The interest rate conundrum: Conflicting forecasts from banking giants

In this week’s video insight I wanted to discuss the contrasting predictions from Australia’s major banks regarding interest rates, painting a nuanced picture of the economic landscape. Shayne Elliott from ANZ anticipates sustained rate hikes amid escalating growth pressures. In contrast, NAB’s Ross McEwan suggests rates might have peaked, while CBA hints at a possible rate cut. These varied perspectives hold significant implications for households with mortgages and investors.

Transcript:

Listen to three of the big four banks, and they’ll each give you a very different prediction about what interest rates will do in the next few months or quarters. Now, they’re in the business of administering interest rates to customers or from customers, and even they can’t reach a consensus.

Shayne Elliott from the Australia and New Zealand Banking Group (ASX: ANZ) believes high levels of immigration are adding growth pressures. The ANZ chief executive officer (CEO) says Australia must prepare for ‘higher-for-longer’ interest rates, with baked-in government spending pressures from infrastructure, housing and the climate transition set to make inflation sticky. He thinks there could be another official rate hike early in 2024.

But, speak to the Commonwealth Bank of Australia (ASX: CBA) or the National Australia Bank (ASX: NAB) bosses and an entirely different prediction emerges. Only a week or so ago, NAB CEO Ross McEwan said the Reserve Bank of Australia (RBA) had probably lifted rates enough for this cycle, while the CBA thinks an official rate cut is on the agenda sometime next year.

Of course, all this matters for those households in Australia who have a mortgage. And, of course, stock market investors care very much about what interest rates will do because they impact the multiples of earnings, sales, and book values investors are willing to pay for shares. Any sign that interest rates might start to head down again and the compression in price-to-earnings ratios we saw in 2022, for example, could reverse, boosting stock market returns even if corporate earnings don’t expand materially.

One group of investors who might be less concerned with recent interest rate moves on part of their portfolio are those investors in the Aura High Yield SME Fund available to wholesale and sophisticated investors only.

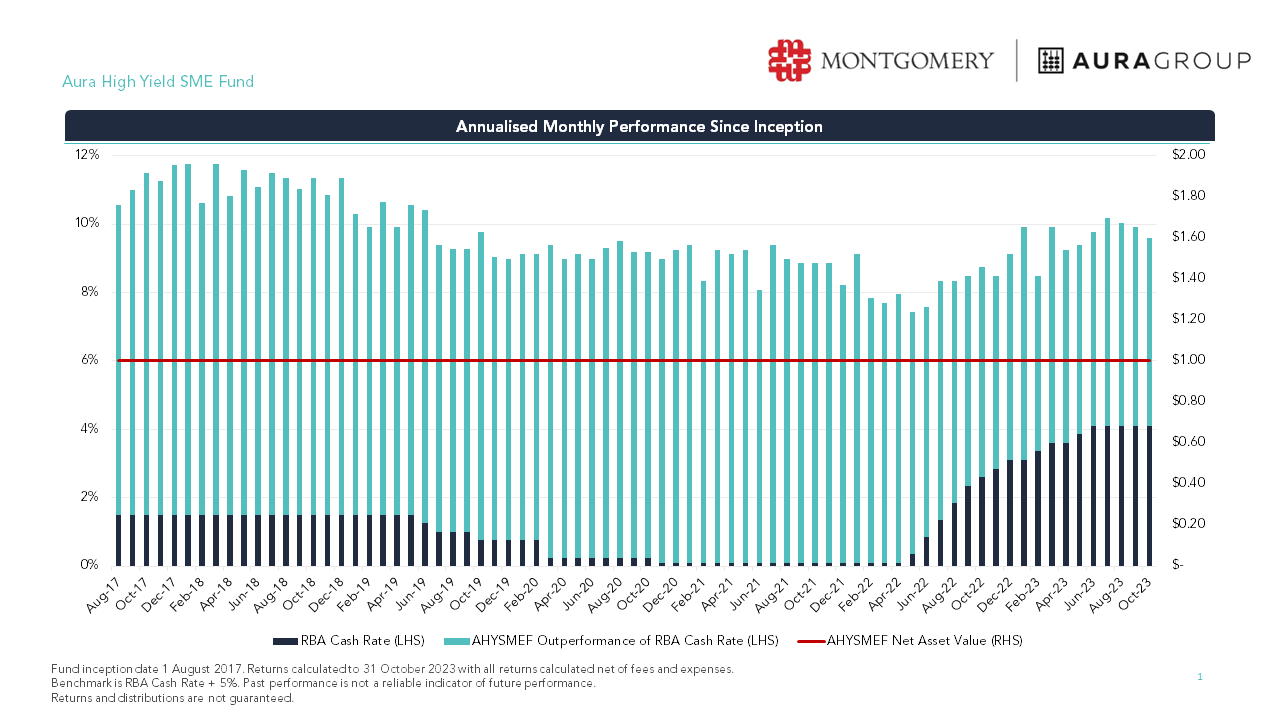

Have a look at this chart, the RBA’s official cash rate is marked in black. You can see from August 2017 through to May 2019, the RBA cash rate was stable at 1.5 per cent. From June 2019 however, rates started to decline, and by November 2020, they sat at just 0.1 per cent. And there they remained until May 2022. Now, in that 57-month period between August 2017 and May 2022, the annualised rate of return for investors in the Aura High Yield SME Fund for wholesale and sophisticated investors varied between 11.75 per cent and 7.44 per cent per annum. Importantly, past performance is not a reliable indicator of future performance and returns and distributions are not guaranteed.

In May 2022, the RBA official cash rates started their highly publicised increase and arguably caused consternation for investors in almost every asset class. Once again though, investors in some private credit funds, including those wholesale and sophisticated investors in the Aura High Yield SME Fund, experienced improving annualised returns as the RBA raised rates. Annualised rates of return for the Aura High Yield SME Fund climbed from 7.44 per cent per annum in May 2022 to 10.16 per cent per annum in July 2023 and 9.64 per cent per annum in October 2023.

Because rates charged to borrowers are floating and because the average term, on 51 per cent of the 11,764 loans in the portfolio at the 31st of October 2023, was less than three months, investors have experienced rising returns as the RBA cash rate has risen. Once again, past performance is not a reliable indicator of future performance and returns and distributions are not guaranteed. Investors should always seek and take professional personal advice.

I hope we have been able to show that despite all the press to the contrary, some Australian investors are finding benefits that have accrued from the recent increases in the RBA’s official cash rates.

I hope you can see that not all investors are treated equally when the RBA raises rates. And while we don’t know whether the RBA will raise rates, keep rates on hold or cut rates next year, and neither do the big banks. What we do know is that private credit offers uncorrelated returns.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura High Yield SME Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery and Aura Group do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.