SEEK: Topping the list of list providers

Continuing on from our recent blog post on Australia’s best listed-list providers, specifically Carsales.com.au (CRZ), Domino’s Pizza Limited (DMP) and REA Group Ltd (REA) – or realestate.com.au – in what is arguably the standout result in this reporting season, Seek.com.au (SEK) has produced an outstanding update with impressive growth numbers reported across the board.

Naturally, given SEK holds the second largest position in both The Montgomery Fund and The Montgomery [Private] Fund, this is something we are very pleased to see. Below you will find some of our preliminary notes after skimming through their half-year report.

Company Code: SEK

Company Name: SEEK Limited

Review: 2014 Half Year Result

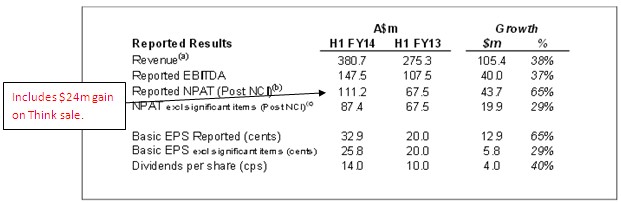

- Record HY14. Not much to dislike in this result, which I would argue was stronger than that of REA

- Strong revenue, EBITDA, NPAT, EPS and DPS growth

- Key drivers SEEK International and SEEK Education (IDP)

- Domestic SEEK is mature, which actually went backwards and is moreso just a cash cow to fund international growth

- This quick overview below speaks volumes and with guidance for a stronger H2FY14, the underlying momentum in SEK from internationally owned sites is clearly apparent, impressive and will continue

SEEK Australia

- SEK now accounts for 25% of total employment placements in Australia

- Segment is still the largest contributor to EBITDA, but is mature

- Revenues fell 3% and EBITDA -5% to $71.6m

- The stability is impressive given volumes fell 11%

- Volume decline is offset by 8% increase in yields (price increases)

SEEK International

- Clearly the driver of the business going forward. Revenue growth 56%, EBITDA +79%

- Market will focus here from now in my opinion. SEK to be seen as a true international growth story

- Key international employment classifieds websites: Zhaopin, JobsDB (about to be turbocharged with JobStreet acquisition), Brazil and Mexico all now contributing to EBITDA with positive results and growing with A$24.7m, $10.2m, $18.3m and $5.7m respectively

- Margins on learning/international expansion are improving and have a long way to go!

Acquisition

- SEK currently owns 69% of JobsDB/SEK ASIA and 22% of JobStreet

- Are moving from 22% to 75% ownership of JobStreet.com (Malaysia) – top employment classifieds website in Asia

- JobsDB and JobStreet will be combined as part of the transaction

- Total incremental investment is $374m and looking at the balance sheet, they have sufficient capacity to fund this

Guidance

- Total group second half to be ahead of the first half – I find this impressive, given they will be cycling off very high growth. This speaks volumes to the business’ underlying momentum

- Momentum is apparent in all divisions (employment, learning, international – Zhaopin, JobsDB, Brazil, OCC, JobStreet) which expected to show improvement on PCP

- Given both the strength of this result and the underlying momentum, I’m expecting upgrades to consensus numbers in the order of 10-15%

- Guidance implies ~$175m NPAT for 2014 and valuation improves from $13.20 to $15.50

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Russell, Roger

Are you able to expand a little on why you consider SEK’s moat/network effect to be safe? Roger mentioned in response to an earlier comment that SEEK.com is obvious and intuitive unlike competitors such as LinkedIn. But don’t you think that is something that could be easily copied by competitors? A webpage which offers a search tool based on data already stored on that particular site is not exactly rocket science.

eFinancialCareers Australia offers a very similar job search function to SEK, but it is nowhere near as successful. Why do you think people continue to flock to SEEK.com when all it offers is a simple job search tool? Do you really think its brand alone is likely to protect it from start-ups looking to steal some of its market share?

Looking forward to hearing your thoughts.

The network effect.

Are you able to expand a little Roger? Don’t you think an established, well-recognised competitor such as LinkedIn could gradually steal some of Seek’s market share over time? LinkedIn is well known in Australia and already popular among employers, recruitment firms and job seekers.

I agree LinkedIn’s current job job search function is rubbish, but if it fixes that (which I imagine is quite easy for it to do) doesn’t it suddenly become a big threat to SEK’s main revenue stream? Can we really classify SEK’s network effect as a “moat”?

Hi Michael,

Please look back at our previous posts on “network effects” – use the search bar to find our discussions on the topic.

By way of comparison, Seek’s lead over the competition can be expressed a number of ways. Two often-quoted measures are page views per visit and the time spent on the site (in minutes).

Compared to LinkedIn, these numbers are currently 8.8 and 9.4 versus 1.0 and 0.8 respectively. This should give you a feel of the yawning gap between the number one player and everyone else, and put to rest any fear of LinkedIn being an issue any time soon.

Russell

Any chance of placing the formula you used , adopting your own internal profit forecasts, to come up with the valuation …?

Sorry Anthony. No.

Great summary Russell, well done.

Im a bit confused though, Skaffold has a totally different valuation to the $13.20 you stated, why are your valuations different to the product we use?

Thanks Dylan.

Hi Dylan,

The main difference is the adoption of our own internal profit forecasts, which are, at times very different to consensus analysts.

Seek needs to counter linked-in’s competitive threat. LI is a global provider and will compete with Seek in every market. In Australia LI has already established itself and is enjoying growth.

Regards

Shanker

Yes, We’ve heard that one before.

Have you tried using Linked In for job search? It is a painful operation, particularly compared to Seek’s easy to use website.

Linked In have a long way to go in order to challenge the job classifieds market with any success.

Entirely agree Andrew. If its not immediately obvious and intuitive, users move on. Witness the adoption rate at WhatsApp as an example.

While I agree with the lack of intuitive UI, I like to point out that LI has a different business model, in that it charges a subscription fee for Candidates to access ‘premium’ features. Moreover if there is strong intent, then this is not difficult to fix.

With a market cap of approx US$25B and blistering sales growth, my humble opinion is, LI potential to crash Seek’s party cannot be underestimated. It is seen by many as next generation of ‘listing’ model. Best.

Hi team

2 questions –

1) SEK’s close price today is $15.70. Would this indicate you are possibly looking at selling as you currently value it at $15.50? Or because you believe there are good times ahead, you’ll hold (and if it eventuates, the calculated value will then increase)?

2) What is the largest position held by the Funds?

Hi Asher,

The answer for you depends on your strategy and process. We would continue to hold for as long as the quality remains, the price is not overly expensive and the prospects remain bright.

Hi Roger/Russell

Great summary as always.

One of the questions I have in the back of my mind is how will the impending float of Zhaopin benefit existing seek shareholders. Will the cash from the float simply fall to the bottom line and hence an increased or special dividend is paid. Is there some capacity for an allocation of shares from the float to go to existing seek shareholders.

Sorry if this is such a silly question.

Also loved Sirtex’s report in fact I bought a very small parcel of shares for each of my 5 grandchildren the day before.

Both Seek and Sirtex are the largest holding in our SMSF.

Keep up the great work

Regards

Ray

Thanks for the encouraging words Ray. Regrading Seek, One suspects a capital returns is a high probability outcome.

Great insights into seek is the largest holding in the voigt family fund as well.

Could we get a blog post in forge and its implosion. I know Montgomery held the stock a long time ago and up until recently was rated A1 or A2 on skafflold. I don’t own shares in forge and haven’t for a long time just wishing to understand what to look for when this happens as obviously it financial metrics were quiet good up until recently.

Regards

Brad Voigt

Hi Brad, You might to take a look at the changes in cash flow over time and in particular any deterioration in the classic studies of cash flow. Of course the ratings are only as good as the truthfulness/transparency of the information that a company provides.

“Of course the ratings are only as good as the truthfulness/transparency of the information that a company provides.” The auditors didn’t flag any deficiencies in truth, but then they never do! But of course the good old WA factor is operative here and Bentham IMF clearly have a different view. I’ll watch with interest how this former darling and A1 is exposed.

If there was truth in reporting it could not be an A1. That’s the point!