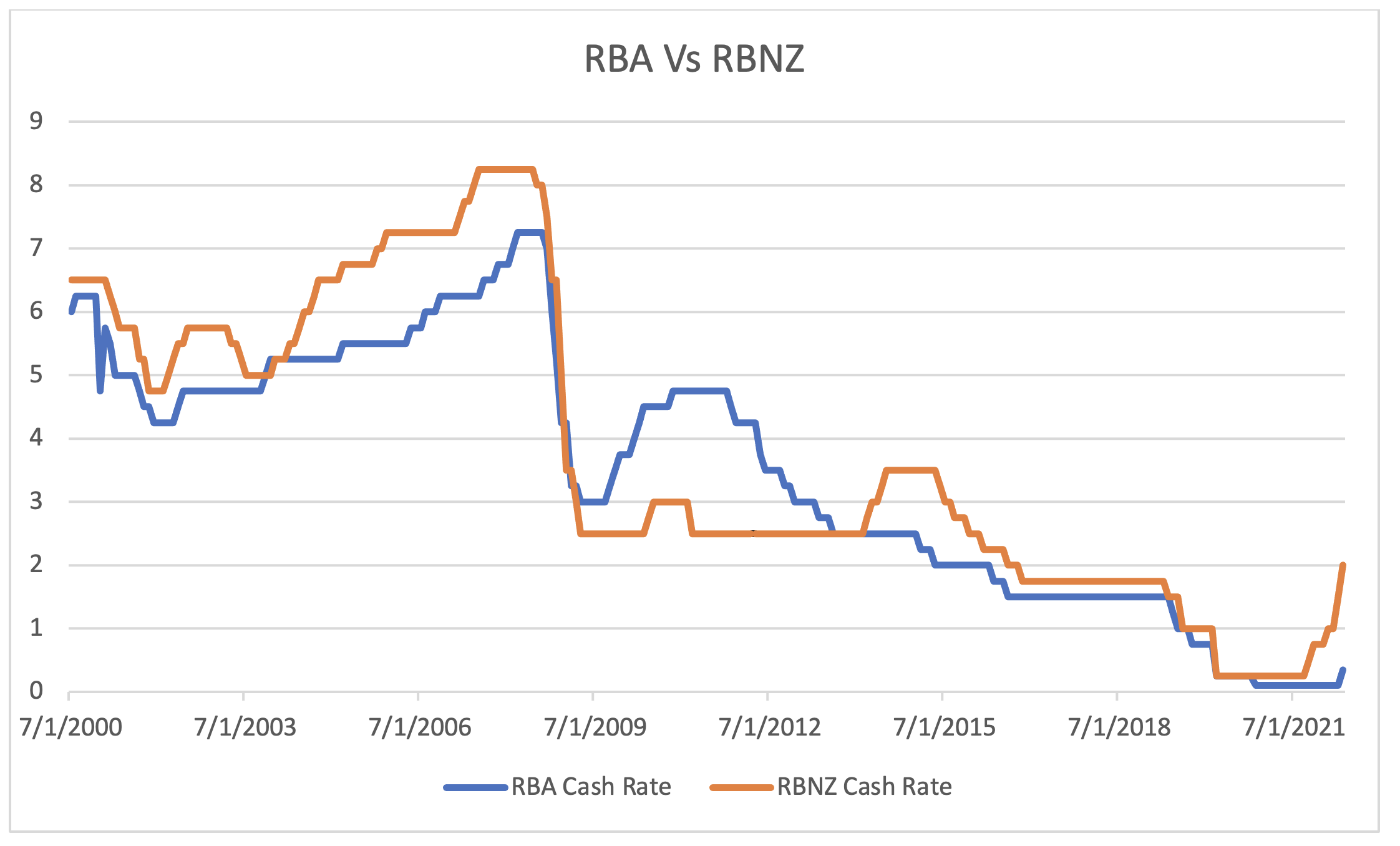

RBNZ – fifth tightening since October 2021: 0.25 per cent to 2.0 per cent

As I have detailed previously, the Reserve Bank of New Zealand (RBNZ) has been relatively pro-active in its tightening cycle, commencing on 6 October 2021 and taking their official cash rate from 0.25 per cent to 2.0 per cent.

The RBNZ has two overriding mandates from the Government – to keep the inflation rate at around two per cent, plus or minus one per cent, whilst ensuring maximum sustainable employment.

New Zealand’s annual inflation rate has more than doubled from 3.3 per cent in the year to June 2021 to 6.9 per cent in the year to March 2022. And it seems likely the inflation rate for the year to June 2022 is going even higher given the figure for the June 2021 quarter of (only) 1.3 per cent rolls off.

The RBNZ said “A larger and earlier increase in the official cash rate reduces the risk of inflation becoming persistent, while also providing more policy flexibility ahead in light of the highly uncertain global economic environment.” Further interest rate increases over the balance of this year towards 3.0 per cent appears a distinct possibility, and as indicated previously this is likely to place increasing pressure on the prices of residential property.

The central forecast for inflation in Australia for 2022 is 6.0 per cent with an underlying inflation rate of 4.75 per cent. While the unemployment rate is sub 4.0 per cent or nearly a 50-year low, I suspect the Reserve Bank of Australia (RBA) will likely feel forced to play catch-up football with several other of the Western World Central Banks. An increase of the Australian official cash rate on Tuesday 7 June by 0.40 per cent from 0.35 per cent to 0.75 per cent seems a reasonable probability, and a move towards 2.0 per cent over the balance of 2022 cannot be ruled out.

Like New Zealand, it seems likely Australian residential property prices have peaked and many forecasters expect a decline of 10 per cent to 15 per cent from the peak in the near term.

You can read my previous post here: New Zealand; The canary in the coal mine