The RBA Tea Leaves

For the 30 seconds before the Reserve Bank’s decision flashes across the RBATCTR page of trader’s Bloomberg terminals, silence descends on dealing room floors around the country. Someone then cries out; “up 25bips” or “no change” and mayhem ensues. As a young graduate in a dealing room it all seems very exciting and front line. But as a more seasoned observer and participant, one does wonder what all the fuss is about.

Investors can do much better investing in ‘businesses’ rather than trying to use interest rate changes as a predictor of stock prices. In any case, once you have predicted correctly whether interest rates will rise or fall, you then have to predict what the reaction will be by investors in each individual stock. And generally it is worth being reminded of the fact that economists have had a mixed track record over the long run at predicting rates in the first place.

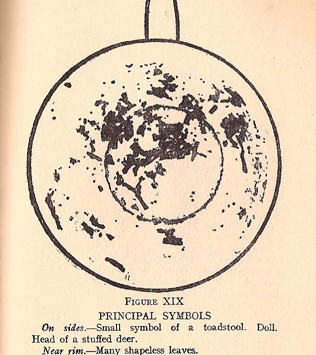

Tea leaf reading springs to mind. The image of the tea cup with tea leaf interpretations described below it is an example of the ‘art’ from the 1922 Edition of Telling Fortunes By Tea Leaves by Cecily Yates. The interpretation of the illustrated example: “doll plus toadstool equals a warning against a bad habit of gossiping when feeling bored in society – the stuffed head of the deer showing the distress caused by such unguarded talk”.

The following chart plots the RBA cash rate against the All Ordinaries index over the last twenty five years and demonstrates that trying to predict rates is almost as worthwhile for long term value investors as tea leaf reading. What you will notice is that there are periods when interest rates go up, the stock market goes up. There are also periods when interest rates go up, the stock market goes down.

In the long run, valuations are impacted by interest rates and the relationship is inverse. Generally, declining long term rates means rising intrinsic values and rising interest rates means declining intrinsic values. But as we have suggested here for many years, estimating intrinsic values is not the same as predicting shares prices.

The chart reveals share prices can and do do their own thing, sometimes for a long time. So the next time the RBA is deciding, go and have a cup of tea.