Sizzle to Fizzle

When valuing businesses, it is standard practice for analysts to assume that a business will grow at a constant rate forever. Yet this assumption is deeply flawed, as decline is an inevitable part of every business life cycle – just look at Sizzler Restaurants.

The first Sizzler restaurant opened in Australia in 1985. The chain enjoyed considerable growth for the next two decades and became a highlight for many families (including mine).

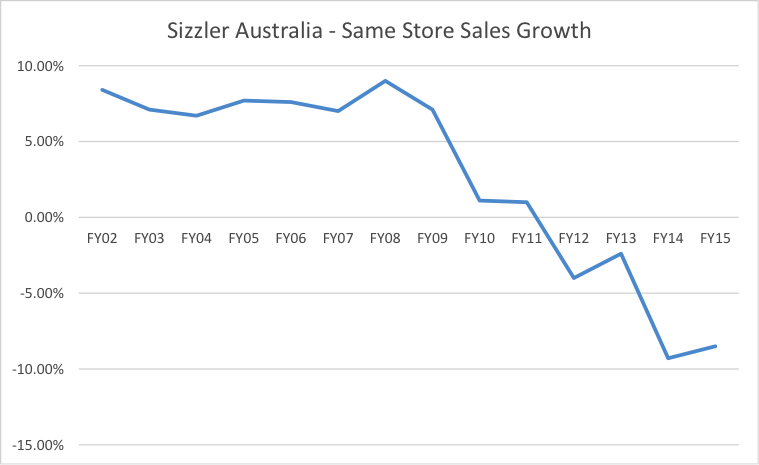

Yet by 2008 the restaurant had lost its appeal, and sales began falling precipitously, forcing Collins Food (ASX: CKF) to effectively write off the division in 2015. This was despite significant investment in an attempt to refresh and reinvigorate the brand.

Now let’s say you were considering Sizzler as an investment in 2002. While we have the benefit of hindsight, with strong sales growth at the time it may have been more tempting to extrapolate these returns than consider that the business could be no more in 10 years. Doing so would have resulted in a material overvaluation. Indeed, in this case the company has implied a zero valuation for the domestic division.

The competitive nature of any industry means that when a business is earning good money, other players will enter to erode that advantage. Abnormal returns cannot last forever, so make sure that your valuations are appropriately conservative.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY