The bull case for small caps

If you were listening carefully during reporting season, you might have noticed a growing buzz around small-cap stocks, both here in Australia and in the United States.

More investors are now seeing small caps as a hidden gem. Small caps seem undervalued, overlooked, and are showing signs of a strong recovery.

If you don’t already have an allocation to small caps in your portfolio, now could be the right time to take a closer look.

Compelling valuation story

Starting with the numbers, small-caps are still trading at some of the most attractive relative valuations we’ve seen in years. Compared to their large-cap counterparts, small caps might be described as exceedingly cheap.

In Australia, small-caps are on the same Price-to-Earnings (P/E) multiple of 20 times forward earnings as their big cap brethren, but they are offering 18 per cent expected earnings growth versus just 4.5 per cent for big caps.

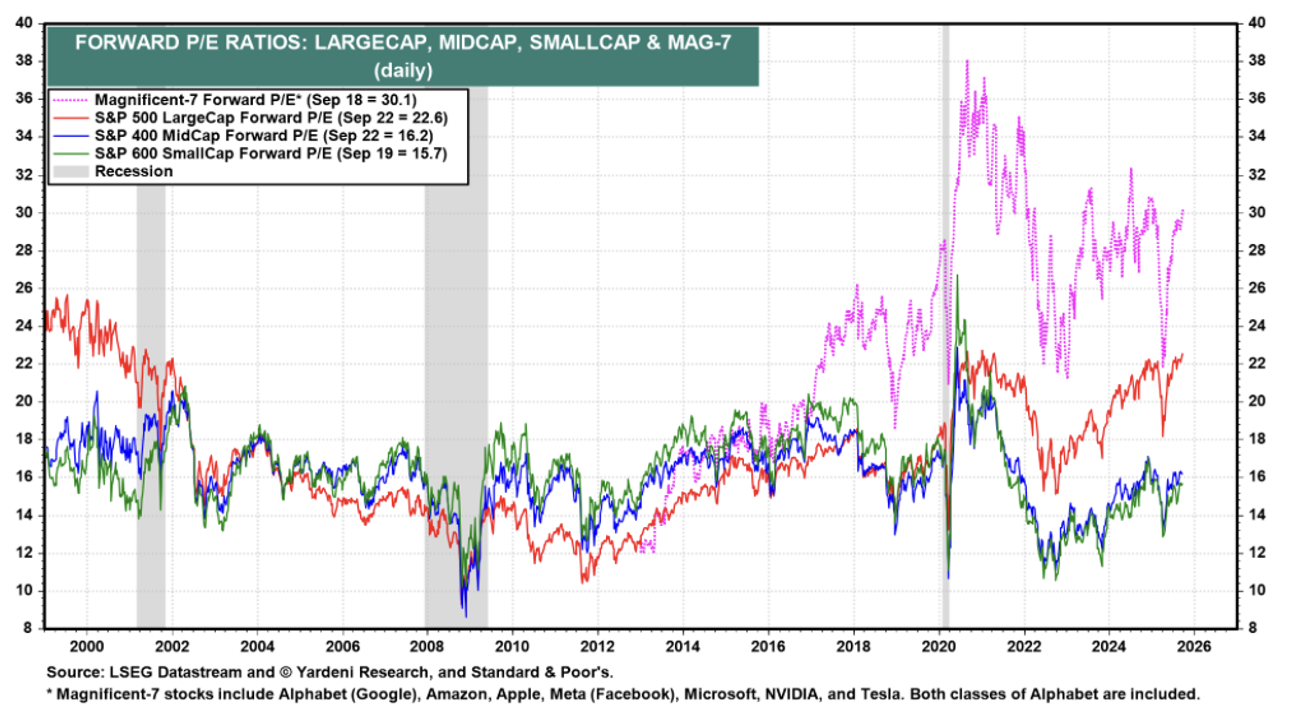

As Figure 1., reveals, U.S. large-cap P/Es (red line) are near their highest level since 2002, and have risen from 10.5 times one-year forward earnings in 2011 to 22.6 times today. By contrast, small-caps, as measured by the S&P 600 small-cap index P/E, have risen from 12.2 times in 2011 to 15.7 times today.

Figure 1. U.S. Large, mid & small-cap P/E ratios

Source: LSEG datastream and Yardeni Research, and Standard & Poor’s.

Additionally, U.S. small caps, as measured by their P/E ratio, are trading only marginally above their long-term average P/E, while large caps are materially higher. Small caps aren’t overvalued relative to their own historical averages.

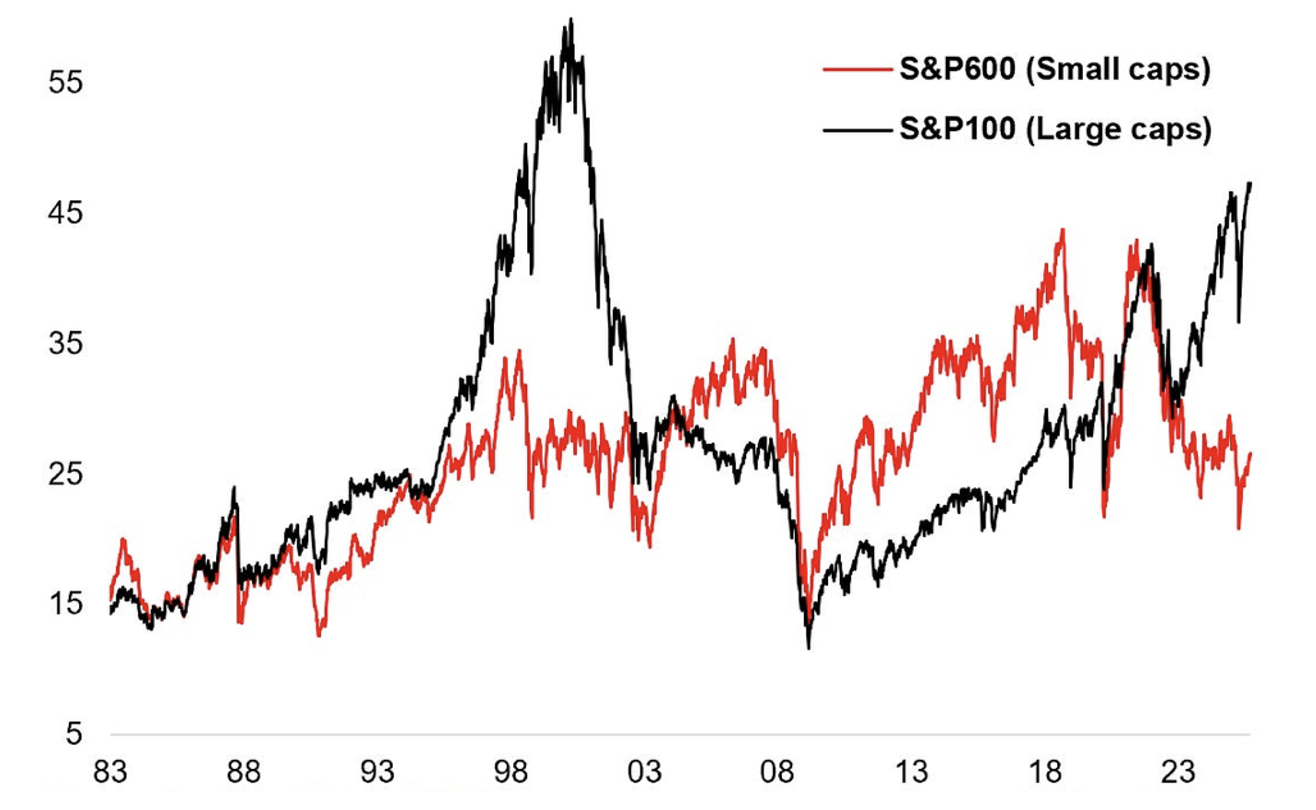

Figure 2. 10-year average earnings P/E Ratio: S&P 100 v S&P 600

Source: LSEG, Topdowncharts

Small caps appear undervalued across several dimensions, making them a potential bargain for savvy investors looking to diversify away from the high-flying, often overpriced large-cap space.

Sentiment is shifting – and that’s a good thing

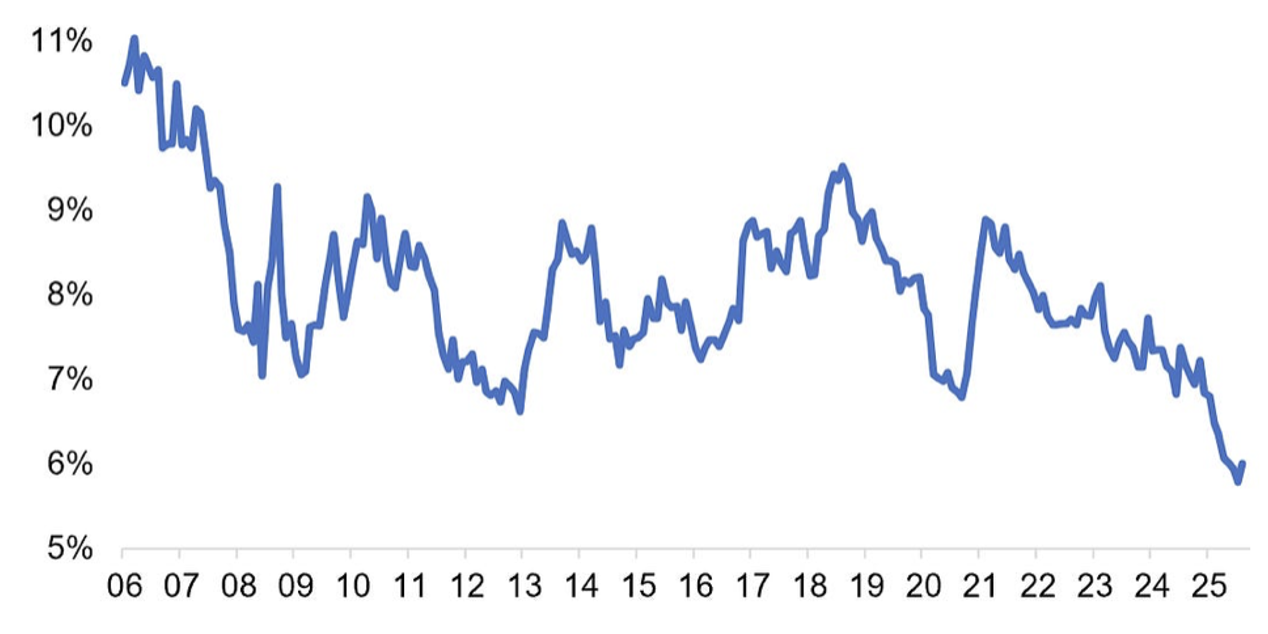

However, despite recent chatter, small caps remain one of the most under-owned and underappreciated parts of the market. This year alone, we’ve seen significant outflows from small-cap equity funds, with investor allocations dropping to historic lows. Meanwhile, short futures positions on small caps are near record highs, creating the potential for a short squeeze that could push prices higher.

Figure 3. Market share: U.S. Small Cap ETFs v All U.S. Domestic Equity ETFs

Source: Topdown Charts

But here’s the intriguing part: sentiment may be shifting. After hitting its bottom, investor interest in small caps has begun to rise. While there’s no guarantee of continuity, when an asset class falls out of favour, only to show early signs of renewed interest, it can mark the commencement of relative outperformance.

Macro tailwinds

The macroeconomic climate could also be favouring small caps. With the Federal Reserve contemplating further interest rate cuts (albeit cautiously, while Jerome Powell remains Chair), and with Trump forcefully insisting on cuts, small caps – often more sensitive to borrowing costs – may be well-positioned to benefit. Lower rates ease financing pressures for smaller companies, giving them more room to grow and invest.

But it’s not just about rates. Small-cap indices are heavily weighted toward traditional cyclical sectors, such as manufacturing, energy, and consumer goods, unlike the tech-heavy large-cap indices. This means small caps could thrive in a scenario where global growth reaccelerates, providing diversified exposure to any economic recovery. And here’s a key data point: small-cap earnings revisions have been surging recently, reflecting growing optimism about their future profitability.

The combination of lower rates, cyclical exposure, and improving earnings momentum forms a strong basis for small-cap outperformance.

Navigating the risks

All investing carries risks, and small-cap stocks are no exception. Perhaps the most serious concern is the potential for a U.S. recession. If sentiment shifts toward a deep downturn, it could weigh on all equities, including small caps, and lead to negative absolute returns. However, even in this scenario, small caps might still outperform on a relative basis. Large caps, particularly in tech and artificial intelligence (AI)-driven sectors, are grappling with stretched valuations and speculative exuberance. Of course, not all AI stocks are expensive, but there is ample evidence of speculative behaviour. In a bear market, the highest flyers could fall harder and faster than small caps, which are already priced more conservatively.

Moreover, if a recession is short and shallow – especially if it’s accompanied by aggressive rate cuts and fiscal stimulus – small caps could emerge as a net-positive investment. Their resilience and undervaluation render them a possible hedge against large-cap volatility.

What to watch next

Keep an eye on three key factors. First, monitor earnings revisions. The recent surge in positive revisions has been a reasonably reliable bullish signal in the past; however, sustained momentum will be crucial to confirm the trend. Second, keep an eye on central bank liquidity – any tightening of liquidity would suggest the rally will run out of steam. Finally, remain attuned to the macro environment. Rate cuts and signs of global growth could propel small caps higher, but recessionary signals could introduce volatility.

Small caps appear to be cheap, relatively under-owned, and possibly primed for relative outperformance. Always stick to quality, or with a manager focused on quality small-caps such as the Montgomery Small Companies Fund. With attractive valuations, early signs of shifting sentiment, and an increasingly favourable macro backdrop, they offer a compelling opportunity for investors looking to diversify.

The potential for small caps to outperform – whether in absolute terms or relative to large caps – makes them hard to ignore today.