Reporting Season Update

Over the past week more than 100 companies have reported their full year results. These results have begun to flow through Skaffold, resulting in the changes listed below for each company. A membership to Skaffold ensures you are constantly up to date with changes to the quality and valuations of every Australian listed company.

To become a Skaffold member and start taking advantage of market inefficiencies that may transpire during reporting season CLICK HERE

And here’s a list of the elements in Skaffold that change automatically as companies report:

1. Earnings and Dividends, Capital History and Cash Flow Evaluate screens updated with 2012 figures

2. New 2012 Skaffold Score

3. 2012 Intrinsic Value – Actual

4. 2013, 2014 and 2015 Intrinsic Value forecasts

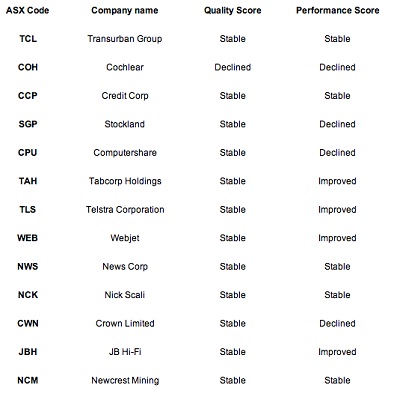

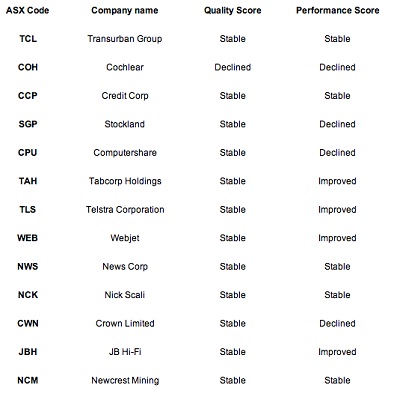

The following is a sample of companies whose full year results have flowed through Skaffold and the resulting changes to their Skaffold Scores. Members receive weekly updates to changes in margins of safety and benefit from their members-only 2012 reporting season calendar.

Published on behalf of Skaffold

Published on behalf of Skaffold

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Published on behalf of Skaffold

Published on behalf of Skaffold