Soaring crane numbers tell the story of our apartment boom

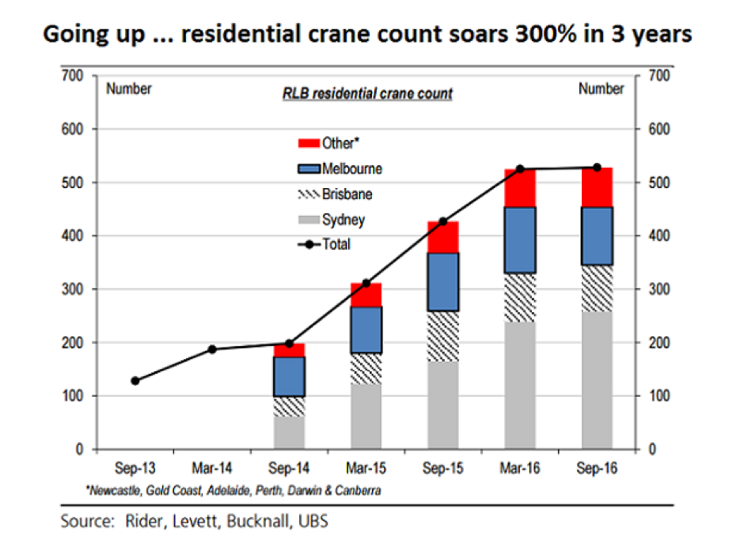

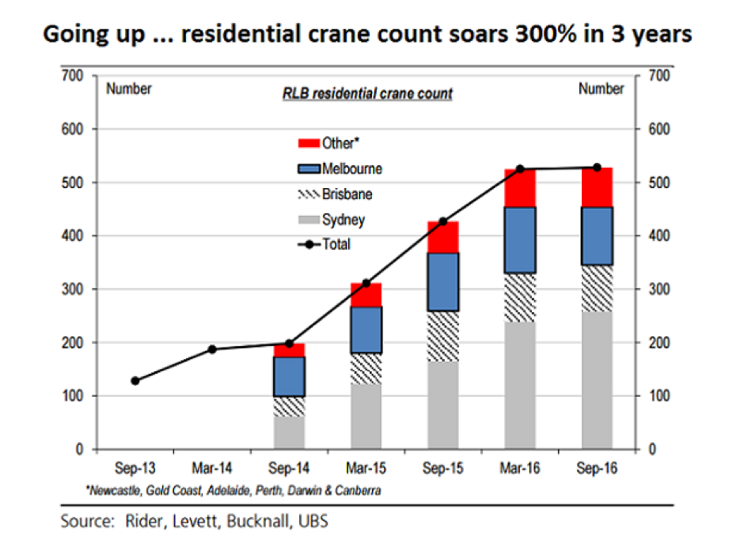

Have you noticed how many cranes are piercing the skyline? Rider Levett Bucknall’s Crane Index reports there are now 663 cranes across Australia’s capital cities – mostly involved in home building.

An ABC News story has revealed that there are more cranes employed in the construction of residential developments in Sydney, Melbourne and Brisbane than a large group of major North American cities including New York, Boston, Chicago, San Francisco, Los Angeles, Toronto and up to Calgary.

“Morgan Stanley recently estimated that the [apartment] oversupply in the sector would be around 100,000 units which could spark a sudden downturn which in turn put around 200,000 jobs at risk.

“Another investment bank, UBS, argues there is still a fair way to run in the boom, having raised its forecast for overall housing commencements to a record 228,000 in 2016 and a still strong 205,000 before easing back in 2018.

“Completions are expected to peak in 2018 at 216,000.

“But within this, completions of (free-standing) houses already peaked last year, while in contrast the multi’s super-cycle is still only about half done, with the number of units completed in 2018 likely to end up well over double the pre-boom trend,” UBS economist George Tharenou noted.”

The full article can be read here.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

You are reading an article about:

Property

Just want to point out that the text in the above article states there are 663 Cranes however a quick look at the graph and ABC news link state 528 cranes in Australia

There’s variety of estimates and data providers.

Seeing reports that spring sales transactions are down up to 40% in Melbourne and Sydney. If true then the transaction based businesses such as agents would be feeling it. Any sign of REA and the like reporting this hit?

663 Cranes * 100 Unit average = 66300 Units

66300 * 4 people average household = 265200

We’re making enough houses for the 1 percent of Australian population. That’s how much Australia’s population grow each year. Unless I’m missing something here…

Ahhhh… the ABS has produced a significantly higher construction figure than that. Cranes move from site to site at different stages of a build so the 100 unit per crane might be an underestimate and many dev don’t need a crane.

Hi Roger,

I have been following your commentary about apartment over supply, and the links to others, with interest. In my small suburb of Northern Sydney and the surrounding 1-2 there would be approximately 12 cranes all related to apartment construction.

Peter

the ship will sink so bad.. that Australia has to sell god knows what to china to recover. like kidman & Co.