Rally in the offing? Canaccord’s market strategist weighs in

In a recent briefing, Canaccord’s seasoned stock market strategist outlined his perspective on the current market environment. Amidst concerns of an impending recession and financial stress, there’s a silver lining that might lead to a market rally.

The dominant view, if not the consensus view, is that until now, the U.S. economy has remained resilient, reinforced by robust job gains and consumer spending. Amid a faltering recovery in China however, the lagged impact of the U.S. Federal Reserve bank’s aggressive rate hikes is expected to slow the U.S. economy from here in. The U.S. consumer is expected to taper their spending now that excess savings are depleted and as job growth becomes more subdued.

Consensus cannot, it seems, be reached on how the equity market will respond.

It would seem appropriate and logical to adopt a more defensive or cautious posture, given the above. However, Canaccord’s strategist believes the environment sets the stage for a rally in equities. This is partly because, in the strategist’s view, the U.S. economy will slow down very rapidly due to the lagged impact of higher interest rates and tight financial conditions. In fact, they see a U.S. recession as highly likely but argue that it’s too late to take a negative view on markets when the bad news is possibly already priced in. (Note the U.S. bank equity index has already been smashed by 50 per cent.)

The environment also seems primed for a rally based on a fixed income view the strategist called “higher for shorter.” While hopes abound for a ‘soft landing’ scenario, such an outcome would actually be problematic for equity markets because the Federal Reserve would need to maintain elevated rates for a prolonged period. But a soft landing is unlikely, and this is due to the lack of buyers for treasuries and a consequent outflow of capital at banks, restricting their ability to lend.

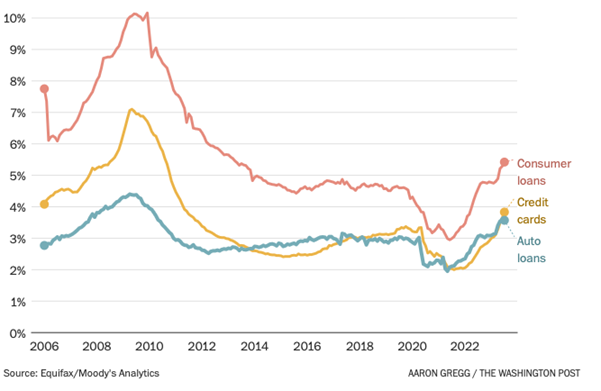

Meanwhile, America’s consumer debt is mounting. Spelling trouble for the economy, default rates in U.S. auto loans have risen above pre-pandemic levels to over two per cent, and more Americans are falling behind on their credit card payments than at any time in more than a decade.

For these reasons, it is anticipated that the U.S. economy will decelerate rapidly, with a recession on the horizon. And lest investors become sanguine, relying upon the fact Treasury bond rates have been at five per cent before, it’s worth remembering when they were at five per cent previously, debt-to-GDP was not at 131 per cent as it is now!

Figure 1. U.S. delinquencies by type of debt, 2006-2023

Each recession begins with a spike in the unemployment rate from a low level. Unemployment tends to go down an escalator and up on an elevator. Economically sensitive stocks have cratered already, reflecting a recessionary scenario.

In fact, that’s a major part of the set-up for investors who subscribe to the pending rally scenario.

Amid all of the above concerns, investors have been pulling money from equities. Recently, here in Australia, listed funds manager Pinnacle noted in the three months to September 2023, it received $200 million of net fund inflows with “Notable inflows in Private Credit, Private Equity and Fixed Income”. In other words, investors were steering clear of equities.

But the advent of a sharply slowing economy is expected to bring bond yields down. As they fall, investors should expect a major bounce in small caps and economically sensitive stocks at the expense of the mega caps and energy.

Hidden undercurrents reflect doom and gloom

Interestingly, except for NASDAQ and S&P500, which are market cap-weighted, every other index has already seen a sharp decline. The top 10 stocks in the S&P500 now account for over one-third of the index’s value. This means that while these stocks have held strong, 65 per cent of other stocks have plummeted more than 20 per cent from their 52-week highs. That’s a correction by traditional definitions.

It’s also noteworthy that we’ve experienced the fastest rate hike cycle in history, with the treasury pumping significant paper into the market. Government spending continues its upward trajectory, exerting pressure on mortgage rates.

Canaccord has maintained a cautious stance over the past two years, given the unprecedented speed of interest rate hikes since World War II and the rapid tightening of the balance sheet in an already indebted system. This has placed the likelihood of the U.S. entering a recession at a near certainty.

The silver lining

Despite the gloom, there’s potential for a rally. As yields decrease, all that money avoiding equities may surge back, resulting in a robust bounce in small caps and economically sensitive stocks, which have been underperforming in contrast to mega caps and energy.

While economies, geopolitics and the market all seem to be in a precarious position, it seems most equities have already factored the worst in. If that conclusion is correct, a rapidly slowing economy, followed by declining rates, sets the stage for a bounce, particularly in sectors most affected by higher rates. As always, investors should keep an eye on the horizon and make informed decisions.