The need for speed

Last week I posted some data from the Australian Bureau of Statistics to find out how fast Australia’s appetite for downloads had been growing over the past few years. If you haven’t read it, you can find the post here.

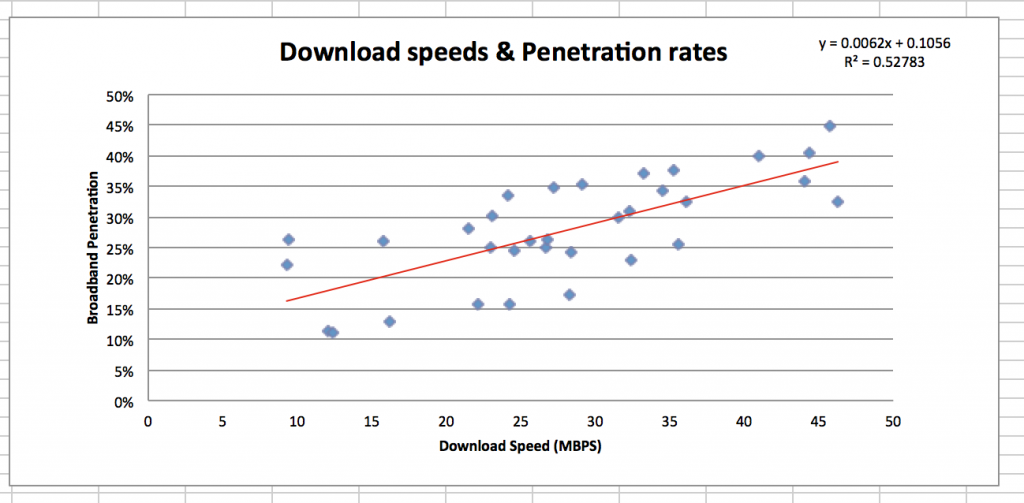

Now I pose a different question although slightly related, is there a relationship between the speed of internet offered in a country and demand? Interestingly enough there is.

We have set up a simple chart here for nations in the OCED. On the vertical axis, we have the demand data labeled ‘’BB Penetration Rate’’ and simply refers to the number of connections per citizen in a country. On the horizontal axis we have internet speed in megabits per second.

The penetration rate data can be downloaded from the OECD (here) and the download speed data was recorded from Ookla several weeks ago (here).

Leaving the statistics aside, we can say that there’s a fairly strong relationship between internet speed and the number of internet connections a country has. What does this mean for us? Well as the National Broadband Network (which will increase Australia’s average internet speed) rolls out, companies that sell internet services will likely have significant number of new customers.

Naturally as new customers enter the market, operators such as TPG Telecom Limited (ASX: TPM) or Dodo (operated by M2 Group Limited (ASX: MTU)) have a natural advantage in that they can offer lower priced internet plans. Recently, this strategy has enabled both players to grow market share in the broadband market and we see little to stop them continuing to do so.

Montgomery Investment Management holds M2 Group Limited (ASX: MTU) in both The Montgomery Fund and The Montgomery [Private] Fund.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Chris B

:

This data is strongly linked to people watching more videos and TV on the internet.

Hedley Calvert

:

Do you expect companies like Big Air (BGL), Vocus (VOC) and Amcom (AMM) to also benefit in the same extent as MTU given that they are more focused on business rather than retail customers. I’d be interested to hear your thoughts.

Scott Shuttleworth

:

Hi Hedley

To a degree yes, the rising tide will carry all boats but not always to the same extent. Research on company specifics risks is required as well.