The REA Group wild share price ride

For a company with such high quality, REA Group (ASX:REA) has experienced an amazing share price range in the last twelve months. On 5 November 2021 REA hit a market capitalisation of $23.9bn when somebody paid $180.67 per share. Just seven months later, the share price hit $93.77 giving the company a market value of $12.4bn. And 43 trading days later, with the share price up 45.8 per cent at $136.70, the market value of REA Group was $18.1bn.

The frequency and magnitude of market values got me thinking about Ben Graham’s Mr. Market allegory;

Ben Graham asks you, the investor, to imagine being one of two owners of a business. The partner in your business venture is an individual named Mr. Market. Frequently, if not daily, Mr. Market offers to sell you his share of the business or to buy your share. There is one trait however you must never forget; Mr. Market is manic-depressive. His estimate of the business’s value fluctuates from extremely pessimistic to wildly optimistic. Fortunately, you are always free to ignore or decline Mr. Markets offer, as he will return with a completely new one shortly, reflecting his mood at the time.

Perhaps the most interesting aspect of this allegory is the prices offered are not reflective of the business’s value or performance. Instead, the prices are a reflection of emotions such as euphoria and are therefore often irrational.

Ben Graham goes on to suggest the offers don’t serve you but they do guide you. In short you must take advantage of Mr. Market’s inevitable bouts of depression, especially when they are inspired by events that have nothing to do with the business in question.

Warren Buffet more recently suggested the same, simply be greedy when others are fearful and fearful when others are greedy.

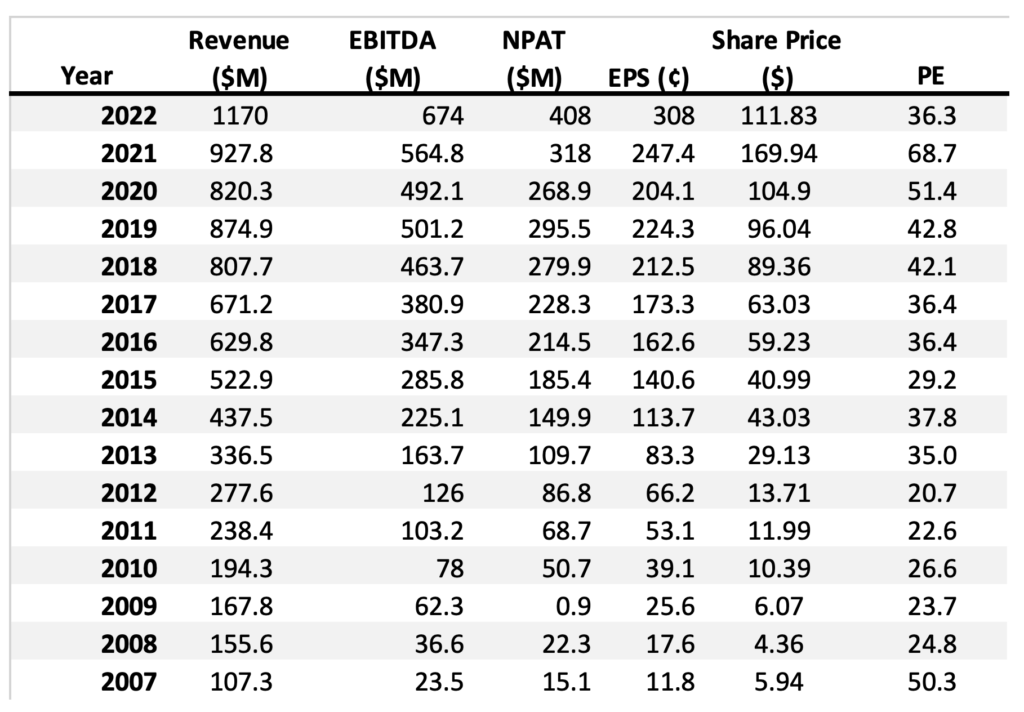

Let’s return to REA Group for a moment. Table 1. reveals some interesting statistics for REA Group.

Table 1. REA Group vitals

EBITDA, NPAT and EPS have all grown, over 15 years by about 25 per cent per annum. That is extraordinary and it stems from the very high quality economics of this business.

If you owned a business generating tremendous growth and amazing returns on equity with relatively little debt, your biggest fear would be a new competitor emerging, charging a lower price and taking away customers. In REA’s case, there is no shortage of competition. Indeed, the last time I checked there were approximately 83 sites in Australia offering property vendors the opportunity to list their home for sale. And of those, almost all of them offered a much lower price than REA Group’s. Indeed, the vast majority of real estate sites offered vendors the opportunity to list their home for sale for free!

Free! There couldn’t possibly be a lower price a competitor could charge. And yet, REA Group’s main website, realestate.com.au, despite charging the highest price, has the most visitors to its website and the most houses listed for sale.

The network effect REA enjoys, simply means it has the most houses because it has the most viewers, and it has the most viewers because it has the most houses. Provided management and the staff at REA continue to improve the offering, including UI, UX etc., such that it remains ahead of competitors, it should continue to enjoy the benefit of the network effect. And what is that benefit?

A competitive advantage, the most valuable of which is the ability to charge a higher price without a detrimental impact on unit sales volume. The best business to own is one which the only decision to make is; how much should we raise the price of our product this year? REA Group has been raising the price of its services for years, such that even as the national number of listings declines, the company’s revenue, EBITDA, NPAT and EPS rises. It is, quite simply, one of the few listed companies in Australia able to pull that feat off regularly.

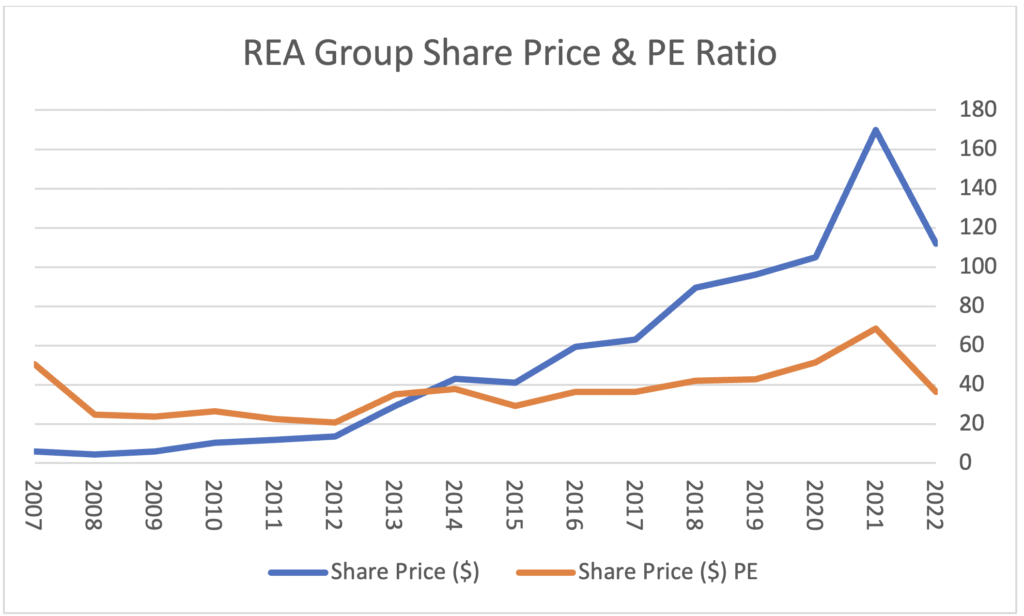

Figure 1. REA Group Share price and PE Ratio

PE Ratios measure nothing more than the popularity of a stock

The higher the price-to-earnings ratio, the more popular it is. The price-to-earnings ratio is lower when investors aren’t willing to pay as much for a dollar of the company’s earnings. Conversely when Mr. Market is euphoric, he’s willing to pay a very high price for each dollar of earnings.

Today. The share price is about where it was at the commencement of the pandemic but revenue is 10 per cent higher, while EBITDA and NPAT are more than 11 per cent higher. Earnings per share is about five per cent higher than 2019 levels. Meanwhile the price-to-earnings ratio investors are willing to pay, is about the average of the last 15 years. A true bargain, assuming the growth of the company’s revenue and earnings continue apace, would be when (if) Mr. Market becomes depressed about inflation, interest rates and recession, and the share price hits the low-to-mid $90 level. At that point the popularity of the stock (P/E of 30 times or less) would again be lower than at any time in the last decade.

The Montgomery Funds own shares in REA Group. This article was prepared 30 August 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade REA Group you should seek financial advice.