Some Melbourne Flats suffer 30pc falls

That property prices can slide without an increase in interest rates or unemployment is being missed by many commentators.

The above heading on the front page of yesterday’s The Australian Financial Review reveals some Melbourne CBD apartments, and in particular a development at 27 Little Collins St, have caught investors off guard with a three-bedroom, two-bathroom apartment occupying 140sqm, and with two car parks, selling for $1.565m in August, 29 per cent below the purchase price of $2.195m in November 2010.

That property prices will fall is something we have been cautioning investors about here at the Insights Blog for some years. But a glaring inconsistency is ignored in the article and this, along with the mechanics of falling prices, requires an explanation today.

The article quotes; “While more apartments would limit the growth of rents, as long as interest rates remain low there was unlikely to be a big correction in prices, said BIS Shrapnel analyst Angie Zigomanis.”

Many commentators have suggested that property price declines can only occur if interest rates or unemployment rise. Such views fail to acknowledge the mechanics behind price movements.

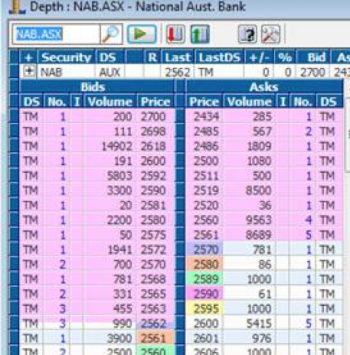

The reason this blog post’s image is the market depth screen for trading in National Australia Bank Shares, is because it shows that both buyers (Bids) and sellers (Asks) are responsible for determining the price at which NAB share will trade.

There are a number of means through which prices can fall. The most obvious is that sellers might decide to sell more urgently and hit progressively lower bids. The result will be lower traded prices. This is akin to property owners being forced to sell if they lose their jobs or can no longer meet higher interest payments on their mortgages.

But owners aren’t the only determinant of prices. Buyers/Bidders are also responsible for determining prices. If buyers simply pull back their bids, for example, in anticipation of lower prices in the future, then the gap between sellers and buyers will widen. The market then only requires a single seller to meet a lower bid to register a new lower price around which subsequent buyers will anchor.

As developers experience lower presales, they will be forced to discount remaining apartments in order to meet their debt obligations. They will have to meet the lower bids from buyers who can see mounting oversupply.

That is how property prices can fall even without an increase in unemployment or interest rates.

And the glaring inconsistency? The article reveals that 197 properties in the 3000 postcode have suffered an average fall of 9.15 per cent and some apartments have already fallen 30 per cent, and yet neither interest rates nor unemployment have risen.

Clearly neither are required to see lower property prices transpire.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

GAV J said on MARCH 31, 2016 AT 9:38 PM:

“The thing is though that it has never been a good idea to buy new apartments directly from developers.”

Very true, although it seems to be a recent discovery for some.

Ignoring my previous comment about broker depth, the other thing that is true about choosing to live in a filing cabinet in the city, is that if you have 5 apartments in the same building, and let’s say 2 or 3 are similar floor height and aspect/perspective, the bidder takes these into account and that has an impact on price.. i.e. there’s less differentiation in what is on the market.

Lets say you have 3 or 4 motivated sellers in a building where 10 apartments are for sale, and they just want to liquidate, that’s where you see gapping. They set the floor – and you are 100% right, it takes only one person to break discipline for a new price floor to be made.

As you know, in stocks you see gapping more in smaller companies and microcaps when someone just decides to back the truck up and offload. Look at the SMN chart over last 4 months and compare that to vol and you can tell what is making the drop. The Bid recovers eventually – or it doesn’t and you’ve done your dough.

In Megacaps like NAB it’s a lot harder to spot when someone is motivated to sell, usually it’s news cycle related and because of its overall size, the price is affected just as much by cyclicality as structural issues. If you look at the chart for MXUPA over 10 years, without delving too far into the history, this shows you the impact of having a thinly traded market with an extremely (compelled to sell) motivated seller, where there are few people on the bid – what happens to prices.

Now – the crux to whether we see 9.14% losses or 30+% losses, I feel comes at the point as to whether the seller is compelled to sell, and whether there is sufficient demand.

I for example withhold the purchase of my next TV because I know that over time, the price of a TV will go down, and the same applies to city apartments. I see the cranes around me – I see the supply coming in the pipe.

And these apartments aren’t like mega cap stocks where 1 share is the same as all the other billions of identical shares – but when it comes to differentiation between one apartment and the other, they’re quite similar.

They’re machines for living and I agree the price is more a function of buyer demand than any ability for the seller to have any control over price.

The other thing that doesn’t occur in the property market is that 9.5% of everyones paycheque is force fed via super into financial assets. So even if everyone woke up and wanted to sell NAB, there’s still a rolling bid to buy more as people attempt to allocate their savings dollars into the market. This doesn’t exist in the property market and this is what provides some form of cushion and then alter on once stabilized, ramp, to the price. Creating a structural support.

I see you also use the broker depth screen to chop out multiple robots at the same pricing point. Touche.

Not something we can control Lucas.

If housing was a listed stock it would of crashed and been short sold further by anyone with a pulse and a calculator.

Why on earth would educated, sane people consider housing to be an investment in this market? These prices just do not add up! Everything points to a collapse but the lemmings still line up. It is amazing to watch..

The thing is though that it has never been a good idea to buy new apartments directly from developers, particularly off the plan, high rise and directly in the CBD.

Actually it’s worse than it looks particularly for a period of just 5 years because of entry costs, stamp duty and mortgage and legal fees say 5% in total, and exit costs, agents, advertising and legal fees, say 2-3%. A loss of 9% on the face of it is therefore at least a 15% capital loss in reality.

Thanks for the article roger. I read this piece as well and noted the inconsistency in that quote. As someone in my mid-20s, I do feel confused as to whether now is a good time to be buying an apartment. So many competing views as to whether to “get into the market” or to keep renting.

I am lead to believe that the pricing anomaly was caused by another building being built and effectively blocking out the views of the apartments in question.

Tanks Thole, probably doesn’t explain that the 197 properties sold in Melbourne CBD have suffered an average decline of 9.15%.