S&P 500 and the consistent earnings downgrades

With the US S&P 500 rallying 16 per cent over the past ten weeks from 1,810 points to 2,100 points – within a couple of per cent of its record high – I thought I would detail the Index’s consistent earnings downgrades and ask the question why are the analysts so optimistic?

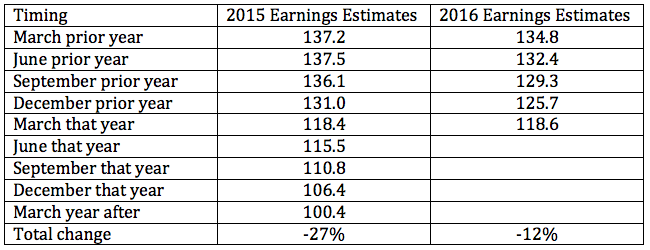

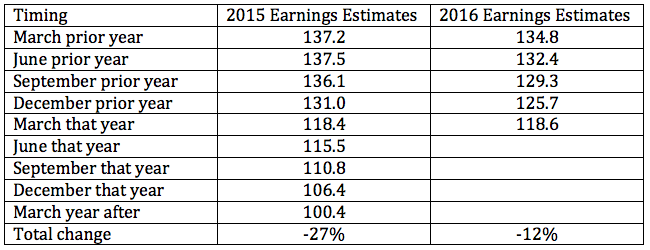

Amazingly, earnings estimates for 2015 came down 27 per cent from $137.2 to $100.4 over the two years to March 2016, placing the S&P 500 on an historical PE of 20.9X. Earnings estimates for 2016 have come down from $134.8 to $118.6 over the year to March 2016, putting the S&P on a prospective PE of 17.7X.

As the companies which make up the S&P 500 report their quarterly earnings for March, June, September and December, we wonder aloud if the earnings estimates for 2016 will also trend down towards $100.

And with the Atlanta Fed’s GDPNow forecast coming in at 0.3 per cent for the March 2016 Quarter (versus the consensus view of 2.5 per cent), it seems logical that pressure on revenue and earnings forecasts remain. Rising business inventories, for example, has lead to the highest inventory-to-sales ratio, at 1.41X, since the GFC.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi David,

Regarding the short positions within the Montaka Fund, if they move significantly against you as they can do if businesses with poor prospects enjoy price rises due to short term sentiment drivers, much like what’s happening now, are you required to put up more cash other assets as collateral?

Phil

No Phil, we are not required to put up more cash or collateral.

The required collateral is not simply a function of the value of individual short positions. Rather it reflects the fund’s broader exposures and risk profile. In fact, we are significantly over-collateralised. This is a reflection of 1) our decision to maintain conservative gross leverage (total longs plus total shorts), and 2) the netting benefit between our long and short portfolios.

We derive additional comfort from the fact that our short portfolio is significantly smaller than our long portfolio and spread over a greater number of positions.

Thank you.