The times, they are a changin’…

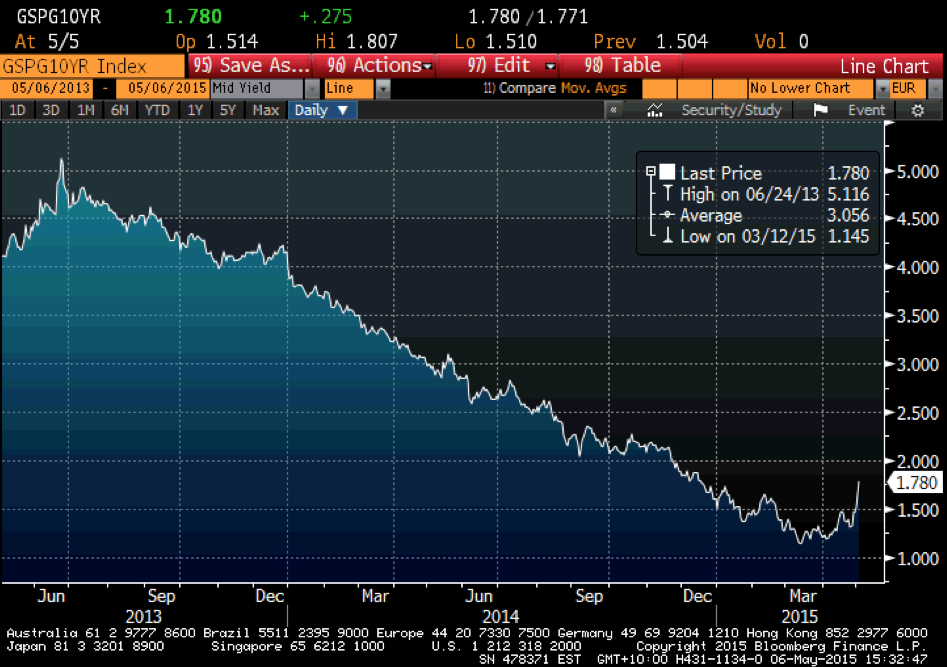

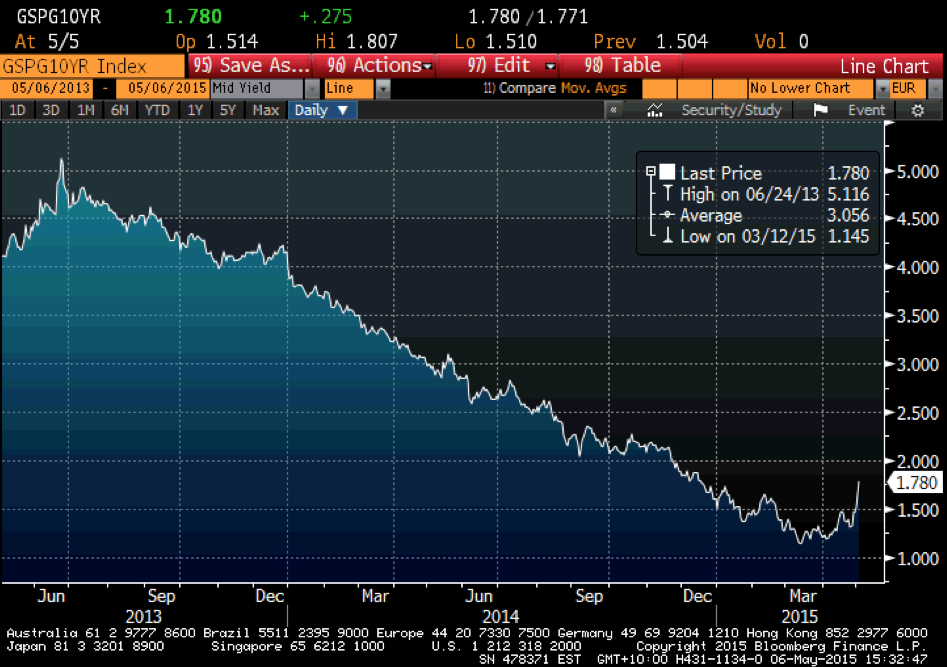

If a picture tells a thousand words then the picture being painted by these graphs is a gloomy one for those fully invested or those levered into recent asset purchases.

Rising interest rates on long bonds, means the incentive to be in risky assets is lower. Rising long rates also means that discount rates to value assets must rise as well. Higher discount rates means lower valuations.

It’s less important that rates are back where they were in December 2014, than whether market sentiment towards the direction of future rates has changed.

How quickly the tide can turn! And note there has been no catalyst.

US 10Yr Bond rates

German 10Yr Bond rates

French 10Yr Bonds rates

Italian 10Yr Bond rates

Spanish 10Yr Bonds yields

And finally, for Sydney property speculators…

Australian 10Yr Bond rates

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Thanks for making these charts available Roger, apparently the spike in 10yr German bunds and resulting drop in price wiped out 25 years of yield. I don’t think there is any historical precedent for global shares and bonds to be so overvalued at the same time. If the rout continues then it would be the clearest evidence yet of a change in investor risk preferences and most certainly the canary in the coal mine. Keep up the good work!

Thanks of the neat perspective Peter.

I need this spelt out….

All graphs show a peak in 2013, followed by a decline over 2014 and then a sharp reversal in the last month or two for bond rates.

From your article this indicates that recent investments are risky. Why is this risky?

Thanks

The last week or two Peter. And only if it continues…

And the other point to note is that these sovereign rates are still at very very low levels. German and French 10yr bonds at around 0.55% and 0.85% respectively for 10yrs?

These are rounding errors. Yet you’re locking your money away for 10 YEARS and as we’ve seen with Greece, risk is certainly not nil (and that’s before taking into account any inflation and other shocks over those years).

People and instos have been making financial decisions based on these extremely low rates as they become acclimatised to this lower for longer theme. What will happen if they kick up by just 2%? We live in extraordinary times!!! And central banks are very much trapped.

We call it The ‘Corruption’ of Risk Assessment

Hi Roger

It seems difficult to see how sentiment towards the direction of rates could have changed, given recent data out of the US showing a record trade deficit and as the Chinese economy continues to slow its difficult to see any meaningful recovery in the world economy which would lead to higher inflation and thus higher interest rates.

In fact the first country to raise rates is almost certainly guaranteeing its own demise given the impact this would have on their currency (e.g. the drag a rising US dollar has had on their economy recently).

Furthermore should rate rises be forthcoming there is no possible way they could be increased substantially given how leveraged both individuals and company’s have become due to record low rates (perhaps this alone is a reason why they should be raised). Given this factor unless inflation picks up significantly even if rates are increased its hard to see the fed making it past 0.5% let alone 1% any time in the near future.

I could probably write a 10,000 word discussion piece on this but effectively given the points I have outlined above what possible justification is there for a rise in bond yields? Are there factors other than the timing of interest rate rises at play here?

“It seems difficult to see how sentiment towards the direction of rates could have changed”. We have always argued that you don’t need things to change for sentiment to change. Sentiment can change simply because the spotlight is shined on something else, something that was always there. One day investors weren’t worried, and the next day they are. That’s why we stick to businesses and valuation, not stocks and prices.