Super Ambitious Group

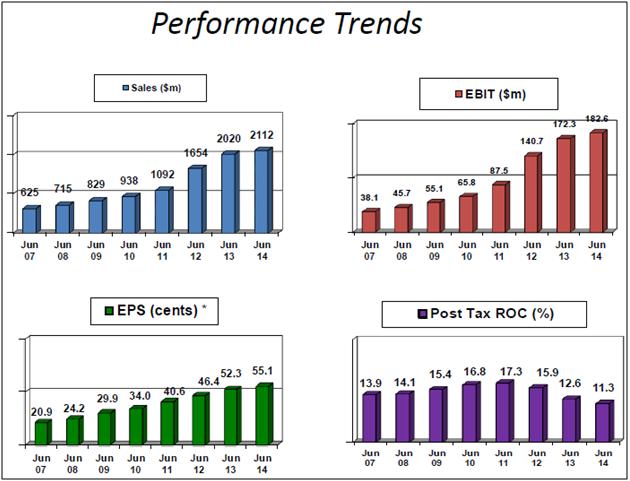

Last week, Super Retail Group Limited (ASX: SUL) reported to an uncertain retail sector. Having a flick through their investor presentation and the group’s financials – and considering some of the headwinds over the last financial year – it’s quite a fair result. Below is a copy of some slides from their presentation that gives a high-level overview of the firm’s performance over the past several years.

The first three tables look good (note: acquisitions and store roll-outs can often make sales, EBIT and EPS time series look very good), and the last is more interesting from our point of view. Declining returns on capital (ROC) are not normally the sign of bright future prospects.

Notably, the firm has set some ambitious five-year targets for its divisions, a few of which are named below:

- 325 Supercheap Auto and Autotrade stores nationwide (currently 291 stores)

- 3% growth in like-for-like sales per annum

- 12% EBIT margins

- Pre-tax ROC of 40%

Leisure

- 225 BCF, Ray’s Outdoors and FCO stores nationwide (currently 171 stores)

- 3% growth in like-for-like sales per annum

- 11% EBIT margins

- Pre-tax ROC of 30%

Sports

- 250 Rebel and Amart stores nationwide (currently 143 stores)

- 4% growth in like-for-like sales per annum

- 11% EBIT margins

- Pre-tax ROC of 21%

A quick back-of-the-envelope projection of these targets generates a valuation of about $11/$12, and its current share price of about $9. The potential would seem to be there, but like with all companies it comes down to execution and that’s where it gets complicated.

As per the above, SUL is comprised of a portfolio of companies whose growth prospects will be dictated by the strength of their competitive advantages. Some businesses in the group have stronger competitive advantages (Supercheap Auto appears to be the standout) and hence a case can be made that this particular business may hit their targets. Others in the group however may struggle, leaving slim prospects for our targets to be hit and hence requiring a greater margin of safety in our valuation.

Overall, when compared to current performance, these targets seem ambitious but they’re by far not impossible to achieve.

Montgomery Investment Management does not hold shares in Super Retail Group Limited (ASX: SUL).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY