Some analysts are forecasting big gains for Gold and Bitcoin

A theory doing the rounds is that we’ve entered a new epoch where central banks will have no option but to create monetary inflation to fund structural fiscal deficits. To be clear monetary inflation is not the same as consumer price inflation. Monetary inflation is brought about through central bank balance sheet expansion or quantitative easing.

As technology advances and displaces labour, and as the western hemisphere’s population ages, government tax bases will be devastated. Meanwhile, escalating government spending demands, by the same aging population, will ensure domestic fiscal deficits. And finally, while geopolitical tensions remain or escalate, foreign savings will be a less reliable source of financing for domestic spending.

According to the U.S. Congressional Budget Office, the stock of U.S. Treasury debt held by the public will almost double to $US46 trillion by 2033, from US$24.3 trillion in 2022. This is equivalent to 118 per cent of future GDP and represents an annual growth rate of 6.1 per cent. By then, interest payments alone will be two-thirds of the new U.S. Treasury debt issuance. One assumes these estimates, which take into account tax revenues, may have underestimated the deterioration in those tax revenues that AI and technology will impose as they drive efficiencies and gut labour.

If the theory proves correct, the world faces permanent and rapid Quantitative Easing, a resultant debasing of paper currencies, the rise of gold and another boom or bubble in cryptocurrencies.

I have never seen gold as a long-term investment because it has always been a bet on fear, and while fear spikes, it generally subsides again. Experts refer to this aspect of gold’s investment role as ‘a call option over monetary disorder or deterioration in geo-politics’.

Gold also has no industrial purpose and produces no income, and therefore, to date, has produced little enduing capital growth. Despite this, central banks have been net accumulators of gold every year since 2009, led by China and Russia.

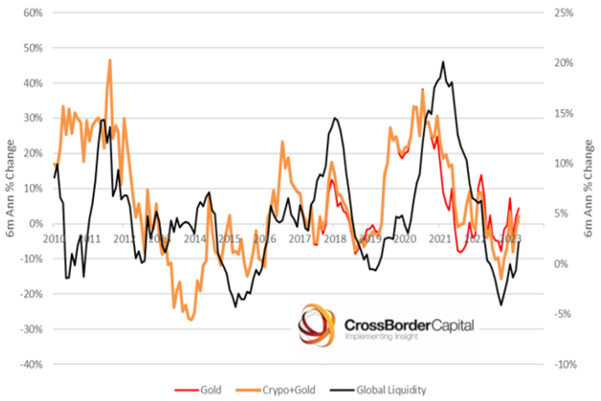

That gold and cryptos are a hedge against monetary inflation is shown in Figure 1, which plots the six monthly annualised change in gold and crypto’s against the same change in global liquidity, with the latter being a barometer of monetary inflation.

Figure 1. Global liquidity, gold and cryptocurrencies

Source: CrossBorder Capital, US Federal Reserve, People’s Bank of China, European Central Bank, Bank of Japan, Bank of England, IMF

According to London-based macro research firm Cross Border Capital, regression analysis reveals each 10 per cent rise in global liquidity leads to a 14 per cent rise in the value of monetary hedges. Importantly, the same analysis, albeit with a small sample size, reveals a greater sensitivity of cryptocurrencies, which rise as much as 75 per cent for every 10 per cent rise in global liquidity.

Importantly, again, gold and crypto are described as hedges against monetary inflation rather than cost inflation. The latter can spike because, for example, the price of oil rises sharply, and gold can prove to be a disappointing hedge in such circumstances.

According to the theorists, high-interest rates on paper money are a drag on the demand for gold. Conversely, however, monetary inflation through Quantitative Easing, puts downward pressure on rates, which should boost demand for gold.

Meanwhile, the accumulation of gold by central banks has been led by China and Russia, who one suspects are seeking to diversify away from U.S. dollars, and limit the impact of any future U.S.-dollar sanctions against them. Their actions of course reduce the supply of gold available on private markets.

The conclusion by macro analysts at Cross Border Capital is that Gold could rise to US$3,000/oz if monetary inflation increases by 75 per cent (forecast by 2033) and Bitcoin could rise to anywhere between US$40,000 and US$100,000.

Gold currently trades at US$1,966/oz and bitcoin is at US$27,731. So Cross Border are suggesting gold could rise by 50 per cent in the next ten years and bitcoin could rise between 48 per cent and 370 per cent.

If they’re right (I’m just reporting their forecasts), you might want to put their forecasts in your calendar! But before getting too excited the Gold forecast amounts to a compounded return of 7.3 per cent per annum to 2033 and the bitcoin forecast amounts to an annual return of between 3.7 and 13.7 per cent compounded.

You might just be able to get that by investing in high-quality growth equities, which also benefit from monetary inflation.

Why do group crypto together with Bitcoin. Is the article about Bitcoin or “Crypto” They are not the same thing. Provide a chart of Bitcoin vs Gold , Bitcoin vs S&P, Bitcoin vs ASX etc.

Cryptocurrency is a broad term for all virtual currencies, including Bitcoin.