The Montgomery Fund’s performance and positioning

In this video Head of Distribution Scott Phillips talks to portfolio manager of The Montgomery Fund Joseph Kim to discuss the relative performance of The Montgomery Fund in early 2022. They discuss which companies will do well in the current macro environment and share Montgomery’s view on commodity prices.

You can view part two of this two part video series here: The Montgomery Fund’s positioning through reporting season and Russia and Ukraine’s conflict

Transcript:

Scott Phillips (00:08):

Welcome everyone to this special update on The Montgomery Fund. My name’s Scott Phillips, the Head of Distribution here at Montgomery and I am with Portfolio Manager for The Montgomery Fund, Joseph Kim.

Scott Phillips (00:23):

It seems a lifetime ago, but calendar year 2021 was a great year for equities both locally and globally. But as we record this video on the 10th of March 2022, we look at the past nine weeks and so much has happened in the world. We’ve seen equities sharply lower both domestically and globally. We’ve seen concerns around inflation and interest rates therefore. We’ve seen a war erupt in the Ukraine, supply constraints come through. There’s some precious materials, both commodities on the soft side and the hard side, and stratospheric prices as a result.

Scott Phillips (01:03):

All of this has meant there’s been huge amounts of volatility and understandably, uncertainty for investors. I’m going to take this moment to talk to Joe and try and unravel a bit about what’s going on in The Montgomery Fund. First thing I’d like to talk about is calendar year 2021, which was a good year for The Montgomery Fund. The Fund outperformed strongly over the broader market. Maybe just take us through the drivers of that and how you saw The Fund being positioned and playing out.

Joseph Kim (01:36):

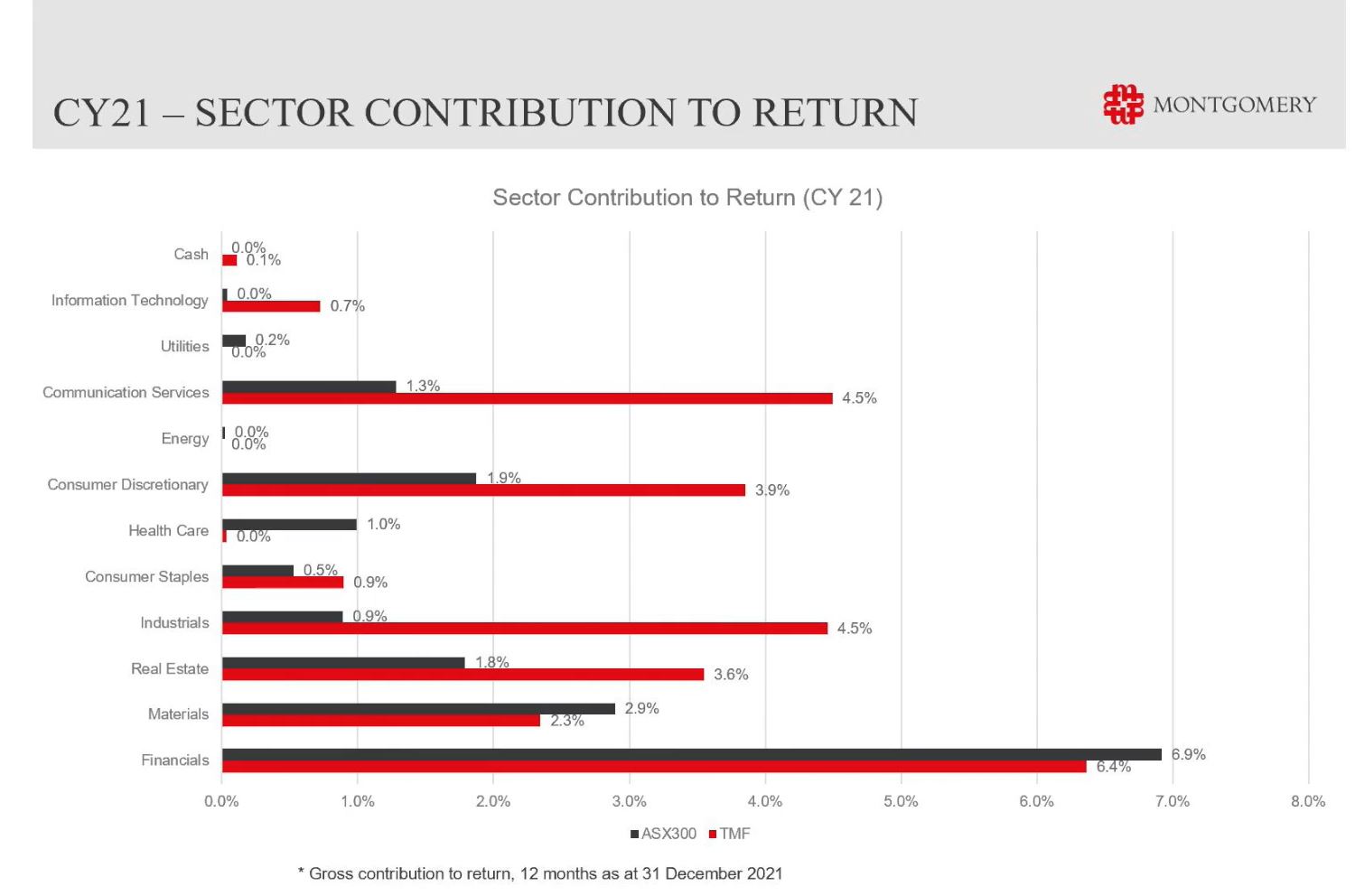

If you look at The Montgomery Fund’s returns over 2021, the drivers of those returns are very broad. If you look at this slide you can see the sector contributions, you can see there’s not any one sector that dominates the return profile. We had our quality companies deliver very good earnings growth. If you look at the likes of Reliance, Goodman, Centuria, all across the spectrum. We also had some very good turn around stories from Telstra. We had very good growth from Unity.

Joseph Kim (02:07):

And then we also had a whole host of reopening plays, with the outlook for COVID improving for most of the year. We had companies like IDP very well managed during the downturn and also Scentre Group as reopening in broader Australia occurred. Finally, on Sydney Airport, we had the takeover offer, which really highlighted the value of the infrastructure asset. There’s not any one thematic that really underpinned the returns for The Montgomery Fund, and that’s what we expect going forward.

Scott Phillips (02:41):

The portfolio has a quality bias across all of the names. As we look into calendar year 2022, the picture’s been very different for the price performance of these businesses, let alone the difference between the operating performance, which I know at the back of reporting season has been strong. Can you just take me through what’s gone on in calendar year 2022 so far, and therefore, why is The Montgomery Fund trailing the broader market?

Joseph Kim (03:16):

I think if you look at 2022 we entered reporting season much more cautious than we were last year. There’s a combination of factors. We know that there is inflationary forces that are spiking. We also know that there were COVID disruptions over the past six months, and we also had supply chain constraints. Finally, we’ve had the outbreak of war, which has effectively dominated discussion.

Joseph Kim (03:42):

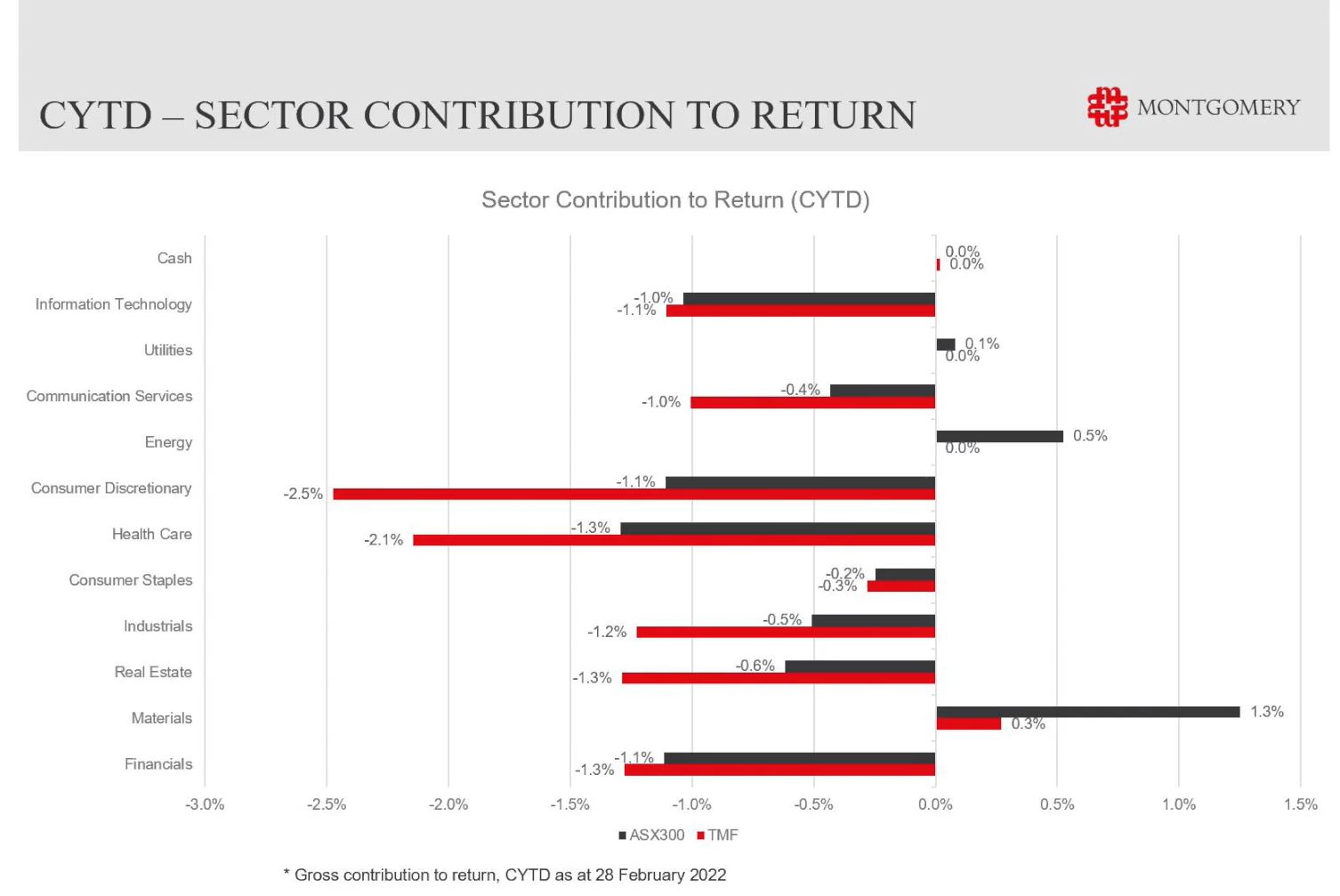

Now, if you look at the slide in front of you, you can see the drivers of the returns in the broader indexes, predominantly being energy and resources. Resources had been performing relatively well prior to the outbreak of the war anyway, but suddenly we’ve had a very big supply shock. Even though The Montgomery Fund’s response prior to the war was to invest in high quality businesses where we felt there was pricing power to offset the effects of inflation, we’ve seen a much bigger price gap over the past two weeks, which has in the short run impacted the valuations of our equities as a lot of these investors are chasing shorter term earnings certainty due to the commodity price spike.

Scott Phillips (04:27):

On that theme of inflation, you talked about the types of businesses that are able to offer some insulation against potential rising prices, input costs, can you name a couple of companies in the portfolio that show that resiliency and how that plays out?

Joseph Kim (04:46):

I think the best example is Reliance Worldwide. The stock has declined quite a bit since the highs of November last year, and there are real concerns around what the copper price and the higher input costs will do to their margins going forward. The result itself was actually of pretty good quality. We saw top line growth partially as a result of volume growth, partially as a result of price increases.

Joseph Kim (05:15):

We did see margins come down, but there’s always a lag associated with passing on some of these cost increases. I think there are some more concerns given what we’ve seen today; how are they going to be able to offset some of this? But we are very confident based on our channel checks of their major retailers that they should be able to pass them on. We’re not seeing any solid slow down in volume, and yet the share price pulled back about 30 per cent. We see that as a very interesting opportunity going forward.

Scott Phillips (05:47):

Joe, we’ve seen big price rises in the companies that offer natural resources and energy in particular. The Montgomery Fund has tended not to own these companies in the past. Can you talk to me about whether we own any at the moment and/or what it would take for The Fund to potentially own these businesses in the portfolio?

Joseph Kim (06:14):

The Montgomery Fund has history of not owning the resources or energy stocks as we perceive them to be of lower quality. There are a couple of reasons for this. The first one is the fact that the commodity like nature of the revenue stream. There’s more price volatility, there’s more earnings volatility. But also the return on investment. And that’s especially true for the oil companies.

Joseph Kim (06:40):

When we look at resources companies, there are two considerations that we make. The first one is stock specific and the second one is more on the earnings front; the earnings considerations. I’d point you to Capricorn, for example, where we saw a stock specific idea outside of just the gold price where we felt like the market was severely underestimating the rerating potential as the company came online and developed the Karlawinda Project. That’s been a very good performer for us and The Montgomery Fund.

Joseph Kim (07:12):

Then the second part of it is the earnings consideration. I mean by that; if you look at the commodity prices in general over a longer term history, we look at the earnings profile, we look at the commodity price profile, and we believe that commodity prices are much closer to peak earnings than they are to trough earnings. You have seen valuation multiples compress as a result of that, and so the valuation multiples look very undemanding. But we are very concerned that the earnings profile of these businesses are trading at elevated above cycle earnings. That’s why we have elected to not invest in this space at this point in time.

Scott Phillips (07:55):

Is it a fair observation that in the last nine weeks or thereabouts, we’ve seen investors around the world look to sell some of the earnings of these high quality, consistent earners and chase the resource and energy exposures for the short-term price increases that their underlying commodities are offering?

Joseph Kim (08:20):

Absolutely, Scott. I think that’s very important for the ASX benchmark where BHP has had an increased weight of 7-8 per cent to 12 per cent as a result of the unification. We’ve suddenly had a much bigger weighting in BHP during very uncertain times as a result of the war. The one thing that investors can have a bit more certainty over is commodity prices have spiked. People have chased this increased earnings profile in earnings certainty.

Joseph Kim (08:53):

We do believe that will normalize as we get some sort of resolution. It’s very difficult to tell, but we are obviously investing for a medium term outlook, and we believe the earnings profile of the companies that we own where we can see more dependable growth prospects. That’s where we’ve chosen to remain invested.

Scott Phillips (09:18):

The performance of The Montgomery Fund during this recent market pullback seems to be a little bit different compared to other pullbacks when the equity market has fallen. Can you maybe take everyone through the reasons as to why The Montgomery Fund has actually underperformed in a down market on this occasion?

Joseph Kim (09:41):

There are two main reasons for that, Scott. The first one is the cash levels. Part of the reason why The Montgomery Fund performed so strongly last year was that we had reduced our cash levels to be more fully invested. Investors would be aware that we benefited a lot on the upside, but as markets do weaken, it does mean that we’re more exposed to those forces, and so we’ve had a bigger pull back on that.

Joseph Kim (10:07):

The second part of it is resources. With resources being almost 30 per cent of the broader benchmark, we’ve seen lot of money flow out of some of the higher quality businesses in the benchmark to some of these resources companies. They are the perceived beneficiaries of an inflationary environment. But now that we’ve had the supply shock, we’ve seen a lot of money flow out of these quality businesses, especially benchmark aware portfolios, in to some of these lower quality businesses like the BHP and the Woodsides of the world.

Scott Phillips (10:43):

Thanks for that, Joe. We will move into part two of the video series with Joe Kim, the Portfolio Manager of The Montgomery Fund, to look a little bit at what changes we’ve made to the portfolio over the past few months. Thank you.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY