The beautiful game

19 February 2020 will go down as the date when many global share markets peaked. Also, on that day was a Champions League (soccer) match between the Bergamo team, Atalanta, and the Spanish team, Valencia, at the famed San Siro Stadium in Milan. Attending were more than 40,000 Bergamaschi, making the 55-kilometre trip to watch their beloved team. Many unknowingly had the Coronavirus, as cases were being reported with great frequency some days later; and Bergamo soon became the worst hit Province in Italy.

With a 4-1 victory to Atalanta, and lots of celebrations at close quarters in the stadium and at the pubs, restaurants and clubs afterwards, it seemed likely that COVID-19 was let loose, with some of the 2,500 Valencia fans, many who had taken the two hour flight to Milan, as well as one third of the Valencia team, picking up this biological time bomb, according to the Bergamo Mayor, Giorgio Gori.

Fast forward six weeks, and by 31 March 2020 we have a situation on our hands where Italy has reported 106,000 infections and 12,500 deaths, while Spain has reported 96,000 infections and 8,500 deaths. At the time of writing, they together have accounted for nearly one quarter of the global infections (of 858,000) and one-half of the global deaths (of 42,000).

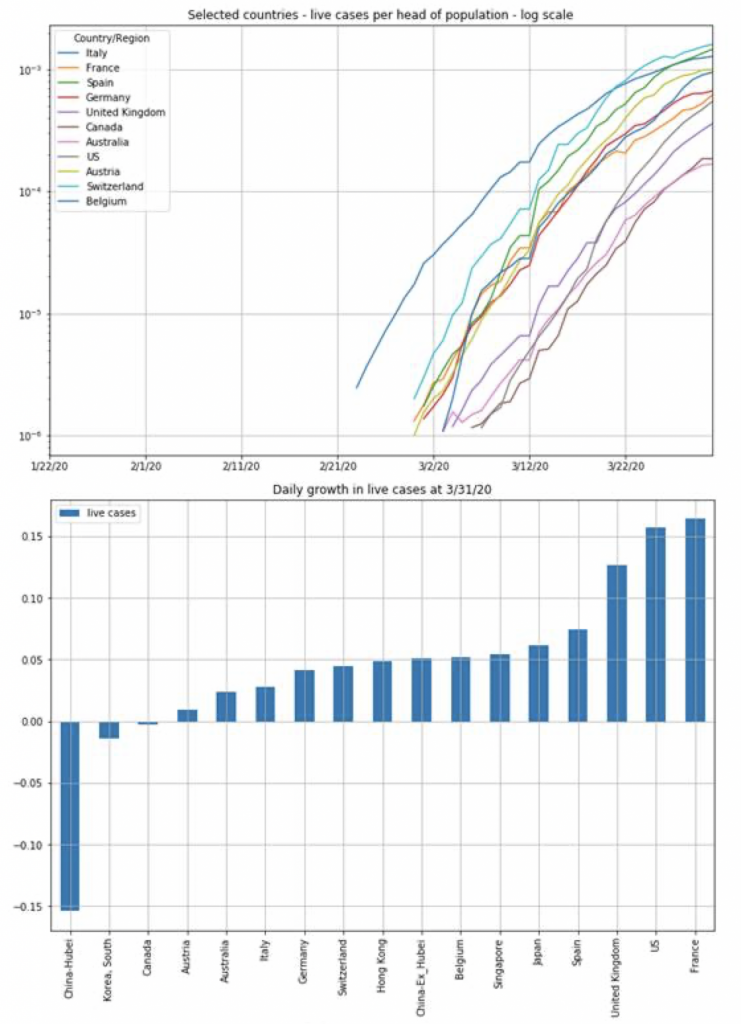

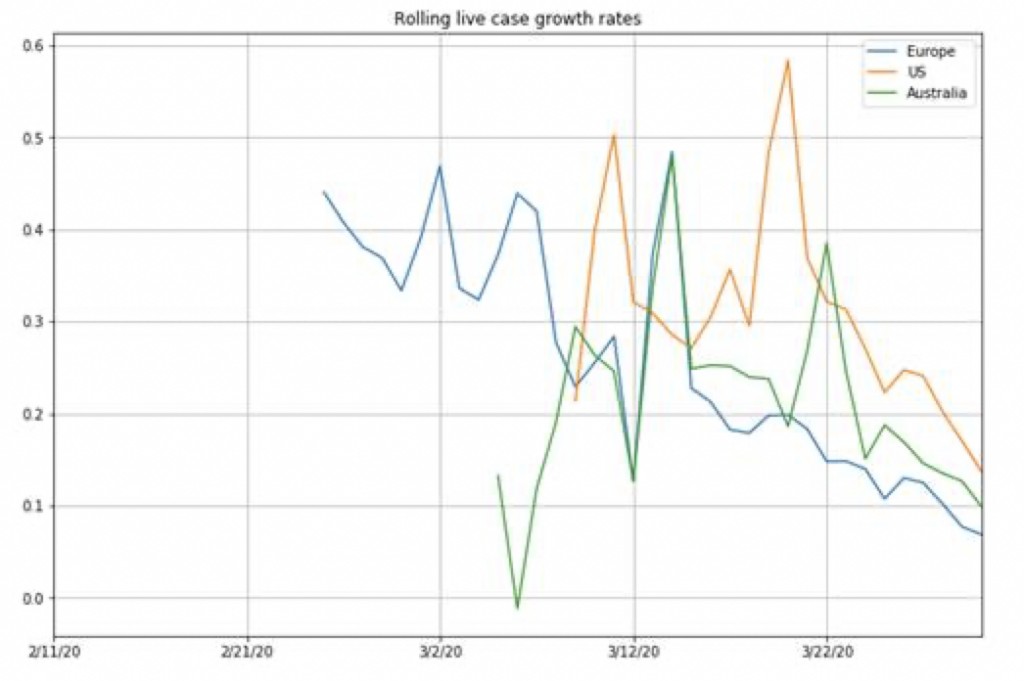

The team at Montgomery Investment Management have been actively analysing a huge amount of Coronavirus related data. The graphs below produced by Tim Kelley show that if there is one piece of relatively good news, it is that there is a decelerating growth rate in those countries which take quarantining seriously. Note, the negative growth rate in the second graph below is where recoveries exceed new cases.

Unfortunately, it seems the UK and North America have been slow to move, and we are looking for the numbers in the US particularly to get substantially worse over the foreseeable future.

And for that reason, we have continued to remain conservatively positioned in terms of our cash holding and are only deploying funds opportunistically when selected high quality stocks become (very) cheap.

To review our current positioning across the Montgomery strategies, please see Dean’s article: Your questions: Fund Positioning

Source: Johns Hopkins CSSE dataset on GitHub

Hi David,

I’ve read a lot on the blog about the market reacting and possibly ‘bottoming’ in response to the worst of the COVID-19 case information. There has then been a relatively strong response to the government stimulus announcements. Does the team think the economic impact of ‘containment’ measures will be another significant determination of future market moves in either direction?

Thanks, I hope my question makes sense.

Peter

Hi Peter, while we have been selecting sniping at a few higher quality businesses on relatively bad days, our thesis has been to focus on the US, the financial centre of the world. The Americans thought they were impregnable, however, we believe the epicentre of the Coronavirus has now shifted from Italy to North America and the numbers there will likely surprise on the upside. Hence our current caution.