The $100 share price club

On Monday, Dominos Pizza (ASX:DMP) was the latest Australian company to join the $100 share price club, joining the likes of luminaries such as healthcare leaders CSL and Cochlear, financial powerhouse Macquarie Group, mining giant Rio Tinto and tech leaders Afterpay, Xero and REA Group.

From an investment perspective, the $100 share price milestone is of no real significance as the share price is merely a reflection of the value of the entire business divided by the total number of shares on issue.

For example, if Dominos had 10 times the number of shares on issue (865 million shares rather than 86.5 million shares), the share price would be $10/share, whilst estimated earnings per share would go from around $2.05 to 20.5 cents per share i.e. the short-hand valuation metric of price-earnings per share would stay the same as would the enterprise value of the business (just under $10 billion).

The corollary to this is if the stock had 10 times less shares on issue, i.e. 8.65 million shares, the share price would be the first Australian company to reach $1,000/share, again with no difference to the value of the overall business.

However, there does appear to be some level of interest from market watchers on the $100 share price, viewed by some as some sort of milestone.

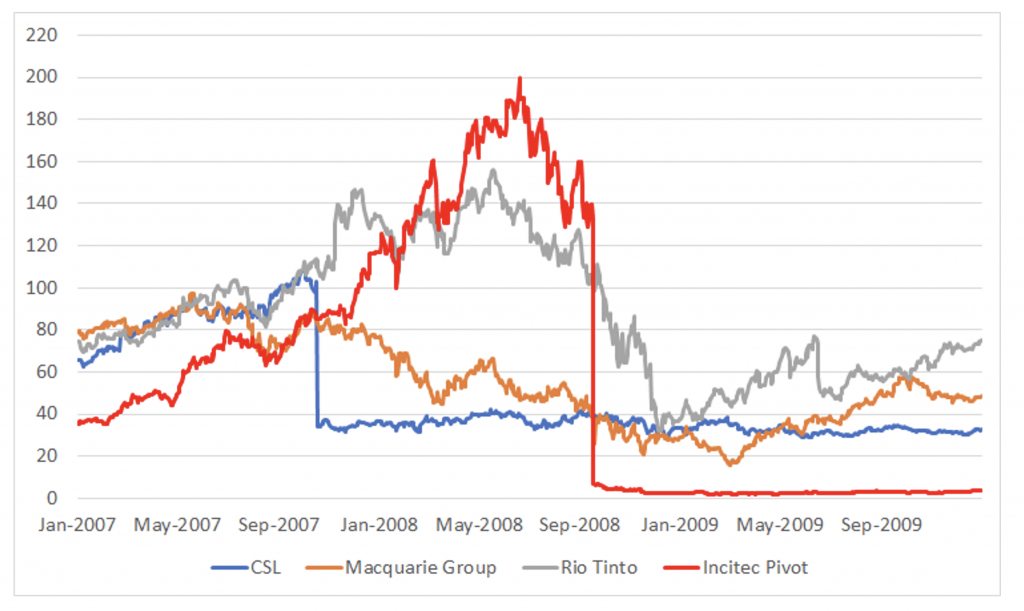

For example, the race to $100 generated interest from observers back in 2007 prior to the GFC, with the three leading contenders being Macquarie Group, CSL and Rio Tinto. Rio Tinto was the first to reach the milestone in May 2007, closely followed by CSL in September (before undergoing a 3:1 split a month later) while 2007 front runner Macquarie failed to crack the ton before GFC concerns hit the share price.

Share price of CSL, MQG, RIO and IPL in 2007

Source: Montgomery, Bloomberg. nb CSL and IPL reflects the share price pre and post-split (CSL 3:1, IPL 20:1) in nominal terms

One company in this 2007 list that may be a surprise for many is fertiliser and explosives company Incitec Pivot, which made a late surge and smashed through $100/share back in December 2007. The share price closed at a high of $199.70 per share in June 2008, buoyed by the boom in energy prices before conducting a 20:1 split in September of that year.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY