Structural change?

Even though we haven’t owned Blackmores shares, last week we read their regular quarterly update for the first nine months of 2013. We did so with some concern. At the top-line, a reported a 29% jump in revenue looks like a strong result. At the bottom-line, the 7% NPAT decline is troubling for a number of reasons.

On the 5th July 2012, BKL completed the acquisition of FIT-BioCeuticals which came with $38m in invoiced sales and $4.6m in EBITDA in the bag. Given a large chunk of this sales growth has therefore been acquired and has grown since then, this leads us to believe there has been very little improvement in the core of Blackmores’ business.

We would have also expected that an acquisition of ~$40m and associated sales growth would result in an immediate boost to underlying profitability post integration. Despite a nine month contribution and the large investment, a decline in fortunes obviously throws up some questions for a business of Blackmores’ quality. So what on earth is going on?

Twelve months ago, we questioned management over their views on competitor Suisse and their very aggressive marketing campaigns which continue apace to this day. Our best guess is Suisse have been running a 6-1 ratio in Suisse advertisements vs Blackmores’. A move clearly designed by Suisse to take market share.

Despite this obvious attack on a market dominated by so few for so long, the entry of a new competitor was largely dismissed given a “shallow” brand. The view was that the quality DNA of the BKL brand would shine through. We wondered aloud whether the incumbent was underestimating the new kid on the block.

A year on and it looks like burying one’s head in the sand may not have been an adequate response to the competitive threat. Suisse are building a well-known brand via their tie-ups with several high profile sporting codes under the “you’ll feel better on Suisse” slogan. This, coupled with lower prices, is forcing Blackmores to lower their prices to compete.

Understanding pricing dynamics can reveal a great deal about the competitive advantages in an industry. If Blackmores are reducing prices, it suggests the value of their brand and the value of their reputation for quality is less valuable. Blackmores’ quarterly report seems to refer to this changing dynamic as ‘structural change’.

Only now does it appear that Blackmores are increasing their marketing spend to compete. But because they are redirecting their cost base, not reducing it, any further price competiveness will continue to impact on their margins and hence bottom line. We wonder whether more painkillers are required?

Are they too late in responding? Reaction is better than inaction but a proactive company is a better one than a reactive one.

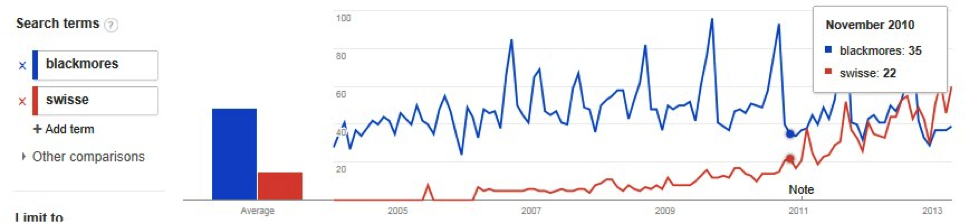

Performing a quick trend search, we can all see that Suisse now have momentum in their brand, which is surpassing even that of Blackmores. And if it were to continue, we wouldn’t bet against more ‘structural change’ for Blackmores.

BKL is undoubtedly a quality listed Australian business. It has an 80 year history, and it’s the number one brand in the Australian natural health category. We will watch with interest to see how the company responds to a competitive threat that can no longer be ignored.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Chris B

:

I have always thought Blackmores products are essentially commoditised products. They were always under threat of margins going lower. So I never valued the brand name as highly as many analysts did. They were just going through a nice era of low competition.

More competition is coming to Australia finally in things such as retail and insurance.

There are very few products I’d classify as great products,

Australian wine brands such as Jacobs Creek and Penfolds I thought were strong brand names but UK supermarkets dropped them for cheaper South American competition.

Blackmores is certainly NOT on the list of great products.

WD40, Heinz and Coca Cola are great products.

Andy Gracey

:

I unfortunately sold my last shares in the mid twenties which with the benefit of hindsight was over 1 year to early. The writing has been on the wall for a while although the weight of money is yet to accept Blackmore’s predicament. The likes of Woolworths, Coles and Chemist Warehouse are far more demanding than health shops and pharmacies.

Robert Pearson

:

Re Blackmores

This company has showed up on my ‘consider’ filters frequently. I chose not to buy them. My medico, based on blood test results, recommends some specific vitamin supplements, As they are essentially medically all the same I buy the cheapest. At the moment that is a ‘pharmacy’ brand, Suisse, and’ Natures own’. The choice partially depends where I am buying.

I much prefer owning stocks whose products I use, if I am buying a competitor probably so are others.

Ian Hammond

:

Hi Russel,

Blackmores is facing a difficult change in the retail landscape.

Blackmores have traditionally sold their products in pharmacies and have made very nice margins. A lot of Blackmore’s promotional investment was training of pharmacy assistants rather than direct to consumer. There was little to no discounting of products and product sold on pharmacy assistant recommendation.

But there is a structural change happening and it is the rise of the discount pharmacy and also the increasing level of sales of complementary medicine products in supermarkets. Both of these retail outlets work on selling high volumes and trying to squeeze the margins of suppliers and offer the products at the lowest price. Training pharmacy assistants does not have the effect that it used to any more.

Walk into a discount pharmacy and it is not unusual to see advertised discounts of 50% off the retail price of certain brands or ranges of product. This is called trade spend and the discount pharmacy and supermarket demand that the supplier pay for the discount and require a certain minimum level of trade spend each year to even stock the product range.

With the long shelf life of the products a regular user can just stock up when there is a sale so there is little benefit to the manufacturer of these discounts.

Unfortunately for Blackmores there is little that they can do to turn the tide. Being one of the first in market gives them an advantage of a well known and trusted brand name. Blackmores do have the advantage of their research and development , however if Blackmores launch a new and successful product there is nothing to stop the competition launching a copy fairly quickly and then the market is determine by price.

Competition also seems to be growing, but the big issue for Blackmores is erosion of their high margins.

Andrew Legget

:

I have a theory that i use to observe markets, people tend to see the same ads on TV over and over again. However, every now and again you will see an ad for a company that you are not used to seeing ads for and i believe this indicates a worried management or poorer performance and they are trying to catch up.

Eftpos was the first one i noticed this for and i had the same feeling yesterday with a blackmores ad so this post is very timely for me as i was only thinking the same things yesterday.

Swisse do a good job of targeting their products and advertising, they choose their spokespeople well. That search you ran backs up my observations. They have the momentum. Trying to get that momentum back can be expensive.