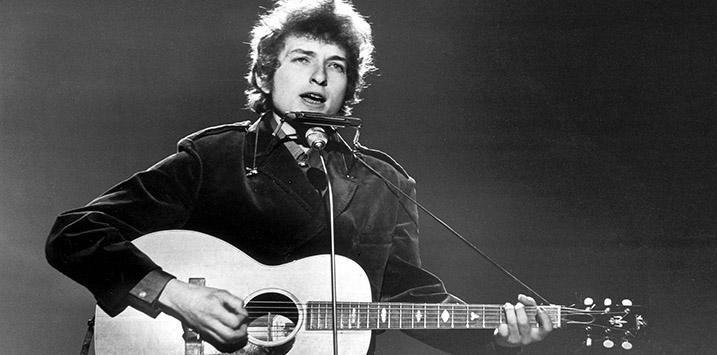

The answer is blowing in the wind

With thanks to Bob Dylan, a reading of the minutes to the December RBA’s board meeting reveals there’s a change in the wind. Typically, what we were taught in economics about Australia’s Monetary Policy has been precisely how the RBA applied its levers. Inflation and economic growth determined the changes in the settings.

Central banks are fast learning that record low interest rates and their buying of treasury bonds has not worked at stimulating consumption or economic growth, and only served to promote asset inflation and a disenfranchisement among the populace that has resulted in the election of Trump and Britain’s exit from the EU.

As we have reported previously, in Denmark where rates have been negative for the longest period of time, savings as a percentage of GDP is rising and consumption is declining – the very reverse of what the text books say should happen when interest rates are reduced and money made cheaper.

The RBA is one of those quick learners that has discovered low rates has not promoted stable economic growth but instead promoted destabilising asset inflation. We also know from reading Reinhart and Rogoff’s ‘This Time is Different’ (see the original video here) that rapidly rising asset prices alongside burgeoning debt are two of the four signals that precede a financial crisis in every example for the last 800 years.

In the December minutes the Board noted: “Over recent years the Board had sought to balance the benefits of lower interest rates in supporting growth and achieving the inflation target with the potential risks to household balance sheets. Members recognised that this balance would need to be kept under review.”

My fellow commentator, Bill Evans, over at Westpac, made the following observation: “I think this observation, which figures so prominently in the minutes, is signalling that the hurdle to even lower rates[,] which would be aimed at boosting demand[,] is very high. With housing markets in the south east remaining vibrant the risks of further cutting rates appear to be quite concerning for the Board.”

Over the course of 2016 we have been warning investors about property investing, the end of the construction boom and the second order impacts on employment, retailers and banks. The RBA is signalling that rate cuts are off the agenda, thanks to a continuation of a property construction boom that will end abruptly (apartment approvals fell by nearly a quarter in October), causing the unemployment of a significant number of people soon, a rise in vacancy rates for newly-minted landlords (thanks to massive oversupply) and significant price depreciation thanks to over-extended developers.

The loss of jobs in the construction industry (which employs 12% of the workforce) is now also playing on the collective mind of the RBA Board; “There was still considerable uncertainty about the momentum in the labour market.” With consumer spending in the September quarter already well below the average and mortgage debt already at record highs, consumers can least afford a loss of jobs or rising mortgage rates (thanks to rising bond rates) – both of which are likely in the near future.

I think your advice for investing in high quality small/mid cap shares is a good one. I have begun fleshing out my portfolio with a few of these stocks.

Cheers

Chris