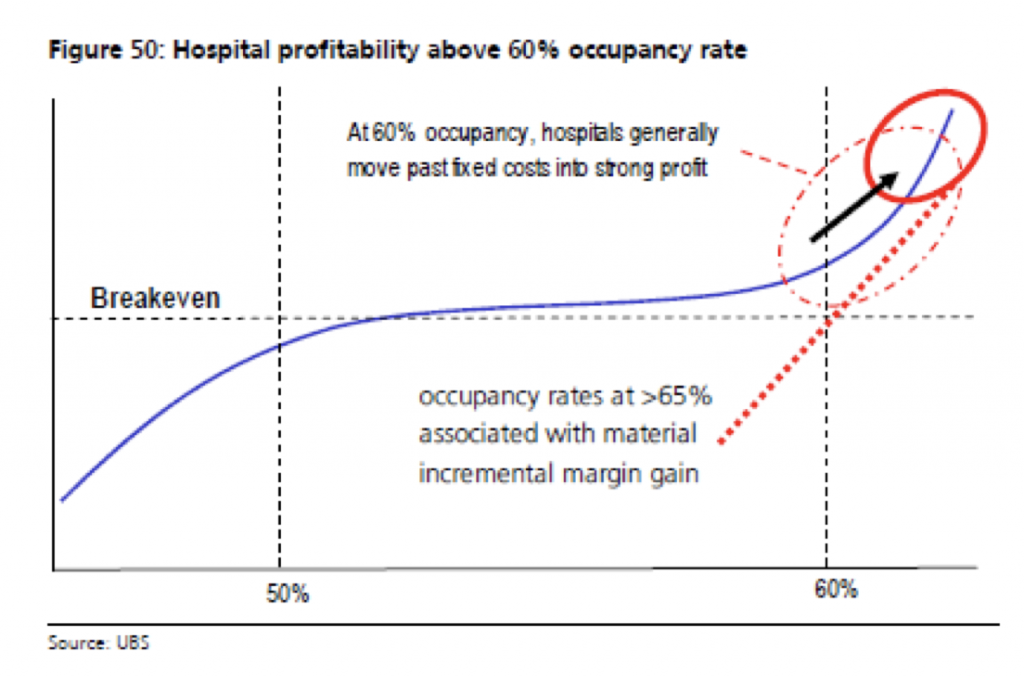

Due to high fixed costs, busy hospitals are significantly more profitable. In 2014 Andrew Goodsall at UBS really brought this point home with a healthcare piece in which he estimated 60 per cent hospital utilisation was necessary to break-even:

This has a direct impact on profitability – it is why greenfields can take three or more years to be profitable (they don’t start off full), whereas brownfield expansion can increase the profit margin of a hospital (by increasing facility utilisation).

One good example of when this went wrong is where Epworth opened a 170-bed facility in 2016. This took significant share from both Geelong Private (HSO’s 107-bed facility) and St John of God (a 252-bed facility). As HSO’s recent result showed, this materially reduced profitability in the hospital and created a drag on the financial results.

2. Scale

As with many businesses, scale is critical. With hospitals, we need to think about two types of scale: local and holistic. On the local side, larger hospitals tend to be more profitable (we can see this in the data). They are better able to share resources, leading to less downtime, and better able to attract doctors. On the holistic side, a larger network of hospitals can lead to better contracts with suppliers and insurers, leading to a more profitable business model.

3. Case mix

Unlike many service businesses – hospitals’ expenses are only partly paid for directly by the patient. The majority of expenses are paid for by the government (in public hospitals) and private health insurers (in private hospitals). The amount paid is usually determined by a diagnosis related group (DRG) – think of this as an industry-wide expected cost to service. If a hospital is able to deliver the service more efficiently than the DRG, it can keep the margin.

In general, the available margin is larger for more complex procedures (e.g. brain surgery is usually more profitable than removing a splinter). As a result, hospitals need to ensure they have a reasonable mix of specialists to attract more profitable procedures into their facility. This means their services will be higher margin.

Of course, as we’ve seen in the latest results period, it’s not all blue skies. Hospitals have huge fixed costs – they require large infrastructure and expensive technologies. Whilst this creates great leverage when volumes are high – it can be just as painful when volumes are low – or lower than expected.

In addition, there is a lot of variability in each of the three profit drivers, making this very attractive space volatile in the short term.

However, longer term, we continue to see these as good quality growth businesses – at the right price.

The Montgomery Funds own shares in both Ramsay Healthcare and Healthscope

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Should an investor be concerned about ongoing costs of energy to the hospital sector within Australia and the potential for further price rises going forward? Considering that hospitals are high consumers of energy from the grid are these cost’s passed directly to the patient?

Hi Samuel,

That’s a great question. Hospitals are indeed exposed to rising costs of energy. The important thing to consider here is who takes up the bill. For private hospitals the vast majority of funding comes from private health insurers – so you can imagine that rising costs are a key discussion point in contract renegotiation between insurers and hospitals. As this is a cost of doing business, it would be reasonable for costs to be passed down.

Epworth ;h Geelong Private (HSO’s 107-bed facility) and St John of God (a 252-bed facility) – are these all owned by Healthscope?

Hi Darren,

Healthscope owns Geelong Private.

St. John of God owns the St John of God Geelong hospital.

Epworth owns Epworth Geelong.

St. John of God and Epworth are both unlisted hospital operators.