The Year Ahead, Tell Us What You Think – The Results

We recently asked our readers to answer three questions on where they think the best returns will come from and what risks lie ahead for equity markets in 2019. Here are the results.

Thank you to those that participated in the survey! Please see a summary of the results below plus a few observations. You can access the survey questions here.

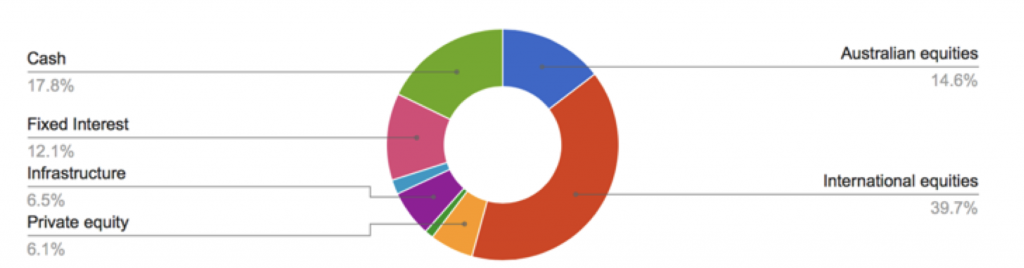

Q.1: Where do you think the best returns will come from in 2019?

Of the major asset classes listed, you voted the best returns would come from International equities in 2019.

Given the international equity returns over the last few years, it suggests investors believe these returns will continue, then this result may make sense.

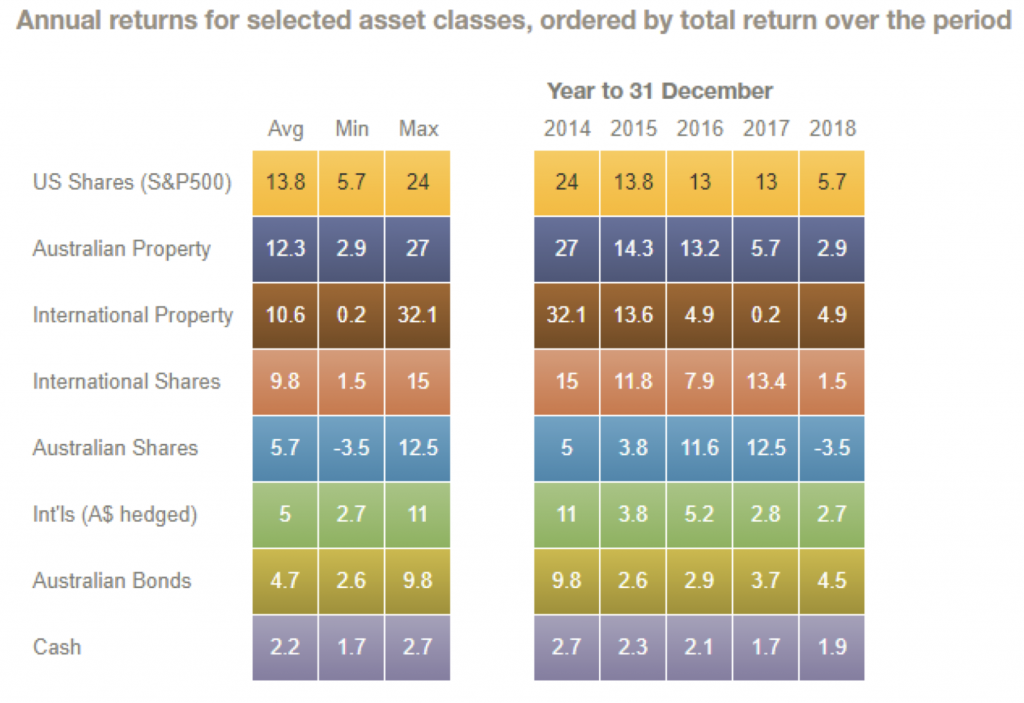

If you look at a broader group of asset class returns of the last five years as pictured below, U.S equities have been the best performing with an average return of 13.8 per cent, closely followed by Australian and International Property and more broadly International Shares at an average return of 9.8 per cent.

Source: Vanguard

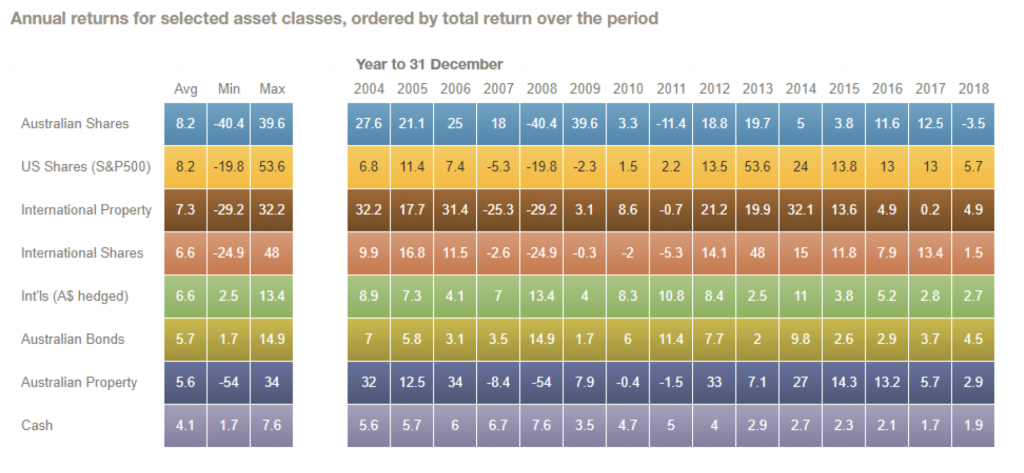

Taking a longer-term view

However, if we look at the same asset group over 15 years the picture changes quite significantly. So what can we draw from this?

The first point is simple, past asset class returns are not a good predictor of future asset class returns. Secondly, what is also interesting is the asset class drawdowns, particularly for equities, greatly increase when comparing the five to fifteen year average returns. A drawdown is the peak-to-trough decline during a specific recorded period.

As we know, the last five years have been a particularly good period for equity investors with below average levels of volatility, and as such the tailwinds that favour particular asset classes can change period-to-period.

Furthermore, equities as a broader category tend to be the top performing asset class over longer periods of time. However, given the variability of asset class outcomes over shorter time periods, diversification at the asset class level absolutely makes sense which our Head of Research more broadly explored in a recent blog post here.

Source: Vanguard

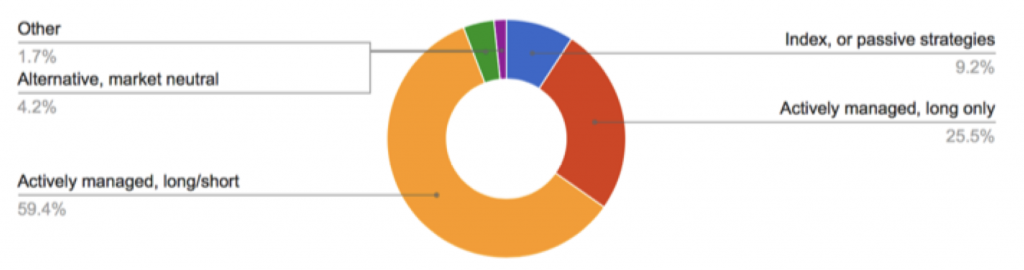

Q.2: Now focussing on equities, what style of strategy do you think will best perform in 2019?

An active style of management was significantly favoured by almost 85 per cent of our survey participants over index or passive strategies.

Many active managers believe increased volatility will favour lower beta and variable beta like strategies. According to Mark Van Der Zwan of JP Morgan, “we expect turning points in global economic growth trends and episodic shocks from geopolitical events will lead to higher volatility and less predictable asset class correlations, ushering in an investment environment very supportive of active management.” [1]

Moreover, Howard Marks in his latest memo to investors prompted a proceed with caution view, in that “after roughly 50 years in the business, I’m convinced that risk is the more important, intriguing and difficult part of investing. Risk, not return, is what distinguishes the superior investor: whatever the return may be, I’m convinced the superior investor achieves it with less risk than others.” [2]

While we support this view as an active manager ourselves, we do warn investors about the potential trap of index investing. As index exchange traded funds (ETFs) grew in popularity and fund flow, many were forced to invest ever greater amounts in larger companies, irrespective of price or profit outlook. And that may leave many ETF investors following indexes exposed to any large falls in markets.

We note of course that markets also tend to overreact in the short-term and that will present investors with opportunities.

Andrew Macken discusses one of the most important aspects of active funds management – the ability to change exposures in our portfolios, in a recent video which you can view here.

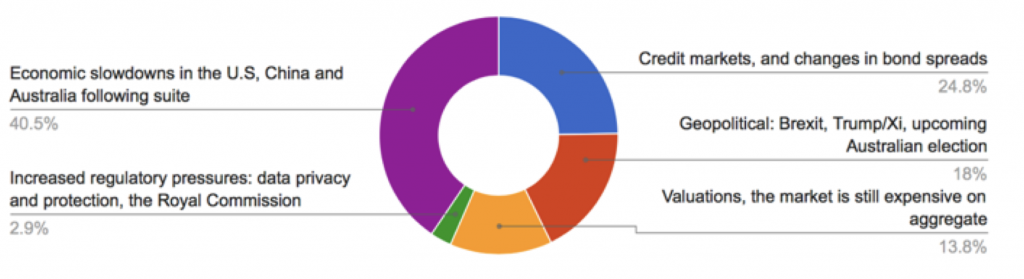

Q.3: For equity markets, where do you think the greatest risks lie for the year ahead?

Our readership consensus was clear about the greatest risk to equity markets lies in the performance of various key geographies which arguably drove the global synchronised growth story throughout calendar year 2017 and early 2018.

To provide further insight on the Montgomery house view on future risks to equity markets, I have drawn on the expertise of two key investment personnel who share their views on the same question below:

Roger Montgomery, Chief Investment Officer of Montgomery Investment Management

“I think any one of the risks noted are right. We know is that there is approximately US$490 billion of CCC-rated credit due to be refinanced this year, a credit market record. If credit markets dry up, liquidity issues will become a concern as will funding costs for U.S corporate. The massive supply of U.S treasuries is another concern that could push yields higher. Higher yields on treasuries makes them more attractive and can cause investors to sell out of high-yield and investment-grade corporate bonds in favour of treasuries, thereby increasing corporate bond rates and therefore corporate costs. Pressure on margins as economic growth slows, might not be seen favourably by equity market investors.

Domestically, I think business is very nervous about an ALP victory at the next Australian Federal election. Further declines in property prices would be likely and that means negative equity, which combined with high debt, means lower spending and investing. The RBA has just lowered its estimate for 2019 GDP growth from 3.25 per cent to 2.75 per cent and while there is no correlation between economic growth and stock market performance, the high valuations in the market aren’t pricing in much scope for disappointment.”

Andrew Macken, Chief Investment Officer of Montgomery Global Investment Management

“As we enter 2019, we remain fully aware and engaged on the significant global risks that persist and must be navigated by global equity investors. The relationship between the U.S and China remains top of the list. And, of course, this will be impacted by the impending legal issues facing President Trump which appear to be building. How Brexit is managed (or not) will be a major development over the coming weeks. And, of course, global liquidity conditions are always key determinants of equity valuations in general.

There are certainly a number of negative scenarios on the horizon which are very possible. And yet, we have been deploying cash, not building cash. This is because the shape of the probability distribution of possible future equity returns has improved, in our view. The primary driver of the improvement in the shape of the probability distribution profile is lower stock prices.”

[1]https://www.morganstanley.com/im/publication/insights/investment-insights/ii_2019marketoutlookhedgefunds_us.pdf?1550019597244

[2]https://www.livewiremarkets.com/wires/key-takeaways-from-howard-marks-ama