The view from the top of Australia…

It was interesting to read in yesterday’s Australian Financial Review that auction clearance rates surged past 70% at the weekend. There’s almost an air of desperation at some auctions. The fear of missing out is a much greater influence on investor behaviour than the fear of loss.

Steve Keen is the unconventional economist that walked backwards naked to the top of Mt Kosciusko while juggling three echidnas, a Latvian mountain goat and a Venezuelan pigmy – okay I am exaggerating, see the article here – after losing a November 2008 bet against Macquarie Bank interest rate strategist, Rory Robertson, that Australian residential prices would fall. The bet was made in front of 80-100 Parliament House staffers (and some politicians) at a “Vital Issues Seminar” series run by the Parliamentary Library.

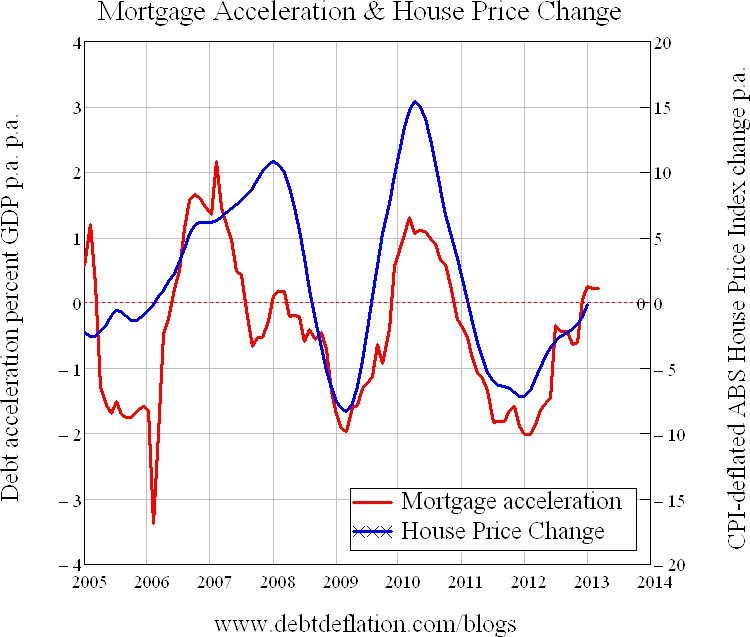

In Steve Keen’s Debtwatch, he points out that he has been predicting this rise in house prices for some time – since mortgage debt has been accelerating (since the beginning of 2012):

Chart 1 – source www.debtdeflation.com

Importantly however, Steve believes that this is a “suckers rally”, and that house prices are nearing a ceiling, as Mortgage Debt to GDP is very high (compared to the US for example, who have reduced their debt since the GFC)…

Chart 2 – source www.debtdeflation.com

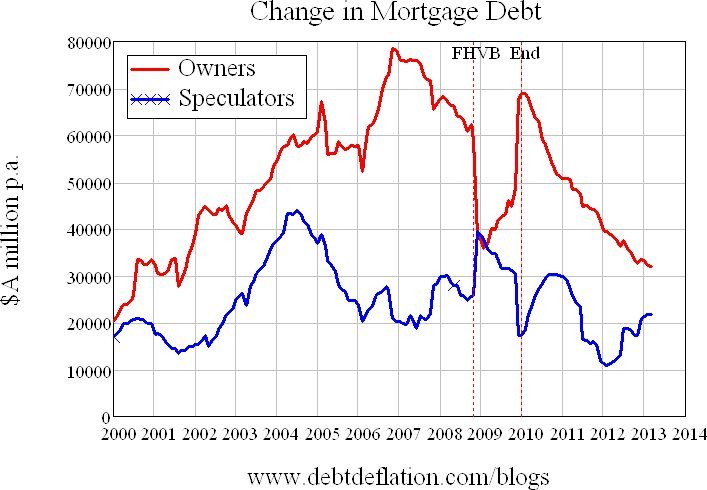

…and the rally is almost completely attributable to speculators rather than owners (Chart 3). This later point is an interesting one, because speculators can have a dramatic and sustained impact on residential real estate prices, as China, the US and Japan have experienced – if credit conditions are right of course.

Chart 3 – source www.debtdeflation.com

In the past, I have said that I believe that house prices will see limited rates of price appreciation in the long run, and that save for intermittent rallies fuelled by interest rates, population factors and wars, the baby boomers (the largest cohort of home owners) are faced with the need to fund their retirement living and health expenses by selling property to the generation below them – who complain that house prices are too high. You can read our thoughts here…

The only saving grace for baby boomers and “house price hopers” will be the group that both Steve Keen and an attendee at last week’s Australian Investors Association seminar in Chatswood mentioned – Chinese pollution escapees.

Steve concludes, “The fact that public policy in Australia is tilted in favour of speculators against homeowners, and property prices against young would-be home-owners, might yet bring home the bacon for all those speculators playing ‘flip that house’ right now”.

Real estate home prices in Australia have never had any relationship to overseas home prices.In fact they haven’t had much of a relationship with different parts of Australia or even other parts of given city.Real estate is always a classic supply and demand play.The demand is usually supported by strong employment situations and relative low interest rates.There has been a sluggish employment and under employment throughout Australia and with the uncertain economic situation over seas,there hasn’t been a lot of confidence in Australia to purchase Real estate or in the Share Market and until this changes the markets will generally be stagnant.