The RBA’s battle with inflation: Examining the latest data points

The Australian Bureau of Statistics (ABS) released some important data points last week on the state of inflation and the national accounts. The headline figures did not demonstrate the signs of contraction the Reserve Bank of Australia (RBA) is trying to achieve, however looking into the underlying causes and effects can provide some clarity and sense of optimism.

Inflation

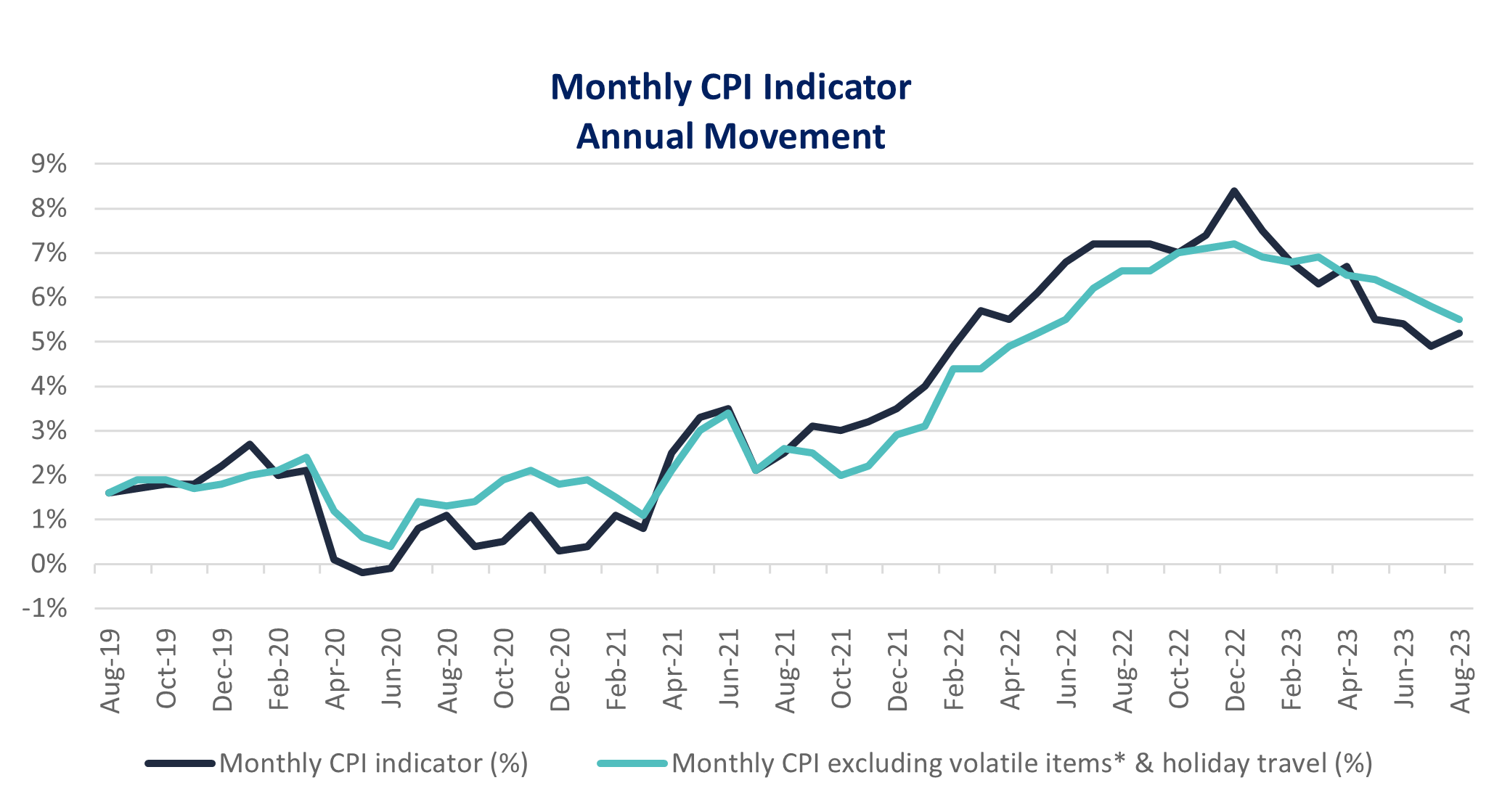

Inflation rose by 5.2 per cent in the 12 months up to August 2023, according to the latest monthly Consumer Price Index (CPI) indicator. This is slightly higher than the 4.9 per cent reported in July. On a positive note, annual inflation remains well below the 8.4 per cent peak reported in December 2022.

The main contributors to the August annual increase were housing, transport, food and non-alcoholic beverage and insurance and financial services.

It is, however, important to note that the inflation rate is also affected by spikes in volatile items. This reading was greatly affected by the rising cost of fuel, fruit and vegetables and holiday travel. If we exclude these items from the headline CPI reading, we can get a view of the underlying inflation read. By excluding these volatile items from the August monthly CPI indicator, the annual rise of 5.5 per cent in August is lower than the annual rise of 5.8 per cent reported in July. Showing a consistent downward trend.

National accounts

Household wealth was up 2.6 per cent for the June quarter of 2023, the third consecutive rise reported. This is also 3.9 per cent higher than what was reported last year.

The primary driver is the increasing value of property and up lift in house prices this year. Additionally, we are seeing superannuation balances increase off the back of additional super contributions from employers considering the strong labour market conditions.

Despite the improvement seen in households’ balance sheets, there were signs that their budgets were under stress in the June quarter. Household deposit accounts fell by $6 billion dollars. Notably, this is the first quarterly decline since June 2007, during the global financial crisis.

This implies that households are tapping into their cash reserves, in order to offset the rising cost of living. This narrative is consistent with the declining household savings ratio, sitting at its lowest level since 2008.

Despite the headline figures not presenting the picture we want to see, the underlying data is demonstrating a retraction in household spending and slowing rate of inflation. As such, we can confidently say the RBA’s interest rates are continuing to have their desired effect. The speed of the contraction is another story, and whether the RBA is happy with the rate at which inflation is being brought back towards to the 2-3 per cent target range will be proven this afternoon.